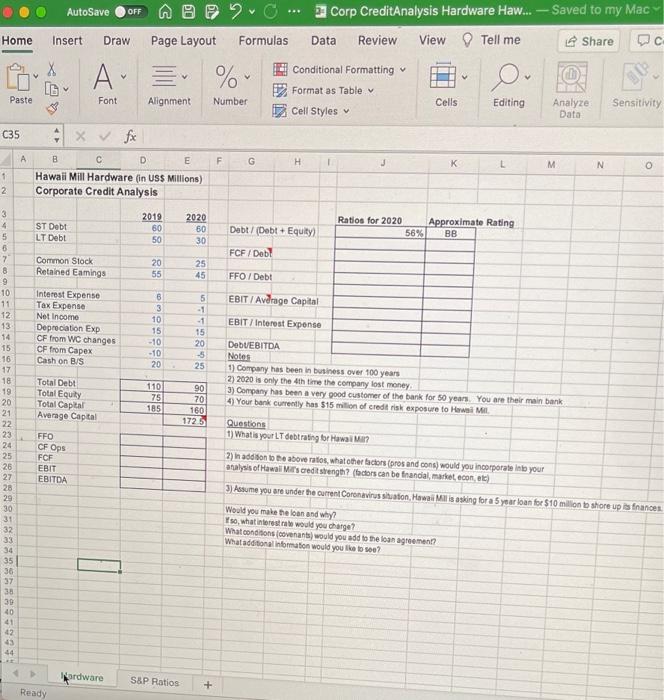

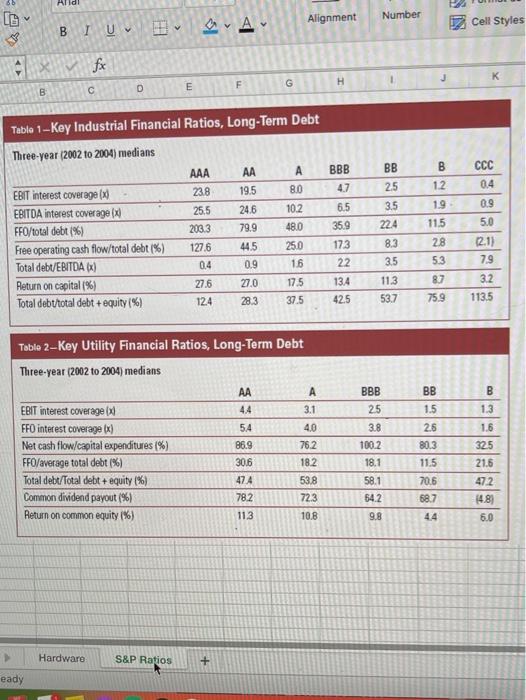

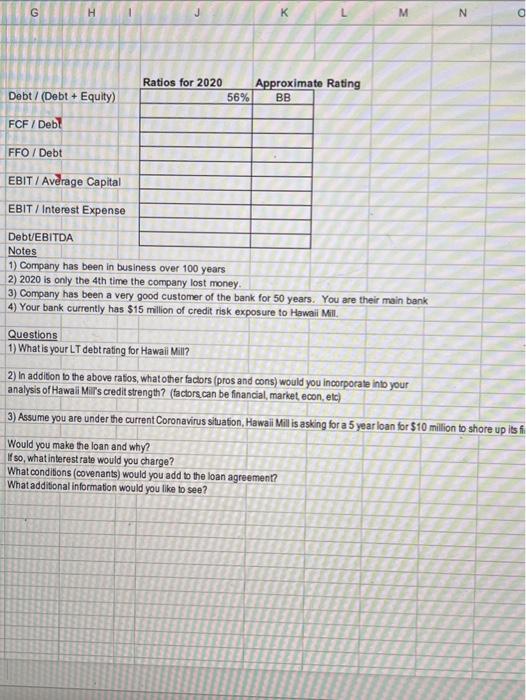

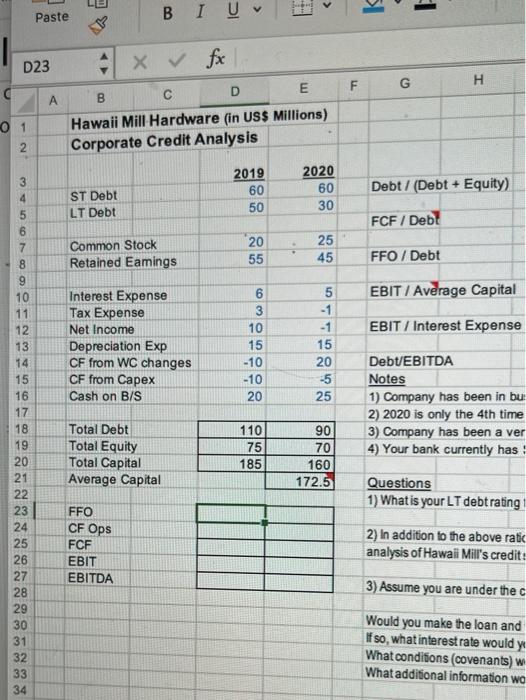

AutoSave OFF 2 Corp CreditAnalysis Hardware Haw... - Saved to my Mac Data Review View Tell me Share Home Insert Draw Page Layout Formulas X LG A % v Conditional Formatting Format as Table Cell Styles O. Paste Font Alignment Number Cells Editing Analyze Data Sensitivity C35 A F G H K M N 1 2 B D E Hawaii Mill Hardware (in USS Millions) Corporate Credit Analysis ST Debt LT Debt 2019 60 50 2020 60 30 Debt / (Debt + Equity Ratios for 2020 Approximate Rating 56% BB FCF / Deb? Common Stock Retained Eamings 20 55 25 45 FFO/ Debt EBIT / Avdrage Capital Interest Expense Tax Expense Net Income Depreciation Exp CF from WC changes CF from Capex Cash on B/S EBIT / Interest Expense B 3 10 15 -10 -10 20 5 -1 -1 15 20 -5 25 DebUEBITDA Notes 1) Company has been in business over 100 years 2) 2020 is only the 4th time the company lost money 3) Company has been a very good customer of the bank for 50 years. You are their main bank 4 Your bank currently has $15 million of credit risk exposure to HwM 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 30 40 Total Debt Total Equity Total Capital Average Captal 110 75 185 Vol0/8 Questions 1) What is your LT debt rating for Hawa? FFO CF Ops FCF EBIT EBITDA 2) in addition to the above ratos, what other factors pros and cond) would you incorporate into your analysis of Hawa Mit's credit strengt? (tadors can be financial market econe) 3) Assume you are under the current Coronavirus sutionHowa Mis asking for 5 year loan for $10 milion shore up s frances Would you make the loan and why? Tso, whaterest rate would you change? Wat conditions over would you add to the loan agreement? What additional information would you like to see? 43 44 Nardware S&P Ratios Ready Arld Alignment Number Number A BIU I Cell Styles 3 fx K G H E B D BBB co BB 25 3.5 CCC 04 1.2 Tabla 1 -Key Industrial Financial Ratios, Long-Term Debt Three-year (2002 to 2004) medians AAA A EBIT interest coverage (8) 23.8 19.5 80 EBITDA interest coverage (x) 25.5 24,6 102 FFO/total debt (%) 203.3 79.9 48.0 Free operating cash flow/total debt (%) 127.6 44.5 25.0 Total debt/EBITDA) 04 0.9 16 Return on capital (%) 27.6 27.0 175 Total debt total debt + equity (%) 124 28.3 37.5 6.5 35.9 0.9 5.0 224 8.3 3.5 1.9 11.5 28 5.3 173 22 13.4 