Question

Ava and her husband, Leo, file a joint return and are in the 24% Federal income tax bracket in 2020. Avas salary is $79,500. Her

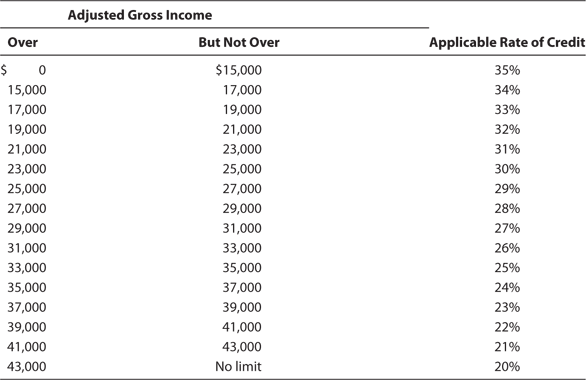

Ava and her husband, Leo, file a joint return and are in the 24% Federal income tax bracket in 2020. Avas salary is $79,500. Her employer offers a child and dependent care reimbursement plan that allows up to $5,950 of qualifying expenses to be reimbursed in exchange for a $5,950 reduction in the employee's salary. Because Ava and Leo have two minor children requiring child care that costs $6,545 each year, Ava is wondering if she should sign up for the program instead of taking advantage of the credit for child and dependent care expenses. Analyze the effect of the two alternatives. Assume a FICA tax rate of 7.65%.

Do not round intermediate computations. If required, round your final answers to the nearest dollar.

Click to view Percentage Credit based on Adjusted Gross Income.

a. If Ava and Leo take advantage of the plan, they would save income taxes because the reimbursement of child care expenses is excluded from gross income. The income tax savings associated with participating in the plan would be $1428. In addition, Ava will save $ ---- of FICA taxes due to the reduction in salary.

Alternatively, if Ava does not take advantage of the plan, their child and dependent care tax credit will be $----. Therefore Ava and Leo's income taxes will be $---- higher if they do not participate in the plan.

b. Assume, instead, that Avas salary was $30,000 and Ava and Leo's AGI is $23,250 and they are in the 10% tax bracket.

The income tax savings associated with participating in the plan would be $595. In addition, Ava will save $---- of FICA taxes due to the reduction in salary.

Alternatively, if Ava does not take advantage of the plan, their child and dependent care tax credit will be $----. Therefore Ava and Leo's income taxes will be $---- lower if they do not participate in the plan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started