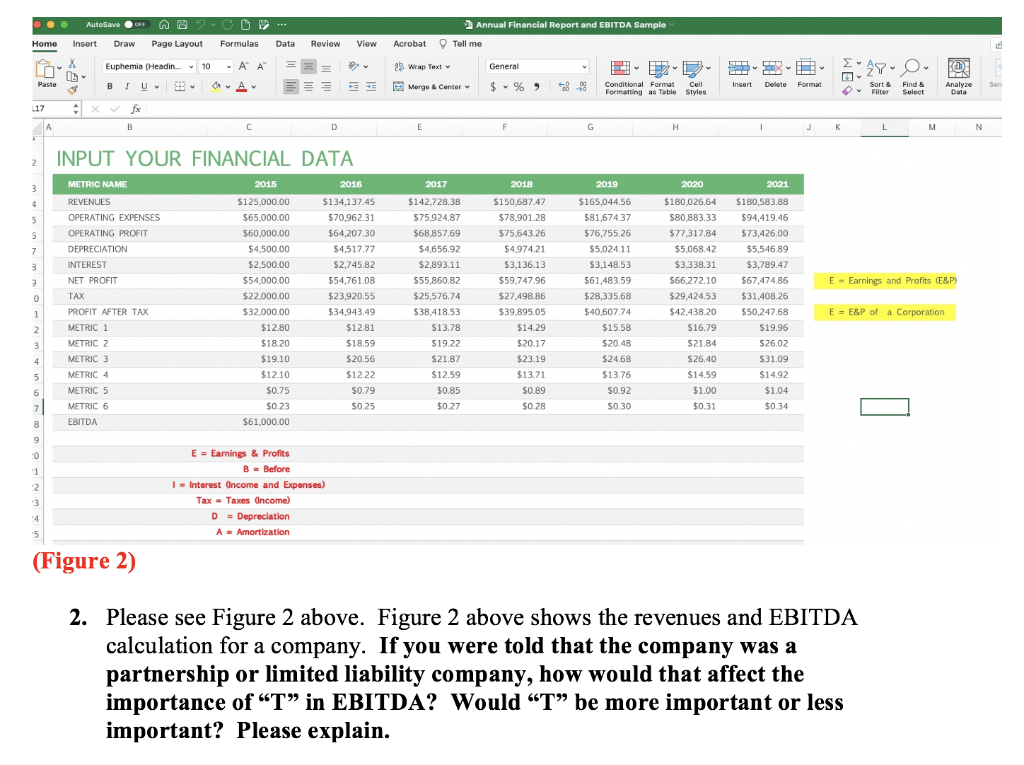

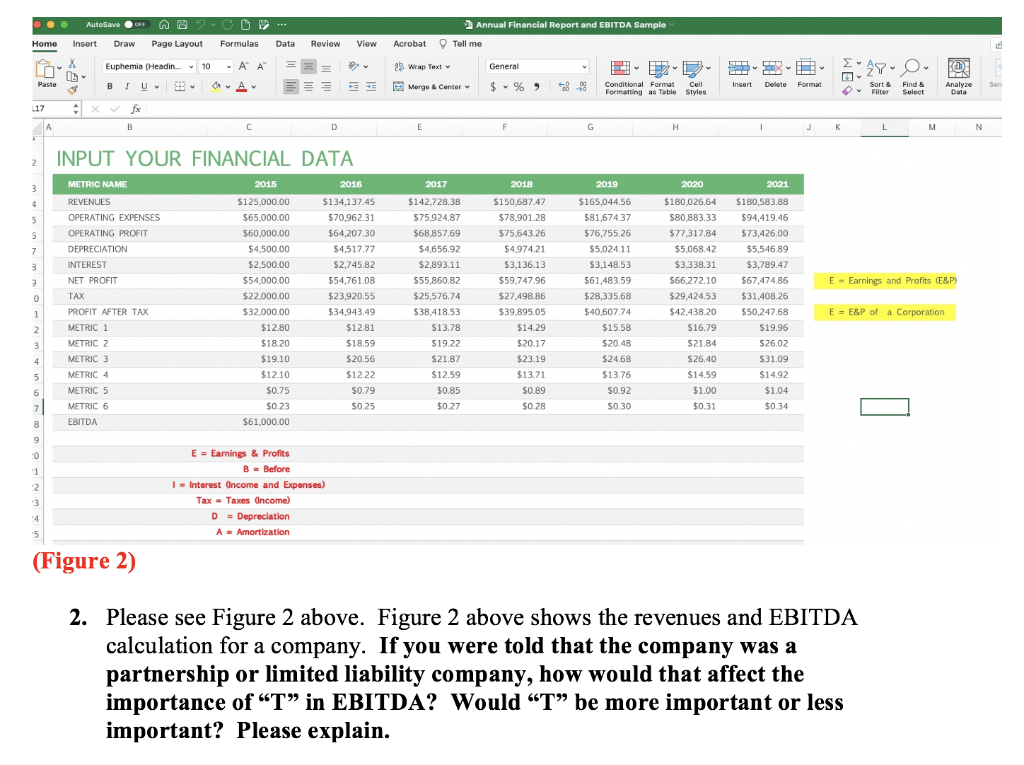

AutoSave OFF O Annual Financial Report and EBITDA Sample Acrobat Tell me Home Draw Page Layout Formulas Data Review View 6 Insert Euphemia (Headin... 10 AA 29 Wrap Text General LEX EL Conditional Format Cell Formatting as Table Styles 28-0 F @ Analyze Data Paste OA Merge & Center $ %> Insert 68 99 Delete Format Sort Filter Sen Find & Select BIU 8x v fx Xfx 117 TA B D E F G H 1 K L M N INPUT YOUR FINANCIAL DATA 2 METRIC NAME 3 2015 2016 2018 2019 2020 4 5 5 $125,000.00 S65,000.00 $60,000.00 54500 7 3 a E - Earnings and Profits (E&P) REVENUES OPERATING EXPENSES OPERATING PROFIT DEPRECIATION INTEREST NET PROFIT TAX PROFIT AFTER TAX METRIC 1 METRIC 2 METRIC 3 METRIC 4 METRIC 5 METRIC 6 EBITDA 0 $134,137.45 $70,962.31 $64,207.30 $4,517.77 52.745 82 $2,745.82 554,761.06 $23.920.55 $34,943.49 1943.49 $12.81 WO $18.59 $20.56 $12.22 S0.79 $0.25 2017 $142,728.38 $75,924.87 $ $68,857.69 $4,656.92 $2.893.11 $55,860.82 $ $25,576.74 $38.418.53 $13.78 9 $19.22 $21.87 $12.59 $0.85 $0.27 $180,026.64 580,883.33 $77,317,84 $5,068.42 53 330 31 $ $3,338.31 566,272.10 $29.424.33 $42.438.20 $16.79 $150,687.47 $78.901.28 $75,643.26 $4.974.21 $ $3,136.13 $59,747.96 $27,498.86 $39.895.05 $14.29 . $20.17 $23.19 $13.71 $0.89 $165,044.56 $81,674.37 $76,755.26 $5,024.11 $3,148.53 $61.483.39 $28,359.00 $40,607.74 $15.58 . $20.48 $24.68 $13.76 $0.92 $0.30 $2.500.00 $54,000.00 $22,000.00 $32,000.00 . $12.80 $ $18.20 $19.10 $12.10 $0.75 $0.23 $61,000.00 1 2021 $180,583.88 594,419.46 $73,426.00 $5,546.89 33,789.47 567.474.00 $31,408.26 $50,247.68 2.217.68 $19.96 $26.02 $31.09 $1492 $1.04 $0.34 $ E = E&P of a Corporation 2 3 4 20.12 $21.84 $26.40 $1459 $1.00 $0.31 5 6 $0.28 8 9 0 1 2 3 E = Eamines & Profits B - Before | - Interest Income and Expenses) Tax - Taxes Oncome) D = Depreciation A - Amortization 14 5 (Figure 2) 2. Please see Figure 2 above. Figure 2 above shows the revenues and EBITDA calculation for a company. If you were told that the company was a partnership or limited liability company, how would that affect the importance of T in EBITDA? Would "T" be more important or less important? Please explain. AutoSave OFF O Annual Financial Report and EBITDA Sample Acrobat Tell me Home Draw Page Layout Formulas Data Review View 6 Insert Euphemia (Headin... 