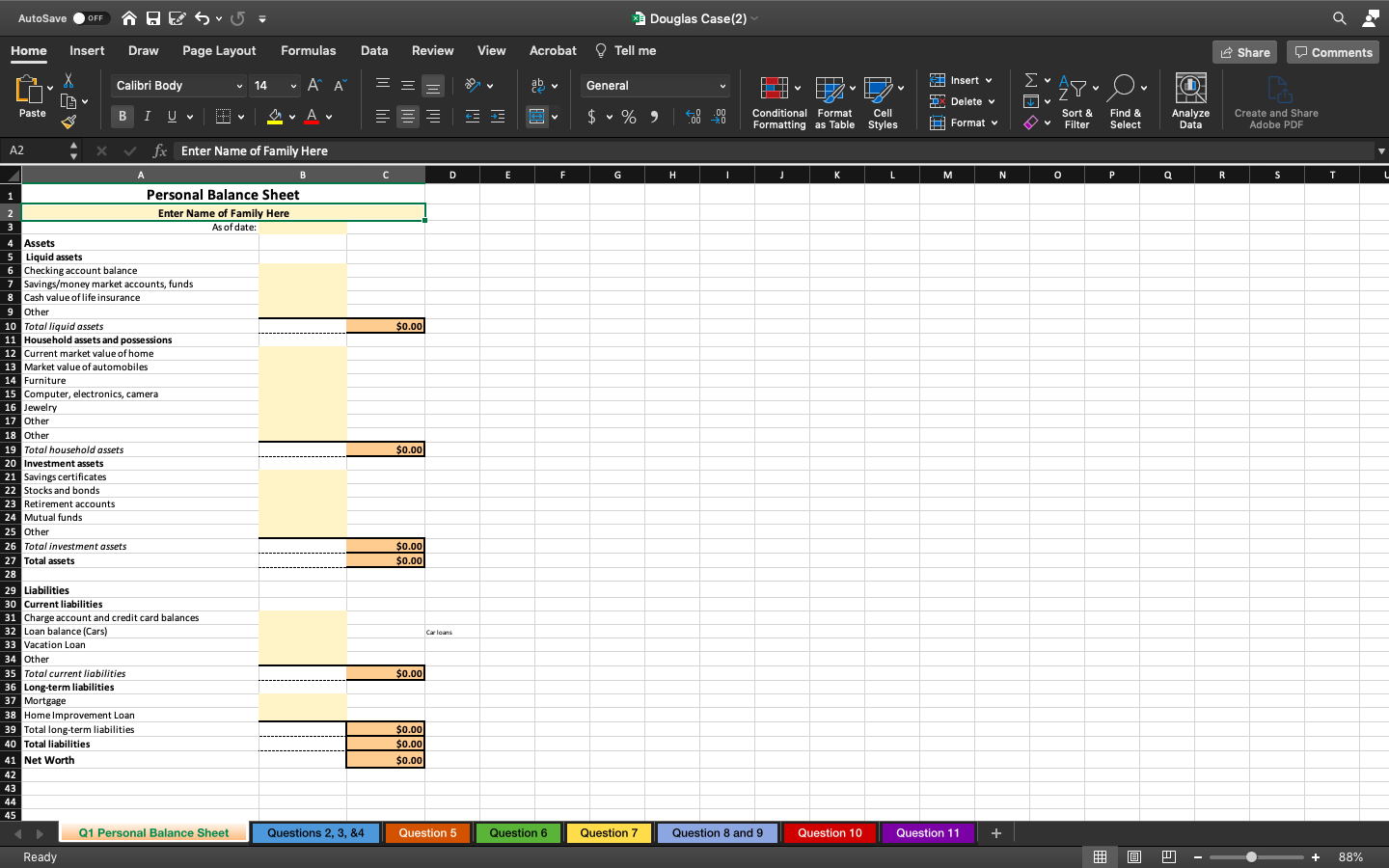

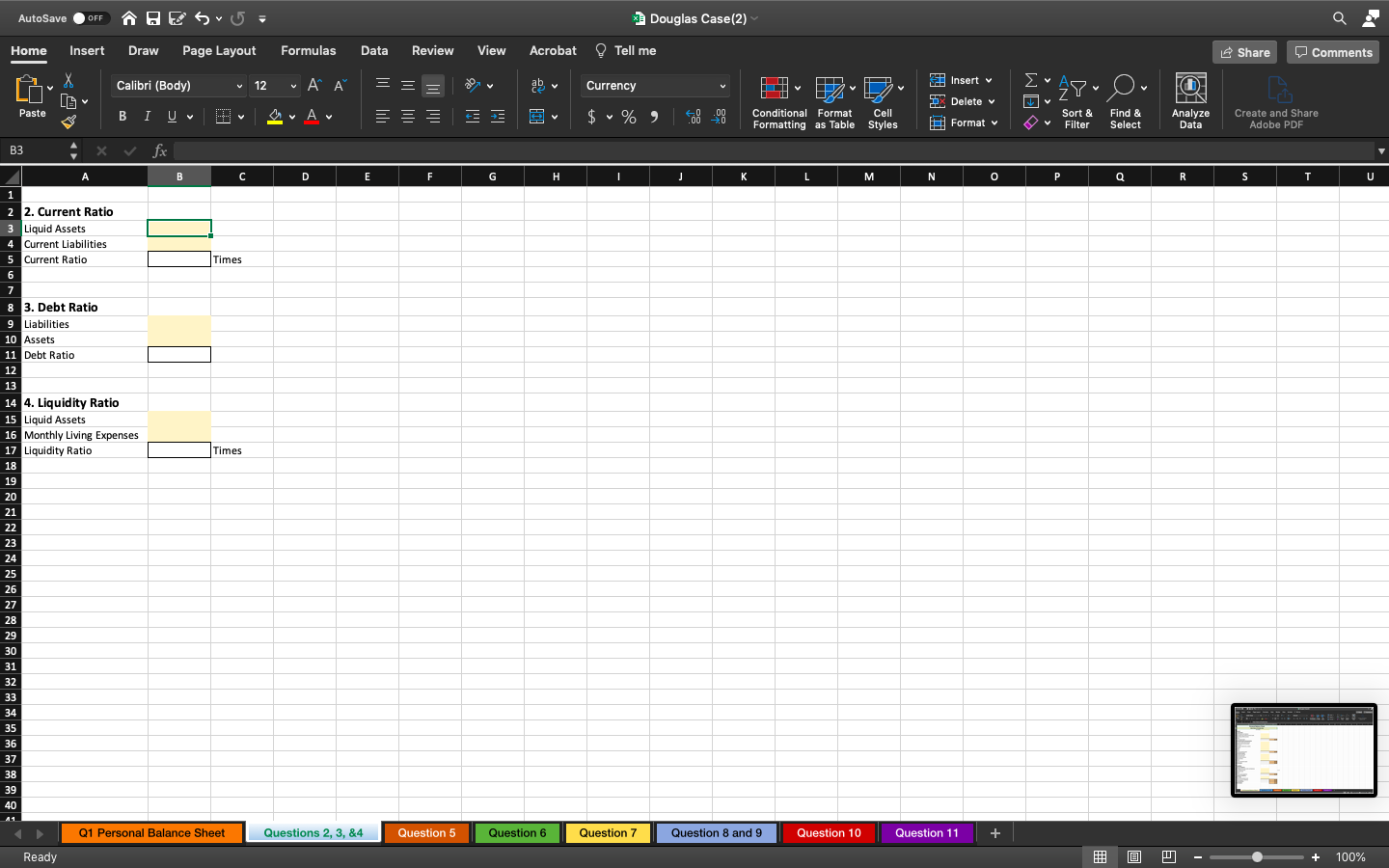

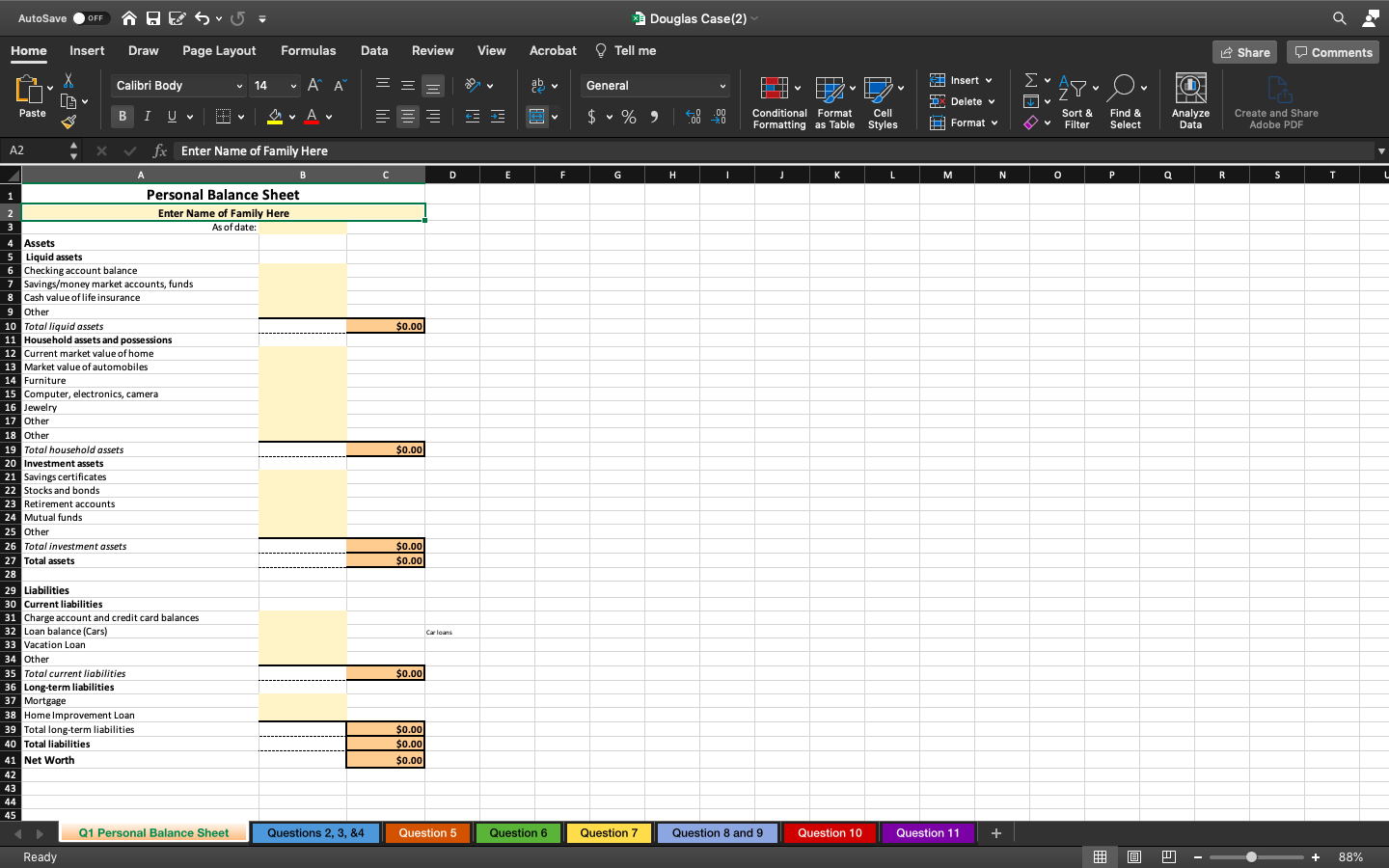

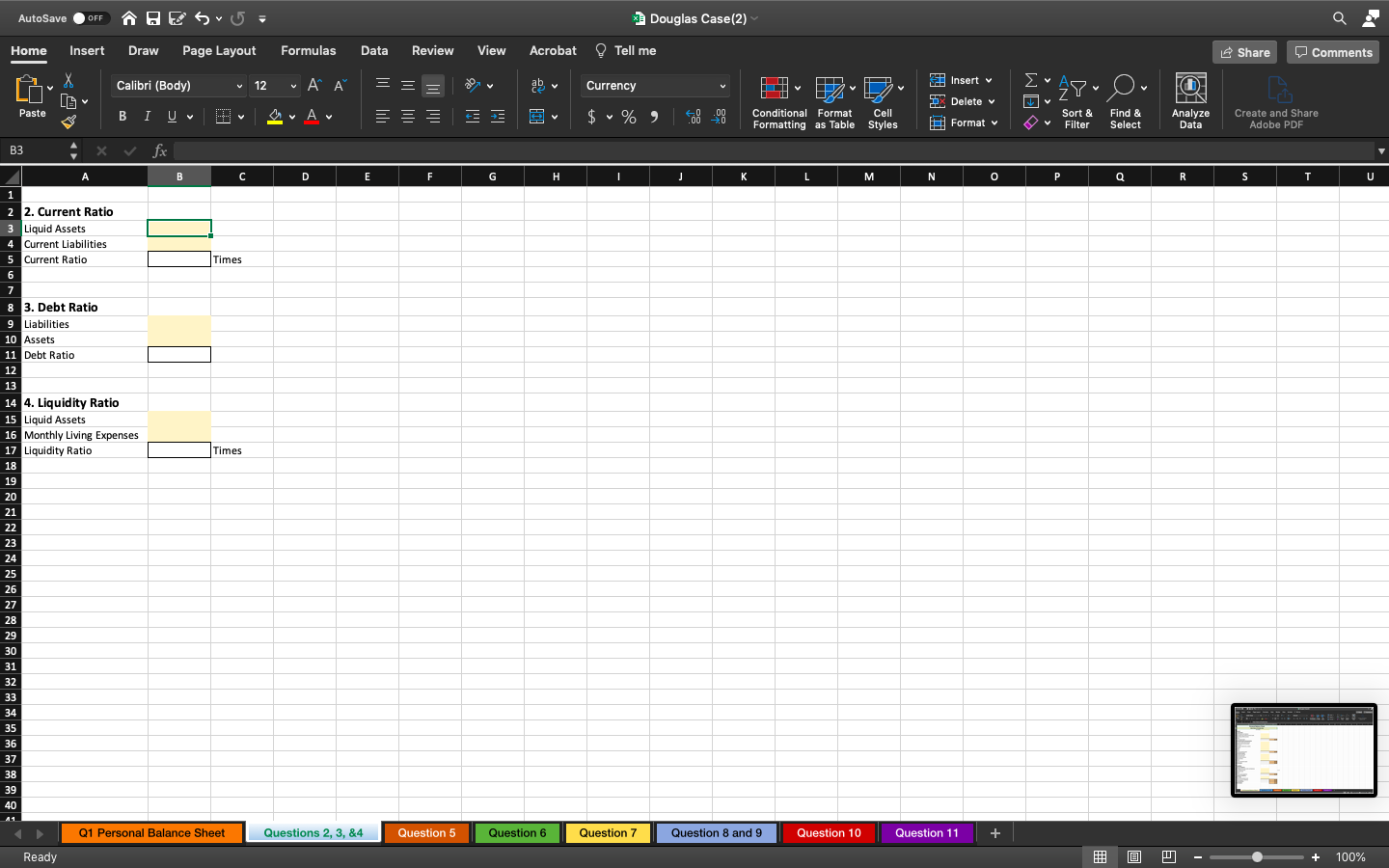

AutoSave OFF w Douglas Case rev 9_7_21(2) - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share Q Comments to Cambria (H... v 16 - AP Aa A 21 AaBbCcDdEe AaBbCcDdEe AaBbCcDdE AaBbccdded AaBb AaBb CeDd Ee AaBb CcD Heading 1 Paste B I x Normal APA U v ab X Title No Spacing Heading 2 Subtitle E Heading 3 Styles Dictate Pane According to AICPA's Statement of Position 82-1 Accounting and Financial Reporting for Personal Financial Statements, personal financial statements should present assets at their estimated current values and liabilities at their estimated current amounts. The estimated current value of an asset in personal financial statements is the amount at which the item could be exchanged between a buyer and seller, each of whom is well informed and willing, and neither of whom is compelled to buy or sell. 3 What is the family's net worth? Please prepare a personal balance sheet. The balance sheet "as of date" should be Dec. 31, 2020. PLEASE NOTE: Because the family owns several common stock investments, it might be helpful to review question 5 (below) and complete the question 5 worksheet in the Excel workbook and then enter the appropriate balance sheet value from that portfolio report. Question 2. The current ratio is a measure of short-term debt burden. A current ratio of 2 indicates that for every $2 of liquid assets there is $1 