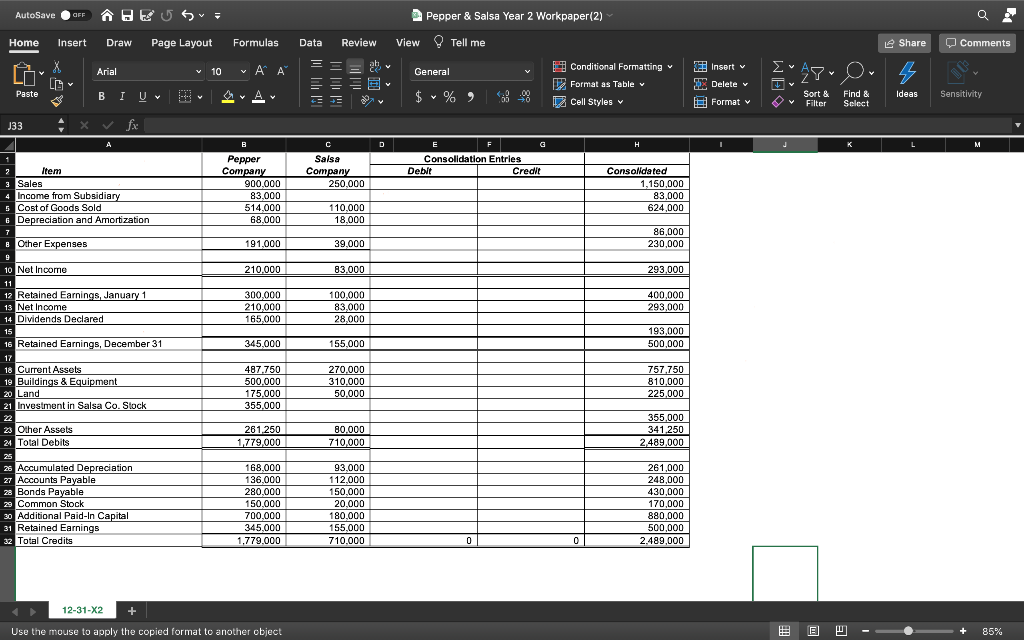

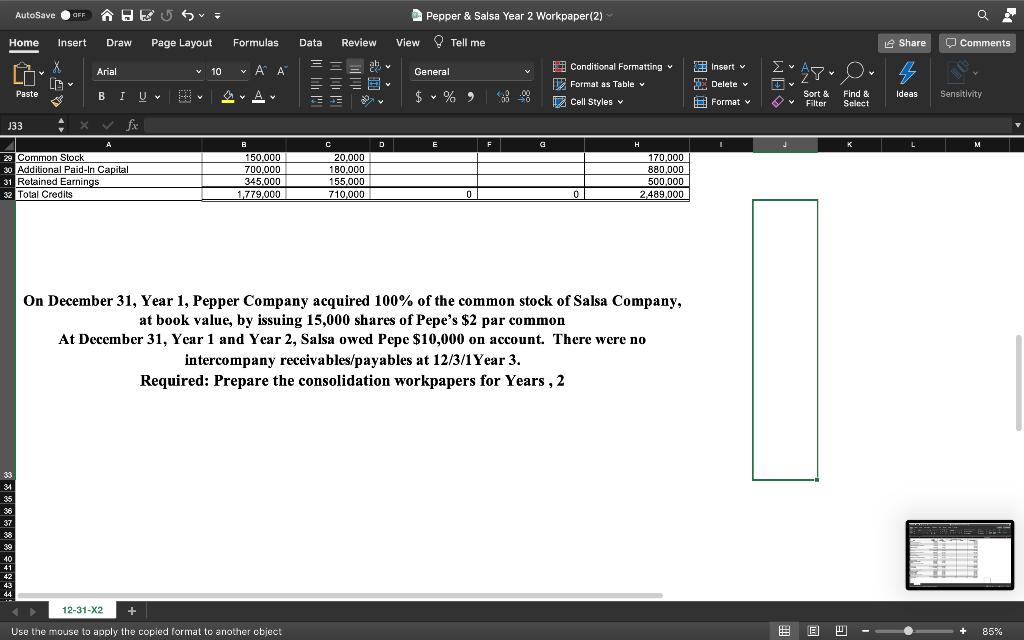

AutoSave OFF Q Pepper & Salsa Year 2 Workpaper(2) View Tell me Home Insert Draw Page Layout Formulas Data Review Le Share 0 Comments Arial v 10 v i A General u O Y Conditional Formatting v V Format as Table Cell Styles v 4 LL B Insert v & Delete v Format v Tv Paste BI U A $ % ) Y Sensitivity Sort & Filter Find & Select Ideas J33 fxe A C D E H J 4 Salsa Company 250.000 Consolidation Entries Debit Credit B Pepper Company 900.000 83,000 514.000 68,000 ? Item 3 Sales 3 4 Income from Subsidiary 5 Cost of Goods Sold 6 Depreciation and Amortization Consolidated 1,150,000 83,000 624,000 110,000 18,000 7 191,000 86,000 230,000 39,000 210,000 83.000 293,000 300,000 210,000 165,000 100,000 83,000 28,000 & Other Expenses 9 10 Net Income 11 12 Retained Earnings, January 1 13 Net Income 14 Dividends Declared 15 16 Retained Earnings, December 31 17 18 Current Assets 19 Buildings & Equipment 20 Land 21 Investment in Salsa Co. Stock 400,000 293,000 193,000 500,000 345,000 155.000 487.750 500.000 175.000 355.000 270.000 310.000 50.000 757.750 810,000 225,000 261250 1,779,000 80.000 710,000 355.000 341.250 2,489,000 23 Other Assets 21 Total Debits 25 Accumulated Depreciation 27 Accounts Payable 23 Bonds Payable 29 Common Stock 30 Additional Paid-In Capital 31 Retained Earnings 32 Total Credits 168,000 136.000 280.000 150.000 700.000 345.000 1.779.000 93,000 112,000 150,000 20,000 180,000 155.000 710.000 261,000 248,000 430,000 170,000 880,000 500,000 2.489,000 0 0 12-31-X2 + Use the mouse to apply the copied format to another object 85% AutoSave OFF Q Pepper & Salsa Year 2 Workpaper(2) View Tell me Home Insert Draw Page Layout Formulas Data Review Le Share 0 Comments Arial v 10 v A A General Insert v & Delete v EAR-Ou 4 Conditional Formatting Format as Table v Cell Styles v LL Paste BIU $ % ) Sensitivity Sort & Filter Ideas Format v Find & Select 133 . x fx E F J 29 Common Stock 30 Additional Paid-In Capital 31 Retained Earnings 32 Total Credits 150.000 700.000 345.000 1,779,000 20.000 180.000 155.000 710,000 H 170,000 880,000 500,000 2,489,000 0 0 On December 31, Year 1, Pepper Company acquired 100% of the common stock of Salsa Company, at book value, by issuing 15,000 shares of Pepe's $2 par common At December 31, Year 1 and Year 2, Salsa owed Pepe $10,000 on account. There were no intercompany receivables/payables at 12/3/1 Year 3. Required: Prepare the consolidation workpapers for Years, 2 34 37 38 40 41 43 44 12-31-X2 + Use the mouse to apply the