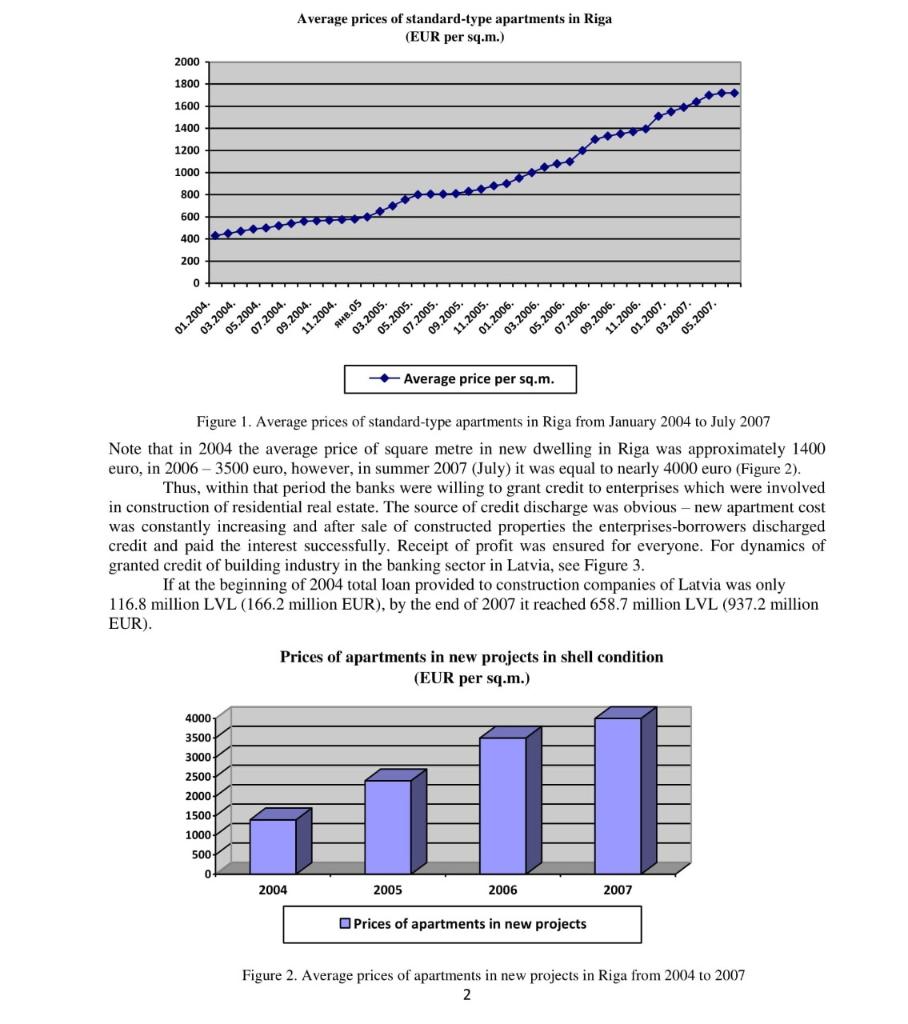

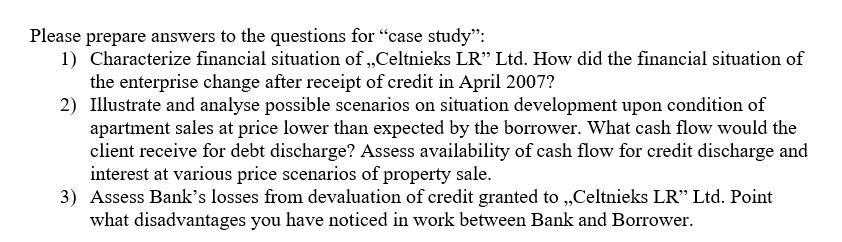

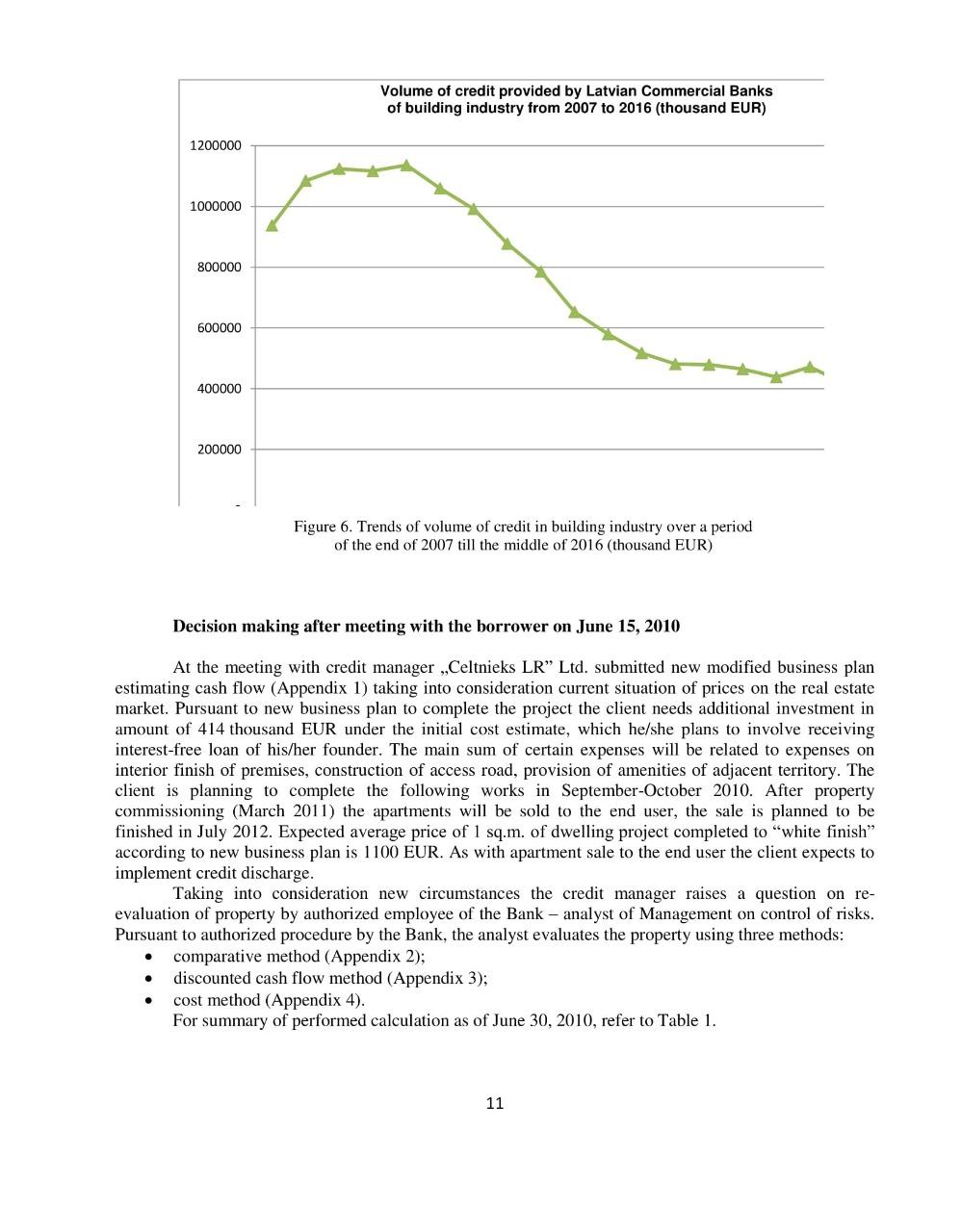

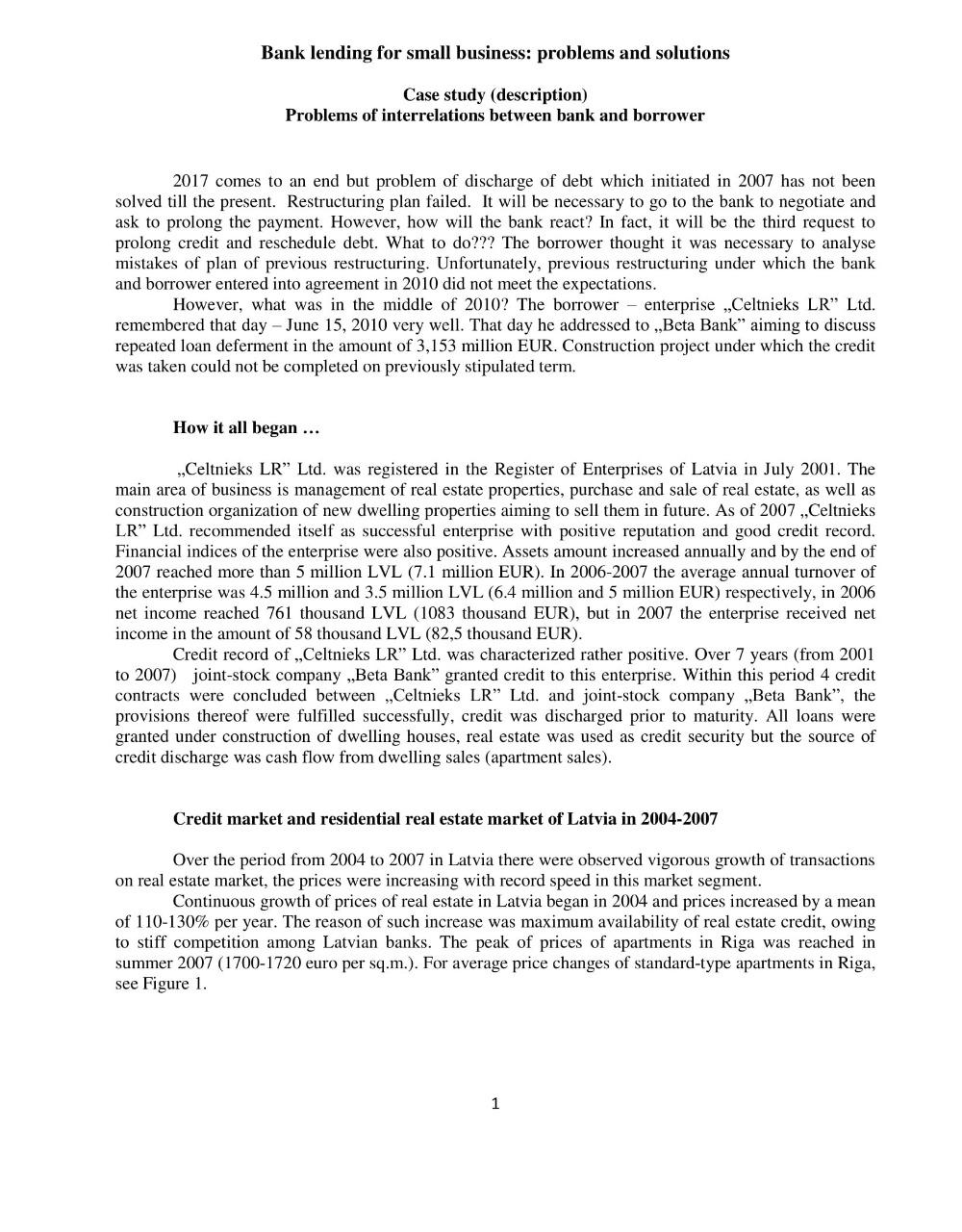

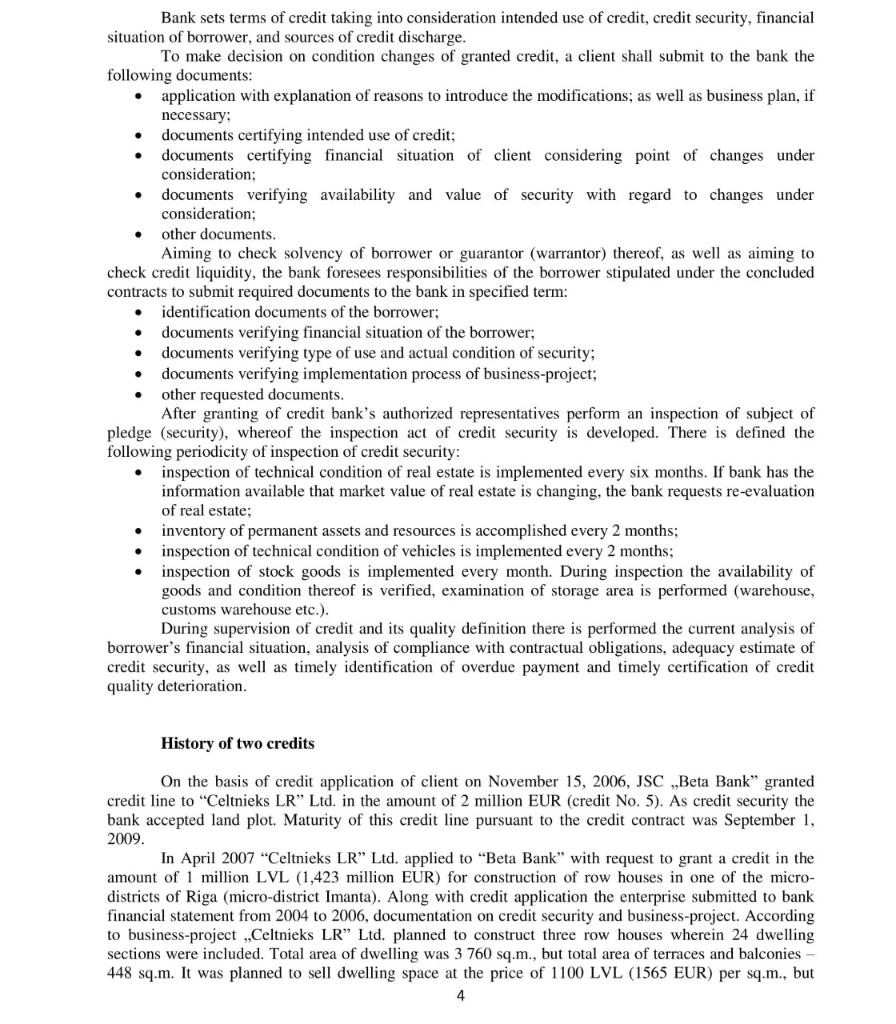

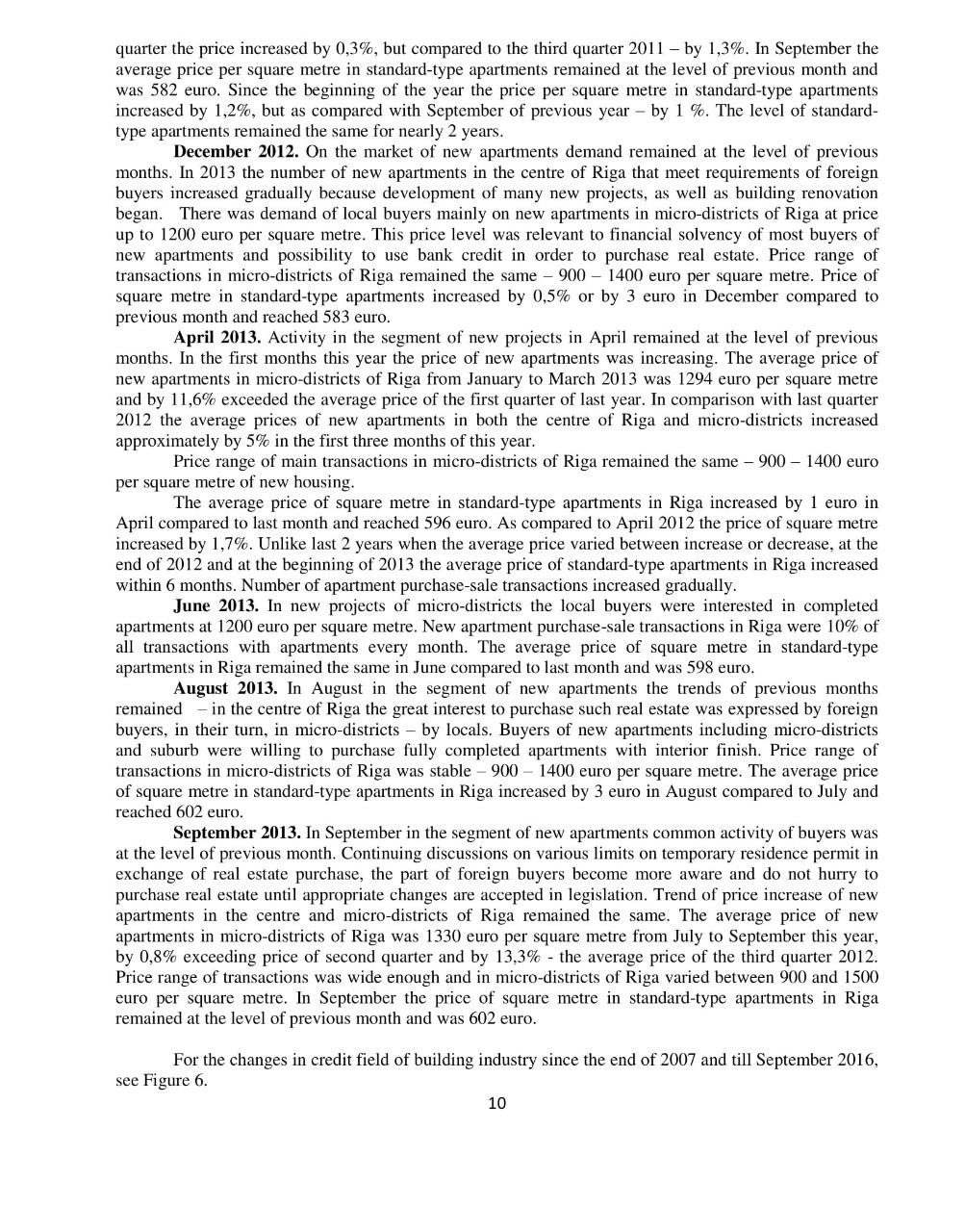

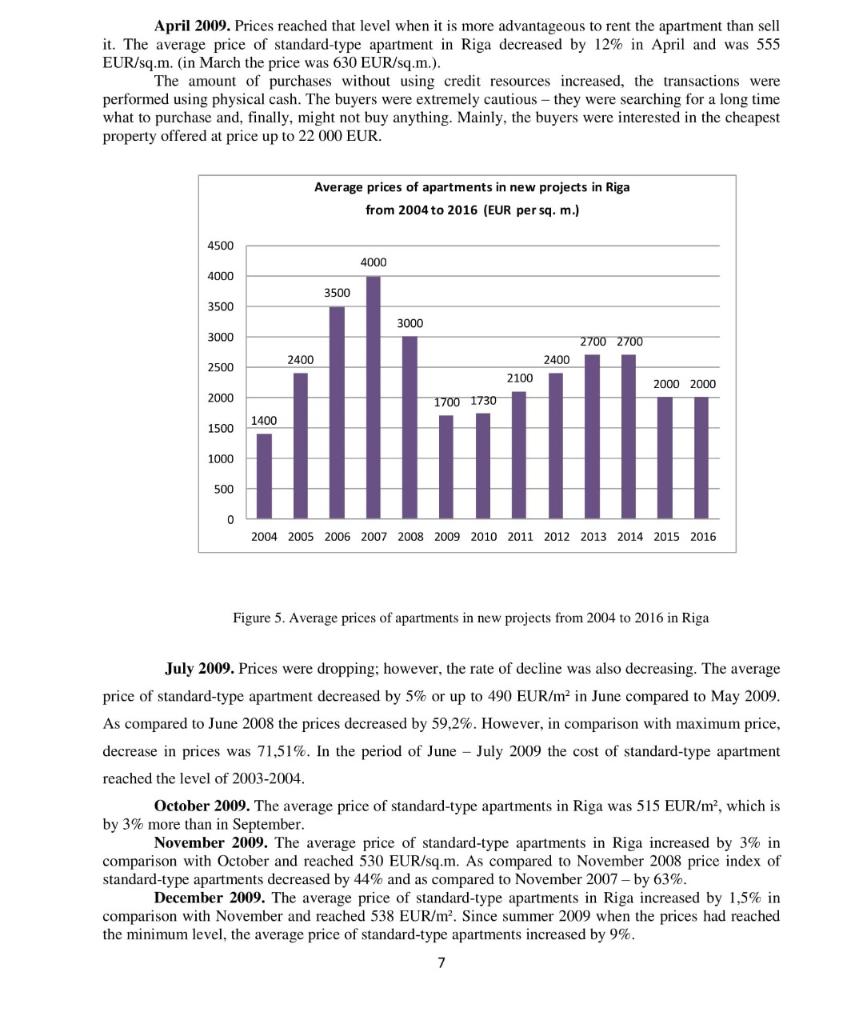

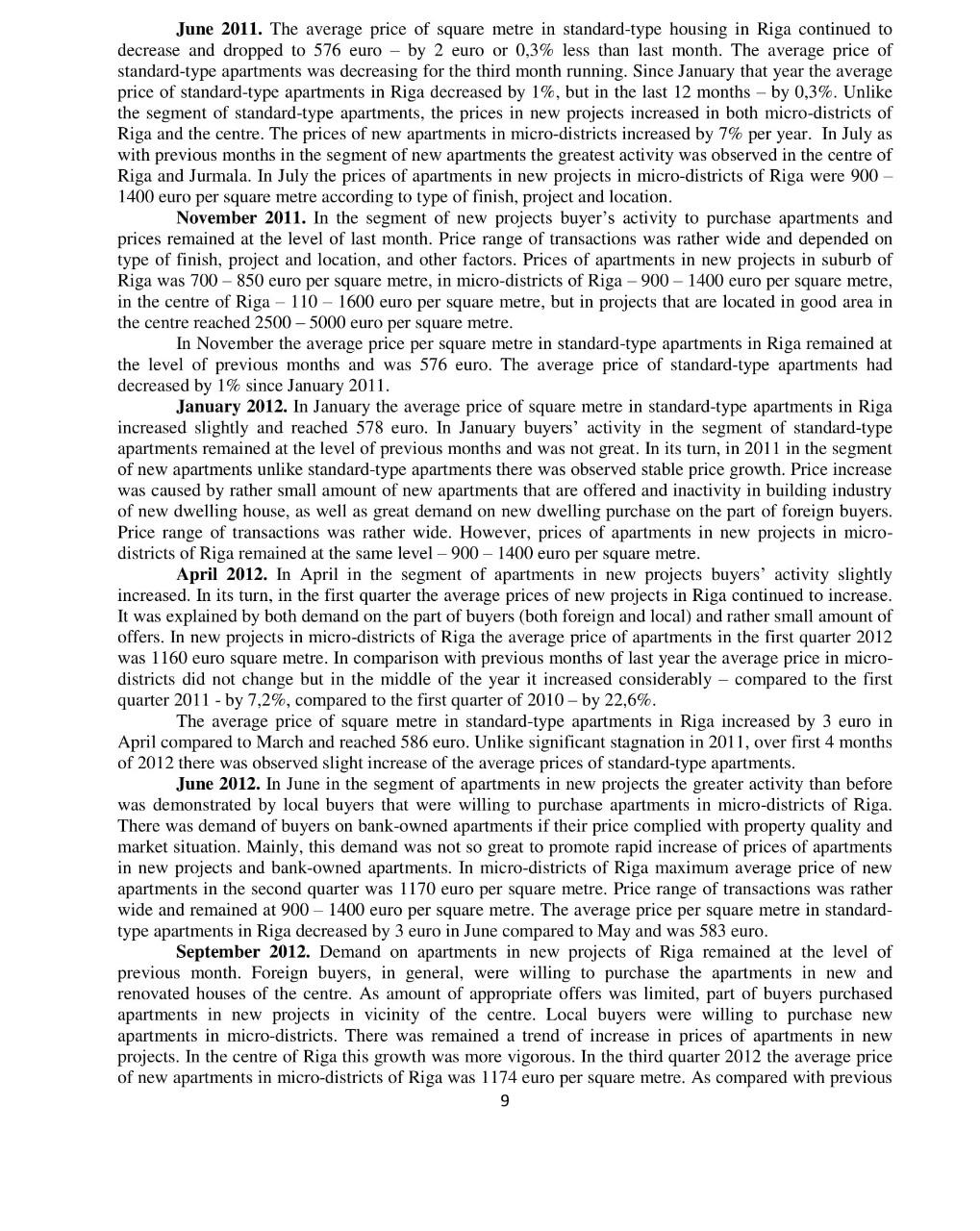

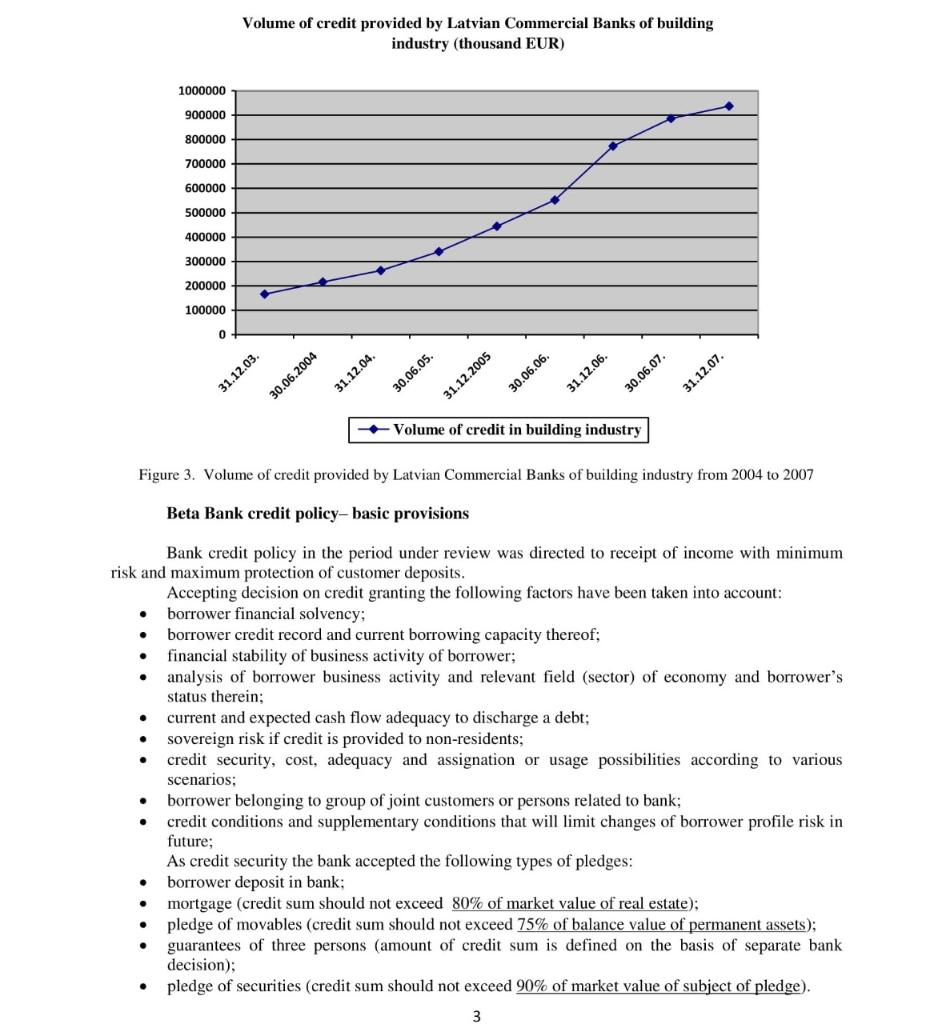

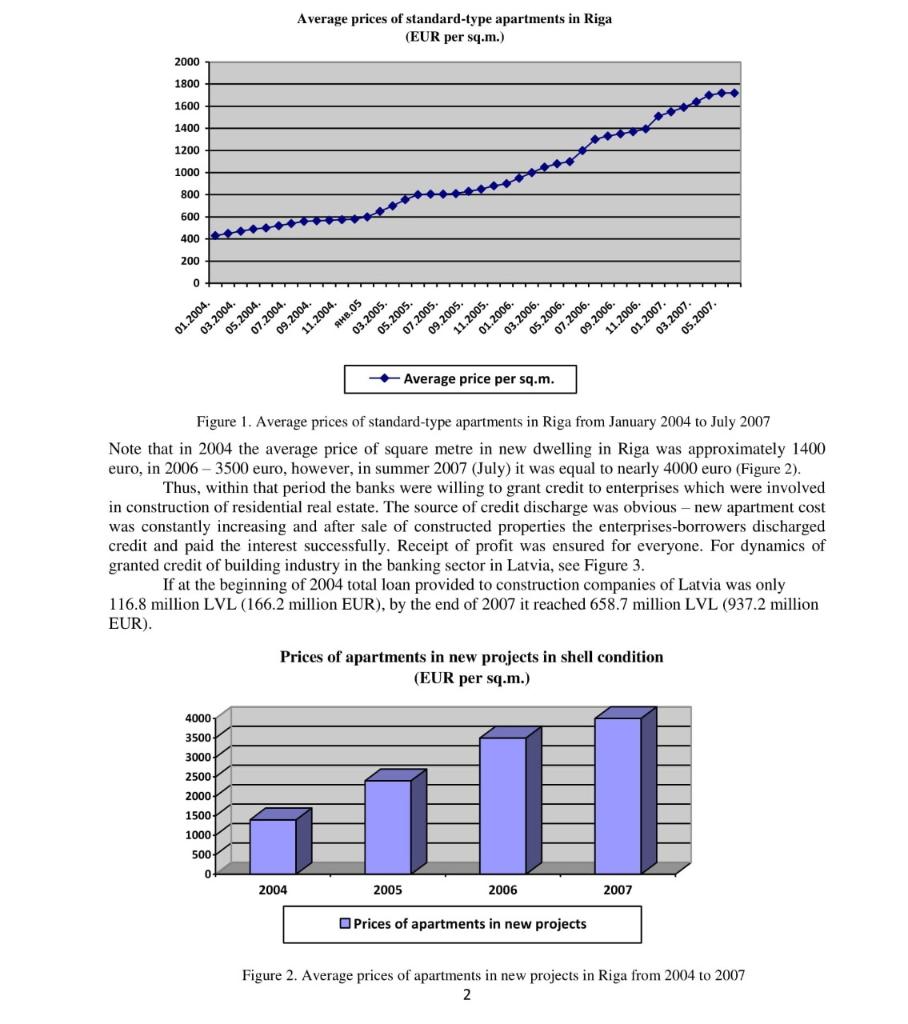

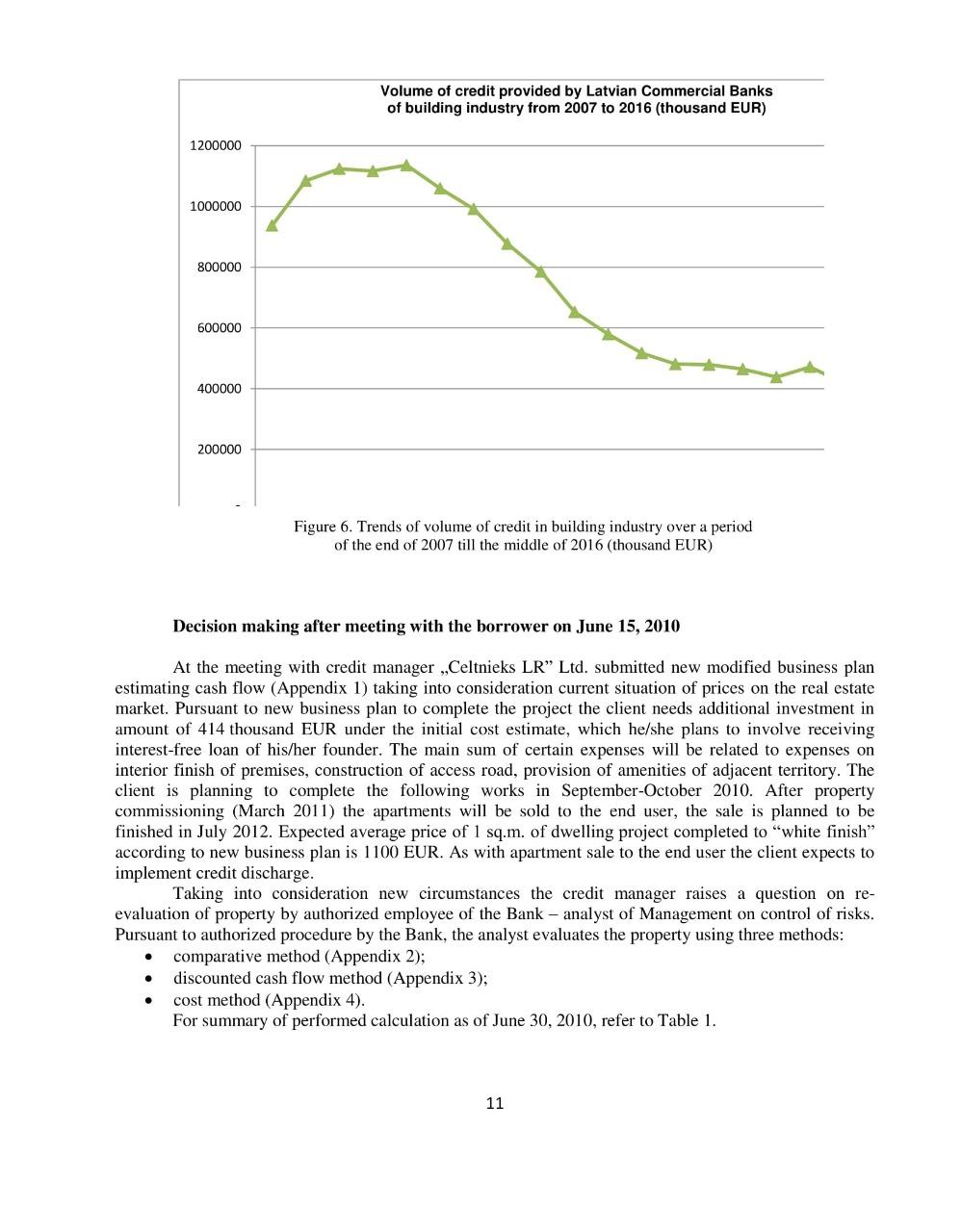

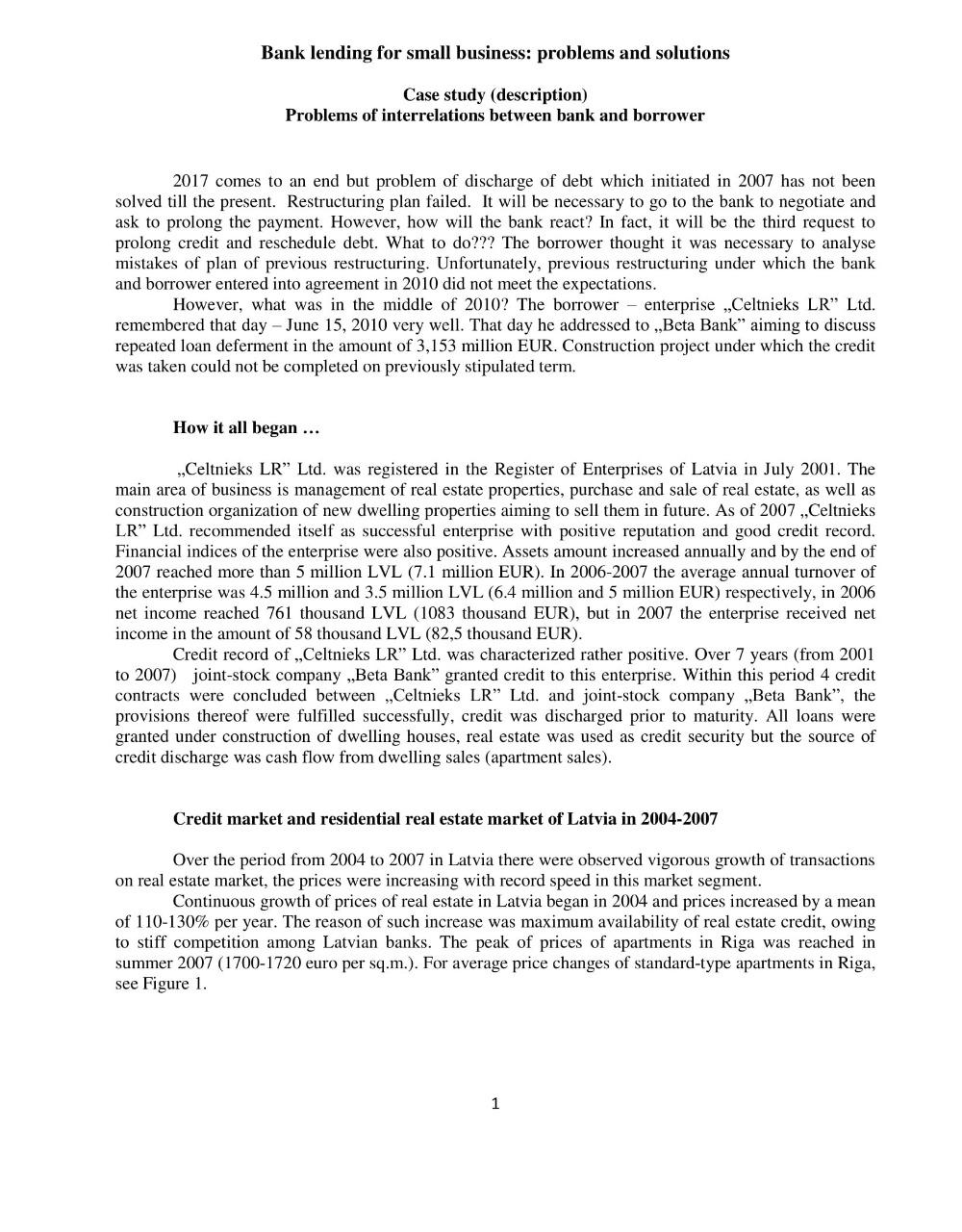

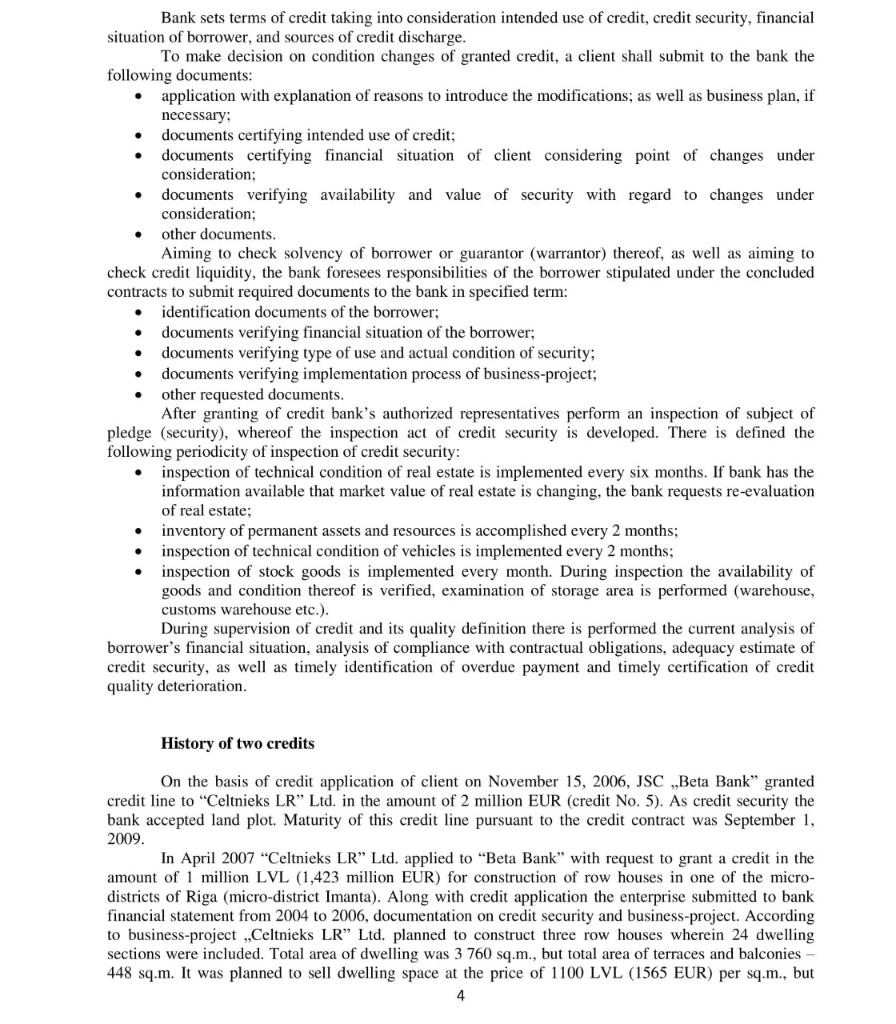

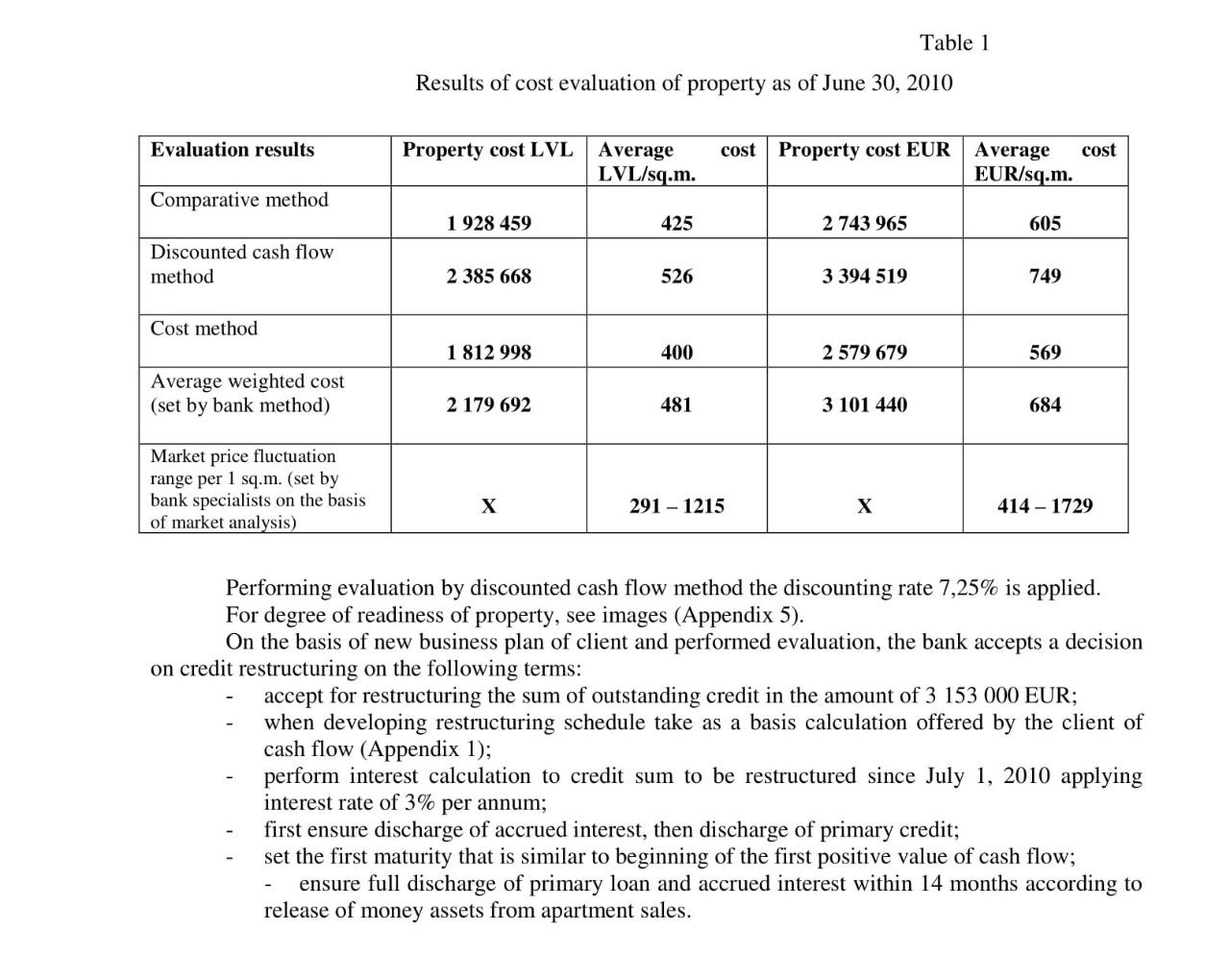

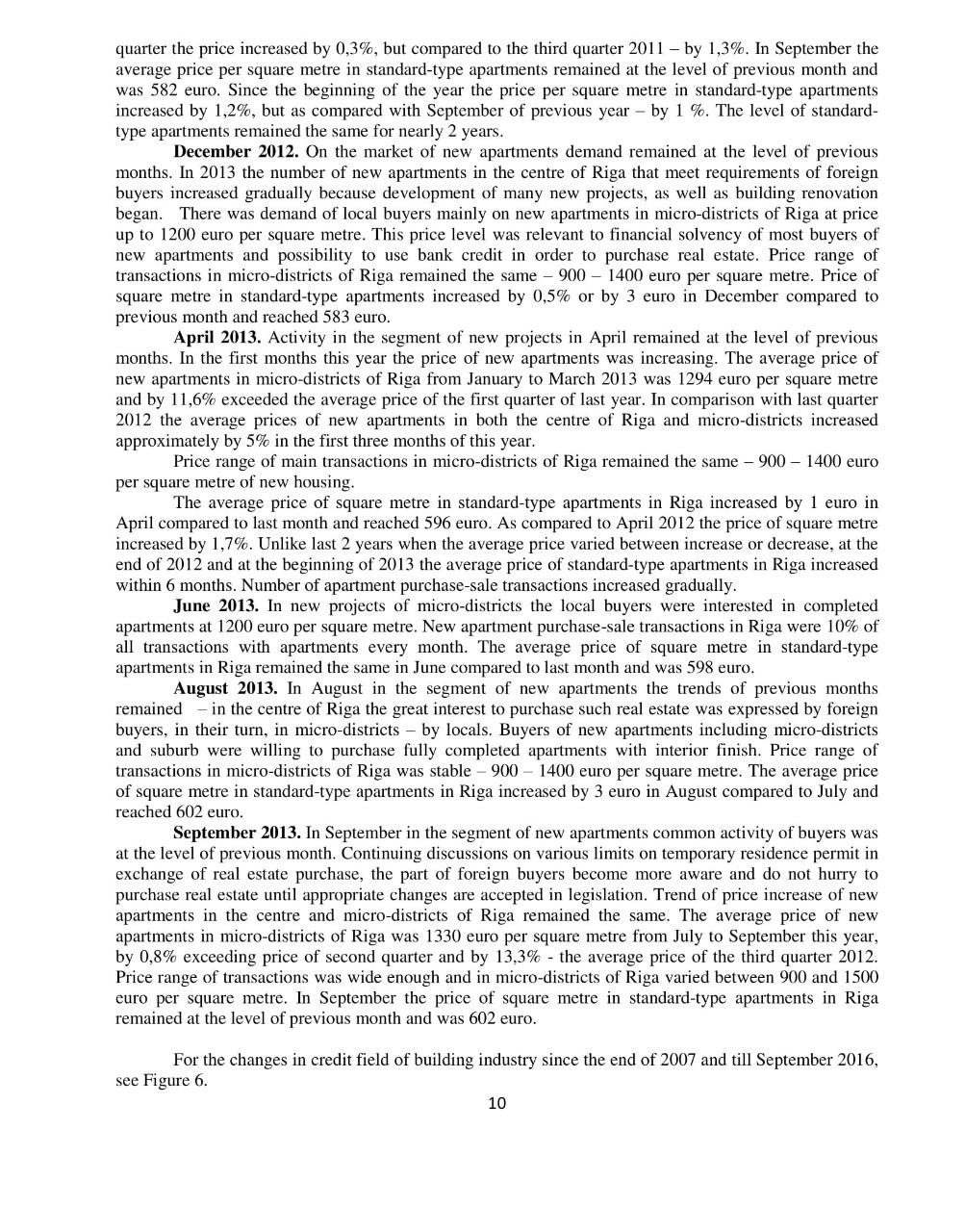

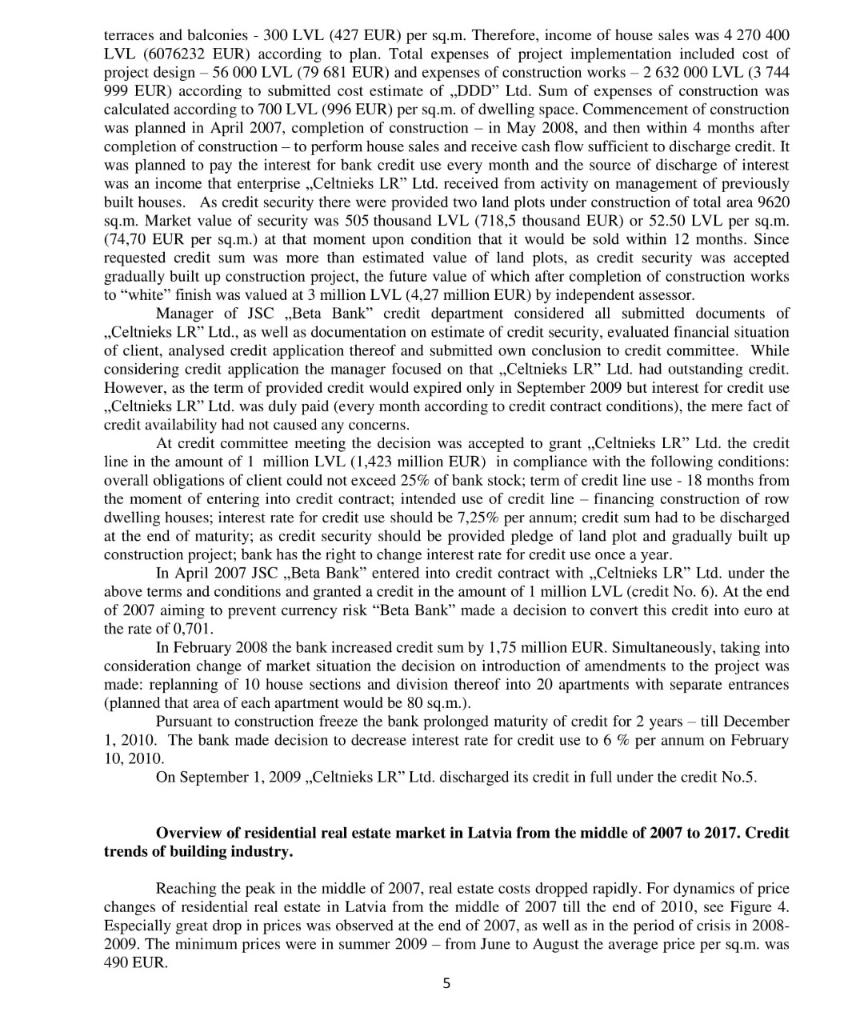

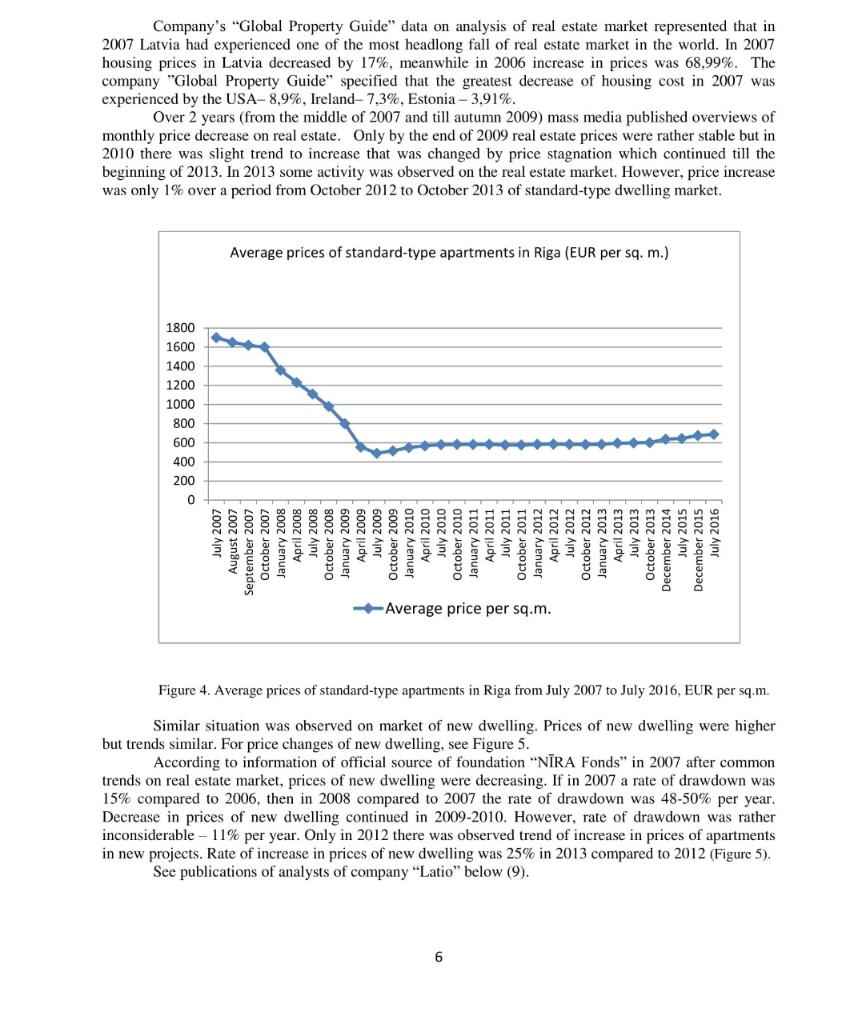

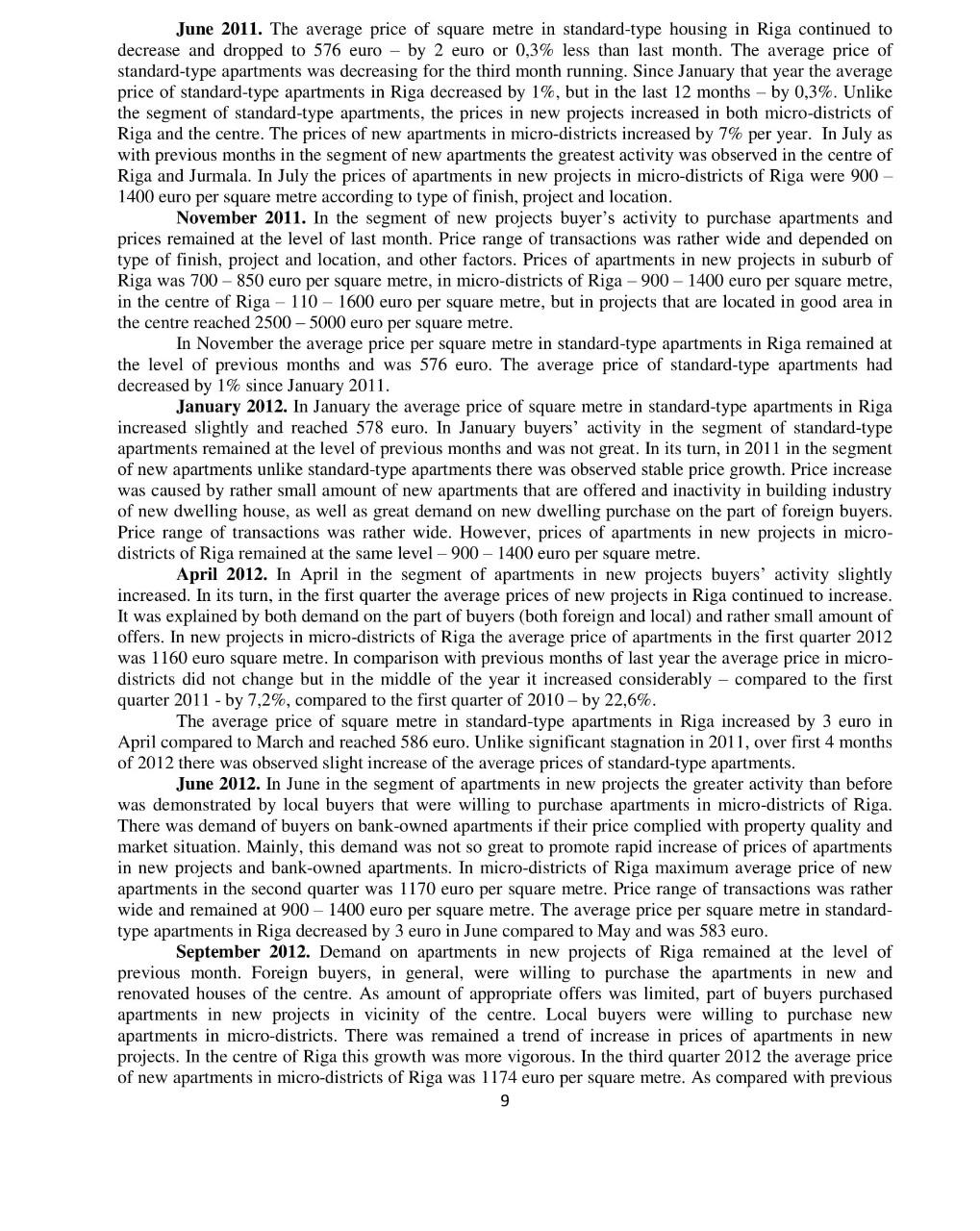

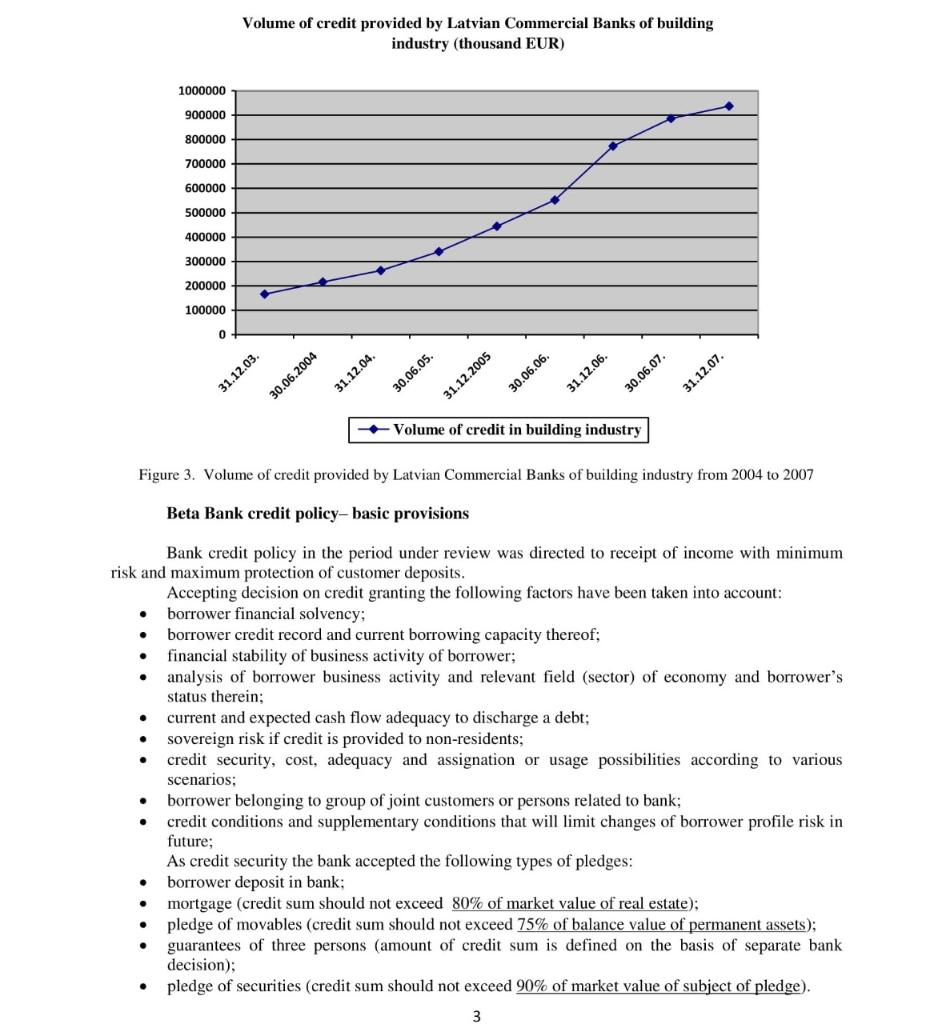

Average prices of standard-type apartments in Riga (EUR per sq.m.) - Average price per sq.m. Figure 1. Average prices of standard-type apartments in Riga from January 2004 to July 2007 Note that in 2004 the average price of square metre in new dwelling in Riga was approximately 1400 euro, in 2006 - 3500 euro, however, in summer 2007 (July) it was equal to nearly 4000 euro (Figure 2 ). Thus, within that period the banks were willing to grant credit to enterprises which were involved in construction of residential real estate. The source of credit discharge was obvious - new apartment cost was constantly increasing and after sale of constructed properties the enterprises-borrowers discharged credit and paid the interest successfully. Receipt of profit was ensured for everyone. For dynamics of granted credit of building industry in the banking sector in Latvia, see Figure 3. If at the beginning of 2004 total loan provided to construction companies of Latvia was only 116.8 million LVL (166.2 million EUR), by the end of 2007 it reached 658.7 million LVL (937.2 million EUR). Prices of apartments in new projects in shell condition (EUR per sq.m.) Figure 2. Average prices of apartments in new projects in Riga from 2004 to 2007 2 Please prepare answers to the questions for "case study": 1) Characterize financial situation of "Celtnieks LR" Ltd. How did the financial situation of the enterprise change after receipt of credit in April 2007? 2) Illustrate and analyse possible scenarios on situation development upon condition of apartment sales at price lower than expected by the borrower. What cash flow would the client receive for debt discharge? Assess availability of cash flow for credit discharge and interest at various price scenarios of property sale. 3) Assess Bank's losses from devaluation of credit granted to ,"Celtnieks LR Ltd. Point what disadvantages you have noticed in work between Bank and Borrower. Figure 6. Trends of volume of credit in building industry over a period of the end of 2007 till the middle of 2016 (thousand EUR) Decision making after meeting with the borrower on June 15,2010 At the meeting with credit manager ,Celtnieks LR" Ltd. submitted new modified business plan estimating cash flow (Appendix 1) taking into consideration current situation of prices on the real estate market. Pursuant to new business plan to complete the project the client needs additional investment in amount of 414 thousand EUR under the initial cost estimate, which he/she plans to involve receiving interest-free loan of his/her founder. The main sum of certain expenses will be related to expenses on interior finish of premises, construction of access road, provision of amenities of adjacent territory. The client is planning to complete the following works in September-October 2010. After property commissioning (March 2011) the apartments will be sold to the end user, the sale is planned to be finished in July 2012. Expected average price of 1 sq.m. of dwelling project completed to "white finish" according to new business plan is 1100 EUR. As with apartment sale to the end user the client expects to implement credit discharge. Taking into consideration new circumstances the credit manager raises a question on reevaluation of property by authorized employee of the Bank - analyst of Management on control of risks. Pursuant to authorized procedure by the Bank, the analyst evaluates the property using three methods: - comparative method (Appendix 2); - discounted cash flow method (Appendix 3); - cost method (Appendix 4). For summary of performed calculation as of June 30,2010 , refer to Table 1. 2017 comes to an end but problem of discharge of debt which initiated in 2007 has not been solved till the present. Restructuring plan failed. It will be necessary to go to the bank to negotiate and ask to prolong the payment. However, how will the bank react? In fact, it will be the third request to prolong credit and reschedule debt. What to do??? The borrower thought it was necessary to analyse mistakes of plan of previous restructuring. Unfortunately, previous restructuring under which the bank and borrower entered into agreement in 2010 did not meet the expectations. However, what was in the middle of 2010? The borrower - enterprise Celtnieks LR Ltd. remembered that day - June 15,2010 very well. That day he addressed to Beta Bank aiming to discuss repeated loan deferment in the amount of 3,153 million EUR. Construction project under which the credit was taken could not be completed on previously stipulated term. How it all began ... Celtnieks LR Ltd. was registered in the Register of Enterprises of Latvia in July 2001. The main area of business is management of real estate properties, purchase and sale of real estate, as well as construction organization of new dwelling properties aiming to sell them in future. As of 2007 ,"Celtnieks LR" Ltd. recommended itself as successful enterprise with positive reputation and good credit record. Financial indices of the enterprise were also positive. Assets amount increased annually and by the end of 2007 reached more than 5 million LVL (7.1 million EUR). In 2006-2007 the average annual turnover of the enterprise was 4.5 million and 3.5 million LVL (6.4 million and 5 million EUR) respectively, in 2006 net income reached 761 thousand LVL (1083 thousand EUR), but in 2007 the enterprise received net income in the amount of 58 thousand LVL (82,5 thousand EUR). Credit record of Celtnieks LR Ltd. was characterized rather positive. Over 7 years (from 2001 to 2007) joint-stock company Beta Bank granted credit to this enterprise. Within this period 4 credit contracts were concluded between Celtnieks LR Ltd. and joint-stock company Beta Bank, the provisions thereof were fulfilled successfully, credit was discharged prior to maturity. All loans were granted under construction of dwelling houses, real estate was used as credit security but the source of credit discharge was cash flow from dwelling sales (apartment sales). Credit market and residential real estate market of Latvia in 2004-2007 Over the period from 2004 to 2007 in Latvia there were observed vigorous growth of transactions on real estate market, the prices were increasing with record speed in this market segment. Continuous growth of prices of real estate in Latvia began in 2004 and prices increased by a mean of 110130% per year. The reason of such increase was maximum availability of real estate credit, owing to stiff competition among Latvian banks. The peak of prices of apartments in Riga was reached in summer 2007 (1700-1720 euro per sq.m.). For average price changes of standard-type apartments in Riga, see Figure 1. Bank sets terms of credit taking into consideration intended use of credit, credit security, financial situation of borrower, and sources of credit discharge. To make decision on condition changes of granted credit, a client