Answered step by step

Verified Expert Solution

Question

1 Approved Answer

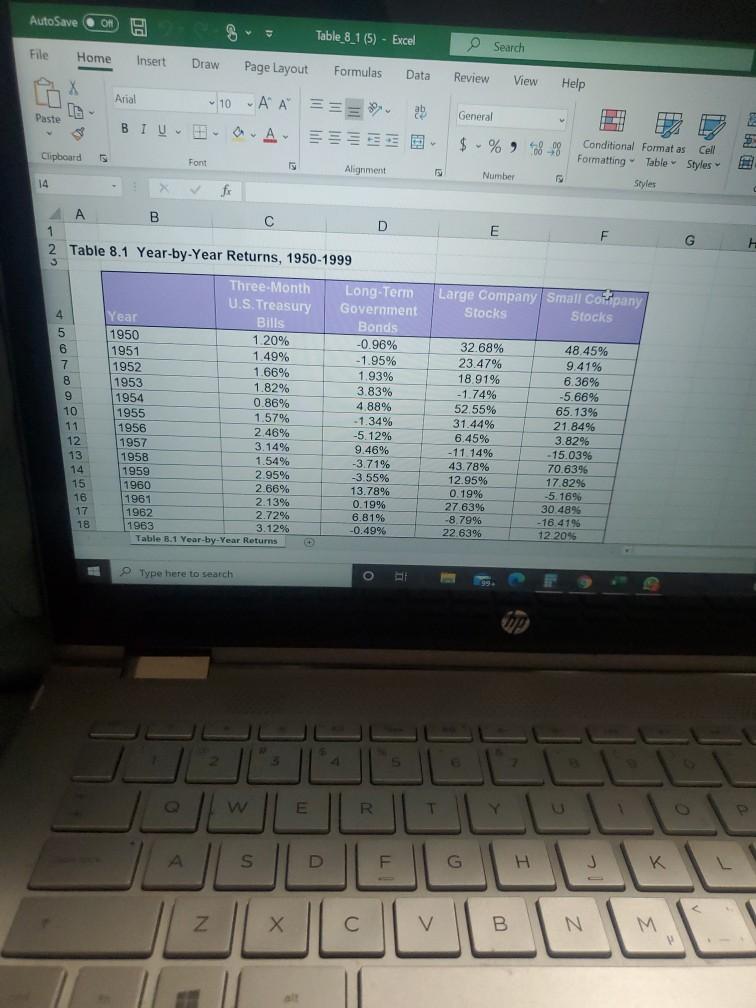

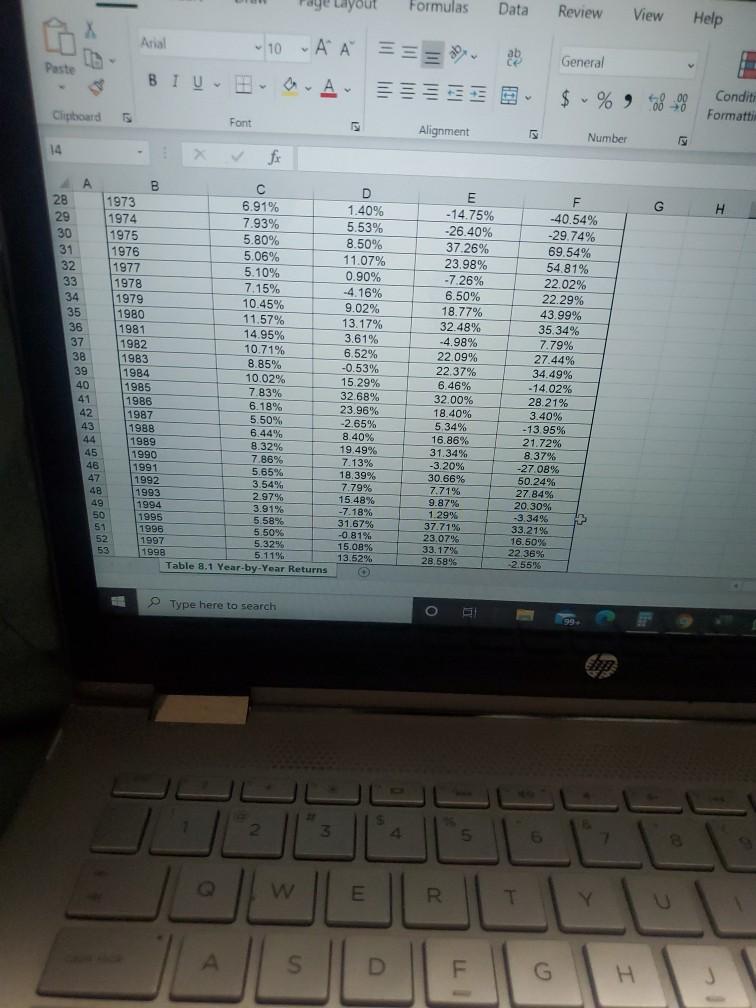

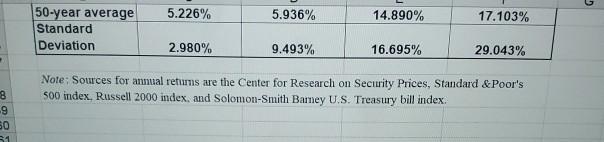

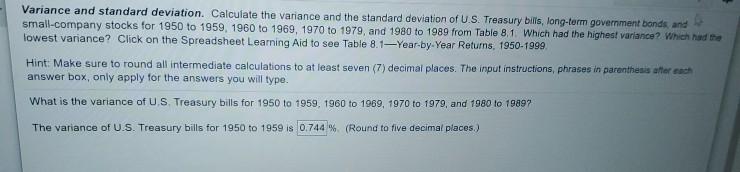

AutoSave On Table 81 (5) - Excel e Search File Home Insert Draw Page Layout Formulas Data Review View X Help Arial -10 AA 33