42.5 12.1) 7.9 3.2 113.5 11.3 53.7 87 75.9 BBB 25 BB 1.5 B 1.3 Tablo 2 - Key Utility Financial Ratios, Long-Term Debt Three-year (2002 to 2004) medians AA EBIT interest coverage 1 3.1 FFO interest coverage (x) 54 4.0 Net cash flow/capital expenditures (%) 86.9 76.2 FFO/average total debt (%) 30.6 182 Total debt/Total debt + equity (%) 474 53.8 Common dividend payout (%) 782 723 Return on common equity (%) 113 2.6 80.3 11.5 1.6 325 21.6 3.8 100.2 18.1 58.1 64.2 9.8 706 68.7 47.2 14.8) 6.0 108 Hardware S&P Ratios + eady G H M N O Debt / (Debt + Equity) Ratios for 2020 56% Approximate Rating BB FCF / Debt FFO / Debt EBIT / Average Capital EBIT / Interest Expense DebUEBITDA Notes 1) Company has been in business over 100 years 2) 2020 is only the 4th time the company lost money. 3) Company has been a very good customer of the bank for 50 years. You are their main bank 4) Your bank currently has $15 million of credit risk exposure to Hawaii Mill. Questions 1) What is your LT debt rating for Hawaii Mill? 2) In addition to the above ratos, what other factors (pros and cons) would you incorporate into your analysis of Hawali Mill's credit strength? (factors can be financial market, econ, etc) 3) Assume you are under the current Coronavirus situation, Hawaii Mill is asking for a 5 year loan for $10 milion to shore up its fi Would you make the loan and why? 180, what interest rate would you charge? What conditions (covenants) would you add to the loan agreement? What additional information would you like to see? > Paste BI U D23 x & fx H G F 0 1 2 B D E Hawaii Mill Hardware (in US$ Millions) Corporate Credit Analysis 2019 60 50 2020 60 30 Debt / (Debt + Equity) ST Debt LT Debt FCF / Debt Common Stock Retained Eamings 20 55 25 45 FFO/ Debt EBIT / Average Capital Interest Expense Tax Expense Net Income Depreciation Exp CF from WC changes CF from Capex Cash on B/S 6 3 10 15 EBIT / Interest Expense 5 -1 -1 15 20 -5 25 -10 -10 20 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 Debt EBITDA Notes 1) Company has been in bu 2) 2020 is only the 4th time 3) Company has been a ver 4) Your bank currently has Total Debt Total Equity Total Capital Average Capital 110 75 185 90 70 160 172.5 Questions 1) What is your LT debt rating FFO CF Ops FCF EBIT EBITDA 2) In addition to the above ratic analysis of Hawaii Mill's credit 3) Assume you are under the c Would you make the loan and If so, what