of current liabilities (a current ratio = 2). A high current ratio indicates the ability to meet short-term obligations. What is the current ratio on December 31st for the Douglas family? Question 3. Debt burden is something that every family should monitor. One ratio is a debt ratio (liabilities/assets). In recent years, the Douglas family's debt ratio was running around 40%. What is their current debt ratio? Question 4. The liquidity ratio indicates the number of months that living expenses can be paid from liquid assets if an emergency arises (such as any event that would result in a serious decrease in income) If the family's monthly living expenses are about $6,000, what is their liquidity ratio? Page 3 of 8 3336 words NE English (United States) D Focus E B E - + 143% AutoSave OFF DES 5- Douglas Case(2) Q Home Insert Draw Page Layout Formulas Data Review View Acrobat Tell me Share Comments Insert v Calibri Body v 14 LG ~ v = = General LIH V Ayu Or 0 DX Delete v Paste B I U a v Av A V V E v $ % ) 70 Conditional Format Cell Formatting as Table Styles Format Sort & Filter Find & Select Analyze Data Create and Share Adobe PDF A2 fx Enter Name of Family Here D E F G H I I J K L L M N 0 O P Q R S T L $0.00 $0.00 B 1 1 Personal Balance Sheet 2 Enter Name of Family Here 3 As of date: 4 Assets 5 Liquid assets 6 Checking account balance 7 Savings/money market accounts, funds 8 Cash value of life insurance 9 Other 10 Total liquid assets 11 Household assets and possessions 12 Current market value of home 13 Market