shall submit to the bank the following documents: - application with explanation of reasons to introduce the modifications; as well as business plan, if necessary; - documents certifying intended use of credit; - documents certifying financial situation of client considering point of changes under consideration; - documents verifying availability and value of security with regard to changes under consideration; - other documents. Aiming to check solvency of borrower or guarantor (warrantor) thereof, as well as aiming to check credit liquidity, the bank foresees responsibilities of the borrower stipulated under the concluded contracts to submit required documents to the bank in specified term: - identification documents of the borrower; - documents verifying financial situation of the borrower; - documents verifying type of use and actual condition of security; - documents verifying implementation process of business-project; - other requested documents. After granting of credit bank's authorized representatives perform an inspection of subject of pledge (security), whereof the inspection act of credit security is developed. There is defined the following periodicity of inspection of credit security: - inspection of technical condition of real estate is implemented every six months. If bank has the information available that market value of real estate is changing, the bank requests re-evaluation of real estate; - inventory of permanent assets and resources is accomplished every 2 months; - inspection of technical condition of vehicles is implemented every 2 months; - inspection of stock goods is implemented every month. During inspection the availability of goods and condition thereof is verified, examination of storage area is performed (warehouse, customs warehouse etc.). During supervision of credit and its quality definition there is performed the current analysis of borrower's financial situation, analysis of compliance with contractual obligations, adequacy estimate of credit security, as well as timely identification of overdue payment and timely certification of credit quality deterioration. History of two credits On the basis of credit application of client on November 15, 2006, JSC Beta Bank granted credit line to "Celtnieks LR" Ltd. in the amount of 2 million EUR (credit No. 5). As credit security the bank accepted land plot. Maturity of this credit line pursuant to the credit contract was September 1, 2009. In April 2007 "Celtnieks LR" Ltd. applied to "Beta Bank" with request to grant a credit in the amount of 1 million LVL (1,423 million EUR) for construction of row houses in one of the microdistricts of Riga (micro-district Imanta). Along with credit application the enterprise submitted to bank financial statement from 2004 to 2006 , documentation on credit security and business-project. According to business-project Celtnieks LR Ltd. planned to construct three row houses wherein 24 dwelling sections were included. Total area of dwelling was 3760 sq.m., but total area of terraces and balconies 448 sq.m. It was planned to sell dwelling space at the price of 1100LVL (1565 EUR) per sq.m., but 4 Results of cost evaluation of property as of June 30, 2010 Performing evaluation by discounted cash flow method the discounting rate 7,25% is applied. For degree of readiness of property, see images (Appendix 5). On the basis of new business plan of client and performed evaluation, the bank accepts a decision on credit restructuring on the following terms: - accept for restructuring the sum of outstanding credit in the amount of 3153000 EUR; - when developing restructuring schedule take as a basis calculation offered by the client of cash flow (Appendix 1); - perform interest calculation to credit sum to be restructured since July 1, 2010 applying interest rate of 3% per annum; - first ensure discharge of accrued interest, then discharge of primary credit; - set the first maturity that is similar to beginning of the first positive value of cash flow; - ensure full discharge of primary loan and accrued interest within 14 months according to release of money assets from apartment sales. January 2010. In January the average cost of standard-type apartments of medium condition in Riga was 550EUR/m2, which is by 2% more than in previous month (538EUR/m2). Most significant increase in prices was observed of 3-room and 4-room apartments. February 2010. Real estate company "Latio" did not identify changes of average price index of apartments in February. In February the average price of standard-type apartments in Riga remained at the level of previous month - 550 EUR/sq.m. March 2010. The average price of standard-type apartments in Riga increased by 2% in March compared to February and reached 562 euro per square metre. April 2010. The average price of standard-type apartments in Riga increased by 1% in April compared to March and reached 568 euro per square metre. Price increase of apartments (even unsubstantial) was related to decrease of qualitative offer that meets requirements of the buyers. Supply of small and inexpensive standard-type apartments continued falling because such dwelling was purchased first of all during revival of market. Amount of transaction slightly increased, however, in general, it remained at the average level of last year. May 2010. The average price of standard-type apartments in Riga increased by 1% in May compared to April and reached 575 euro per square metre. The average price of apartments increased by 11% per year - in May 2009 it was 518 euro per square metre. The average price of standard-type apartments over the last nine months had increased by 15%. In May the number of buyers, who were willing to use bank loan for property acquisition, increased in all housing segment. However, most transactions were made without loan use. "Despite the commercial banks renewed credit granting, the loan amount is rather small. Changes of credit portfolio are still negative - the banks receive more money from households rather than provide as credit. Along with increase of credit granting there could be observed increase in prices of apartments, because at normal economic situation dwelling is purchased using bank loan", assessed Mris Grnbergs, market analyst of "Latio". Forecast on 2011 -2012 (view from the middle of 2011). It was forecasted that in 2011-2012 prices of standard-type apartments remained at present level as considerable improvement of economic situation was not observed, which would enable increase of mortgage credit and demand (9). Actual situation on the market of residential real estate in 2011 -2012 met expectations in the middle of 2010. On real estate market the stagnation period took place. The following reports were published by analyst of company "Latio" during that period (9). February 2011. The average price of standard-type apartments in Riga did not change in February compared to January and remained 582 euro per square metre. After rapid increase in the first half of last year the prices of standard-type housing stabilized and were at present level - approximately 580 euro per square metre - during several months. In segment of new apartment projects current offer continued to decrease gradually, since the activity of buyers is stable and transactions are made. The buyers expressed the interest in projects where the reservation of apartments had been started. Prices of apartments in new projects in micro-districts of Riga did not change in February and varied between 1000 and 1400 euro per square metre according to type of finish, project and location. In the centre of Riga prices of new projects were 11001600 euro per square metre, but in midtown 20002500 euro per square metre. April 2011. In April the average price per square metre in standard-type houses in Riga slightly increased - by 1-2 euro - and reached 583 euro, but in general, price level of standard-type housing remained the same during long time. Most demand on apartments in new projects in April, as well as in preceding months was observed in the centre of Riga and Jurmala where the high market activity was maintained by foreign buyers, mainly by the residents from Russia and other CIS counties. Part of these buyers was interested in apartment purchase due to receipt of temporary resident permit after purchase of real estate. Great interest of foreign buyers in apartment purchase also set a tendency of increase in offer prices in new projects in the centre of Riga and Jurmala. New apartments in micro-districts, in general, appealed to local buyers whose activity did not change and remained at low level in comparison with last months. In April the prices of apartments in new projects in micro-districts of Riga were between 900 and 1400 euro per square metre according to type of finish, project and location. 