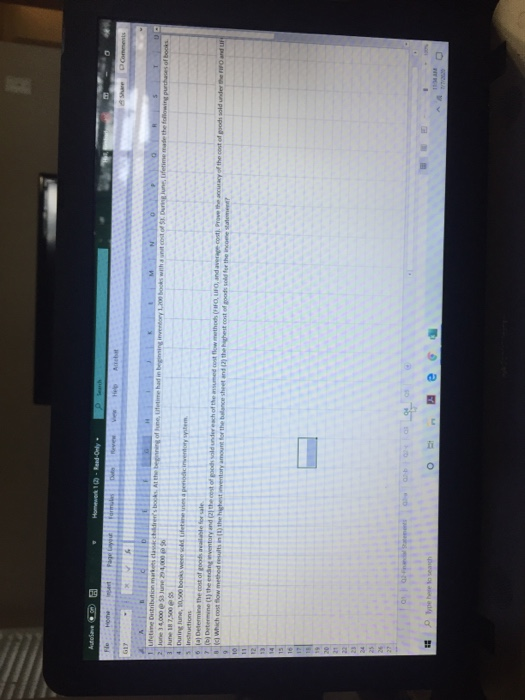

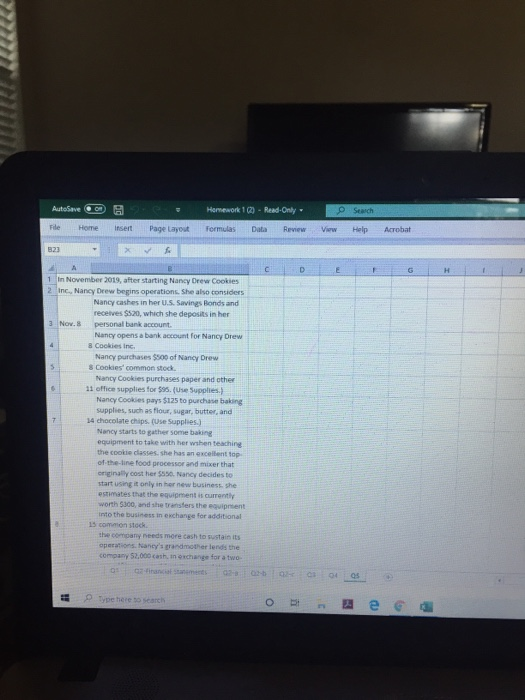

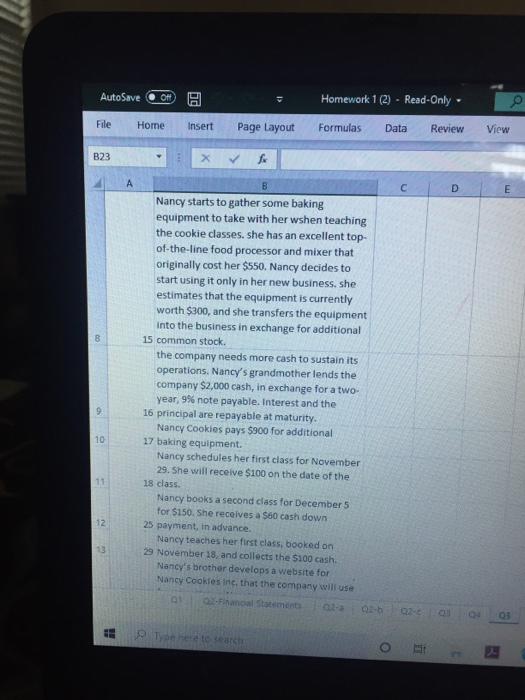

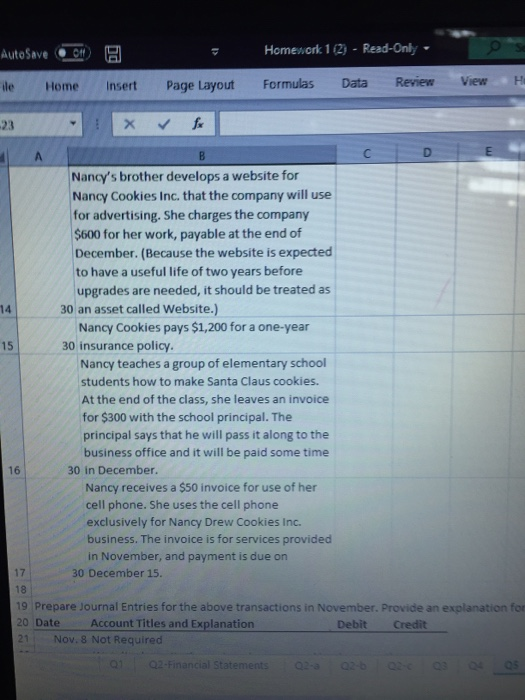

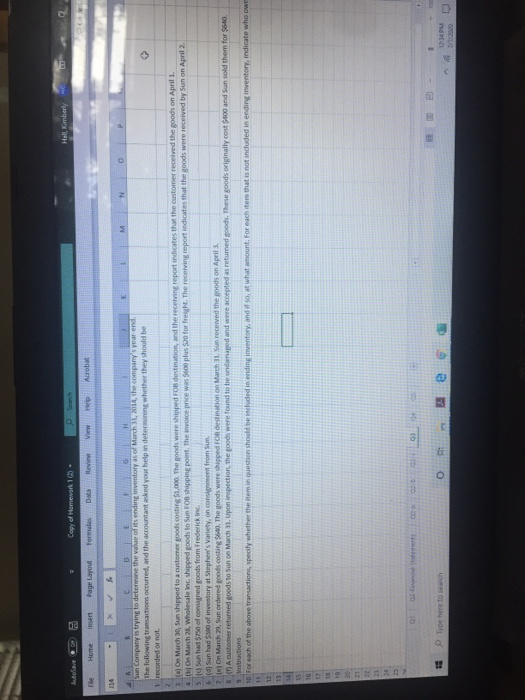

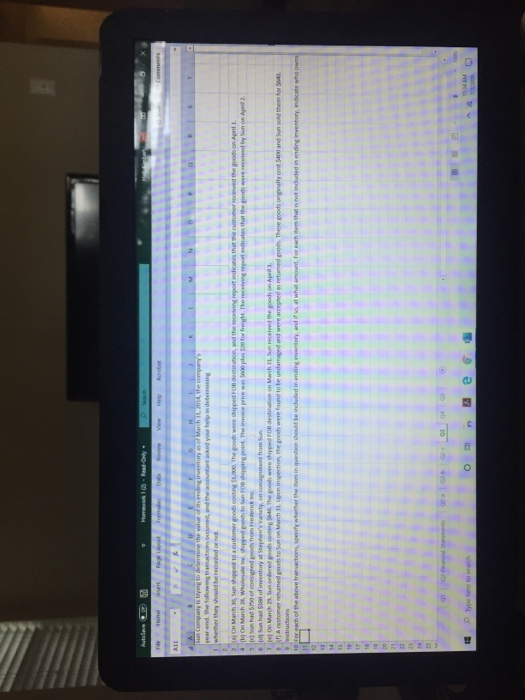

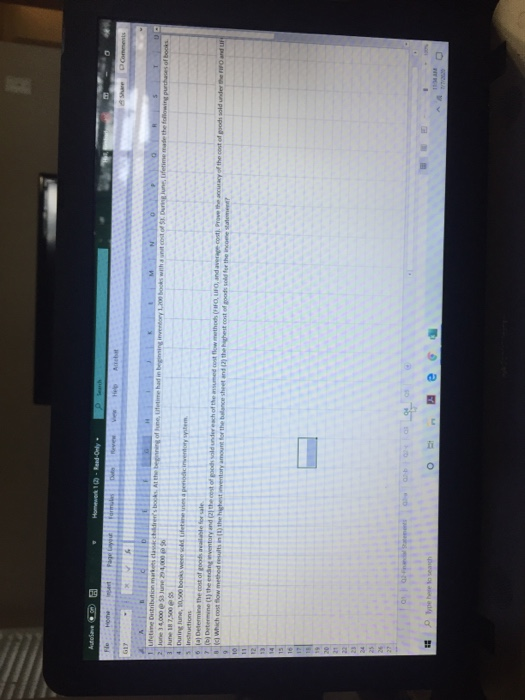

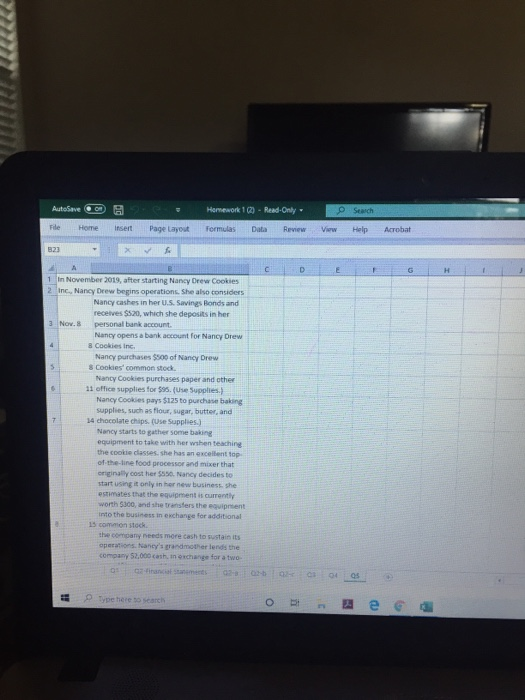

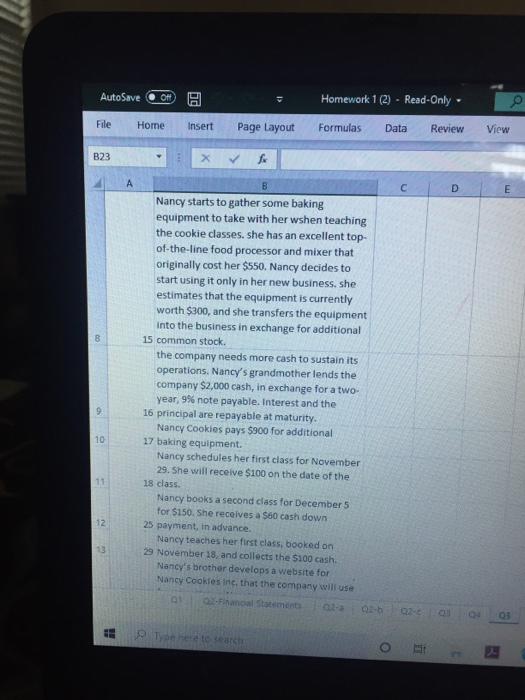

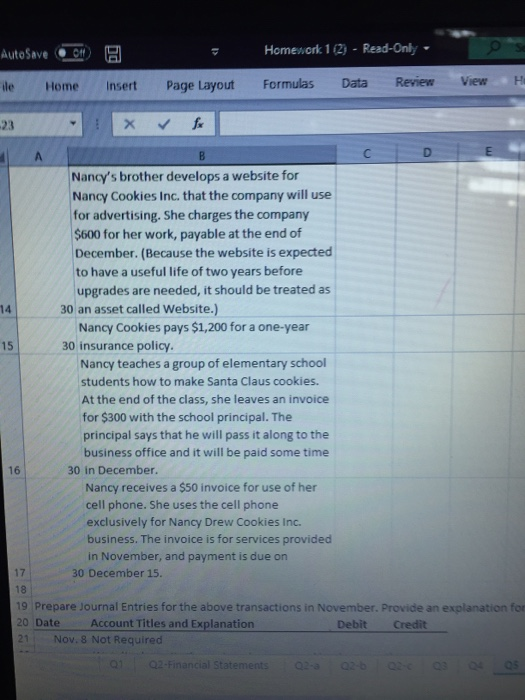

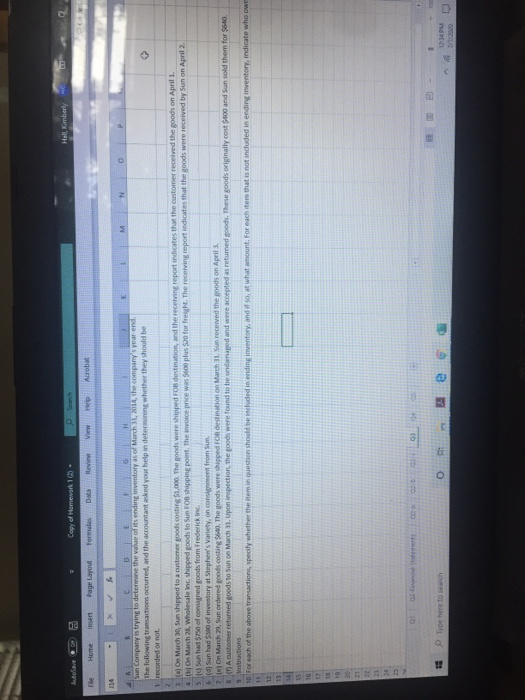

Auteve Home 12 - Read-Only Home out Robot ALI SUS Company is trying to determine the valueitsendinginventory of March, 2014, the company's year end the following timeand the mounted your help in determining whether they should be recorded or not. on March 3, Sun shipped to a customer goodscoting $1,000. The goods were shipped FOB destination the report Indice cerved the goods on April on March, Wowped to the point. The price was coples Sofory. The receiving report indicates that the goods were received by Sun on Apel 2. Son had $5 of conged goods from Frederick Suhad $10 of inventory Stephen's variety on congument from Sun te on March 23, Sunordered goods casting. The goods were shipped on destination on March 11. Sun received the goods on April 8 Acustomer returned goods to Sun on March Upon inspection, the goods were found to be undone and were acested returned goods. These goods originally cost $400 and Sunsold them for 40 wtructions 10 hof the above traction, sely whether the item in quo should be included in ending intory, and it sa, at what amount for each item that is not included in ending inventory, indicate who 15 18 19 01 O G SunCompanyistryingtodeterminethevalueofitsendinginventoryasof March31, 2014, thecfollowingtransaction soccurred, andtheaccountantaskedyour helpindeterminingwhether the(a)On March30, Sunshippedtoacustomer goodscosting1,000. The goods were shipped FOB (b) On March 28, Wholesale Inc. shipped goods to Sun FOB shipping point. The invoice price was (c) Sun had 7500f consignedgoods from Frederick Inc. (d) Sunhad380 of inventory at Stephen H Homework 10 - Read-Only Fle Hoche 41 Page Fas eve Arrebat uletine Distribution markets cadress At the beginning of Pune, fetime had in being invy 1.200 books with a todos. De fetime made the following purchases of books June 34.000 53 June 24,000 $ une 187.00 4 During lune, 1 books were some poinventory tem Instructions Determine the cost of alle for sale Determine the endingwentory and the cost of goods soldundereach of the cost other, and average cost. Prove the way of the cost