interest rate would y What conditions (covenants) W What additional information wo AutoSave OFF 2 Corp CreditAnalysis Hardware Haw... - Saved to my Mac Data Review View Tell me Share Home Insert Draw Page Layout Formulas X LG A % v Conditional Formatting Format as Table Cell Styles O. Paste Font Alignment Number Cells Editing Analyze Data Sensitivity C35 A F G H K M N 1 2 B D E Hawaii Mill Hardware (in USS Millions) Corporate Credit Analysis ST Debt LT Debt 2019 60 50 2020 60 30 Debt / (Debt + Equity Ratios for 2020 Approximate Rating 56% BB FCF / Deb? Common Stock Retained Eamings 20 55 25 45 FFO/ Debt EBIT / Avdrage Capital Interest Expense Tax Expense Net Income Depreciation Exp CF from WC changes CF from Capex Cash on B/S EBIT / Interest Expense B 3 10 15 -10 -10 20 5 -1 -1 15 20 -5 25 DebUEBITDA Notes 1) Company has been in business over 100 years 2) 2020 is only the 4th time the company lost money 3) Company has been a very good customer of the bank for 50 years. You are their main bank 4 Your bank currently has $15 million of credit risk exposure to HwM 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 30 40 Total Debt Total Equity Total Capital Average Captal 110 75 185 Vol0/8 Questions 1) What is your LT debt rating for Hawa? FFO CF Ops FCF EBIT EBITDA 2) in addition to the above ratos, what other factors pros and cond) would you incorporate into your analysis of Hawa Mit's credit strengt? (tadors can be financial market econe) 3) Assume you are under the current Coronavirus sutionHowa Mis asking for 5 year loan for $10 milion shore up s frances Would you make the loan and why? Tso, whaterest rate would you change? Wat conditions over would you add to the loan agreement? What additional information would you like to see? 43 44 Nardware S&P Ratios Ready Arld Alignment Number Number A BIU I Cell Styles 3 fx K G H E B D BBB co BB 25 3.5 CCC 04 1.2 Tabla 1 -Key Industrial Financial Ratios, Long-Term Debt Three-year (2002 to 2004) medians AAA A EBIT interest coverage (8) 23.8 19.5 80 EBITDA interest coverage (x) 25.5 24,6 102 FFO/total debt (%) 203.3 79.9 48.0 Free operating cash flow/total debt (%) 127.6 44.5 25.0 Total debt/EBITDA) 04 0.9 16 Return on capital (%) 27.6 27.0 175 Total debt total debt + equity (%) 124 28.3 37.5 6.5 35.9 0.9 5.0 224 8.3 3.5 1.9 11.5 28 5.3 173 22 13.4 42.5 12.1) 7.9 3.2 113.5 11.3 53.7 87 75.9 BBB 25 BB 1.5 B 1.3 Tablo 2 - Key Utility