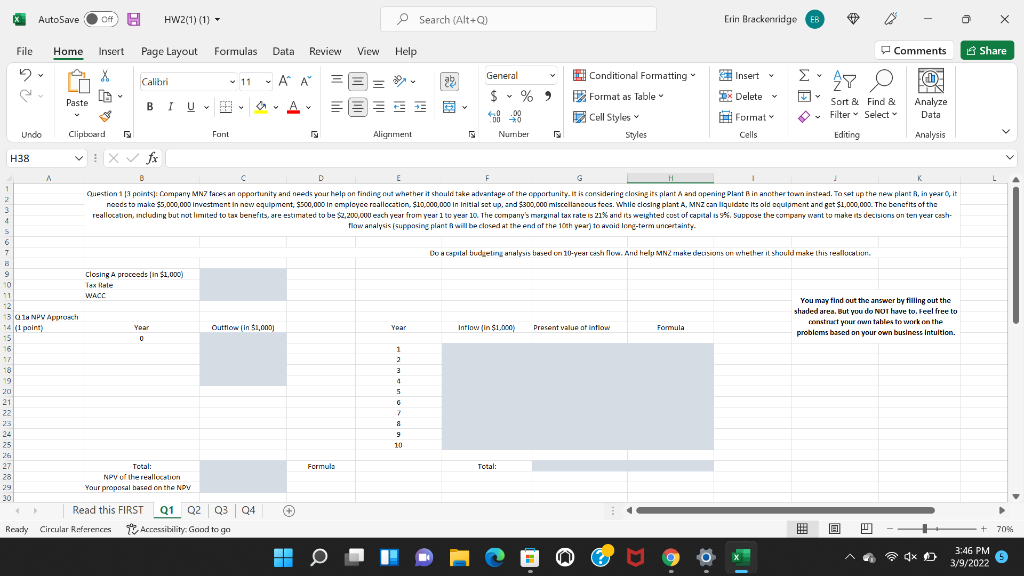

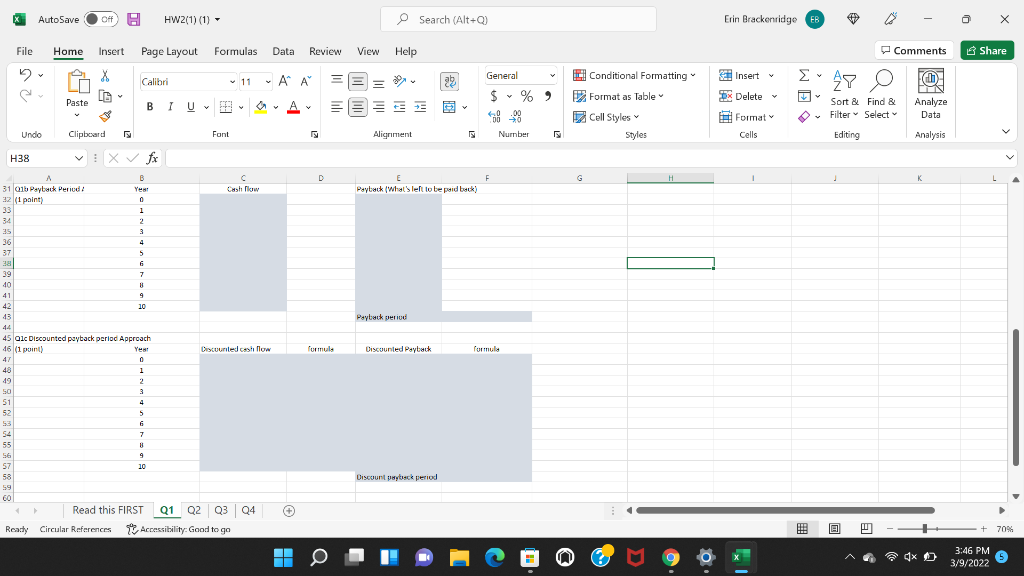

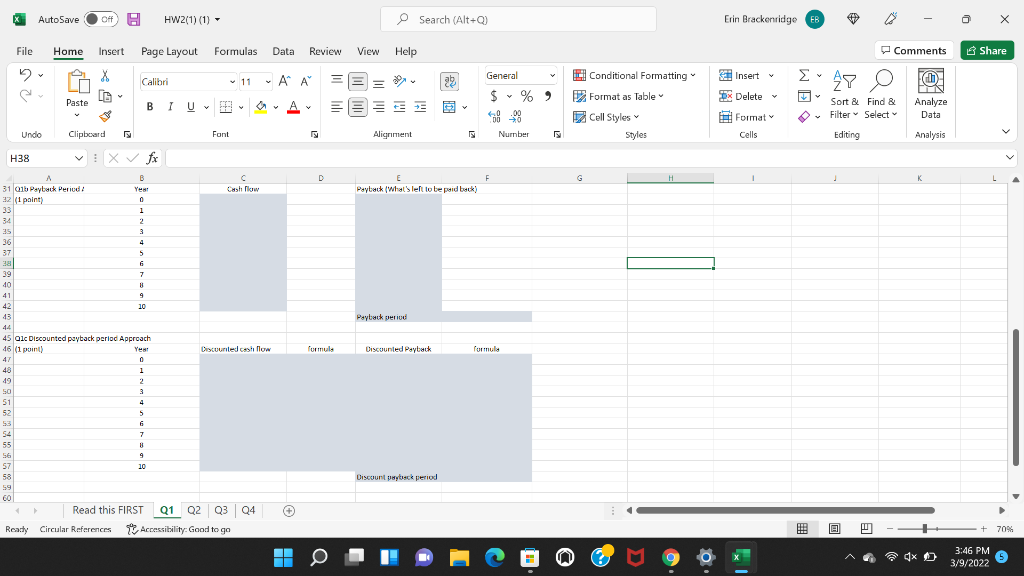

AutoSave Off H HW2(1)(1) O Search (Alt+Q Erin Brackenridge B a X Share V ' 49 Paste Y y L File Home Insert Page Layout Formulas Data Review View Help Comments 2 X X General Conditional Formatting - A LN Calibri v 11 A A Insert 22 Fah) $ % ) Format as Table DX Delete U UA = Sort & Find & Analyze 40 000 Cell Styles Data Format Filter Select Undo Clipboard Font Alignment 5 Nurnber F Styles Cells Editing Analysis H38 fx A B D H 1 1 Question 11 pcints: Company MNZ faces an opportunity and needs your help an finding out whether it should take advantage of the opportunity. It is considering closing its plant and opening Plant Bin another town instead. To set up the new plant R, in year, it 2 needs to make $5,000,000 Investment in new equipment, $500,000 in cmployce reallocation, $10,000,000 In Initial set up, and $300.000 miscellaneous tces. While closing plant A, MNZ can liquidate Its old equipment and get $1,000,000. The benefits of the 3 reallocation, including but not limited to tax benefits, are estimated to be $2,200,000 each year from year 1 to year 10. The company's marginal tax rate is 21% and its weighted cost of capital is 5%. Suppose the company want to make its decisions on ten year cash- 4 flow analysis (supposing plant will be closed at the end of the 10th year) to avoid long-term uncertainty -. 5 6 7 Do a capital budgeting analysis based on 10-year cash flow. And hely MNZ make decisions on whether it should make this resllocation. 8 9 Closing proceeds in $1,000) 10 Tax Rule 11 WACC You may find out the answer by filling out the 12 shaded area. But you do NOT have to. Feel free to 13 18 NPV Apurosch 14(1 point) contact your own tables to work on the Year Outflow in $1,000 Year Intlow in $1,000 Present value of now Formula problems based on your own business Intuition. 