value of automobiles 14 Furniture 15 Computer, electronics, camera 16 Jewelry 17 Other 18 Other 19 Total household assets 20 Investment assets 21 Savings certificates 22 Stocks and bonds 23 Retirement accounts 24 Mutual funds 25 Other 26 Total investment assets 27 Total assets 28 29 Liabilities 30 Current liabilities 31 Charge account and credit card balances 32 Loan balance (Cars) 33 Vacation Loan 34 Other 35 Total current liabilities 36 Long-term liabilities 37 Mortgage 38 Home Improvement Loan 39 Total long-term liabilities 40 Total liabilities 41 Net Worth 42 43 44 45 Q1 Personal Balance Sheet Questions 2, 3, &4 $0.00 $0.00 Carleans $0.00 $0.00 $0.00 $0.00 Question 5 Question 6 Question 7 Question 8 and 9 Question 10 Question 11 + Ready m P 88% AutoSave OFF ES5= Douglas Case(2) Q Home Insert Draw Page Layout Formulas Data Review View Acrobat Tell me Share Comments v 12 Insert v H Calibri (Body) . = = X LG ab Currency H Ayu Or 0 DX Delete v PX Paste BI MA V $ %) EM V Conditional Format Cell Formatting as Table Styles 70 Format v Sort & Filter Find & Select Analyze Data Create and Share Adobe PDF B3 x fx B D D E F G H J L M N O 0 P P Q R S Times Times 1 1 2 2. Current Ratio 3 Liquid Assets 4 Current Liabilities 5 Current Ratio 6 7 8 3. Debt Ratio 9 Liabilities 10 Assets 11 Debt Ratio 12 13 14 4. Liquidity Ratio 15 Liquid Assets 16 Monthly Living Expenses 17 Liquidity Ratio 18 19 20 21 - 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Q1 Personal Balance Sheet Questions 2, 3, 84 Question 5 Question 6 