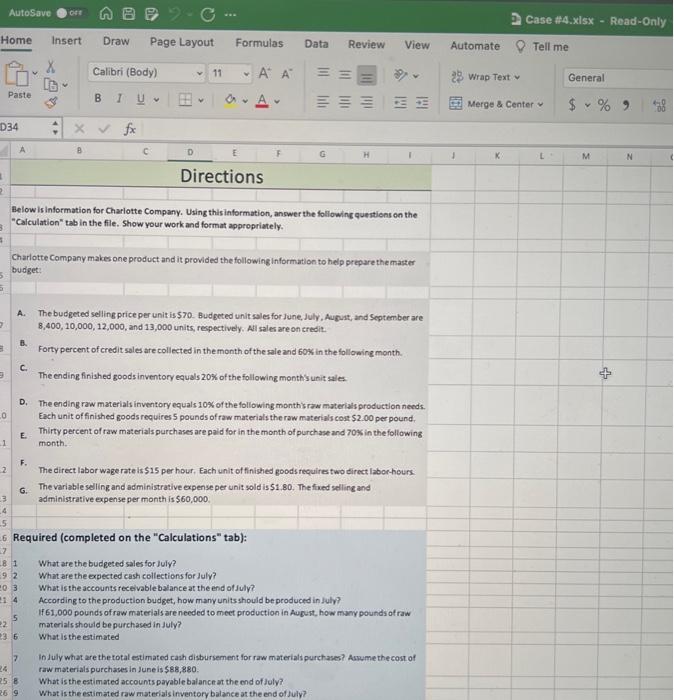

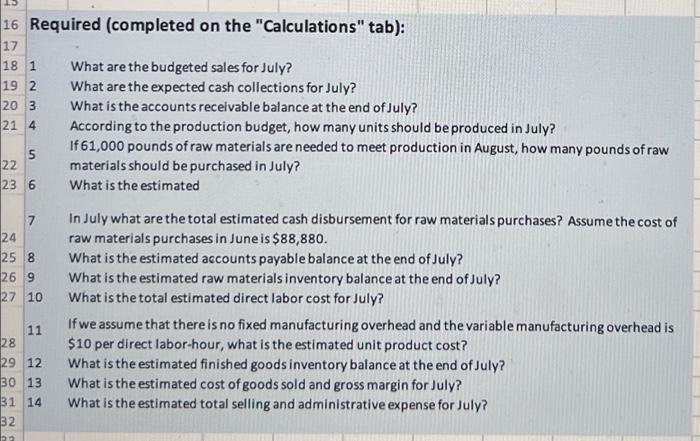

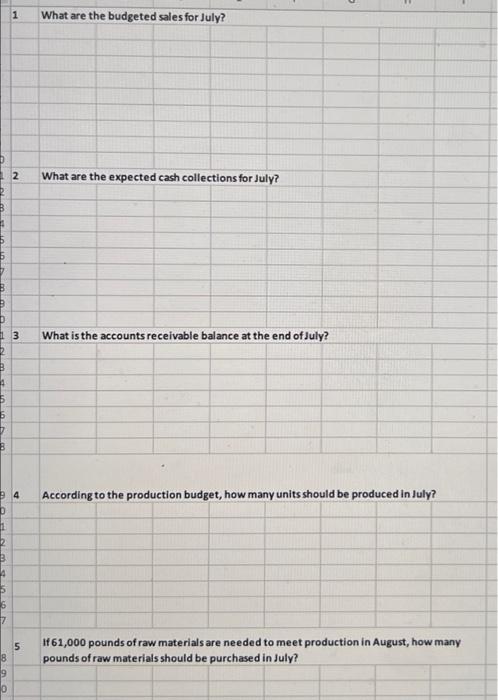

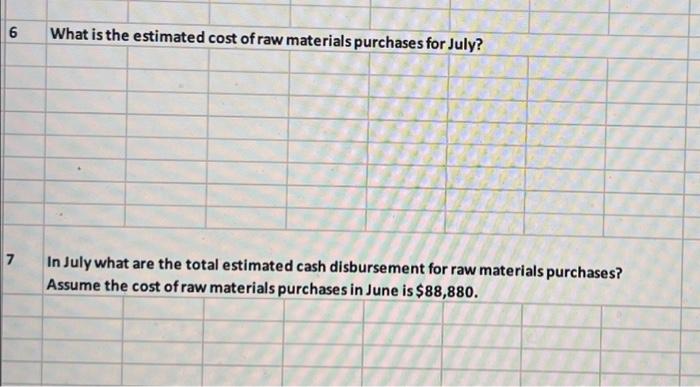

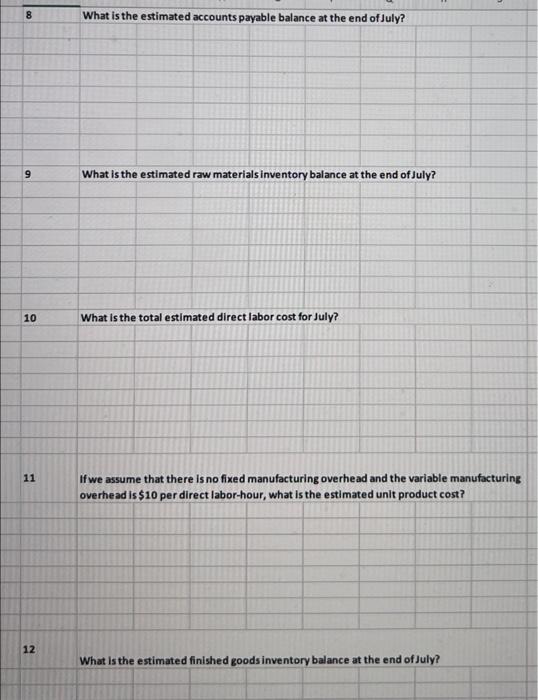

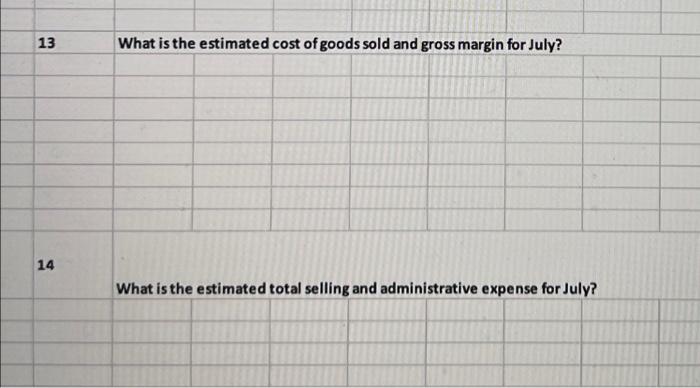

AutoSave Oots 9. Case 44xi5x Road =0nly Home Insert Draw Page Layout Formulas Data Review View Automate D34 4. Below is information for Charlotte Company. Using this information, answer the following quertions on the "Caiculation" tab in the file. Show your work and format appropriately. Charlotte Company makes one product and it provided the following information to help prepare themaster budget: A. The budgeted selling price per unit is 570 . Budgeted unit sales for June, duly, August, and September are 8,400,10,000,12,000, and 13,000 units, respectively. All sales are on eredit. B. Forty percent of credit soles are collected in the month of the sale and 60% in the following month. C. The ending finished goods inventory equals 20% of the following monthy sunit sales D. The ending raw materials inventory equals 10% of the following monthis raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials the raw materials cost $2.00 per pound, E. Thirty percent of raw materials purchases are pald for in the month of purchase and 70% in the following month. F. The direct labor wage rate is $15 per hour, Each unit of finished goods requires two direct labor-hours. G. The variable seling and administrative expense per unit sold is 51.80 . The fixed selling and administrative expense per month is $60,000. Required (completed on the "Calculations" tab): What are the budgeted sales for July? What are the expected cash collections for July? What isthe accounts receivable balance at the end of July? According to the production budget, how many units should be produced in July? If 61,000 pounds of raw materials are needed to meet production in Augurt, how many pounds of raw materials should be purchased in July? What is the estimated 7 In luly what are the total estimated cash disbursement for raw materials purchases? Aswme the cost of raw materials purchases in June is $88,880. What is the estimated accounts payable bal ance at the end of July? What is the estimated raw materials inventory balance at the end of July? Required (completed on the "Calculations" tab): What are the budgeted sales for July? What are the expected cash collections for July? What is the accounts receivable balance at the end of July? According to the production budget, how many units should be produced in July? If 61,000 pounds of raw materials are needed to meet production in August, how many pounds of raw materials should be purchased in July? What is the estimated In July what are the total estimated cash disbursement for raw materials purchases? Assume the cost of