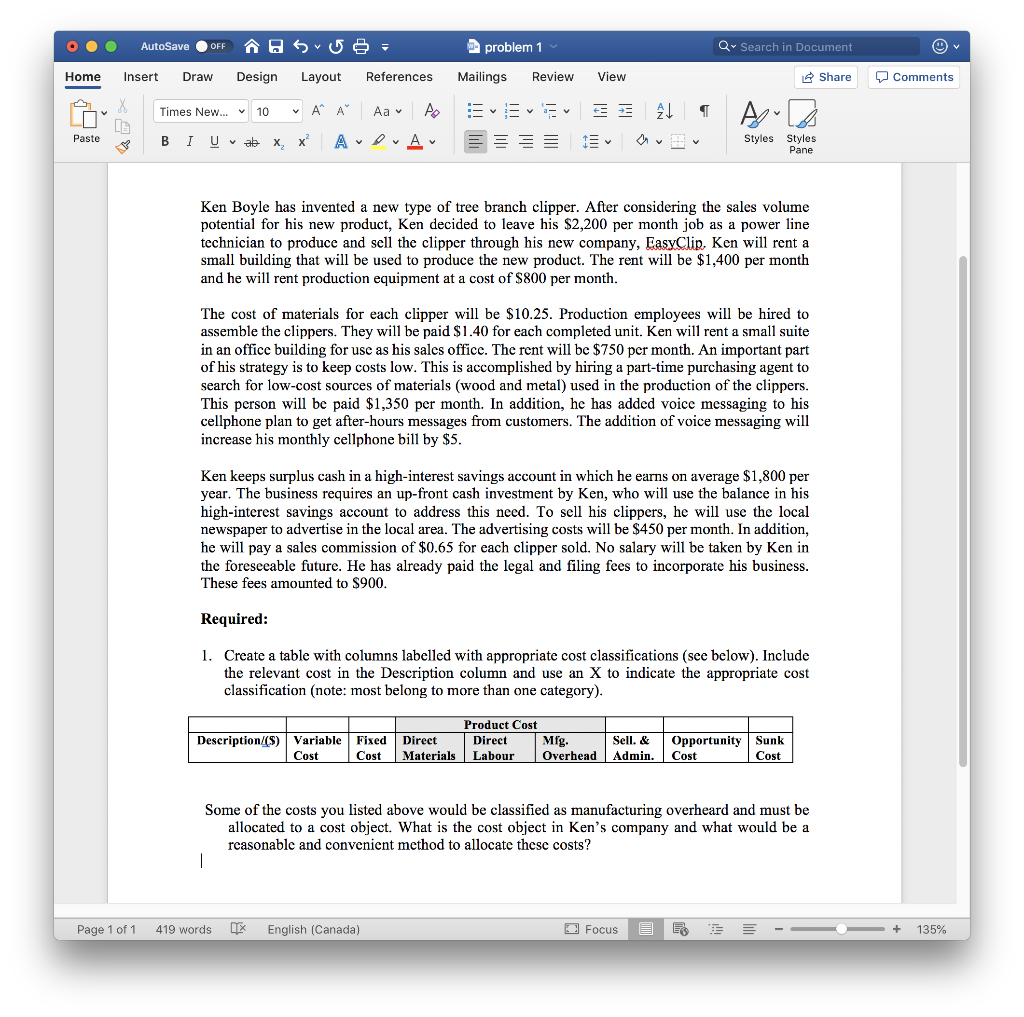

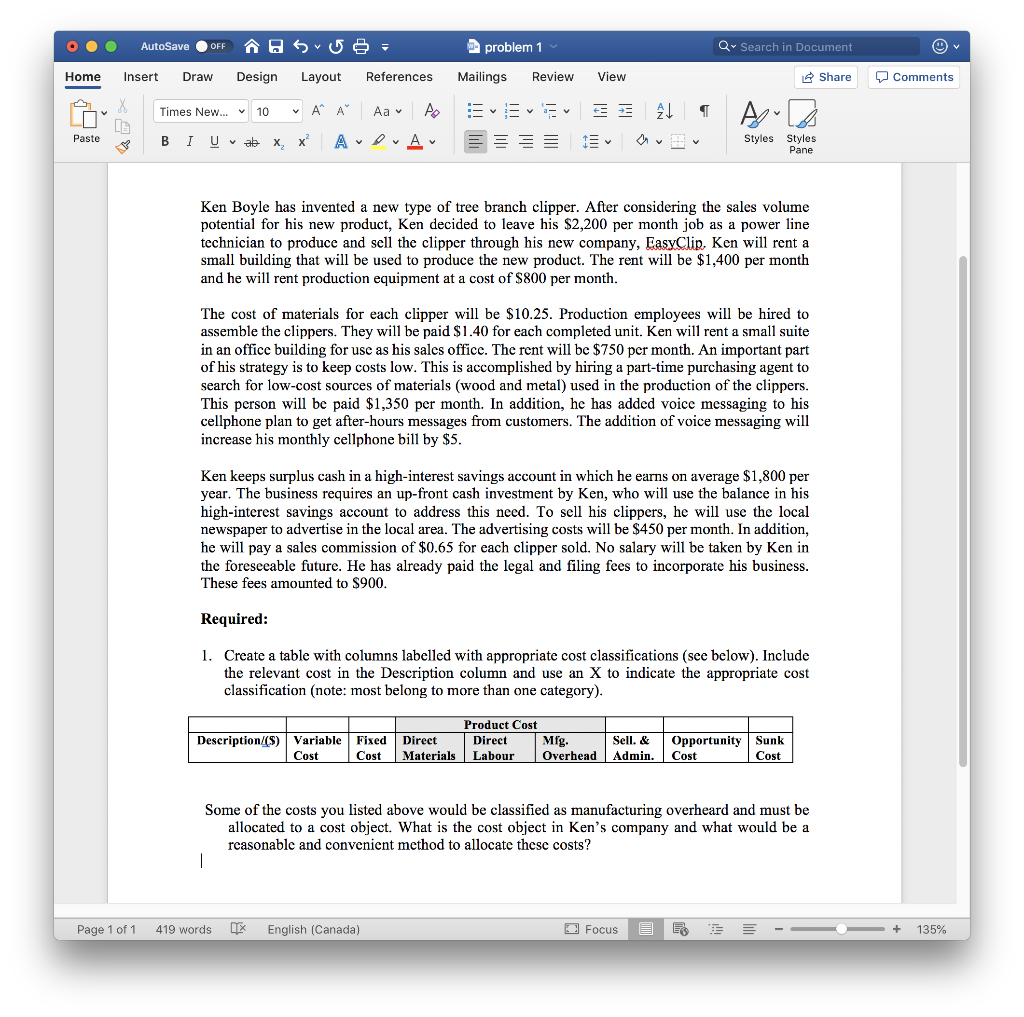

AutoSave OFF o Su 8 = w problem 1 Qv Search in Document Home Insert Draw Design Layout References Mailings Review View Share o Comments Times New... V 10 A A Aa v A A Paste Uvab X x ADA 19 Styles Styles Pane Ken Boyle has invented a new type of tree branch clipper. After considering the sales volume potential for his new product, Ken decided to leave his $2,200 per month job as a power line technician to produce and sell the clipper through his new company, EasyClip, Ken will rent a small building that will be used to produce the new product. The rent will be $1,400 per month and he will rent production equipment at a cost of $800 per month. The cost of materials for each clipper will be $10.25. Production employees will be hired to assemble the clippers. They will be paid $1.40 for each completed unit. Ken will rent a small suite in an office building for use as his sales office. The rent will be $750 per month. An important part of his strategy is to keep costs low. This is accomplished by hiring a part-time purchasing agent to search for low-cost sources of materials (wood and metal) used in the production of the clippers. This person will be paid $1,350 per month. In addition, he has added voice messaging to his cellphone plan to get after-hours messages from customers. The addition of voice messaging will increase his monthly cellphone bill by $5. Ken keeps surplus cash in a high-interest savings account in which he earns on average $1,800 per year. The business requires an up-front cash investment by Ken, who will use the balance in his high-interest savings account to address this need. To sell his clippers, he will use the local newspaper to advertise in the local area. The advertising costs will be $450 per month. In addition, he will pay a sales commission of $0.65 for each clipper sold. No salary will be taken by Ken in the foreseeable future. He has already paid the legal and filing fees to incorporate his business. These fees amounted to $900. Required: 1. Create a table with columns labelled with appropriate cost classifications (see below). Include the relevant cost in the Description column and use an X to indicate the appropriate cost classification (note: most belong to more than one category). Description (5) Variable Cost Fixed Product Cost Direct Direct Mfg. Sell. & Materials Labour Overhead Admin. Opportunity Cost Sunk Cost Cost Some of the costs you listed above would be classified as manufacturing overheard and must be allocated to a cost object. What is the cost object in Ken's company and what would be a reasonable and convenient method to allocate these costs? Page 1 of 1 419 words X English (Canada) O Focus ES 135%