Question

Avaya Dry Clean is evaluating a new business venture that anticipates the following forecasts. The machine is to be used for a three-year tax life

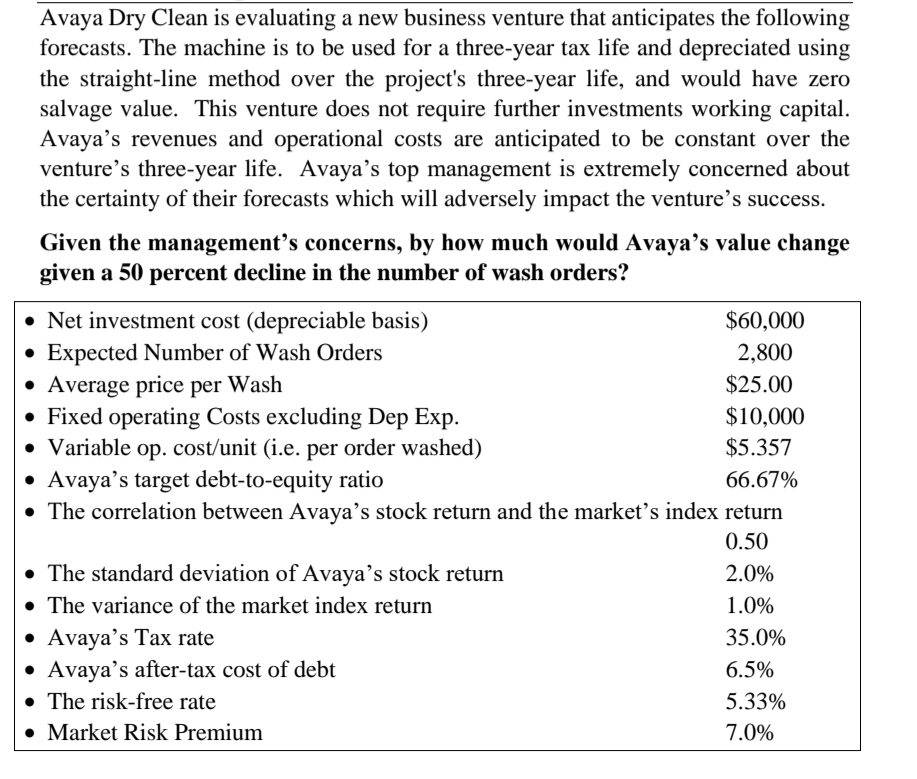

Avaya Dry Clean is evaluating a new business venture that anticipates the following forecasts. The machine is to be used for a three-year tax life and depreciated using the straight-line method over the project's three-year life, and would have zero salvage value. This venture does not require further investments working capital. Avaya's revenues and operational costs are anticipated to be constant over the venture's three-year life. Avaya's top management is extremely concerned about the certainty of their forecasts which will adversely impact the venture's success. Given the management's concerns, by how much would Avaya's value change given a 50 percent decline in the number of wash orders? - Net investment cost (depreciable basis) $60,000 - Expected Numb

Avaya Dry Clean is evaluating a new business venture that anticipates the following forecasts. The machine is to be used for a three-year tax life and depreciated using the straight-line method over the project's three-year life, and would have zero salvage value. This venture does not require further investments working capital. Avaya's revenues and operational costs are anticipated to be constant over the venture's three-year life. Avaya's top management is extremely concerned about the certainty of their forecasts which will adversely impact the venture's success. Given the management's concerns, by how much would Avaya's value change given a 50 percent decline in the number of wash orders? - Net investment cost (depreciable basis) $60,000 - Expected Numb

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started