raw materials purchases in June is $88,880. What is the estimated accounts payable balance at the end of July? What is the estimated raw materials inventory balance at the end of July? What is the total estimated direct labor cost for July? If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $10 per direct labor-hour, what is the estimated unit product cost? What is the estimated finished goods inventory balance at the end of July? What is the estimated cost of goods sold and gross margin for July? What is the estimated total selling and administrative expense for July? 1 What are the budgeted sales for July? 2 What are the expected cash collections for July? 3 What is the accounts receivable balance at the end of July? 4 According to the production budget, how many units should be produced in July? 5. If 61,000 pounds of raw materials are needed to meet production in August, how many pounds of raw materials should be purchased in July? In July what are the total estimated cash disbursement for raw materials purchases? Assume the cost of raw materials purchases in June is $88,880. What is the estimated raw materials inventory balance at the end of July? What is the total estimated direct labor cost for July? If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $10 per direct labor-hour, what is the estimated unit product cost? What is the estimated finished goods inventory balance at the end of July? What is the estimated total selling and administrative expense for July? AutoSave Oots 9. Case 44xi5x Road =0nly Home Insert Draw Page Layout Formulas Data Review View Automate D34 4. Below is information for Charlotte Company. Using this information, answer the following quertions on the "Caiculation" tab in the file. Show your work and format appropriately. Charlotte Company makes one product and it provided the following information to help prepare themaster budget: A. The budgeted selling price per unit is 570 . Budgeted unit sales for June, duly, August, and September are 8,400,10,000,12,000, and 13,000 units, respectively. All sales are on eredit. B. Forty percent of credit soles are collected in the month of the sale and 60% in the following month. C. The ending finished goods inventory equals 20% of the following monthy sunit sales D. The ending raw materials inventory equals 10% of the following monthis raw materials production needs. Each unit of finished goods requires 5 pounds of raw materials the raw materials cost $2.00 per pound, E. Thirty percent of raw materials purchases are pald for in the month of purchase and 70% in the following month. F. The direct labor wage rate is $15 per hour, Each unit of finished goods requires two direct labor-hours. G. The variable seling and administrative expense per unit sold is 51.80 . The fixed selling and administrative expense