of goods sold under the Oandur 3 which cost flow methods in the highest inventory mount for the balance sheet and (2) the chest cost of goods sold for the income statement 9 10 12 13 15 type here to search O AutoSave Homework 1 (2) - Read-Only- Search File Home insert Page Layout Formulas Data Review View Help Acrobat 323 2 C D 1 In November 2019, after starting Nancy Drew Cookies 2 Inc., Nancy Drew begins operations. She also considers Nancy cashes in her U.S. Savings Bonds and receives $520, which she deposits in her 3 Nov. personal bank account Nancy opens a bank account for Nancy Drew 8 Cookies Inc Nancy purchases $500 of Nancy Drew 5 8 Cookies' common stock Nancy Cookies purchases paper and other 11 office supplies for $95. (Use Supplies) Nancy Cookies pays $125 to purchase baking supplies, such as flour, sugar, butter, and 14 chocolate chips. (Use Supplies) Nancy starts to gather some baking equipment to take with her when teaching the cookie classes, she has an excellent top of the line food processor and mixer that originally cost her $550 Nancy decides to start using it only in her new business, she estimates that the equipment is currently worth 5300, and the transfers the vient Into the business in exchange for additional 15 common stock the company reeds more cash to sustain its operations. Nancy's grandmother end the company 52,000 cash in exchange for a two 23 05 Type here to search O 3 AutoSave OH bg Homework 1 (2) - Read-Only O File Home Insert Page Layout Formulas Data Review View B23 A D E 8 B Nancy starts to gather some baking equipment to take with her wshen teaching the cookie classes. She has an excellent top- of-the-line food processor and mixer that originally cost her $550. Nancy decides to start using it only in her new business. She estimates that the equipment is currently worth $300, and she transfers the equipment into the business in exchange for additional 15 common stock. the company needs more cash to sustain its operations. Nancy's grandmother lends the company $2,000 cash, in exchange for a two- year, 9% note payable. Interest and the 16 principal are repayable at maturity. Nancy Cookies pays $900 for additional 17 baking equipment. Nancy schedules her first class for November 29. She will receive $100 on the date of the 18 class. Nancy books a second class for December 5 for $150. She receives a $60 cash down 25 payment, in advance. Nancy teaches her first class, booked on 29 November 18, and collects the $100 cash. Nancy's brother develops a website for