8 January 2010. In January the average cost of standard-type apartments of medium condition in Riga was 550EUR/m2, which is by 2% more than in previous month (538EUR/m2). Most significant increase in prices was observed of 3-room and 4-room apartments. February 2010. Real estate company "Latio" did not identify changes of average price index of apartments in February. In February the average price of standard-type apartments in Riga remained at the level of previous month - 550 EUR/sq.m. March 2010. The average price of standard-type apartments in Riga increased by 2% in March compared to February and reached 562 euro per square metre. April 2010. The average price of standard-type apartments in Riga increased by 1% in April compared to March and reached 568 euro per square metre. Price increase of apartments (even unsubstantial) was related to decrease of qualitative offer that meets requirements of the buyers. Supply of small and inexpensive standard-type apartments continued falling because such dwelling was purchased first of all during revival of market. Amount of transaction slightly increased, however, in general, it remained at the average level of last year. May 2010. The average price of standard-type apartments in Riga increased by 1% in May compared to April and reached 575 euro per square metre. The average price of apartments increased by 11% per year - in May 2009 it was 518 euro per square metre. The average price of standard-type apartments over the last nine months had increased by 15%. In May the number of buyers, who were willing to use bank loan for property acquisition, increased in all housing segment. However, most transactions were made without loan use. "Despite the commercial banks renewed credit granting, the loan amount is rather small. Changes of credit portfolio are still negative - the banks receive more money from households rather than provide as credit. Along with increase of credit granting there could be observed increase in prices of apartments, because at normal economic situation dwelling is purchased using bank loan", assessed Mris Grnbergs, market analyst of "Latio". Forecast on 2011 -2012 (view from the middle of 2011). It was forecasted that in 2011-2012 prices of standard-type apartments remained at present level as considerable improvement of economic situation was not observed, which would enable increase of mortgage credit and demand (9). Actual situation on the market of residential real estate in 2011 -2012 met expectations in the middle of 2010. On real estate market the stagnation period took place. The following reports were published by analyst of company "Latio" during that period (9). February 2011. The average price of standard-type apartments in Riga did not change in February compared to January and remained 582 euro per square metre. After rapid increase in the first half of last year the prices of standard-type housing stabilized and were at present level - approximately 580 euro per square metre - during several months. In segment of new apartment projects current offer continued to decrease gradually, since the activity of buyers is stable and transactions are made. The buyers expressed the interest in projects where the reservation of apartments had been started. Prices of apartments in new projects in micro-districts of Riga did not change in February and varied between 1000 and 1400 euro per square metre according to type of finish, project and location. In the centre of Riga prices of new projects were 11001600 euro per square metre, but in midtown 20002500 euro per square metre. April 2011. In April the average price per square metre in standard-type houses in Riga slightly increased - by 1-2 euro - and reached 583 euro, but in general, price level of standard-type housing remained the same during long time. Most demand on apartments in new projects in April, as well as in preceding months was observed in the centre of Riga and Jurmala where the high market activity was maintained by foreign buyers, mainly by the residents from Russia and other CIS counties. Part of these buyers was interested in apartment purchase due to receipt of temporary resident permit after purchase of real estate. Great interest of foreign buyers in apartment purchase also set a tendency of increase in offer prices in new projects in the centre of Riga and Jurmala. New apartments in micro-districts, in general, appealed to local buyers whose activity did not change and remained at low level in comparison with last months. In April the prices of apartments in new projects in micro-districts of Riga were between 900 and 1400 euro per square metre according to type of finish, project and location. 8 quarter the price increased by 0,3%, but compared to the third quarter 2011 by 1,3%. In September the average price per square metre in standard-type apartments remained at the level of previous month and was 582 euro. Since the beginning of the year the price per square metre in standard-type apartments increased by 1,2%, but as compared with September of previous year - by 1%. The level of standardtype apartments remained the same for nearly 2 years. December 2012. On the market of new apartments demand remained at the level of previous months. In 2013 the number of new apartments in the centre of Riga that meet requirements of foreign buyers increased gradually because development of many new projects, as well as building renovation began. There was demand of local buyers mainly on new apartments in micro-districts of Riga at price up to 1200 euro per square metre. This price level was relevant to financial solvency of most buyers of new apartments and possibility to use bank credit in order to purchase real estate. Price range of transactions in micro-districts of Riga remained the same 9001400 euro per square metre. Price of square metre in standard-type apartments increased by 0,5% or by 3 euro in December compared to previous month and reached 583 euro. April 2013. Activity in the segment of new projects in April remained at the level of previous months. In the first months this year the price of new apartments was increasing. The average price of new apartments in micro-districts of Riga from January to March 2013 was 1294 euro per square metre and by 11,6% exceeded the average price of the first quarter of last year. In comparison with last quarter 2012 the average prices of new apartments in both the centre of Riga and micro-districts increased approximately by 5% in the first three months of this year. Price range of main transactions in