115 16 1 17 2 18 3 3 19 4 20 S 21 G 22 7 23 8 24 9 25 10 26 27 Total: Formula Total: 28 NPV of the reallocation 29 Your proposal based on the NPV 30 Read this FIRST Q1 Q2 Q3 04 Really Circular References Accessibility: Good to go e 0 + 70% 3:46 PM 3/9/2022 AutoSave Off H HW2(1)(1) O Search (Alt+Q Erin Brackenridge B a X File Home Insert Page Layout Formulas Data Review View Help Comments Share 2 X X General V Insert - A A A Calibri v 11 ' FO 49 22 $ % ) DX Delete Paste UA U Conditional Formatting Format as Table Cell Styles Styles =r= = Y Sort & Find & Filter Select Analyze Data 40 000 Format Cells Undo Clipboard Font Alignment 5 Nurnber Editing Analysis H38 X fx V D F H 1 Paytak wat left to be paid back) Payback period formula Discounted Payback A B C 31 01b Paybuck Period Yest shik 22 (1 point) 0 33 1 34 2 35 3 36 4 37 5 38 6 39 7 40 41 9 42 10 43 44 45 Olc Discounted payback period Approach 46 (1 point) Yes Discounted castle 47 0 48 1 49 2 50 3 51 4 52 5 53 6 54 7 55 56 9 57 10 58 59 60 Read this FIRST Q1 01 02 Q2 Q3 Q4 Really Circular References Accessibility: Good to go Discount payback period e + 70% 3:46 PM 3/9/2022 AutoSave Off H HW2(1)(1) O Search (Alt+Q Erin Brackenridge B a X Share V ' 49 Paste Y y L File Home Insert Page Layout Formulas Data Review View Help Comments 2 X X General Conditional Formatting - A LN Calibri v 11 A A Insert 22 Fah) $ % ) Format as Table DX Delete U UA = Sort & Find & Analyze 40 000 Cell Styles Data Format Filter Select Undo Clipboard Font Alignment 5 Nurnber F Styles Cells Editing Analysis H38 fx A B D H 1 1 Question 11 pcints: Company MNZ faces an opportunity and needs your help an finding out whether it should take advantage of the opportunity. It is considering closing its plant and opening Plant Bin another town instead. To set up the new plant R, in year, it 2 needs to make $5,000,000 Investment in new equipment, $500,000 in cmployce reallocation, $10,000,000 In Initial set up, and $300.000 miscellaneous tces. While closing plant A, MNZ can liquidate Its old equipment and get $1,000,000. The benefits