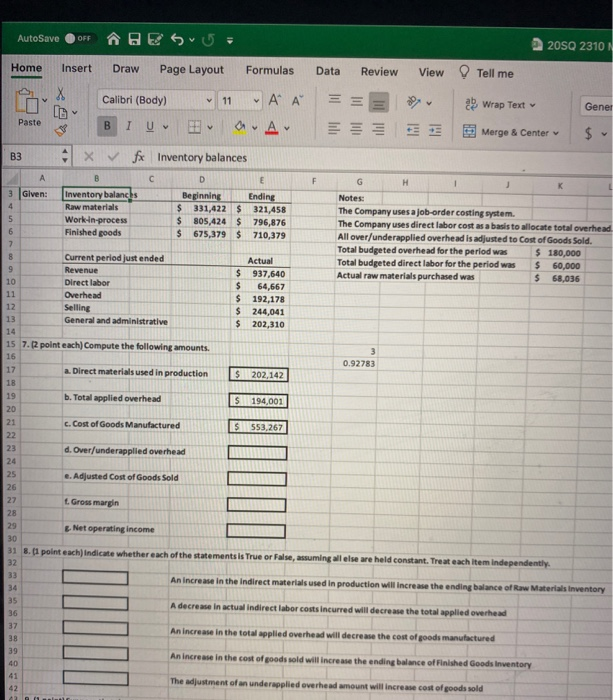

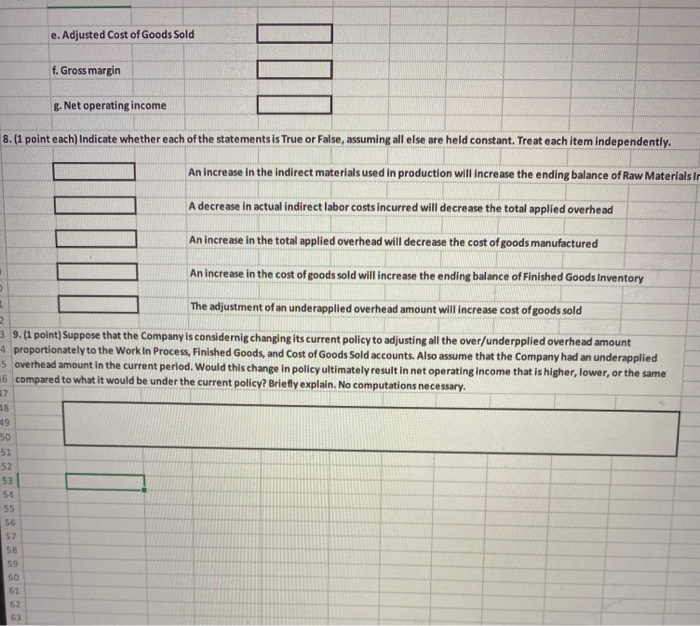

AutoSave OFF 20SQ 2310 Home Insert Draw Page Layout Formulas Data Review View Tell me Calibri (Body) 11 - A A Wrap Text Gener Paste B I u u 0 Merge & Center $ B3 X fx Inventory balances 6 8 9 A B D F G 3 Glven: Inventory balancs Beginning Ending Notes: 4 Raw materials $ 331,422 $ 321,458 The Company uses a job-order costing system. 5 Work-in-process $ 805,424 $ 796,876 The Company uses direct labor cost as a basis to allocate total overhead Finished goods $ 675,379 $ 710,379 All over/underapplied overhead is adjusted to cost of Goods Sold. 7 Total budgeted overhead for the period was $ 180,000 Current period just ended Actual Total budgeted direct labor for the period was $ 60,000 Revenue $ 937,640 Actual raw materials purchased was $ 68,036 10 Direct labor $ 64,667 11 Overhead $ 192,178 12 Selling $ 244,041 13 General and administrative $ 202,310 14 15 7.12 point each) Compute the following amounts. 3 16 0.92783 17 a. Direct materials used in production $ 202,142 18 19 b. Total applied overhead $ 194,001 20 21 c. Cost of Goods Manufactured $ 553,267 22 23 d. Over/underapplied overhead 24 25 e. Adjusted Cost of Goods Sold 26 27 t. Gross margin 28 29 Net operating income 30 31 8.1 point each) Indicate whether each of the statements is True or False, assuming all else are held constant. Treat each item Independently. 32 32 An increase in the Indirect materials used in production will increase the ending balance of Raw Materials Inventory 34 35 A decrease in actual Indirect labor costs incurred will decrease the total applied overhead 36 37 An increase in the total applied overhead will decrease the cost of goods manufactured 38 39 An increase in the cost of goods sold will increase the ending balance of Finished Goods Inventory 40 The adjustment of an underapplied overhead amount will increase cost of goods sold 1000 42 2 e. Adjusted Cost of Goods Sold f. Gross margin g. Net operating income 8. (1 point each) Indicate whether each of the statements is True or False, assuming all else are held constant. Treat each item independently. An increase in the Indirect materials used in production will increase the ending balance of Raw Materials ir A decrease in actual indirect labor costs incurred will decrease the total applied overhead An increase in the total applied overhead will decrease the cost of goods manufactured An increase in the cost of goods sold will increase the ending balance of Finished Goods Inventory 2 The adjustment of an underapplied overhead amount will increase cost of goods sold 39. (1 point) Suppose that the Company is considernig changing its current policy to adjusting all the over/underpplied overhead amount 4 proportionately to the Work In Process, Finished Goods, and Cost of Goods Sold accounts. Also assume that the Company had an underapplied 5 overhead amount in the current period. Would this change in policy ultimately result in net operating income that is higher, lower, or the same 6 compared to what it would be under the current policy? Briefly explain. No computations necessary. 17 18 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63