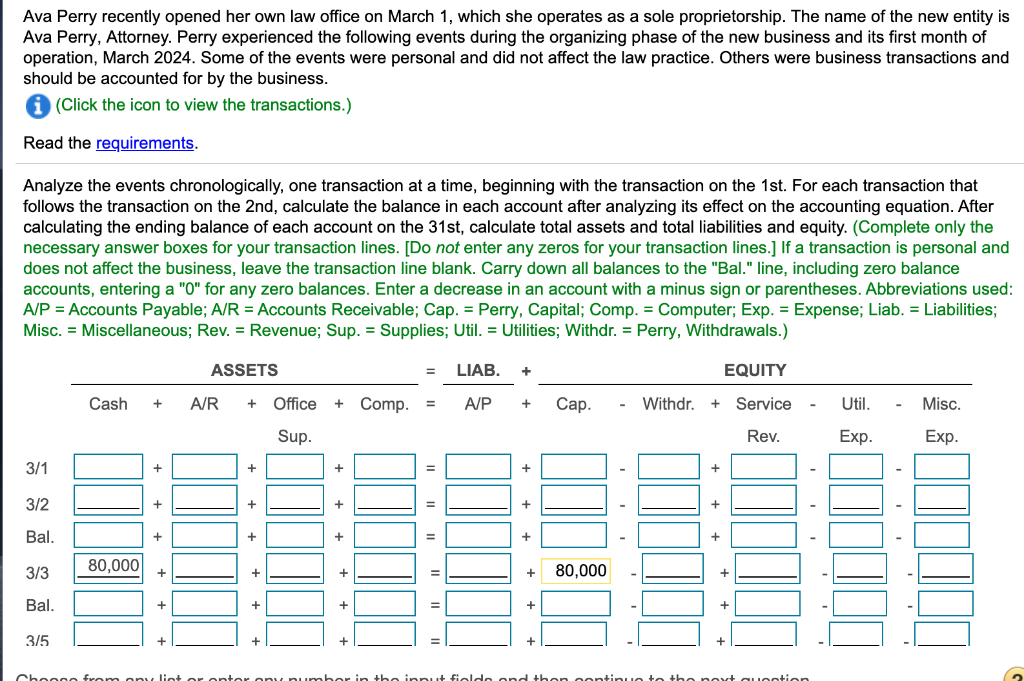

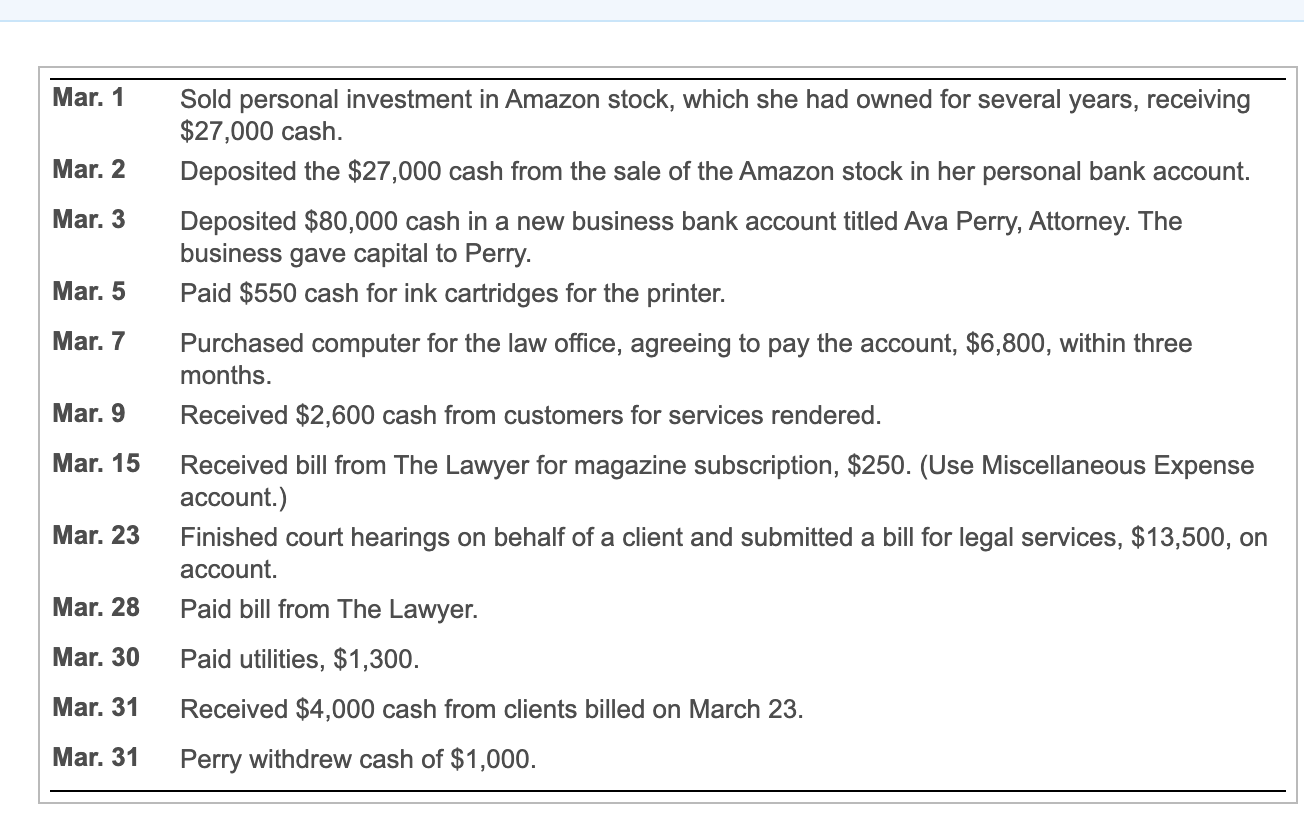

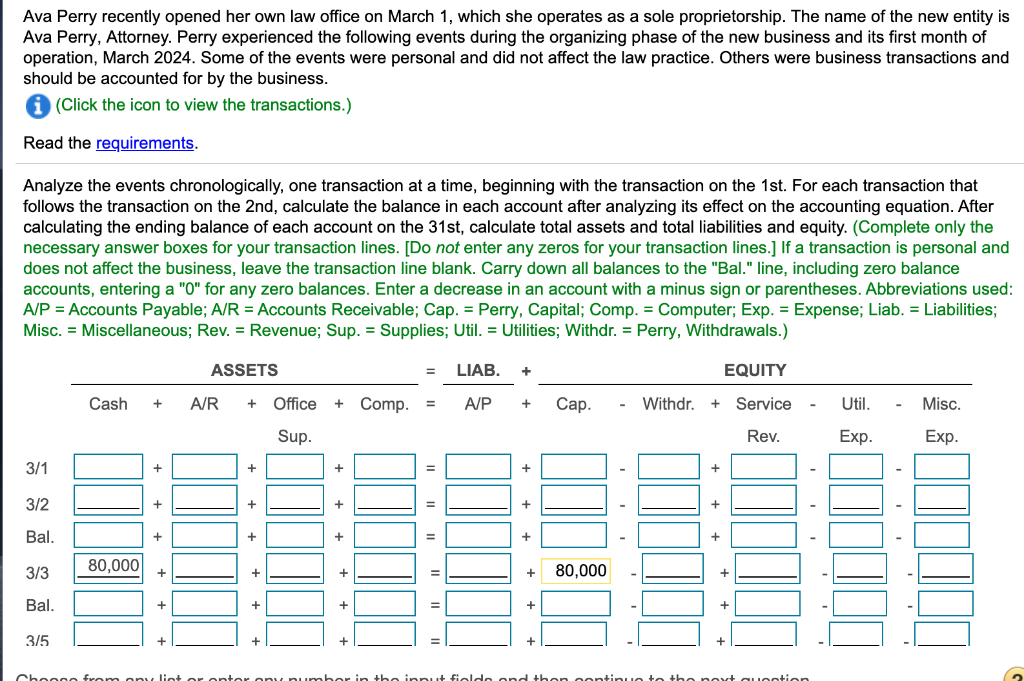

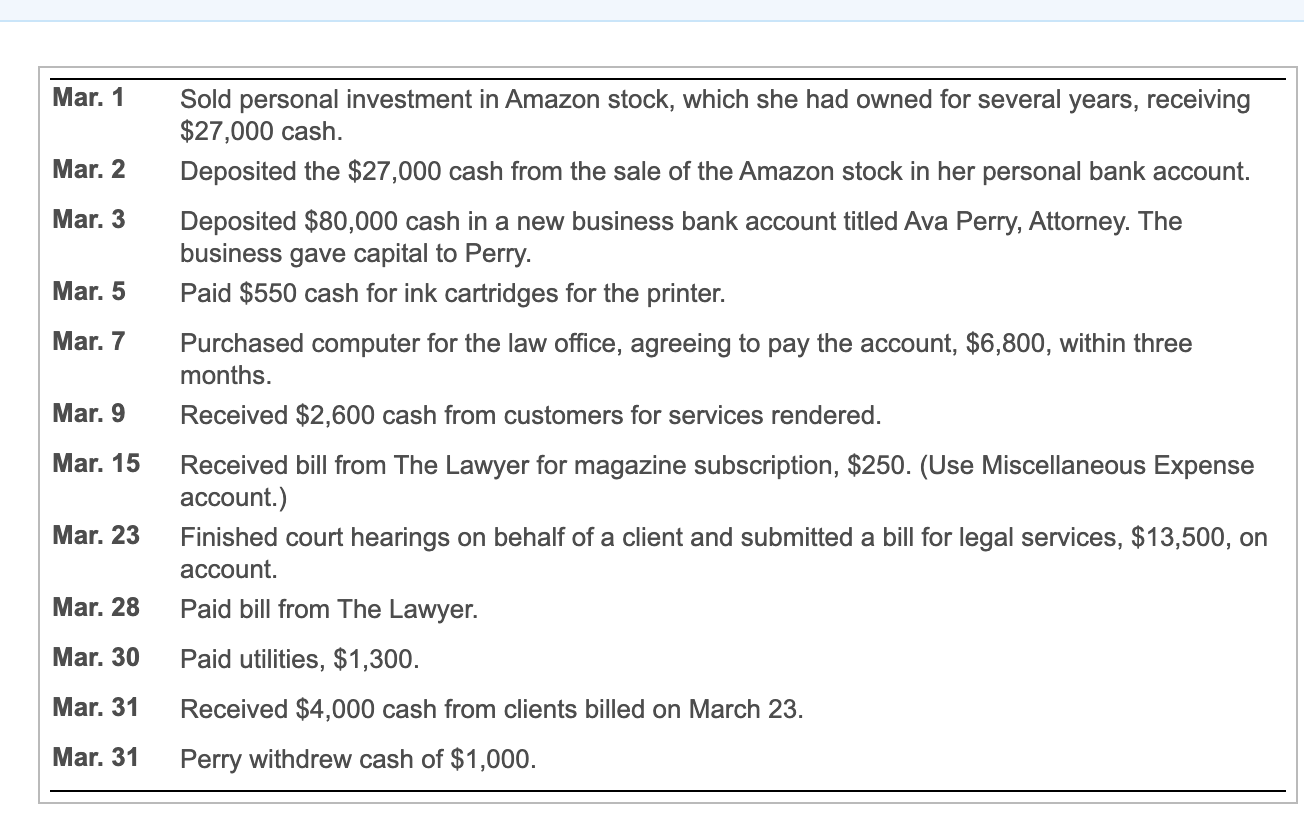

Ava Perry recently opened her own law office on March 1, which she operates as a sole proprietorship. The name of the new entity is Ava Perry, Attorney. Perry experienced the following events during the organizing phase of the new business and its first month of operation, March 2024. Some of the events were personal and did not affect the law practice. Others were business transactions and should be accounted for by the business. (Click the icon to view the transactions.) Read the requirements. Analyze the events chronologically, one transaction at a time, beginning with the transaction on the 1st. For each transaction that follows the transaction on the 2nd, calculate the balance in each account after analyzing its effect on the accounting equation. After calculating the ending balance of each