micro-districts of Riga remained the same 9001400 euro per square metre of new housing. The average price of square metre in standard-type apartments in Riga increased by 1 euro in April compared to last month and reached 596 euro. As compared to April 2012 the price of square metre increased by 1,7%. Unlike last 2 years when the average price varied between increase or decrease, at the end of 2012 and at the beginning of 2013 the average price of standard-type apartments in Riga increased within 6 months. Number of apartment purchase-sale transactions increased gradually. June 2013. In new projects of micro-districts the local buyers were interested in completed apartments at 1200 euro per square metre. New apartment purchase-sale transactions in Riga were 10% of all transactions with apartments every month. The average price of square metre in standard-type apartments in Riga remained the same in June compared to last month and was 598 euro. August 2013. In August in the segment of new apartments the trends of previous months remained - in the centre of Riga the great interest to purchase such real estate was expressed by foreign buyers, in their turn, in micro-districts - by locals. Buyers of new apartments including micro-districts and suburb were willing to purchase fully completed apartments with interior finish. Price range of transactions in micro-districts of Riga was stable 9001400 euro per square metre. The average price of square metre in standard-type apartments in Riga increased by 3 euro in August compared to July and reached 602 euro. September 2013. In September in the segment of new apartments common activity of buyers was at the level of previous month. Continuing discussions on various limits on temporary residence permit in exchange of real estate purchase, the part of foreign buyers become more aware and do not hurry to purchase real estate until appropriate changes are accepted in legislation. Trend of price increase of new apartments in the centre and micro-districts of Riga remained the same. The average price of new apartments in micro-districts of Riga was 1330 euro per square metre from July to September this year, by 0,8% exceeding price of second quarter and by 13,3\% - the average price of the third quarter 2012 . Price range of transactions was wide enough and in micro-districts of Riga varied between 900 and 1500 euro per square metre. In September the price of square metre in standard-type apartments in Riga remained at the level of previous month and was 602 euro. For the changes in credit field of building industry since the end of 2007 and till September 2016, see Figure 6. 10 April 2009. Prices reached that level when it is more advantageous to rent the apartment than sell it. The average price of standard-type apartment in Riga decreased by 12% in April and was 555 EUR/sq.m. (in March the price was 630 EUR/sq.m.). The amount of purchases without using credit resources increased, the transactions were performed using physical cash. The buyers were extremely cautious - they were searching for a long time what to purchase and, finally, might not buy anything. Mainly, the buyers were interested in the cheapest property offered at price up to 22000 EUR. Figure 5. Average prices of apartments in new projects from 2004 to 2016 in Riga July 2009. Prices were dropping; however, the rate of decline was also decreasing. The average price of standard-type apartment decreased by 5% or up to 490EUR/m2 in June compared to May 2009. As compared to June 2008 the prices decreased by 59,2%. However, in comparison with maximum price, decrease in prices was 71,51%. In the period of June - July 2009 the cost of standard-type apartment reached the level of 2003-2004. October 2009. The average price of standard-type apartments in Riga was 515EUR/m2, which is by 3% more than in September. November 2009. The average price of standard-type apartments in Riga increased by 3% in comparison with October and reached 530 EUR/sq.m. As compared to November 2008 price index of standard-type apartments decreased by 44% and as compared to November 2007 - by 63%. December 2009. The average price of standard-type apartments in Riga increased by 1,5% in comparison with November and reached 538EUR/m2. Since summer 2009 when the prices had reached the minimum level, the average price of standard-type apartments increased by 9%. terraces and balconies - 300 LVL (427 EUR) per sq.m. Therefore, income of house sales was 4270400 LVL (6076232 EUR) according to plan. Total expenses of project implementation included cost of project design - 56000 LVL (79 681 EUR) and expenses of construction works - 2632000 LVL (3 744 999 EUR) according to submitted cost estimate of ,DDD" Ltd. Sum of expenses of construction was calculated according to 700 LVL (996 EUR) per sq.m. of dwelling space. Commencement of construction was planned in April 2007, completion of construction - in May 2008, and then within 4 months after completion of construction - to perform house sales and receive cash flow sufficient to discharge credit. It was planned to pay the interest for bank credit use every month and the source of discharge of interest was an income that enterprise ,Celtnieks LR" Ltd. received from activity on management of previously built houses. As credit security there were provided two land plots under construction of total area 9620 sq.m. Market value of security was 505 thousand LVL (718,5 thousand EUR) or 52.50 LVL per sq.m. (74,70 EUR per sq.m.) at that moment upon condition that it would be sold within 12 months. Since requested credit sum was more than estimated value of land plots, as credit security was accepted gradually built up construction project, the future value of which after completion of construction works to "white" finish was valued at 3 million LVL (4,27 million EUR) by independent assessor. Manager of JSC Beta Bank" credit department considered all submitted documents of "Celtnieks LR" Ltd., as well as documentation on estimate of credit security, evaluated financial situation of client, analysed credit application thereof and submitted own conclusion to credit committee. While considering credit application the manager focused on that "Celtnieks LR" Ltd. had outstanding credit. However, as the term of provided credit would expired only in September 2009 but interest for credit use "Celtnieks LR" Ltd. was duly paid (every month according to credit contract conditions), the mere fact of credit availability had not caused any concerns. At credit committee meeting the decision was accepted to grant ,"Celtnieks LR" Ltd. the credit line in the amount of I million LVL ( 1,423 million EUR) in compliance with the following conditions: overall obligations of client could not exceed 25% of bank stock; term of credit line use - 18 months from the moment of entering into credit contract; intended use of credit line - financing construction of row dwelling houses; interest rate for credit use should be 7,25% per annum; credit sum had to be discharged at the end of maturity; as credit security should be provided pledge of land plot and gradually built up construction project; bank has the right to change interest rate for credit use once a year. In April 2007 JSC, ,Beta Bank" entered into credit contract with ,Celtnieks LR" Ltd. under the above terms and conditions and granted a credit in the amount of 1 million LVL (credit No. 6). At the end of 2007 aiming to prevent currency risk "Beta Bank" made a decision to convert this credit into euro at the rate of 0,701 . In February 2008 the bank increased credit sum by 1,75 million EUR. Simultaneously, taking into consideration change of market situation the decision