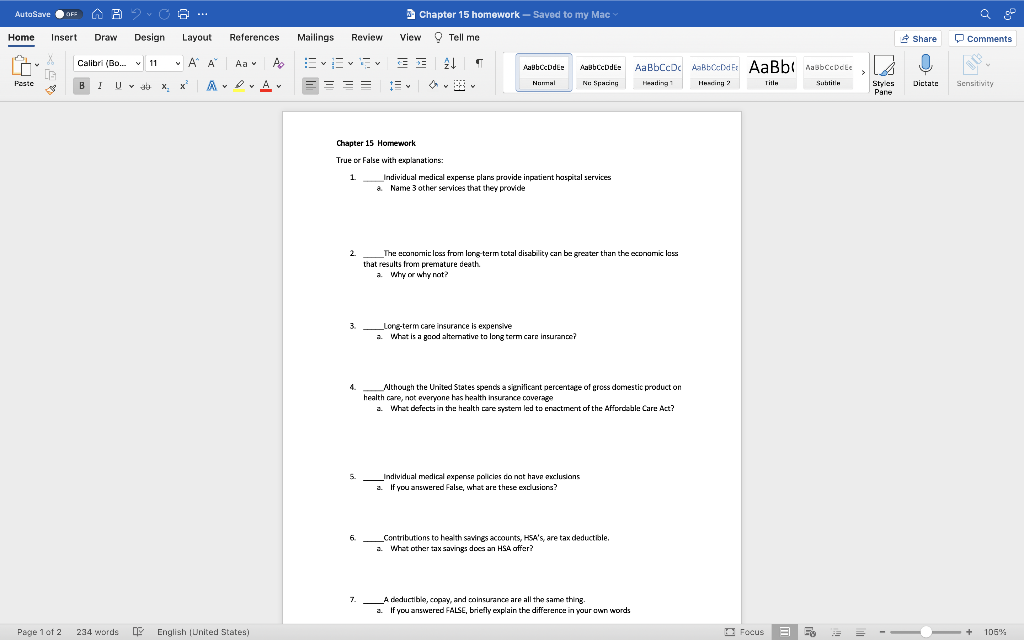

AutoSave OF AAGO... Chapter 15 homework - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments Aalboc de Calibri (Bo... 11 A A Aam AEE21 B 1 U | * * Xx? ADA = = Abc dle Nu Sparing AaBbccc AaB+CcDdEt AaBbt Ausbcbete Paste Normal Hearing Heating Titlu Sulit Dictate Styles Pane Sensitivity Case Application: Sarah purchased an individual medical experise insurance policy that induded a $250 deductible and an 90 - 20 coinsurance provision. She required medical care and the cost of the care provided was $40,750. How much of this amount must Sarah pay and how much wil her insurer pey? How would your answer change of Sarah's policy induded a $30011 out-of-pocket limit that applied to coinsurance payments Page 2 of 2 234 words English (United States Focus 3 - 105% AutoSave OF AAGO... Chapter 15 homework - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments 21 Aalboc de Abc dle AaBbCcDc AaBtoDdEt AaBbc Aabece Calibri (Bo... 11 A A Aam A B I U ab x x | * ADA A Paste = = NAIINI Nu Sparang Hearing Hearing 2 Title Sulit Dictate Styles Pane Sensitivity Chapter 15 Homework True or False with explanations: 1 Individual medical expense plans provide inpatient hospital services a Name 3 other services that they provide 2. The economic loss from long term total disability can be greater than the economic loss that results from premature death a. Why or why not? 3 _Lore-term care insurance is expensive a. What is a good alternative to long term care insurance? Although the United States spends a significant perceritage of gross domestic product on health care, not everyone has health insurance coverage 2. What defects in the health care system led to enactment of the Affordable Care Act? Individual medical expense policies do not have exclusions a. If you answered False, what are these exclusions? 6 _Contributions to health savires accounts, H5A's are tax deductile. .. what other tax savings docs an HSA offer? 7. A deductible, copay, and coinsurance are all the same thing 2. If you answered FALSE, briefly explain the difference in your own words Page 1 of 2 234 words CE English (United States) Focus 3 - 105% AutoSave OF AAGO... Chapter 15 homework - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments Aalboc de Calibri (Bo... 11 A A Aam AEE21 B 1 U | * * Xx? ADA = = Abc dle Nu Sparing AaBbccc AaB+CcDdEt AaBbt Ausbcbete Paste Normal Hearing Heating Titlu Sulit Dictate Styles Pane Sensitivity Case Application: Sarah purchased an individual medical experise insurance policy that induded a $250 deductible and an 90 - 20 coinsurance provision. She required medical care and the cost of the care provided was $40,750. How much of this amount must Sarah pay and how much wil her insurer pey? How would your answer change of Sarah's policy induded a $30011 out-of-pocket limit that applied to coinsurance payments Page 2 of 2 234 words English (United States Focus 3 - 105% AutoSave OF AAGO... Chapter 15 homework - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share Comments 21 Aalboc de Abc dle AaBbCcDc AaBtoDdEt AaBbc Aabece Calibri (Bo... 11 A A Aam A B I U ab x x | * ADA A Paste = = NAIINI Nu Sparang Hearing Hearing 2 Title Sulit Dictate Styles Pane Sensitivity Chapter 15 Homework True or False with explanations: 1 Individual medical expense plans provide inpatient hospital services a Name 3 other services that they provide 2. The economic loss from long term total disability can be greater than the economic loss that results from premature death a. Why or why not? 3 _Lore-term care insurance is expensive a. What is a good alternative to long term care insurance? Although the United States spends a significant perceritage of gross domestic product on health care, not everyone has health insurance coverage 2. What defects in the health care system led to enactment of the Affordable Care Act? Individual medical expense policies do not have exclusions a. If you answered False, what are these exclusions? 6 _Contributions to health savires accounts, H5A's are tax deductile. .. what other tax savings docs an HSA offer? 7. A deductible, copay, and coinsurance are all the same thing 2. If you answered FALSE, briefly explain the difference in your own words Page 1 of 2 234 words CE English (United States) Focus 3 - 105%