Nancy Cookies inc. that the company will use 01 O2-Financal Statements 02-5 9 10 11 12 13 02-a Q5 Type here to search O AutoSave DO Homework 1 (2) - Read-Only- ile Home Insert Formulas Page Layout Data Review View -23 A B Nancy's brother develops a website for Nancy Cookies Inc. that the company will use for advertising. She charges the company $600 for her work, payable at the end of December. (Because the website is expected to have a useful life of two years before upgrades are needed, it should be treated as 14 30 an asset called Website.) Nancy Cookies pays $1,200 for a one-year 15 30 insurance policy. Nancy teaches a group of elementary school students how to make Santa Claus cookies. At the end of the class, she leaves an invoice for $300 with the school principal. The principal says that he will pass it along to the business office and it will be paid some time 16 30 in December Nancy receives a $50 invoice for use of her cell phone. She uses the cell phone exclusively for Nancy Drew Cookies Inc. business. The invoice is for services provided in November, and payment is due on 17 30 December 15. 18 19 Prepare Journal Entries for the above transactions in November. Provide an explanation for 20 Date Account Titles and Explanation Debit Credit 21 Nov. 8 Not Required 01 Q2-Financial Statements Hall, Kimberly AutoSave Copy of Homework 1. Fle insert Page Layout Home Formulas Data le Heb Www Acrobat 114 M N D Sun Company is trying to determine the value of its ending inventory as of March 31, 2014, the company's year-end. The following transactions occurred, and the accountant and your help in determine whether they should be recorded or not. Os March 30, Sun shipped to a customer goods costing $1,000. The goods were shipped on destination, and the receiving report indicates that the customer received the goods on April 1. 4 on March 28, Wholesale inc. shipped goods to Sun FOB shipping point. The price was scooplus Sofortreyht. The receiving report indicates that the goods were received by Sun on April 2 5) Sun had 5750 of corned goods from Frederick in 6. (d) Sun had of inventory at Stephen's variety on content from Sun, ? On March 23, Sun ordered goods casting $40. The goods were shipped Foldestination on March. Sun received the goods on April A customer returned goods to Sun on March 31. upon inspection, the goods were found to be andanaged and were accepted as returned goods. These goods originally cost $100 and Sun sold them for $640 instructions 10 for each of the above transactions, specify