Question 7 Question 8 and 9 Question 10 Question 11 + Ready P 100% AutoSave OFF w Douglas Case rev 9_7_21(2) - Saved to my Mac Home Insert Draw Design Layout References Mailings Review View Tell me Share Q Comments to Cambria (H... v 16 - AP Aa A 21 AaBbCcDdEe AaBbCcDdEe AaBbCcDdE AaBbccdded AaBb AaBb CeDd Ee AaBb CcD Heading 1 Paste B I x Normal APA U v ab X Title No Spacing Heading 2 Subtitle E Heading 3 Styles Dictate Pane According to AICPA's Statement of Position 82-1 Accounting and Financial Reporting for Personal Financial Statements, personal financial statements should present assets at their estimated current values and liabilities at their estimated current amounts. The estimated current value of an asset in personal financial statements is the amount at which the item could be exchanged between a buyer and seller, each of whom is well informed and willing, and neither of whom is compelled to buy or sell. 3 What is the family's net worth? Please prepare a personal balance sheet. The balance sheet "as of date" should be Dec. 31, 2020. PLEASE NOTE: Because the family owns several common stock investments, it might be helpful to review question 5 (below) and complete the question 5 worksheet in the Excel workbook and then enter the appropriate balance sheet value from that portfolio report. Question 2. The current ratio is a measure of short-term debt burden. A current ratio of 2 indicates that for every $2 of liquid assets there is $1 of current liabilities (a current ratio = 2). A high current ratio