Answered step by step

Verified Expert Solution

Question

1 Approved Answer

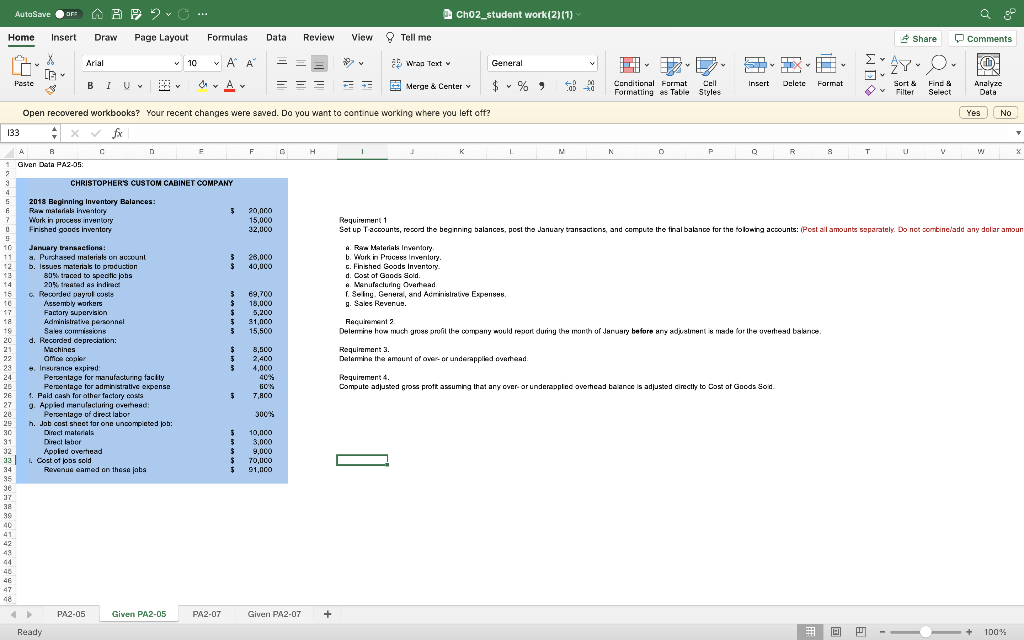

AutoSave OFF Home Insert Draw Page Layout X Arial Peste BI U Ch02_student work(2)(1) Formulas Datal Review View Tell me v 10 A A

AutoSave OFF Home Insert Draw Page Layout X Arial Peste BI U Ch02_student work(2)(1) Formulas Datal Review View Tell me v 10 A A A Wrap Text Merge & Center Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Share Comments General W $%9 00 Conditional Format Cell Formatting as Table Styles Insert Delete Format v Sort & Find & Filter Select Analyze Data Yes No 1 J K L M N P Q R 8 T U V W X Set up Taccounts, record the beginning balances, post the January transactions, and compute the final balance for the following accounts: (Post all amounts separately. Do not combine/add any dollar amoun a. Raw Materials Inventory. d. Cost of Goods Gold. f. Selling, General, and Administrative Expenses. g. Sales Revenue. Requirement 2 Determine how much gross profit the company would report during the month of January before any adjustment is made for the overhead balance. Requirement 3. Determine the amount of over- or underapplied overhead Requirement 4. Compute adjusted gross profit assuming that any over- or underappled overhead balance is adjusted directly to Cost of Goods Sold. 133 x fx A B D E F G H Given Data PA2-05: 2 3 CHRISTOPHER'S CUSTOM CABINET COMPANY 5 2018 Beginning Inventory Balances: 6 Raw materials inventory 7 Work in process inventory B Finished goods inventory 20,000 15,000 32,000 Requirement 1 9 10 January transactions: 11 a. Purchased materials on account 26,000 b. Work in Process Inventory. 12 b. Issues materials to production $ 40,000 c. Finished Goods Inventory. 13 80% traced to specific jobs 14 15 20% treated as indirect Recorded payroll costs e. Manufacturing Overhead. 69,700 16 Assembly workers $ 18,000 17 18 19 20 21 Factory supervision Administrative personnel Sales commissions d. Recorded depreciation: Machines $ 5,200 5 31,000 3 15,500 $ 8,500 22 am coper $ 2,400 23 e. Insurance expired: 4,000 24 Percentage for manufacturing facility 40% 25 Percentage for administrative expense 60% 26 1. Paid cash for other factory costs $ 7,800 27 g. Appied manufacturing overhead: 28 Percentage of direct labor 300% 29 h. Job cost sheet for one uncompleted job: 30 Direct materials $ 10,000 31 Direct labor 5 3,000 32 Applied overhead $ 9,000 33 I. Cost of jobs sold $ 70,000 34 Revenue eamed on these jobs $ 91,000 35 36 37 38 39 40 41 42 43 44 46 46 47 48 PA2-05 Given PA2-05 PA2-07 Given PA2-07 Ready 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started