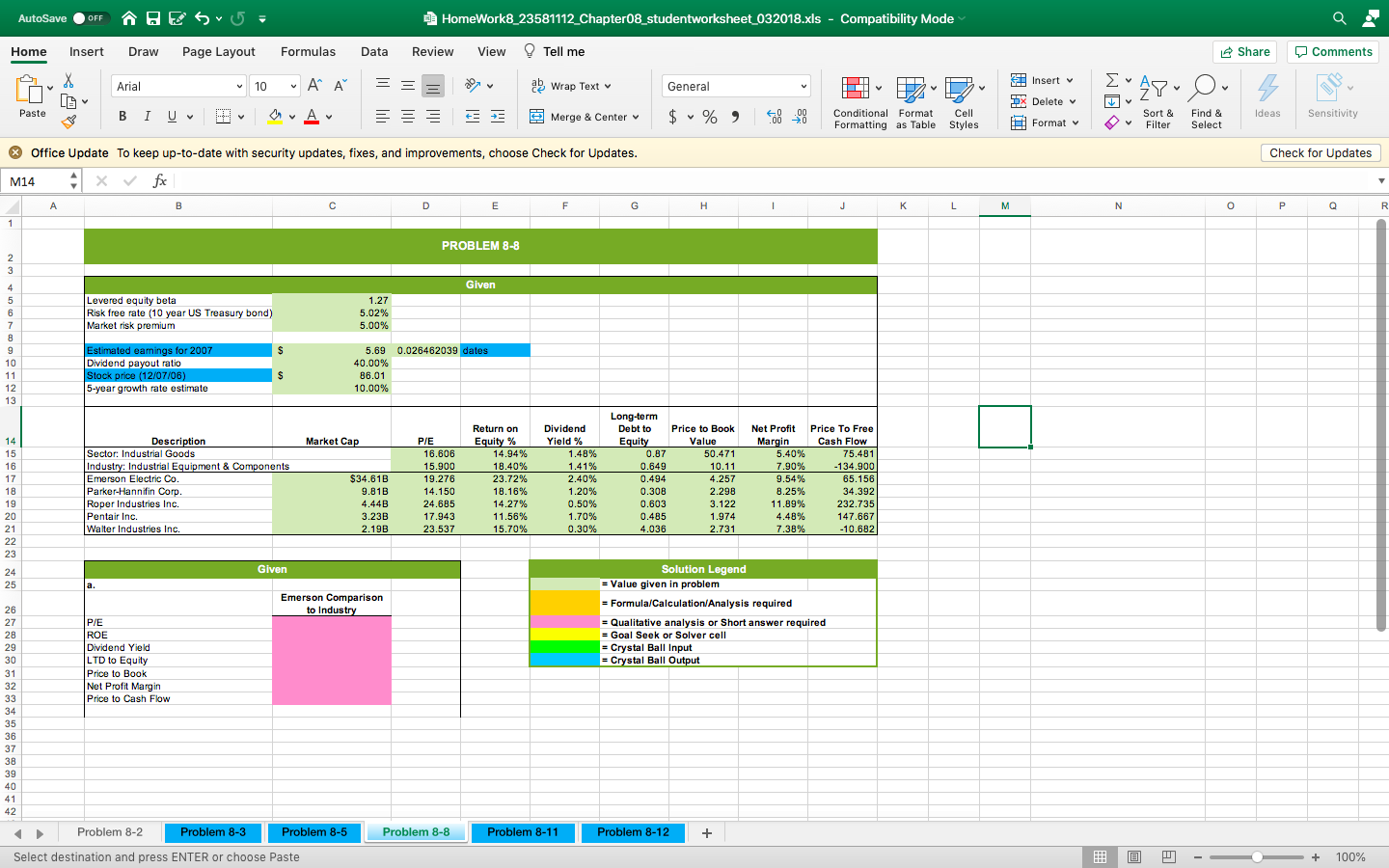

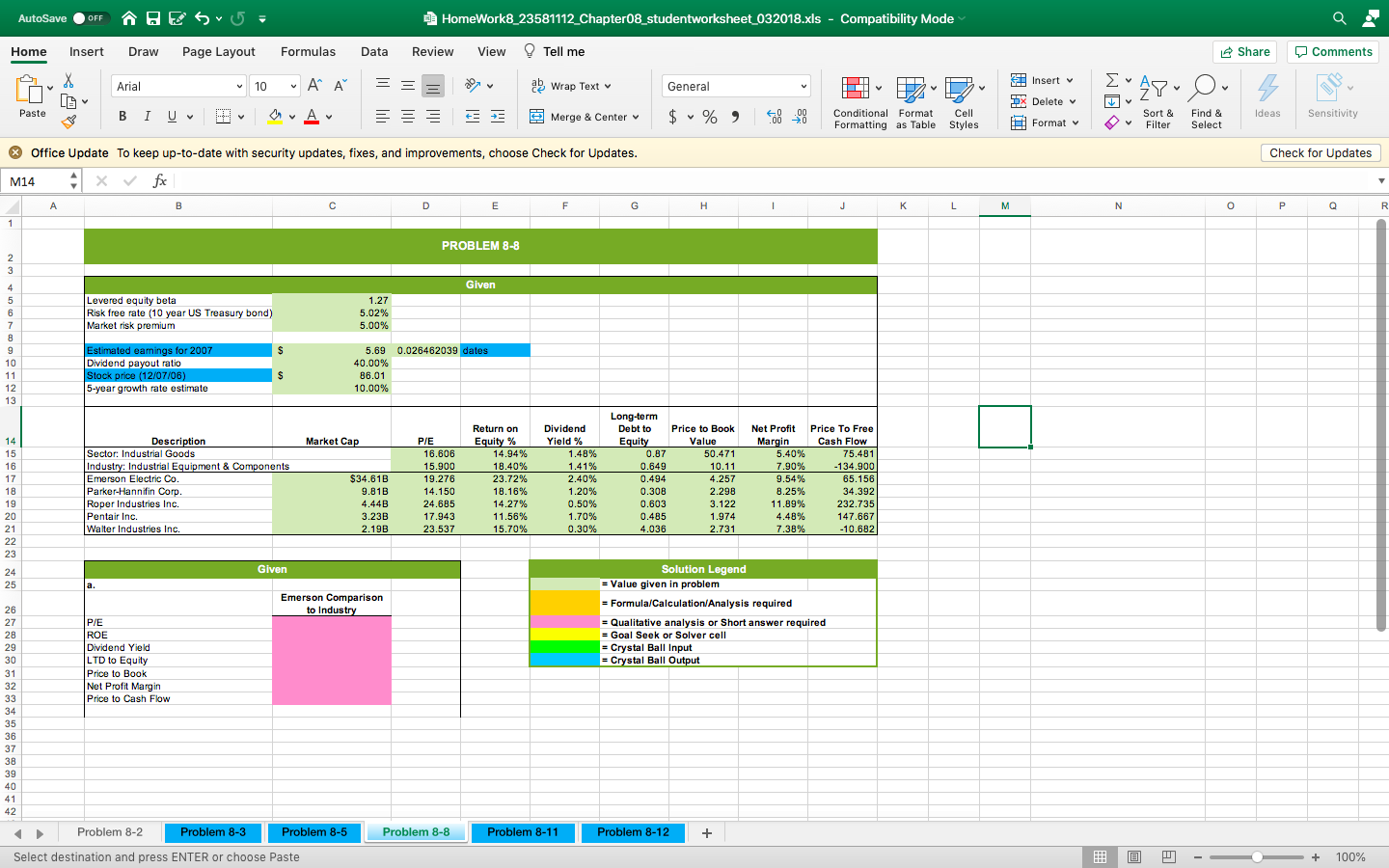

AutoSave OFF ES = HomeWork8_23581112_Chapter08_studentworksheet_032018.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Insert Arial V . AP 10 = = ab Wrap Text General V 48- O 5 4 DX Delete v Paste A 3 Merge & Center V $ %) .00 .00 0 Ideas Conditional Format Formatting as Table Cell Styles Sensitivity Find & Select Format Sort & Filter Check for Updates * Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. M14 4 x fx A B D E F G H 1 J L M N o P Q R 1 PROBLEM 8-8 2 3 Given 4 5 Levered equity beta Risk free rate (10 year US Treasury bond) Market risk premium 1.27 5.02% 5.00% $ 6 7 8 9 9 10 11 12 13 Estimated earnings for 2007 Dividend payout ratio Stock price (12/07/06) 5-year growth rate estimate 5.69 0.026462039 dates 40.00% 86.01 10.00% $ Market Cap 14 15 16 17 18 19 20 21 22 23 Description Sector: Industrial Goods Industry: Industrial Equipment & Components Emerson Electric Co. Parker-Hannifin Corp. Roper Industries Inc. $34.61B 9.81B 4.44B 3.23B 2.19B PIE 16.606 15.900 19.276 14.150 24.685 17.943 23.537 Return on Equity % 14.94% 18.40% 23.72% 18.16% 14.27% 11.56% 15.70% Dividend Yield % 1.48% 1.41% 2.40% 1.20% 0.50% 1.70% 0.30% Long-term Debt to Equity 0.87 0.649 0.494 0.308 0.603 0.485 4.036 Price to Book Value 