indicates the ability to meet short-term obligations. What is the current ratio on December 31st for the Douglas family? Question 3. Debt burden is something that every family should monitor. One ratio is a debt ratio (liabilities/assets). In recent years, the Douglas family's debt ratio was running around 40%. What is their current debt ratio? Question 4. The liquidity ratio indicates the number of months that living expenses can be paid from liquid assets if an emergency arises (such as any event that would result in a serious decrease in income) If the family's monthly living expenses are about $6,000, what is their liquidity ratio? Page 3 of 8 3336 words NE English (United States) D Focus E B E - + 143% AutoSave OFF DES 5- Douglas Case(2) Q Home Insert Draw Page Layout Formulas Data Review View Acrobat Tell me Share Comments Insert v Calibri Body v 14 LG ~ v = = General LIH V Ayu Or 0 DX Delete v Paste B I U a v Av A V V E v $ % ) 70 Conditional Format Cell Formatting as Table Styles Format Sort & Filter Find & Select Analyze Data Create and Share Adobe PDF A2 fx Enter Name of Family Here D E F G H I I J K L L M N 0 O P Q R S T L $0.00 $0.00 B 1 1 Personal Balance Sheet 2 Enter Name of Family Here 3 As of date: 4 Assets 5 Liquid assets 6 Checking account balance 7 Savings/money market accounts, funds 8 Cash value of life insurance 9 Other 10 Total liquid assets 11 Household assets and possessions 12 Current market value of home 13 Market value of automobiles 14 Furniture 15 Computer, electronics, camera 