Question

Ava and her husband, Leo, file a joint return and are in the 24% Federal income tax bracket. Ava's salary is $120,500. Her employer offers

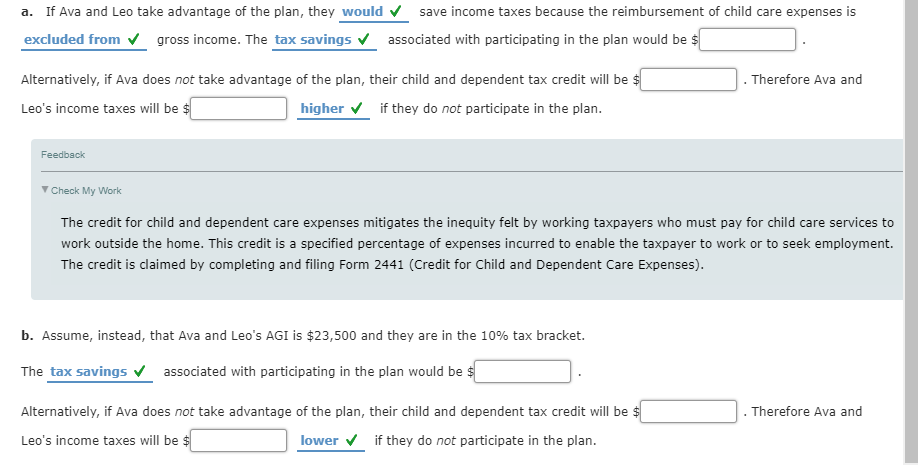

Ava and her husband, Leo, file a joint return and are in the 24% Federal income tax bracket. Ava's salary is $120,500. Her employer offers a child and dependent care reimbursement plan that allows up to $5,100 of qualifying expenses to be reimbursed in exchange for a $5,100 reduction in the employee's salary. Because Ava and Leo have two minor children requiring child care that costs $5,610 each year, Ava is wondering if she should sign up for the program instead of taking advantage of the credit for child and dependent care expenses. Analyze the effect of the two alternatives.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started