50.471 10.11 4.257 2.298 3.122 1.974 2.731 Net Profit Price To Free Margin Cash Flow 5.40% 75.481 7.90% -134.900 9.54% 65.156 8.25% 34.392 11.89% 232.735 4.48% 147.667 7.38% -10.682 Pentair Inc. Walter Industries Inc. Given 24 25 Emerson Comparison to Industry 26 27 28 29 30 31 32 33 P/E ROE Dividend Yield LTD to Equity Price to Book Net Profit Margin Price to Cash Flow Solution Legend - Value given in problem = Formula/Calculation/Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell = Crystal Ball Input = Crystal Ball Output 35 36 37 38 39 40 41 42 Problem 8-2 Problem 8-3 Problem 8-5 Problem 8-8 Problem 8-11 Problem 8-12 + Select destination and press ENTER or choose Paste A i + 100% AutoSave OFF ES = HomeWork8_23581112_Chapter08_studentworksheet_032018.xls - Compatibility Mode Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Insert Arial V . AP 10 = = ab Wrap Text General V 48- O 5 4 DX Delete v Paste A 3 Merge & Center V $ %) .00 .00 0 Ideas Conditional Format Formatting as Table Cell Styles Sensitivity Find & Select Format Sort & Filter Check for Updates * Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. M14 4 x fx A B D E F G H 1 J L M N o P Q R 1 PROBLEM 8-8 2 3 Given 4 5 Levered equity beta Risk free rate (10 year US Treasury bond) Market risk premium 1.27 5.02% 5.00% $ 6 7 8 9 9 10 11 12 13 