on introduction of amendments to the project was made: replanning of 10 house sections and division thereof into 20 apartments with separate entrances (planned that area of each apartment would be 80 sq.m.). Pursuant to construction freeze the bank prolonged maturity of credit for 2 years - till December 1, 2010. The bank made decision to decrease interest rate for credit use to 6% per annum on February 10,2010 . On September 1, 2009 ,Celtnieks LR Ltd. discharged its credit in full under the credit No.5. Overview of residential real estate market in Latvia from the middle of 2007 to 2017. Credit trends of building industry. Reaching the peak in the middle of 2007 , real estate costs dropped rapidly. For dynamics of price changes of residential real estate in Latvia from the middle of 2007 till the end of 2010 , see Figure 4. Especially great drop in prices was observed at the end of 2007 , as well as in the period of crisis in 2008 2009. The minimum prices were in summer 2009 - from June to August the average price per sq.m. was 490 EUR. 5 Company's "Global Property Guide" data on analysis of real estate market represented that in 2007 Latvia had experienced one of the most headlong fall of real estate market in the world. In 2007 housing prices in Latvia decreased by 17%, meanwhile in 2006 increase in prices was 68,99%. The company "Global Property Guide" specified that the greatest decrease of housing cost in 2007 was experienced by the USA- 8,9\%, Ireland- 7,3\%, Estonia 3,91%. Over 2 years (from the middle of 2007 and till autumn 2009) mass media published overviews of monthly price decrease on real estate. Only by the end of 2009 real estate prices were rather stable but in 2010 there was slight trend to increase that was changed by price stagnation which continued till the beginning of 2013. In 2013 some activity was observed on the real estate market. However, price increase was only 1% over a period from October 2012 to October 2013 of standard-type dwelling market. Figure 4. Average prices of standard-type apartments in Riga from July 2007 to July 2016, EUR per sq.m. Similar situation was observed on market of new dwelling. Prices of new dwelling were higher but trends similar. For price changes of new dwelling, see Figure 5. According to information of official source of foundation "NRA Fonds" in 2007 after common trends on real estate market, prices of new dwelling were decreasing. If in 2007 a rate of drawdown was 15% compared to 2006 , then in 2008 compared to 2007 the rate of drawdown was 4850% per year. Decrease in prices of new dwelling continued in 2009-2010. However, rate of drawdown was rather inconsiderable 11% per year. Only in 2012 there was observed trend of increase in prices of apartments in new projects. Rate of increase in prices of new dwelling was 25\% in 2013 compared to 2012 (Figure 5). See publications of analysts of company "Latio" below (9). June 2011. The average price of square metre in standard-type housing in Riga continued to decrease and dropped to 576 euro - by 2 euro or 0,3% less than last month. The average price of standard-type apartments was decreasing for the third month running. Since January that year the average price of standard-type apartments in Riga decreased by 1%, but in the last 12 months - by 0,3%. Unlike the segment of standard-type apartments, the prices in new projects increased in both micro-districts of Riga and the centre. The prices of new apartments in micro-districts increased by 7% per year. In July as with previous months in the segment of new apartments the greatest activity was observed in the centre of Riga and Jurmala. In July the prices of apartments in new projects in micro-districts of Riga were 900 1400 euro per square metre according to type of finish, project and location. November 2011. In the segment of new projects buyer's activity to purchase apartments and prices remained at the level of last month. Price range of transactions was rather wide and depended on type of finish, project and location, and other factors. Prices of apartments in new projects in suburb of Riga was 700850 euro per square metre, in micro-districts of Riga 9001400 euro per square metre, in the centre of Riga - 1101600 euro per square metre, but in projects that are located in good area in the centre reached 25005000 euro per square metre. In November the average price per square metre in standard-type apartments in Riga remained at the level of previous months and was 576 euro. The average price of standard-type apartments had decreased by 1% since January 2011. January 2012. In January the average price of square metre in standard-type apartments in Riga increased slightly and reached 578 euro. In January buyers' activity in the segment of standard-type apartments remained at the level of previous months and was not great. In its turn, in 2011 in the segment of new apartments unlike standard-type apartments there was observed stable price growth. Price increase was caused by rather small amount of new apartments that are offered and inactivity in building industry of new dwelling house, as well as great demand on new dwelling purchase on the part of foreign buyers. Price range of transactions was rather wide. However, prices of apartments in new projects in microdistricts of Riga remained at the same level - 9001400 euro per square metre. April 2012. In April in the segment of apartments in new projects buyers' activity slightly increased. In its turn, in the first quarter the average prices of new projects in Riga continued to increase. It was explained by both demand on the part of buyers (both foreign and local) and rather small amount of offers. In new projects in micro-districts of Riga the average price of apartments in the first quarter 2012 was 1160 euro square metre. In comparison with previous months of last year the average price in microdistricts did not change but in the middle of the year it increased considerably - compared to the first quarter 2011 - by 7,2%, compared to the first quarter of 2010 - by 22,6%. The average price of square metre in standard-type apartments in Riga increased by 3 euro in April compared to March and reached 586 euro. Unlike significant stagnation in 2011, over first 4 months of 2012 there was observed slight increase of the average prices of standard-type apartments. June 2012. In June in the segment of apartments in new projects the greater activity than before was demonstrated by local buyers that were willing to purchase apartments in micro-districts of Riga. There was demand of buyers on bank-owned apartments if their price complied with property quality and market situation. Mainly, this demand was not so great to promote rapid increase of prices of apartments in new projects and bank-owned apartments. In micro-districts of Riga maximum average price of new apartments in the second quarter was 1170 euro per square metre. Price range of transactions was rather wide and remained at 9001400 euro per square metre. The average price per square metre in standardtype apartments in Riga decreased by 3 euro in June compared to May and was 583 euro. September 2012. Demand on apartments in new projects of Riga remained at the level of previous month. Foreign buyers, in general, were willing to purchase the apartments in new and renovated houses of the centre. As amount of appropriate offers was limited, part of buyers purchased apartments in new projects in vicinity of the centre. Local buyers were willing to purchase new apartments in micro-districts. There was remained a trend of increase in prices of apartments in new projects. In the centre of Riga this growth was more vigorous. In the third quarter 