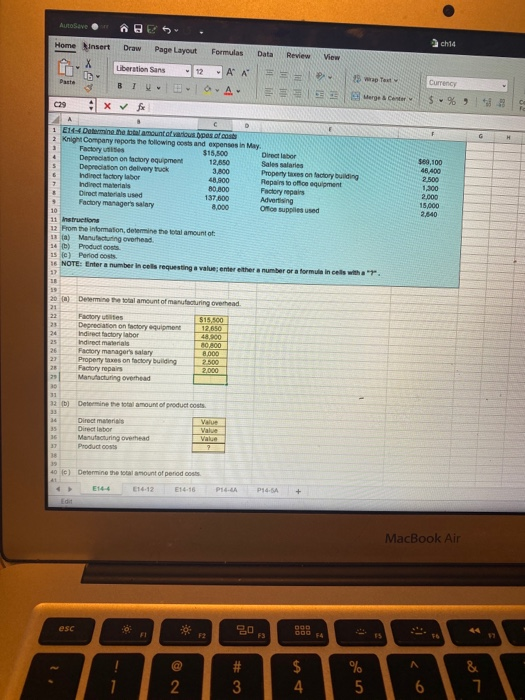

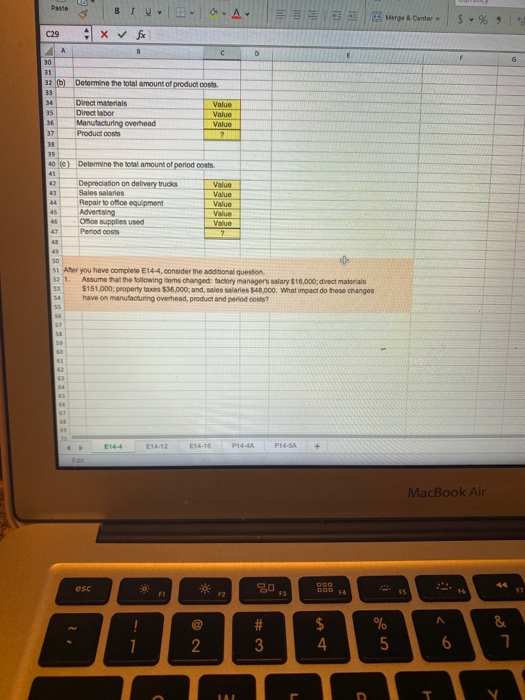

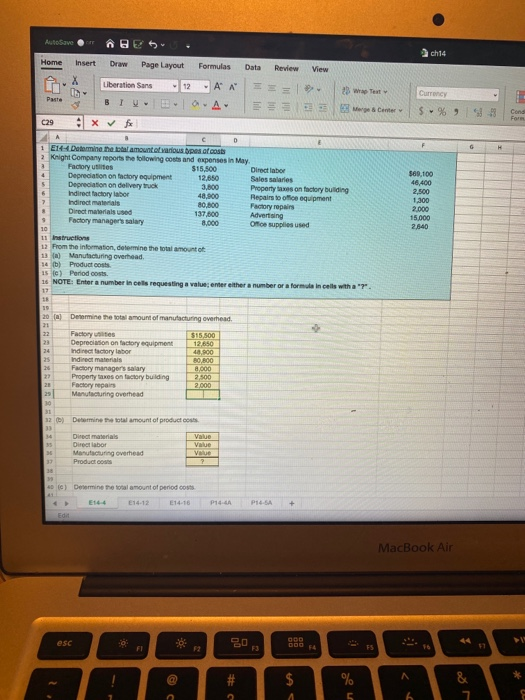

AutoSave ch14 Draw Home insert Page Layout Formulas Data Review View Uberation Sans 12 AA == Paste 3 13 wat Merge Center Currency C29 G H 7 $60,100 48.400 2.500 1,300 2.000 15,000 2,640 9 A 1 E14 Determine the total amount of various as of 2 Knight Company reports the following costs and expenses in May. 3 Factory uses $15,500 Direct labor 4 Depreciation on factory equipment 12,650 Sales salaries 5 Depreciation on delivery truck 3,800 Property on factory building 6 Indirect factory labor 48.900 Repairs to cement Indirect materials 80.000 Factory repairs Direct materials used 137.600 Advertising Factory manager's salary 8.000 Ohoo supplies used 10 11 Instructions 12 From the information, determine the total amount at a) Manufacturing overhead 14) Product costs 15) Period costs 16 NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "T". 17 1 19 20 ) Determine the total amount of manufacturing overhead. 21 22 Factory stes $15.500 23 Depreciation on factory quipment 12,650 26 Indirect factory labor 48.900 Indirect materials 00 26 Factory manager's salary 8.000 23 Property taxes on factory building 2.500 28 Factory repairs 2,000 29 Manufacturing overhead 20 31 12 Determine the total amount of productos Direct man Value Director Value Manufacturing overhead Value 30 Productos 39 40 ) Determine the total amount of period costs 41 E16-4 E14.12 E14.16 Edit PA P1-SA MacBook Air esc FI BO F3 DOD 000 F4 F2 A # 3 $ 4 % 5 2 6 7 Margo & Center s-% 9 F G Poste A EE C29 x & fx B C D 30 31 32 (0) Determine the total amount of productos 33 34 Direct materials Value 35 Direct labor Value 36 Manufacturing overhead Value 37 Productos 7 38 39 40 e) Determine the amount of period costs. 41 42 Depreciation on delivery trucks Value Sales salaries Value Repair to office equipment Value 45 Advertising Value Oon supplies used Value Period costs ? 45 49 50 51 Aher you have complete E14-4, consider the additional question 52 1. Assume that the following items changed: factory manager's salary $16,000; direct materials $151,000, property taxes $36.000; and, sales salaries $40,000. What impact do these changes 54 have on manufacturing overhead, product and period costs? 55 45 47 57 59 61 4 65 70 E14-4 E14.12 14-16 P14-4 P14.5A MacBook Air esc 80 GOD F FI F6 F2 F3 45 & # 3 $ 4 % 5 2 6 7 TAL T AutoSave ch14 Home Insert Draw Page Layout Formulas Data Review View Liberation Sans 12 -AA 16 Paste 23 Wrap Test 3 cm A- Currency $ % 9 Cons Form C29 G H 4 6 $89.100 46,400 2,500 1,300 2.000 15.000 2840 A c E 1 E14-Determine the bal amount of nous opes of coas 2 Knight Company reports the following costs and expenses in May. 3 Factory tits $15,500 Direct labor Depreciation on factory equipment 12,650 Sales salaries 5 Depreciation on delivery truck 3,800 Property taxes on factory building Indirect factory labor 48.000 Repairs to ce equipment 7 Indirect materials 80,000 Factory repair Direct materials used 137,600 Advertising Factory manager's salary 8,000 One supplies used 10 11 Instructions 12 From the information, determine the total amount of 13) Manufacturing overhead 14 b) Product costs 15) Period costs. 16 NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". 17 18 19 20 ) Determine the total amount of manutacturing overhead. 21 22 Factory les $15.500 Depreciation on factory equipment 12.650 24 Indirect factory labor 43.800 Indirect materials 80,800 26 Factory manager's salary 8.000 Property taxes on factory building 2.500 Factory repairs 2.000 25 Manufacturing overhead 12 Dermine the total amount of productos 35 36 33 38 Direct materials Direct labor Manufacturing overhead Productos Value Value Value ? c) Desemine the total amount of periodo E144 E14.12 E14-16 PISA + Edit MacBook Air esc 0 BO 000 . FI FU F4 F5 $ % 5. A 6 7