per month is $60,000. Required (completed on the "Calculations" tab): What are the budgeted sales for July? What are the expected cash collections for July? What isthe accounts receivable balance at the end of July? According to the production budget, how many units should be produced in July? If 61,000 pounds of raw materials are needed to meet production in Augurt, how many pounds of raw materials should be purchased in July? What is the estimated 7 In luly what are the total estimated cash disbursement for raw materials purchases? Aswme the cost of raw materials purchases in June is $88,880. What is the estimated accounts payable bal ance at the end of July? What is the estimated raw materials inventory balance at the end of July? Required (completed on the "Calculations" tab): What are the budgeted sales for July? What are the expected cash collections for July? What is the accounts receivable balance at the end of July? According to the production budget, how many units should be produced in July? If 61,000 pounds of raw materials are needed to meet production in August, how many pounds of raw materials should be purchased in July? What is the estimated In July what are the total estimated cash disbursement for raw materials purchases? Assume the cost of raw materials purchases in June is $88,880. What is the estimated accounts payable balance at the end of July? What is the estimated raw materials inventory balance at the end of July? What is the total estimated direct labor cost for July? If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $10 per direct labor-hour, what is the estimated unit product cost? What is the estimated finished goods inventory balance at the end of July? What is the estimated cost of goods sold and gross margin for July? What is the estimated total selling and administrative expense for July? 1 What are the budgeted sales for July? 2 What are the expected cash collections for July? 3 What is the accounts receivable balance at the end of July? 4 According to the production budget, how many units should be produced in July? 5. If 61,000 pounds of raw materials are needed to meet production in August, how many pounds of raw materials should be purchased in July? In July what are the total estimated cash disbursement for raw materials purchases? Assume the cost of raw materials purchases in June is $88,880. What is the estimated raw materials inventory balance at the end of July? What is the total estimated direct labor cost for July? If we assume that there is no fixed manufacturing overhead and the variable manufacturing overhead is $10 per direct labor-hour, what is the estimated unit product cost? What is the estimated finished goods inventory balance at the end of July? What is the estimated total selling and administrative expense for July