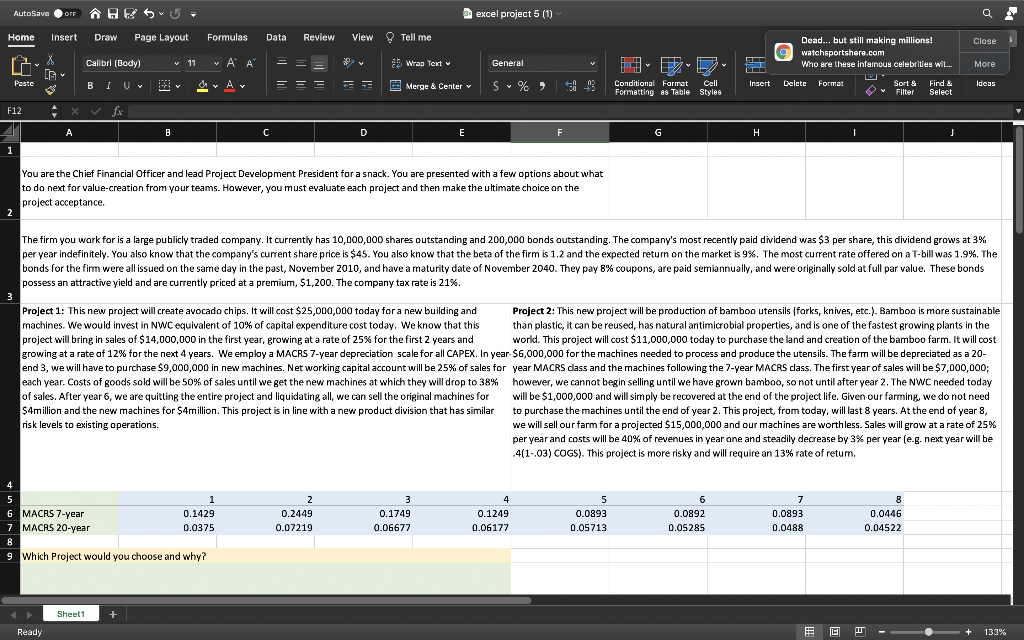

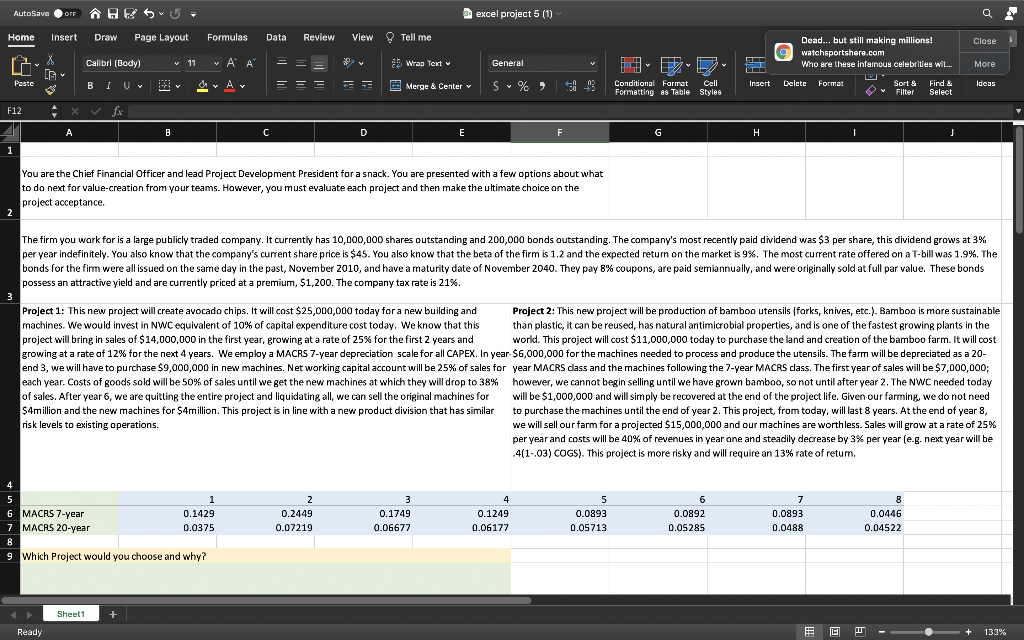

AutoSave IF OFF AGES excel project 5 (1) Home Insert Draw Page Layout Formulas Data Review View Tell me Close X Calibrl (Body) v 11 v A ab Wrap Text General Dead... but still making millions! watchsportshere.com Who are these infamous celebrities wil. Delete Format Sort & Find & Select More v Paste Av BIU = = = - Insert Merge & Center v Y : 493 S%? Ideas Conditional Format Cell Formatting as Table Styles Filter F12 fx A B C D E F G H J 1 You are the Chief Financial Officer and lead Project Development President for a snack. You are presented with a few options about what to do next for value-creation from your teams. However, you must evaluate each project and then make the ultimate choice on the project acceptance. 2 The firm you work for is a large publicly traded company. It currently has 10,000,000 shares outstanding and 200,000 bonds outstanding. The company's most recently paid dividend was $3 per share, this dividend grows at 3% per year indefinitely. You also know that the company's current share price is $45. You also know that the beta of the firm is 1.2 and the expected return on the market is 9%. The most current rate offered on a T-bill was 1.9%. The bonds for the firm were all issued on the same day in the past, November 2010, and have a maturity date of November 2040. They pay 8% coupons, are paid semiannually, and were originally sold at full par value. These bonds possess an attractive yield and are currently priced at a premium, $1,200. The company tax rate is 21%. 3 Project 1: This new project will create avocado chips. It will cost $25,000,000 today for a new building and Project 2: This new project will be production of bamboo utensils (forks, knives, etc.). Bamboo is more sustainable machines. We would invest in NWC equivalent of 10% of capital expenditure cost today. We know that this than plastic, it can be reused, has natural antimicrobial properties, and is one of the fastest growing plants in the project will bring in sales of $14,000,000 in the first year, growing at a rate of 25% for the first 2 years and world. This project will cost $11,000,000 today to purchase the land and creation of the bamboo farm. It will cost growing at a rate of 12% for the next 4 years. We employ a MACRS 7-year depreciation scale for all CAPEX. In year- $6,000,000 