2012 the average price of new apartments in micro-districts of Riga was 1174 euro per square metre. As compared with previous 9 Volume of credit provided by Latvian Commercial Banks of building industry (thousand EUR) Figure 3. Volume of credit provided by Latvian Commercial Banks of building industry from 2004 to 2007 Beta Bank credit policy-basic provisions Bank credit policy in the period under review was directed to receipt of income with minimum risk and maximum protection of customer deposits. Accepting decision on credit granting the following factors have been taken into account: - borrower financial solvency; - borrower credit record and current borrowing capacity thereof; - financial stability of business activity of borrower; - analysis of borrower business activity and relevant field (sector) of economy and borrower's status therein; - current and expected cash flow adequacy to discharge a debt; - sovereign risk if credit is provided to non-residents; - credit security, cost, adequacy and assignation or usage possibilities according to various scenarios; - borrower belonging to group of joint customers or persons related to bank; - credit conditions and supplementary conditions that will limit changes of borrower profile risk in future; As credit security the bank accepted the following types of pledges: - borrower deposit in bank; - mortgage (credit sum should not exceed 80% of market value of real estate); - pledge of movables (credit sum should not exceed 75% of balance value of permanent assets); - guarantees of three persons (amount of credit sum is defined on the basis of separate bank decision); - pledge of securities (credit sum should not exceed 90% of market value of subject of pledge). Average prices of standard-type apartments in Riga (EUR per sq.m.) - Average price per sq.m. Figure 1. Average prices of standard-type apartments in Riga from January 2004 to July 2007 Note that in 2004 the average price of square metre in new dwelling in Riga was approximately 1400 euro, in 2006 - 3500 euro, however, in summer 2007 (July) it was equal to nearly 4000 euro (Figure 2 ). Thus, within that period the banks were willing to grant credit to enterprises which were involved in construction of residential real estate. The source of credit discharge was obvious - new apartment cost was constantly increasing and after sale of constructed properties the enterprises-borrowers discharged credit and paid the interest successfully. Receipt of profit was ensured for everyone. For dynamics of granted credit of building industry in the banking sector in Latvia, see Figure 3. If at the beginning of 2004 total loan provided to construction companies of Latvia was only 116.8 million LVL (166.2 million EUR), by the end of 2007 it reached 658.7 million LVL (937.2 million EUR). Prices of apartments in new projects in shell condition (EUR per sq.m.) Figure 2. Average prices of apartments in new projects in Riga from 2004 to 2007 2 Please prepare answers to the questions for "case study": 1) Characterize financial situation of "Celtnieks LR" Ltd. How did the financial situation of the enterprise change after receipt of credit in April 2007? 2) Illustrate and analyse possible scenarios on situation development upon condition of apartment sales at price lower than expected by the borrower. What cash flow would the client receive for debt discharge? Assess availability of cash flow for credit discharge and interest at various price scenarios of property sale. 3) Assess Bank's losses from devaluation of credit granted to ,"Celtnieks LR Ltd. Point what disadvantages you have noticed in work between Bank and Borrower. Figure 6. Trends of volume of credit in building industry over a period of the end of 2007 till the middle of 2016 (thousand EUR) Decision making after meeting with the borrower on June 15,2010 At the meeting with credit manager ,Celtnieks LR" Ltd. submitted new modified business plan estimating cash flow (Appendix 1) taking into consideration current situation of prices on the real estate market. Pursuant to new business plan to complete the project the client needs additional investment in amount of 414 thousand EUR under the initial cost estimate, which he/she plans to involve receiving interest-free loan of his/her founder. The main sum of certain expenses will be related to expenses on interior finish of premises, construction of access road, provision of amenities of adjacent territory. The client is planning to complete the following works in September-October 2010. After property commissioning (March 2011) the apartments will be sold to the end user, the sale is planned to be finished in July 2012. Expected average price of 1 sq.m. of dwelling project completed to "white finish" according to new business plan is 1100 EUR. As with apartment sale to the end user the client expects to implement credit discharge. Taking into consideration new circumstances the credit manager raises a question on reevaluation of property by authorized employee of the Bank - analyst of Management on control of risks. Pursuant to authorized procedure by the Bank, the analyst evaluates the property using three methods: - comparative method (Appendix 2); - discounted cash flow method (Appendix 3); - cost method (Appendix 4). For summary of performed calculation as of June 30,2010 , refer to Table 1. 2017 comes to an end but problem of discharge of debt which initiated in 2007 has not been solved till the present. Restructuring plan failed. It will be necessary to go to the bank to negotiate and ask to prolong the payment. However, how will the bank react? In fact, it will be the third request to prolong credit and reschedule debt. What to do??? The borrower thought it was necessary to analyse mistakes of plan of previous restructuring. Unfortunately, previous restructuring under which the bank and borrower entered into agreement in 2010 did not meet the expectations. However, what was in the middle of 2010? The borrower - enterprise Celtnieks LR Ltd. remembered that day - June 15,2010 very well. That day he addressed to Beta Bank aiming to discuss repeated loan deferment in the amount of 3,153 million EUR. Construction project under which the credit was taken could not be completed on previously stipulated term. How it all began ... Celtnieks LR Ltd. was registered in the Register of Enterprises of Latvia in July 2001. The main area of business is management of real estate properties, purchase and sale of real estate, as well as construction organization of new dwelling properties aiming to sell them in future. As of 2007 ,"Celtnieks LR" Ltd. recommended itself as successful enterprise with positive reputation and good credit record. Financial indices of the enterprise were also positive. Assets amount increased annually and by the end of 2007 reached more than 5 million LVL (7.1 million EUR). In 2006-2007 the average annual turnover of the enterprise was 4.5 million and 3.5 million LVL (6.4 million and 5 million EUR) respectively, in 2006 net income reached 761 thousand LVL (1083 thousand EUR), but in 2007 the enterprise received net income in the amount of 58 thousand LVL (82,5 thousand EUR). Credit record of Celtnieks LR Ltd. was characterized rather positive. Over 7 years (from 2001 to 2007) joint-stock company Beta Bank granted credit to this enterprise. Within this period 4 credit contracts were concluded between Celtnieks LR Ltd. and joint-stock company Beta Bank, the provisions thereof were fulfilled successfully, credit was discharged prior to maturity. All loans were granted under construction of dwelling houses, real estate was used as credit security but the source of credit discharge was cash flow from