Estimated earnings for 2007 Dividend payout ratio Stock price (12/07/06) 5-year growth rate estimate 5.69 0.026462039 dates 40.00% 86.01 10.00% $ Market Cap 14 15 16 17 18 19 20 21 22 23 Description Sector: Industrial Goods Industry: Industrial Equipment & Components Emerson Electric Co. Parker-Hannifin Corp. Roper Industries Inc. $34.61B 9.81B 4.44B 3.23B 2.19B PIE 16.606 15.900 19.276 14.150 24.685 17.943 23.537 Return on Equity % 14.94% 18.40% 23.72% 18.16% 14.27% 11.56% 15.70% Dividend Yield % 1.48% 1.41% 2.40% 1.20% 0.50% 1.70% 0.30% Long-term Debt to Equity 0.87 0.649 0.494 0.308 0.603 0.485 4.036 Price to Book Value 50.471 10.11 4.257 2.298 3.122 1.974 2.731 Net Profit Price To Free Margin Cash Flow 5.40% 75.481 7.90% -134.900 9.54% 65.156 8.25% 34.392 11.89% 232.735 4.48% 147.667 7.38% -10.682 Pentair Inc. Walter Industries Inc. Given 24 25 Emerson Comparison to Industry 26 27 28 29 30 31 32 33 P/E ROE Dividend Yield LTD to Equity Price to Book Net Profit Margin Price to Cash Flow Solution Legend - Value given in problem = Formula/Calculation/Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell = Crystal Ball Input = Crystal Ball Output 35 36 37 38 39 40 41 42 Problem 8-2 Problem 8-3 Problem 8-5 Problem 8-8 Problem 8-11 Problem 8-12 + Select destination and press ENTER or choose Paste A i + 100%