whether the item in question should be included in ending inventory, and if so, at what amount. For each item that is not included in ending inventory, indicate who own 11 12 14 15 16 1 19 GE 03 04 Type here to ach O RE APU Auteve Home 12 - Read-Only Home out Robot ALI SUS Company is trying to determine the valueitsendinginventory of March, 2014, the company's year end the following timeand the mounted your help in determining whether they should be recorded or not. on March 3, Sun shipped to a customer goodscoting $1,000. The goods were shipped FOB destination the report Indice cerved the goods on April on March, Wowped to the point. The price was coples Sofory. The receiving report indicates that the goods were received by Sun on Apel 2. Son had $5 of conged goods from Frederick Suhad $10 of inventory Stephen's variety on congument from Sun te on March 23, Sunordered goods casting. The goods were shipped on destination on March 11. Sun received the goods on April 8 Acustomer returned goods to Sun on March Upon inspection, the goods were found to be undone and were acested returned goods. These goods originally cost $400 and Sunsold them for 40 wtructions 10 hof the above traction, sely whether the item in quo should be included in ending intory, and it sa, at what amount for each item that is not included in ending inventory, indicate who 15 18 19 01 O G SunCompanyistryingtodeterminethevalueofitsendinginventoryasof March31, 2014, thecfollowingtransaction soccurred, andtheaccountantaskedyour helpindeterminingwhether the(a)On March30, Sunshippedtoacustomer goodscosting1,000. The goods were shipped FOB (b) On March 28, Wholesale Inc. shipped goods to Sun FOB shipping point. The invoice price was (c) Sun had 7500f consignedgoods from Frederick Inc. (d) Sunhad380 of inventory at Stephen H Homework 10 - Read-Only Fle Hoche 41 Page Fas eve Arrebat uletine Distribution markets cadress At the beginning of Pune, fetime had in being invy 1.200 books with a todos. De fetime made the following purchases of books June 34.000 53 June 24,000 $ une 187.00 4 During lune, 1 books were some poinventory tem Instructions Determine the cost of alle for sale Determine the endingwentory and the cost of goods soldundereach of the cost other, and average cost. Prove the way of the cost of goods sold under the Oandur 3 which cost flow methods in the highest inventory mount for the balance sheet and (2) the chest cost of goods sold for the income statement 9 10 12 13 15 type here to search O AutoSave Homework 1 (2) - Read-Only- Search File Home insert Page Layout Formulas Data Review View Help Acrobat 323 2 C D 1 In November 2019, after starting Nancy Drew Cookies 2 Inc., Nancy Drew begins operations. She also considers Nancy cashes in her U.S. Savings Bonds and receives $520, which she deposits in her 3 Nov. personal bank account Nancy opens a bank account for Nancy Drew 8 Cookies Inc Nancy purchases $500 of Nancy Drew 5 8 Cookies' common stock Nancy Cookies purchases paper and other 11 office supplies for $95. (Use Supplies) Nancy Cookies pays $125 to purchase baking supplies, such as flour, sugar, butter, and 14 chocolate chips. (Use Supplies) Nancy starts to gather some baking equipment to take with her when teaching the cookie classes, she has an excellent top of the line food processor and mixer that originally cost her $550 Nancy decides to start using it only in her new business, she estimates that the equipment is currently worth 5300, and the transfers the vient Into the business in exchange for additional 15 common stock the company reeds more cash to sustain its operations. Nancy's grandmother end the company 52,000 cash in exchange for a two 23 05 Type here to search O 3 AutoSave OH bg Homework 1 (2) - Read-Only O File Home Insert Page Layout Formulas Data Review View B23 A D E 8 B Nancy starts to gather some baking equipment to take with her wshen teaching the cookie classes. She has an excellent top- of-the-line food processor and mixer that originally cost her $550. Nancy decides to start using it only in her new business. She estimates that the equipment is currently worth $300, and she transfers the equipment into the business in exchange for additional 15 common stock. the company needs more cash to sustain its operations. Nancy's grandmother lends the company $2,000 cash, in exchange for a two- year, 9% note payable. Interest and the 16 principal are repayable at maturity. Nancy Cookies pays $900 for additional 17 baking equipment. Nancy schedules her first class for November 29. She will receive $100 on the date of the 18 class. Nancy books a second class for December 5 for $150. She receives a $60 cash down 25 payment, in advance. Nancy teaches her first class, booked on 29 November 18, and collects the $100 cash. Nancy's brother develops a website for Nancy Cookies inc. that the company will use 01 O2-Financal Statements 02-5 9 10 11 12 13 02-a Q5 Type here to search O AutoSave DO Homework 1 (2) - Read-Only- ile Home Insert Formulas Page Layout Data Review View -23 A B Nancy's