dwelling sales (apartment sales). Credit market and residential real estate market of Latvia in 2004-2007 Over the period from 2004 to 2007 in Latvia there were observed vigorous growth of transactions on real estate market, the prices were increasing with record speed in this market segment. Continuous growth of prices of real estate in Latvia began in 2004 and prices increased by a mean of 110130% per year. The reason of such increase was maximum availability of real estate credit, owing to stiff competition among Latvian banks. The peak of prices of apartments in Riga was reached in summer 2007 (1700-1720 euro per sq.m.). For average price changes of standard-type apartments in Riga, see Figure 1. Bank sets terms of credit taking into consideration intended use of credit, credit security, financial situation of borrower, and sources of credit discharge. To make decision on condition changes of granted credit, a client shall submit to the bank the following documents: - application with explanation of reasons to introduce the modifications; as well as business plan, if necessary; - documents certifying intended use of credit; - documents certifying financial situation of client considering point of changes under consideration; - documents verifying availability and value of security with regard to changes under consideration; - other documents. Aiming to check solvency of borrower or guarantor (warrantor) thereof, as well as aiming to check credit liquidity, the bank foresees responsibilities of the borrower stipulated under the concluded contracts to submit required documents to the bank in specified term: - identification documents of the borrower; - documents verifying financial situation of the borrower; - documents verifying type of use and actual condition of security; - documents verifying implementation process of business-project; - other requested documents. After granting of credit bank's authorized representatives perform an inspection of subject of pledge (security), whereof the inspection act of credit security is developed. There is defined the following periodicity of inspection of credit security: - inspection of technical condition of real estate is implemented every six months. If bank has the information available that market value of real estate is changing, the bank requests re-evaluation of real estate; - inventory of permanent assets and resources is accomplished every 2 months; - inspection of technical condition of vehicles is implemented every 2 months; - inspection of stock goods is implemented every month. During inspection the availability of goods and condition thereof is verified, examination of storage area is performed (warehouse, customs warehouse etc.). During supervision of credit and its quality definition there is performed the current analysis of borrower's financial situation, analysis of compliance with contractual obligations, adequacy estimate of credit security, as well as timely identification of overdue payment and timely certification of credit quality deterioration. History of two credits On the basis of credit application of client on November 15, 2006, JSC Beta Bank granted credit line to "Celtnieks LR" Ltd. in the amount of 2 million EUR (credit No. 5). As credit security the bank accepted land plot. Maturity of this credit line pursuant to the credit contract was September 1, 2009. In April 2007 "Celtnieks LR" Ltd. applied to "Beta Bank" with request to grant a credit in the amount of 1 million LVL (1,423 million EUR) for construction of row houses in one of the microdistricts of Riga (micro-district Imanta). Along with credit application the enterprise submitted to bank financial statement from 2004 to 2006 , documentation on credit security and business-project. According to business-project Celtnieks LR Ltd. planned to construct three row houses wherein 24 dwelling sections were included. Total area of dwelling was 3760 sq.m., but total area of terraces and balconies 448 sq.m. It was planned to sell dwelling space at the price of 1100LVL (1565 EUR) per sq.m., but 4 Results of cost evaluation of property as of June 30, 2010 Performing evaluation by discounted cash flow method the discounting rate 7,25% is applied. For degree of readiness of property, see images (Appendix 5). On the basis of new business plan of client and performed evaluation, the bank accepts a decision on credit restructuring on the following terms: - accept for restructuring the sum of outstanding credit in the amount of 3153000 EUR; - when developing restructuring schedule take as a basis calculation offered by the client of cash flow (Appendix 1); - perform interest calculation to credit sum to be restructured since July 1, 2010 applying interest rate of 3% per annum; - first ensure discharge of accrued interest, then discharge of primary credit; - set the first maturity that is similar to beginning of the first positive value of cash flow; - ensure full discharge of primary loan and accrued interest within 14 months according to release of money assets from apartment sales. January 2010. In January the average cost of standard-type apartments of medium condition in Riga was 550EUR/m2, which is by 2% more than in previous month (538EUR/m2). Most significant increase in prices was observed of 3-room and 4-room apartments. February 2010. Real estate company "Latio" did not identify changes of average price index of apartments in February. In February the average price of standard-type apartments in Riga remained at the level of previous month - 550 EUR/sq.m. March 2010. The average price of standard-type apartments in Riga increased by 2% in March compared to February and reached 562 euro per square metre. April 2010. The average price of standard-type apartments in Riga increased by 1% in April compared to March and reached 568 euro per square metre. Price increase of apartments (even unsubstantial) was related to decrease of qualitative offer that meets requirements of the buyers. Supply of small and inexpensive standard-type apartments continued falling because such dwelling was purchased first of all during revival of market. Amount of transaction slightly increased, however, in general, it remained at the average level of last year. May 2010. The average price of standard-type apartments in Riga increased by 1% in May compared to April and reached 575 euro per square metre. The average price of apartments increased by 11% per year - in May 2009 it was 518 euro per square metre. The average price of standard-type apartments over the last nine months had increased by 15%. In May the number of buyers, who were willing to use bank loan for property acquisition, increased in all housing segment. However, most transactions were made without loan use. "Despite the commercial banks renewed credit granting, the loan amount is rather small. Changes of credit portfolio are still negative - the banks receive more money from households rather than provide as credit. Along with increase of credit granting there could be observed increase in prices of apartments, because at normal economic situation dwelling is purchased using bank loan", assessed Mris Grnbergs, market analyst of "Latio". Forecast on 2011 -2012 (view from the middle of 2011). It was forecasted that in 2011-2012 prices of standard-type apartments remained at present level as considerable improvement of economic situation was not observed, which would enable increase of mortgage credit and demand (9). Actual situation on the market of residential real estate in 2011 -2012 met expectations in the middle of 2010. On real estate market the stagnation period took place. The following reports were published by analyst