10 AA 29 Wrap Text General LEX EL Conditional Format Cell Formatting as Table Styles 28-0 F @ Analyze Data Paste OA Merge & Center $ %> Insert 68 99 Delete Format Sort Filter Sen Find & Select BIU 8x v fx Xfx 117 TA B D E F G H 1 K L M N INPUT YOUR FINANCIAL DATA 2 METRIC NAME 3 2015 2016 2018 2019 2020 4 5 5 $125,000.00 S65,000.00 $60,000.00 54500 7 3 a E - Earnings and Profits (E&P) REVENUES OPERATING EXPENSES OPERATING PROFIT DEPRECIATION INTEREST NET PROFIT TAX PROFIT AFTER TAX METRIC 1 METRIC 2 METRIC 3 METRIC 4 METRIC 5 METRIC 6 EBITDA 0 $134,137.45 $70,962.31 $64,207.30 $4,517.77 52.745 82 $2,745.82 554,761.06 $23.920.55 $34,943.49 1943.49 $12.81 WO $18.59 $20.56 $12.22 S0.79 $0.25 2017 $142,728.38 $75,924.87 $ $68,857.69 $4,656.92 $2.893.11 $55,860.82 $ $25,576.74 $38.418.53 $13.78 9 $19.22 $21.87 $12.59 $0.85 $0.27 $180,026.64 580,883.33 $77,317,84 $5,068.42 53 330 31 $ $3,338.31 566,272.10 $29.424.33 $42.438.20 $16.79 $150,687.47 $78.901.28 $75,643.26 $4.974.21 $ $3,136.13 $59,747.96 $27,498.86 $39.895.05 $14.29 . $20.17 $23.19 $13.71 $0.89 $165,044.56 $81,674.37 $76,755.26 $5,024.11 $3,148.53 $61.483.39 $28,359.00 $40,607.74 $15.58 . $20.48 $24.68 $13.76 $0.92 $0.30 $2.500.00 $54,000.00 $22,000.00 $32,000.00 . $12.80 $ $18.20 $19.10 $12.10 $0.75 $0.23 $61,000.00 1 2021 $180,583.88 594,419.46 $73,426.00 $5,546.89 33,789.47 567.474.00 $31,408.26 $50,247.68 2.217.68 $19.96 $26.02 $31.09 $1492 $1.04 $0.34 $ E = E&P of a Corporation 2 3 4 20.12 $21.84 $26.40 $1459 $1.00 $0.31 5 6 $0.28 8 9 0 1 2 3 E = Eamines & Profits B - Before | - Interest Income and Expenses) Tax - Taxes Oncome) D = Depreciation A - Amortization 14 5 (Figure 2) 2. Please see Figure 2 above. Figure 2 above shows the revenues and EBITDA calculation for a company. If you were told that the company was a partnership or limited liability company, how would that affect the importance of T in EBITDA? Would "T" be more important or less important? Please explain