16 Jewelry 17 Other 18 Other 19 Total household assets 20 Investment assets 21 Savings certificates 22 Stocks and bonds 23 Retirement accounts 24 Mutual funds 25 Other 26 Total investment assets 27 Total assets 28 29 Liabilities 30 Current liabilities 31 Charge account and credit card balances 32 Loan balance (Cars) 33 Vacation Loan 34 Other 35 Total current liabilities 36 Long-term liabilities 37 Mortgage 38 Home Improvement Loan 39 Total long-term liabilities 40 Total liabilities 41 Net Worth 42 43 44 45 Q1 Personal Balance Sheet Questions 2, 3, &4 $0.00 $0.00 Carleans $0.00 $0.00 $0.00 $0.00 Question 5 Question 6 Question 7 Question 8 and 9 Question 10 Question 11 + Ready m P 88% AutoSave OFF ES5= Douglas Case(2) Q Home Insert Draw Page Layout Formulas Data Review View Acrobat Tell me Share Comments v 12 Insert v H Calibri (Body) . = = X LG ab Currency H Ayu Or 0 DX Delete v PX Paste BI MA V $ %) EM V Conditional Format Cell Formatting as Table Styles 70 Format v Sort & Filter Find & Select Analyze Data Create and Share Adobe PDF B3 x fx B D D E F G H J L M N O 0 P P Q R S Times Times 1 1 2 2. Current Ratio 3 Liquid Assets 4 Current Liabilities 5 Current Ratio 6 7 8 3. Debt Ratio 9 Liabilities 10 Assets 11 Debt Ratio 12 13 14 4. Liquidity Ratio 15 Liquid Assets 16 Monthly Living Expenses 17 Liquidity Ratio 18 19 20 21 - 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Q1 Personal Balance Sheet Questions 2, 3, 84 Question 5 Question 6 Question 7 Question 8 and 9 Question 10 Question 11 + Ready P 100%