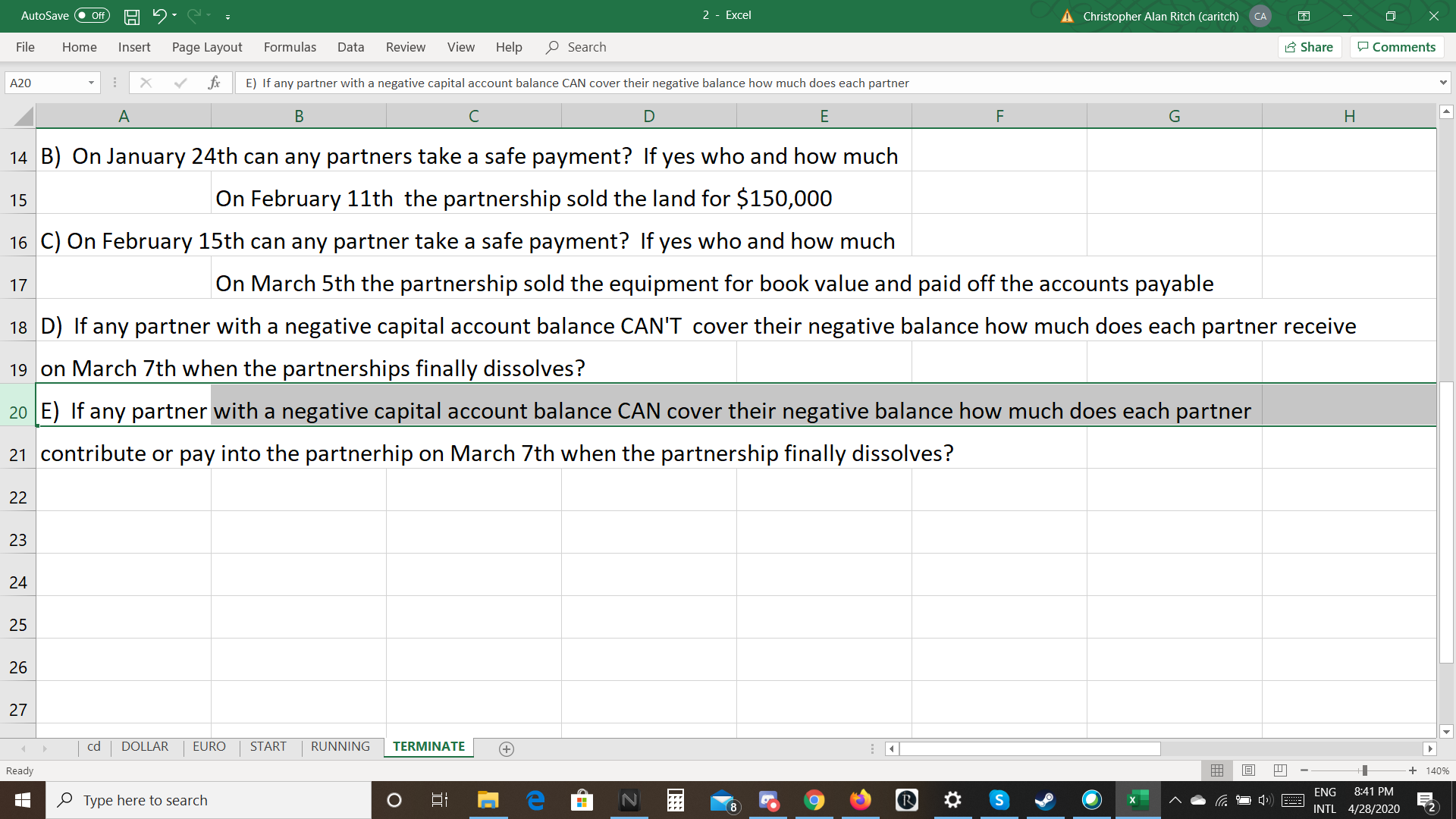

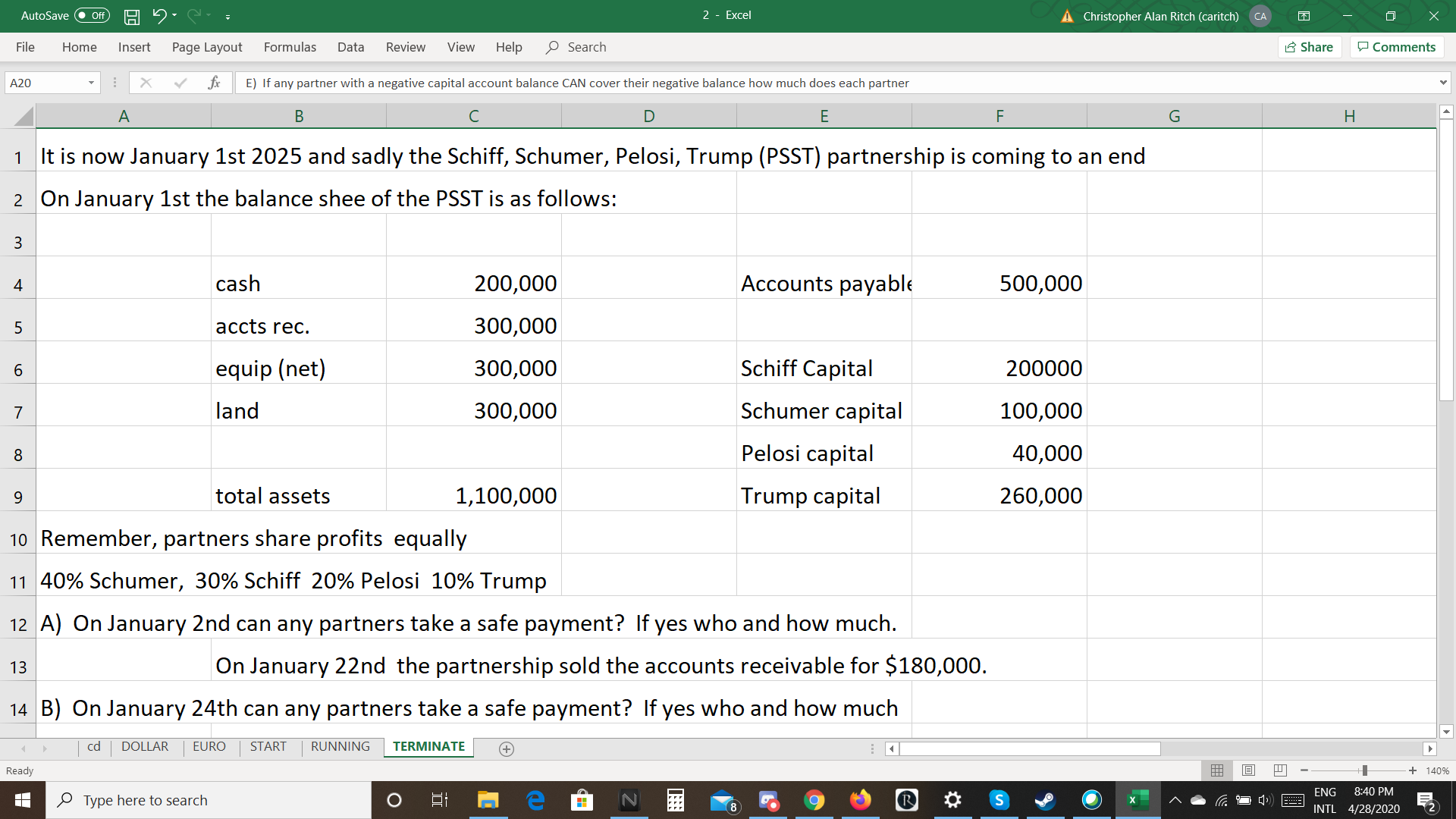

AutoSave ( Off) H 2 - Excel A Christopher Alan Ritch (caritch) CA X File Home Insert Page Layout Formulas Data Review View Help 9 Search Share Comments A20 X fx E) If any partner with a negative capital account balance CAN cover their negative balance how much does each partner A B C D E F G H 1 It is now January 1st 2025 and sadly the Schiff, Schumer, Pelosi, Trump (PSST) partnership is coming to an end 2 On January 1st the balance shee of the PSST is as follows: 3 4 cash 200,000 Accounts payable 500,000 5 accts rec. 300,000 6 equip (net) 300,000 Schiff Capital 200000 7 land 300,000 Schumer capital 100,000 8 Pelosi capital 40,000 9 total assets 1,100,000 Trump capital 260,000 10 Remember, partners share profits equally 11 40% Schumer, 30% Schiff 20% Pelosi 10% Trump 12 A) On January 2nd can any partners take a safe payment? If yes who and how much. 13 On January 22nd the partnership sold the accounts receivable for $180,000. 