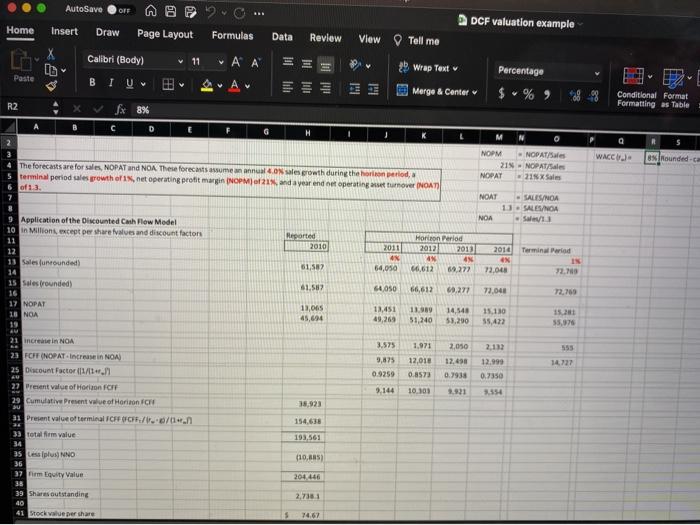

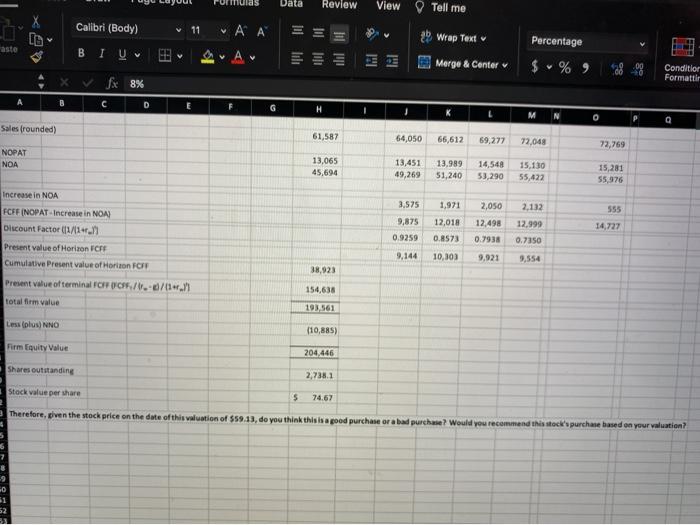

AutoSave OFF 2DCF valuation example Home Insert Draw Page Layout Formulas Data Review View Tell me Calibri (Body) 11 V Wrap Text A A Av Percentage Paste Merge & Center $ % Conditional Format Formatting as Table R2 fx 8% A B WACC) BN Rounded- The forecasts are for sales, NOPAT and NOA. These forecasts assume an annual growth during the horizon period, terminal period sales prowth of net operating profit margin INOM 21% and a year end et operating at turnover NOAT of 13. NOP NOPAT/Sales 21N NOPATA NOPAT 215 x Sales NOAT SALES NOA 13. SALES/NOA Sale NOA Application of the Discounted Cash Flow Model 10 in Millions, except per sharelvalves and discount factors 11 12 13 Salesfounded Heported 2010 2011 ex 54,050 Horizon Period 2012 2013 4 4 66,612 69272 61,582 2014 Terminal Period ex 72.000 7210 61.582 64,050 66,612 69.277 72,040 72,700 11.065 45,6944 13,451 49,269 13.989 51,240 14,548 55,290 15.110 55,422 55,00 3.575 1.971 2,050 2,132 555 12.490 12.999 9,875 0.9259 14727 12.018 0.8573 0.7938 0.2350 9.144 10.103 2,921 3.554 15 sales rounded) 16 17 NOPAT 18 NOA 19 44 21 Increase in NOA 23 FCFF(NOPAT Increase NOA) 25 Discount Factor (1/1) 27 Present value of Horizon FCF 29 Cumulative present value of Horison FC 0 31 Present value of terminal ICFFFFF/1.0/1.1 BE 33 total om value 34 35 Les plus NNO 36 37 m Equity Value 35 39 Share outstanding 40 41 Stock value per share 154.638 193,561 110,885) 2,7181 74,67 Data Review View Tell me X Calibri (Body) 11 $ Wrap Text Percentage BIU V A Merge & Center $ % 9 Conditior Formattir XS 8% D B H M Sales (rounded) 61,587 64,050 66,612 69.277 72,048 72,769 NOPAT NOA 13,065 45,694 13,451 49,269 13.989 51,240 14,548 53,290 15,130 55,422 15,281 55,976 Increase in NOA 1,971 FCFFINOPAT Increase in NOA) Discount Factor (1/14/1 3.575 9,875 0.9259 2,050 12.498 0.7938 12,018 0.8573 10,103 2,132 12,999 0.7150 555 14,727 Present value of Horizon FCFF Cumulative Present value of Horison FCFF 9,144 9,554 38,923 Present value of terminal FCFF CF/0.0/1. total firm value 154,638 193,561 Less (plus) NNO (10,885) Firm Equity Value 204,446 Shares outstanding 2,738.1 Stock value per share $ 74.67 Therefore, given the stock price on the date of this valuation of $59.13, do you think this is a good purchase or a bad purchase? Would you recommend this stock's purchase based on your valuation? 7 0 52