brother develops a website for Nancy Cookies Inc. that the company will use for advertising. She charges the company $600 for her work, payable at the end of December. (Because the website is expected to have a useful life of two years before upgrades are needed, it should be treated as 14 30 an asset called Website.) Nancy Cookies pays $1,200 for a one-year 15 30 insurance policy. Nancy teaches a group of elementary school students how to make Santa Claus cookies. At the end of the class, she leaves an invoice for $300 with the school principal. The principal says that he will pass it along to the business office and it will be paid some time 16 30 in December Nancy receives a $50 invoice for use of her cell phone. She uses the cell phone exclusively for Nancy Drew Cookies Inc. business. The invoice is for services provided in November, and payment is due on 17 30 December 15. 18 19 Prepare Journal Entries for the above transactions in November. Provide an explanation for 20 Date Account Titles and Explanation Debit Credit 21 Nov. 8 Not Required 01 Q2-Financial Statements Hall, Kimberly AutoSave Copy of Homework 1. Fle insert Page Layout Home Formulas Data le Heb Www Acrobat 114 M N D Sun Company is trying to determine the value of its ending inventory as of March 31, 2014, the company's year-end. The following transactions occurred, and the accountant and your help in determine whether they should be recorded or not. Os March 30, Sun shipped to a customer goods costing $1,000. The goods were shipped on destination, and the receiving report indicates that the customer received the goods on April 1. 4 on March 28, Wholesale inc. shipped goods to Sun FOB shipping point. The price was scooplus Sofortreyht. The receiving report indicates that the goods were received by Sun on April 2 5) Sun had 5750 of corned goods from Frederick in 6. (d) Sun had of inventory at Stephen's variety on content from Sun, ? On March 23, Sun ordered goods casting $40. The goods were shipped Foldestination on March. Sun received the goods on April A customer returned goods to Sun on March 31. upon inspection, the goods were found to be andanaged and were accepted as returned goods. These goods originally cost $100 and Sun sold them for $640 instructions 10 for each of the above transactions, specify whether the item in question should be included in ending inventory, and if so, at what amount. For each item that is not included in ending inventory, indicate who own 11 12 14 15 16 1 19 GE 03 04 Type here to ach O RE APU