AutoSave On Table 81 (5) - Excel e Search File Home Insert Draw Page Layout Formulas Data Review View X Help Arial -10 AA 33 Paste General BIU . $ % Clipboard 5 Font 15 Conditional Format as Cell Formatting Table Styles Styles Alignment Number 14 fo D 4 A B 1 Table 8.1 Year-by-Year Returns, 1950-1999 E F G 3 Large Company Small Coffpany Stocks Stocks 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Three Month U.S.Treasury Year Bills 1950 1.20% 1951 1.49% 1952 1.66% 1953 1.82% 1954 0.86% 1955 1.57% 1956 2.46% 1957 3.14% 1958 1.54% 1959 2.95% 1960 2.66% 1961 2.13% 1962 2.72% 1963 3.12% Table 8.1 Year-by-Year Returns Long-Term Government Bonds -0.96% -1.95% 1.93% 3.83% 4.88% -1.34% -5.12% 9.46% -3.71% -3.55% 13.78% 0.19% 6.81% -0.49% 32.68% 23.47% 18.91% -1.74% 52.55% 31.44% 6.45% -11.14% 43.78% 12.95% 0.19% 27 63% -8.79% 22.639 48.45% 9.41% 6.36% -5.66% 65.13% 21.84% 3.8296 - 15.039 70.6396 178296 -5. 169 30.4896 -16.4196 12 20% Type here to search __ w E R T A S F G H J Z N V B NM yout Formulas Data Review View Help Arial - 10 - A A === ab ce General Paste BIU $ % 9 428_09 Conditi Formatti Clipboard Font Alignment Number 14 fi G H B 28 1973 29 1974 30 1975 31 1976 32 1977 33 1978 34 1979 35 1980 36 1981 37 1982 38 1983 39 1984 40 1985 41 1986 42 1987 43 1988 44 1989 45 1990 46 1991 47 1992 48 1993 49 1994 50 1995 51 1996 52 1997 53 1998 D 6.91% 1.40% 7.93% 5.53% 5.80% 8.50% 5.06% 11.07% 5.10% 0.90% 7.15% -4.16% 10.45% 9.02% 11.57% 13.17% 14.95% 3.61% 10.71% 6.52% 8.85% -0.53% 10.02% 15.29% 7.83% 32.68% 6.18% 23.96% 5.50% -2.65% 6.44% 8 40% 8.32% 19.49% 7.86% 7.13% 5.65% 18.39% 3.54% 7.79% 2.97% 15.48% 3.91% -7.18% 5.58% 31.67% 5.50% -0.81% 5.32% 15.08% 5 11% 13.52% Table 8.1 Year-by-Year Returns O E -14.75% -26.40% 37.26% 23.98% -7.26% 6.50% 18.77% 32.48% -4.98% 22.09% 22.37% 6.46% 32.00% 18.40% 5.34% 16.86% 31.34% -3.20% 30.66% 7.71% 9.87% 1.29% 37.71% 23.07% 33,17% 28.58% F -40.54% -29.74% 69.54% 54.81% 22.02% 22.29% 43.99% 35.34% 7.79% 27.44% 34.49% -14.02% 28.21% 3.40% -13.95% 21.72% 8.37% -27.08% 50.24% 27.84% 20.30% -3.34% 33.21% 16.50% 22 36% 2.556 Type here to search S 2 3 5 6 7 w E R T A S D F G H 5.226% 5.936% 14.890% 17.103% 50-year average Standard Deviation 2.980% 9.493% 16.695% 29.043% Note: Sources for annual retums are the Center for Research on Security Prices, Standard & Poor's 500 index, Russell 2000 index, and Solomon-Smith Bamey U.S. Treasury bill index 8 -9 50 Variance and standard deviation. Calculate the variance and the standard deviation of U.S. Treasury bills, long-term government bonds and small-company stocks for 1950 to 1959, 1960 to 1969, 1970 to 1979, and 1980 to 1989 from Table 8.1 Which had the highest variance? Which had the lowest variance? Click on the Spreadsheet Learning Aid to see Table 8.1-Year-by-Year Returns, 1950-1999 Hint: Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phrases in parenthesis after each answer box, only apply for the answers you will type. What is the variance of US Treasury bills for 1950 to 1959, 1960 to 1969, 1970 to 1979, and 1980 to 19897 The variance of U.S. Treasury bills for 1950 to 1959 is 0.744 % (Round to five decimal places.) AutoSave On Table 81 (5) - Excel e Search File Home Insert Draw Page Layout Formulas Data Review View X Help Arial -10 AA 33 Paste General BIU . $ % Clipboard 5 Font 15 Conditional Format as Cell Formatting Table Styles Styles Alignment Number 14 fo D 4 A B 1 Table 8.1 Year-by-Year Returns, 1950-1999 E F G 3 Large Company Small Coffpany Stocks Stocks 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Three Month U.S.Treasury Year Bills 1950 1.20% 1951 1.49% 1952 1.66% 1953 1.82% 1954 0.86% 1955 1.57% 1956 2.46% 1957 3.14% 1958 1.54% 1959 2.95% 1960 2.66% 1961 2.13% 1962 2.72% 1963 3.12% Table 8.1 Year-by-Year Returns Long-Term Government Bonds -0.96% -1.95% 1.93% 3.83% 4.88% -1.34% -5.12% 9.46% -3.71% -3.55% 13.78% 0.19% 6.81% -0.49% 32.68% 23.47% 18.91% -1.74% 52.55% 31.44% 6.45% -11.14% 43.78% 12.95% 0.19% 27 63% -8.79% 22.639 48.45% 9.41% 6.36% -5.66% 65.13% 21.84% 3.8296 - 15.039 70.6396 178296 -5. 169 30.4896 -16.4196 12 20% Type here to search __ w E R T A S F G H J Z N V B NM yout Formulas Data Review View Help Arial - 10 - A A === ab ce General Paste BIU $ % 9 428_09 Conditi Formatti Clipboard Font Alignment Number 14 fi G H B 28 1973 29 1974 30 1975 31 1976 32 1977 33 1978 34 1979 35 1980 36 1981 37 1982 38 1983 39 1984 40 1985 41 1986 42 1987 43 1988 44 1989 45 1990 46 1991 47 1992 48 1993 49 1994 50 1995 51 1996 52 1997 53 1998 D 6.91% 1.40% 7.93% 5.53% 5.80% 8.50% 5.06% 11.07% 5.10% 0.90% 7.15% -4.16% 10.45% 9.02% 11.57% 13.17% 14.95% 3.61% 10.71% 6.52% 8.85% -0.53% 10.02% 15.29% 7.83% 32.68% 6.18% 23.96% 5.50% -2.65% 6.44% 8 40% 8.32% 19.49% 7.86% 7.13% 5.65% 18.39% 3.54% 7.79% 2.97% 15.48% 3.91% -7.18% 5.58% 31.67% 5.50% -0.81% 5.32% 15.08% 5 11% 13.52% Table 8.1 Year-by-Year Returns O E -14.75% -26.40% 37.26% 23.98% -7.26% 6.50% 18.77% 32.48% -4.98% 22.09% 22.37% 6.46% 32.00% 18.40% 5.34% 16.86% 31.34% -3.20% 30.66% 7.71% 9.87% 1.29% 37.71% 23.07% 33,17% 28.58% F -40.54% -29.74% 69.54% 54.81% 22.02% 22.29% 43.99% 35.34% 7.79% 27.44% 34.49% -14.02% 28.21% 3.40% -13.95% 21.72% 8.37% -27.08% 50.24% 27.84% 20.30% -3.34% 33.21% 16.50% 22 36% 2.556 Type here to search S 2 3 5 6 7 w E R T A S D F G H 5.226% 5.936% 14.890% 17.103% 50-year average Standard Deviation 2.980% 9.493% 16.695% 29.043% Note: Sources for annual retums are the Center for Research on Security Prices, Standard & Poor's 500 index, Russell 2000 index, and Solomon-Smith Bamey U.S. Treasury bill index 8 -9 50 Variance and standard deviation. Calculate the variance and the standard deviation of U.S. Treasury bills, long-term government bonds and small-company stocks for 1950 to 1959, 1960 to 1969, 1970 to 1979, and 1980 to 1989 from Table 8.1 Which had the highest variance? Which had the lowest variance? Click on the Spreadsheet Learning Aid to see Table 8.1-Year-by-Year Returns, 1950-1999 Hint: Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phrases in parenthesis after each answer box, only apply for the answers you will type. What is the variance of US Treasury bills for 1950 to 1959, 1960 to 1969, 1970 to 1979, and 1980 to 19897 The variance of U.S. Treasury bills for 1950 to 1959 is 0.744 % (Round to five decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started