for the machines needed to process and produce the utensils. The farm will be depreciated as a 20- end 3, we will have to purchase $9,000,000 in new machines. Net working capital account will be 25% of sales for year MACRS dass and the machines following the 7-year MACRS dass. The first year of sales will be $7,000,000; each year. Costs of goods sold will be 50% of sales until we get the new machines at which they will drop to 38% however, we cannot begin selling until we have grown bamboo, so not until after year 2. The NWC needed today of sales. After year 6, we are quitting the entire project and liquidating all, we can sell the original machines for will be $1,000,000 and will simply be recovered at the end of the project life. Given our farming, we do not need $4million and the new machines for $4million. This project is in line with a new product division that has similar to purchase the machines until the end of year 2. This project, from today, will last 8 years. At the end of year 8, risk levels to existing operations. we will sell our farm for a projected $15,000,000 and our machines are worthless. Sales will grow at a rate of 25% per year and costs will be 40% of revenues in year one and steadily decrease by 3% per year (e.g. next year will be 4(1-03) COGS). This project is more risky and will require an 13% rate of retum. 4 8 5 1 6 MACRS 7-year 0.1429 7 MACRS 20-year 0.0375 8 9 Which Project would you choose and why? 2 0.2449 0.07219 3 0.1749 0.06677 0.1249 0.06177 5 0.0893 0.05713 6 0.0892 0.05285 7 0.0893 0.0488 0.0446 0.04522 Sheel1 Ready C w 133% % For project 1, if costs across all years went to 55% of sales revenues, what would be the new NPV? If this scenario, sensitivity or simulation analysis? 4 As a financial manager, describe and explain some factors (or advantages/disadvantages) to consider when 15 deciding which financing choices (aka capital structure) could be used for this project. 16 Of the three motives for holding cash within a firm, which do YOU feel is most important, and why (no right/wrong choice, if the choice is explained correctly)? Define your choice and why you chose it. What are the 17 major costs associated with holding cash in a firm? 18 Of the five reasons given for why investors may prefer dividends, which do you think sounds most 19 belivable/plausible? Define your choice and why you chose it