account on the 31st, calculate total assets and total liabilities and equity. (Complete only the necessary answer boxes for your transaction lines. [Do not enter any zeros for your transaction lines.] If a transaction is personal and does not affect the business, leave the transaction line blank. Carry down all balances to the "Bal." line, including zero balance accounts, entering a "0" for any zero balances. Enter a decrease in an account with a minus sign or parentheses. Abbreviations used: A/P = Accounts Payable; A/R = Accounts Receivable; Cap. = Perry, Capital; Comp. = Computer; Exp. = Expense; Liab. = Liabilities; Misc. = Miscellaneous; Rev. = Revenue; Sup. = Supplies; Util. = Utilities; Withdr. = Perry, Withdrawals.) ASSETS LIAB. EQUITY Cash + A/R + Office + Comp. = A/P + . . Withdr. + Service Util. Misc. Sup. Rev. Exp. Exp. 3/1 + + + 3/2 + + + + Bal. + + = + + + + + + + + + + + + + + + + 3/3 80,000 - + + + + 80,000 + + Bal. 3/5 from any liot ons ut fields and then nout quantion Mar. 1 Sold personal investment in Amazon stock, which she had owned for several years, receiving $27,000 cash. Deposited the $27,000 cash from the sale of the Amazon stock in her personal bank account. Mar. 2 Mar. 3 Mar. 5 Mar. 7 Mar. 9 Deposited $80,000 cash in a new business bank account titled Ava Perry, Attorney. The business gave capital to Perry. Paid $550 cash for ink cartridges for the printer. Purchased computer for the law office, agreeing to pay the account, $6,800, within three months. Received $2,600 cash from customers for services rendered. Received bill from The Lawyer for magazine subscription, $250. (Use Miscellaneous Expense account.) Finished court hearings on behalf of a client and submitted a bill for legal services, $13,500, on account. Paid bill from The Lawyer. Paid utilities, $1,300. Mar. 15 Mar. 23 Mar. 28 Mar. 30 Mar. 31 Received $4,000 cash from clients billed on March 23. Mar. 31 Perry withdrew cash of $1,000