Financial Ratios, Long-Term Debt Three-year (2002 to 2004) medians AA EBIT interest coverage 1 3.1 FFO interest coverage (x) 54 4.0 Net cash flow/capital expenditures (%) 86.9 76.2 FFO/average total debt (%) 30.6 182 Total debt/Total debt + equity (%) 474 53.8 Common dividend payout (%) 782 723 Return on common equity (%) 113 2.6 80.3 11.5 1.6 325 21.6 3.8 100.2 18.1 58.1 64.2 9.8 706 68.7 47.2 14.8) 6.0 108 Hardware S&P Ratios + eady G H M N O Debt / (Debt + Equity) Ratios for 2020 56% Approximate Rating BB FCF / Debt FFO / Debt EBIT / Average Capital EBIT / Interest Expense DebUEBITDA Notes 1) Company has been in business over 100 years 2) 2020 is only the 4th time the company lost money. 3) Company has been a very good customer of the bank for 50 years. You are their main bank 4) Your bank currently has $15 million of credit risk exposure to Hawaii Mill. Questions 1) What is your LT debt rating for Hawaii Mill? 2) In addition to the above ratos, what other factors (pros and cons) would you incorporate into your analysis of Hawali Mill's credit strength? (factors can be financial market, econ, etc) 3) Assume you are under the current Coronavirus situation, Hawaii Mill is asking for a 5 year loan for $10 milion to shore up its fi Would you make the loan and why? 180, what interest rate would you charge? What conditions (covenants) would you add to the loan agreement? What additional information would you like to see? > Paste BI U D23 x & fx H G F 0 1 2 B D E Hawaii Mill Hardware (in US$ Millions) Corporate Credit Analysis 2019 60 50 2020 60 30 Debt / (Debt + Equity) ST Debt LT Debt FCF / Debt Common Stock Retained Eamings 20 55 25 45 FFO/ Debt EBIT / Average Capital Interest Expense Tax Expense Net Income Depreciation Exp CF from WC changes CF from Capex Cash on B/S 6 3 10 15 EBIT / Interest Expense 5 -1 -1 15 20 -5 25 -10 -10 20 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 Debt EBITDA Notes 1) Company has been in bu 2) 2020 is only the 4th time 3) Company has been a ver 4) Your bank currently has Total Debt Total Equity Total Capital Average Capital 110 75 185 90 70 160 172.5 Questions 1) What is your LT debt rating FFO CF Ops FCF EBIT EBITDA 2) In addition to the above ratic analysis of Hawaii Mill's credit 3) Assume you are under the c Would you make the loan and If so, what interest rate would y What conditions (covenants) W What additional information wo