of the 3 reallocation, including but not limited to tax benefits, are estimated to be $2,200,000 each year from year 1 to year 10. The company's marginal tax rate is 21% and its weighted cost of capital is 5%. Suppose the company want to make its decisions on ten year cash- 4 flow analysis (supposing plant will be closed at the end of the 10th year) to avoid long-term uncertainty -. 5 6 7 Do a capital budgeting analysis based on 10-year cash flow. And hely MNZ make decisions on whether it should make this resllocation. 8 9 Closing proceeds in $1,000) 10 Tax Rule 11 WACC You may find out the answer by filling out the 12 shaded area. But you do NOT have to. Feel free to 13 18 NPV Apurosch 14(1 point) contact your own tables to work on the Year Outflow in $1,000 Year Intlow in $1,000 Present value of now Formula problems based on your own business Intuition. 115 16 1 17 2 18 3 3 19 4 20 S 21 G 22 7 23 8 24 9 25 10 26 27 Total: Formula Total: 28 NPV of the reallocation 29 Your proposal based on the NPV 30 Read this FIRST Q1 Q2 Q3 04 Really Circular References Accessibility: Good to go e 0 + 70% 3:46 PM 3/9/2022 AutoSave Off H HW2(1)(1) O Search (Alt+Q Erin Brackenridge B a X File Home Insert Page Layout Formulas Data Review View Help Comments Share 2 X X General V Insert - A A A Calibri v 11 ' FO 49 22 $ % ) DX Delete Paste UA U Conditional Formatting Format as Table Cell Styles Styles =r= = Y Sort & Find & Filter Select Analyze Data 40 000 Format Cells Undo Clipboard Font Alignment 5 Nurnber Editing Analysis H38 X fx V D F H 1 Paytak wat left to be paid back) Payback period formula Discounted Payback A B C 31 01b Paybuck Period Yest shik 22 (1 point) 0 33 1 34 2 35 3 36 4 37 5 38 6 39 7 40 41 9 42 10 43 44 45 Olc Discounted payback period Approach 46 (1 point) Yes Discounted castle 47 0 48 1 49 2 50 3 51 4 52 5 53 6 54 7 55 56 9 57 10 58 59 60 Read this FIRST Q1 01 02 Q2 Q3 Q4 Really Circular References Accessibility: Good to go Discount payback period e + 70% 3:46 PM 3/9/2022