copied format to another object E E E 85% AutoSave OFF Q Pepper & Salsa Year 2 Workpaper(2) View Tell me Home Insert Draw Page Layout Formulas Data Review Le Share 0 Comments Arial v 10 v i A General u O Y Conditional Formatting v V Format as Table Cell Styles v 4 LL B Insert v & Delete v Format v Tv Paste BI U A $ % ) Y Sensitivity Sort & Filter Find & Select Ideas J33 fxe A C D E H J 4 Salsa Company 250.000 Consolidation Entries Debit Credit B Pepper Company 900.000 83,000 514.000 68,000 ? Item 3 Sales 3 4 Income from Subsidiary 5 Cost of Goods Sold 6 Depreciation and Amortization Consolidated 1,150,000 83,000 624,000 110,000 18,000 7 191,000 86,000 230,000 39,000 210,000 83.000 293,000 300,000 210,000 165,000 100,000 83,000 28,000 & Other Expenses 9 10 Net Income 11 12 Retained Earnings, January 1 13 Net Income 14 Dividends Declared 15 16 Retained Earnings, December 31 17 18 Current Assets 19 Buildings & Equipment 20 Land 21 Investment in Salsa Co. Stock 400,000 293,000 193,000 500,000 345,000 155.000 487.750 500.000 175.000 355.000 270.000 310.000 50.000 757.750 810,000 225,000 261250 1,779,000 80.000 710,000 355.000 341.250 2,489,000 23 Other Assets 21 Total Debits 25 Accumulated Depreciation 27 Accounts Payable 23 Bonds Payable 29 Common Stock 30 Additional Paid-In Capital 31 Retained Earnings 32 Total Credits 168,000 136.000 280.000 150.000 700.000 345.000 1.779.000 93,000 112,000 150,000 20,000 180,000 155.000 710.000 261,000 248,000 430,000 170,000 880,000 500,000 2.489,000 0 0 12-31-X2 + Use the mouse to apply the copied format to another object 85% AutoSave OFF Q Pepper & Salsa Year 2 Workpaper(2) View Tell me Home Insert Draw Page Layout Formulas Data Review Le Share 0 Comments Arial v 10 v A A General Insert v & Delete v EAR-Ou 4 Conditional Formatting Format as Table v Cell Styles v LL Paste BIU $ % ) Sensitivity Sort & Filter Ideas Format v Find & Select 133 . x fx E F J 29 Common Stock 30 Additional Paid-In Capital 31 Retained Earnings 32 Total Credits 150.000 700.000 345.000 1,779,000 20.000 180.000 155.000 710,000 H 170,000 880,000 500,000 2,489,000 0 0 On December 31, Year 1, Pepper Company acquired 100% of the common stock of Salsa Company, at book value, by issuing 15,000 shares of Pepe's $2 par common At December 31, Year 1 and Year 2, Salsa owed Pepe $10,000 on account. There were no intercompany receivables/payables at 12/3/1 Year 3. Required: Prepare the consolidation workpapers for Years, 2 34 37 38 40 41 43 44 12-31-X2 + Use the mouse to apply the copied format to another object E E E 85%