14 B) On January 24th can any partners take a safe payment? If yes who and how much cd | DOLLAR EURO START RUNNING TERMINATE + Ready + 140% Type here to search O 8 X ENG 8:40 PM INTL 4/28/2020 FAutoSave ( Off) H 2 - Excel A Christopher Alan Ritch (caritch) CA X File Home Insert Page Layout Formulas Data Review View Help 9 Search Share Comments A20 X v fx E) If any partner with a negative capital account balance CAN cover their negative balance how much does each partner A B C D E F G H 14 B) On January 24th can any partners take a safe payment? If yes who and how much 15 On February 11th the partnership sold the land for $150,000 16 C) On February 15th can any partner take a safe payment? If yes who and how much 17 On March 5th the partnership sold the equipment for book value and paid off the accounts payable 18 D) If any partner with a negative capital account balance CAN'T cover their negative balance how much does each partner receive 19 on March 7th when the partnerships finally dissolves? 20 E) If any partner with a negative capital account balance CAN cover their negative balance how much does each partner 21 contribute or pay into the partnerhip on March 7th when the partnership finally dissolves? 22 23 24 25 26 27 cd | DOLLAR EURO START | RUNNING TERMINATE + Ready + 140% Type here to search O X ENG 8:41 PM INTL 4/28/2020 F