of company "Latio" during that period (9). February 2011. The average price of standard-type apartments in Riga did not change in February compared to January and remained 582 euro per square metre. After rapid increase in the first half of last year the prices of standard-type housing stabilized and were at present level - approximately 580 euro per square metre - during several months. In segment of new apartment projects current offer continued to decrease gradually, since the activity of buyers is stable and transactions are made. The buyers expressed the interest in projects where the reservation of apartments had been started. Prices of apartments in new projects in micro-districts of Riga did not change in February and varied between 1000 and 1400 euro per square metre according to type of finish, project and location. In the centre of Riga prices of new projects were 11001600 euro per square metre, but in midtown 20002500 euro per square metre. April 2011. In April the average price per square metre in standard-type houses in Riga slightly increased - by 1-2 euro - and reached 583 euro, but in general, price level of standard-type housing remained the same during long time. Most demand on apartments in new projects in April, as well as in preceding months was observed in the centre of Riga and Jurmala where the high market activity was maintained by foreign buyers, mainly by the residents from Russia and other CIS counties. Part of these buyers was interested in apartment purchase due to receipt of temporary resident permit after purchase of real estate. Great interest of foreign buyers in apartment purchase also set a tendency of increase in offer prices in new projects in the centre of Riga and Jurmala. New apartments in micro-districts, in general, appealed to local buyers whose activity did not change and remained at low level in comparison with last months. In April the prices of apartments in new projects in micro-districts of Riga were between 900 and 1400 euro per square metre according to type of finish, project and location. 8 January 2010. In January the average cost of standard-type apartments of medium condition in Riga was 550EUR/m2, which is by 2% more than in previous month (538EUR/m2). Most significant increase in prices was observed of 3-room and 4-room apartments. February 2010. Real estate company "Latio" did not identify changes of average price index of apartments in February. In February the average price of standard-type apartments in Riga remained at the level of previous month - 550 EUR/sq.m. March 2010. The average price of standard-type apartments in Riga increased by 2% in March compared to February and reached 562 euro per square metre. April 2010. The average price of standard-type apartments in Riga increased by 1% in April compared to March and reached 568 euro per square metre. Price increase of apartments (even unsubstantial) was related to decrease of qualitative offer that meets requirements of the buyers. Supply of small and inexpensive standard-type apartments continued falling because such dwelling was purchased first of all during revival of market. Amount of transaction slightly increased, however, in general, it remained at the average level of last year. May 2010. The average price of standard-type apartments in Riga increased by 1% in May compared to April and reached 575 euro per square metre. The average price of apartments increased by 11% per year - in May 2009 it was 518 euro per square metre. The average price of standard-type apartments over the last nine months had increased by 15%. In May the number of buyers, who were willing to use bank loan for property acquisition, increased in all housing segment. However, most transactions were made without loan use. "Despite the commercial banks renewed credit granting, the loan amount is rather small. Changes of credit portfolio are still negative - the banks receive more money from households rather than provide as credit. Along with increase of credit granting there could be observed increase in prices of apartments, because at normal economic situation dwelling is purchased using bank loan", assessed Mris Grnbergs, market analyst of "Latio". Forecast on 2011 -2012 (view from the middle of 2011). It was forecasted that in 2011-2012 prices of standard-type apartments remained at present level as considerable improvement of economic situation was not observed, which would enable increase of mortgage credit and demand (9). Actual situation on the market of residential real estate in 2011 -2012 met expectations in the middle of 2010. On real estate market the stagnation period took place. The following reports were published by analyst of company "Latio" during that period (9). February 2011. The average price of standard-type apartments in Riga did not change in February compared to January and remained 582 euro per square metre. After rapid increase in the first half of last year the prices of standard-type housing stabilized and were at present level - approximately 580 euro per square metre - during several months. In segment of new apartment projects current offer continued to decrease gradually, since the activity of buyers is stable and transactions are made. The buyers expressed the interest in projects where the reservation of apartments had been started. Prices of apartments in new projects in micro-districts of Riga did not change in February and varied between 1000 and 1400 euro per square metre according to type of finish, project and location. In the centre of Riga prices of new projects were 11001600 euro per square metre, but in midtown 20002500 euro per square metre. April 2011. In April the average price per square metre in standard-type houses in Riga slightly increased - by 1-2 euro - and reached 583 euro, but in general, price level of standard-type housing remained the same during long time. Most demand on apartments in new projects in April, as well as in preceding months was observed in the centre of Riga and Jurmala where the high market activity was maintained by foreign buyers, mainly by the residents from Russia and other CIS counties. Part of these buyers was interested in apartment purchase due to receipt of temporary resident permit after purchase of real estate. Great interest of foreign buyers in apartment purchase also set a tendency of increase in offer prices in new projects in the centre of Riga and Jurmala. New apartments in micro-districts, in general, appealed to local buyers whose activity did not change and remained at low level in comparison with last months. In April the prices of apartments in new projects in micro-districts of Riga were between 900 and 1400 euro per square metre according to type of finish, project and location. 8 quarter the price increased by 0,3%, but compared to the third quarter 2011 by 1,3%. In September the average price per square metre in standard-type apartments remained at the level of previous month and was 582 euro. Since the beginning of the year the price per square metre in standard-type apartments increased by 1,2%, but as compared with September of previous year - by 1%. The level of standardtype apartments remained the same for nearly 2 years. December 2012. On the market of new apartments demand remained at the level of previous months. In 2013 the number of new apartments in the centre of Riga that meet requirements of foreign buyers increased gradually because development of many new projects, as well as building renovation began. There was demand of local buyers mainly on new apartments in micro-districts of Riga at price up to 1200 euro per square metre. This price level was relevant to financial solvency of most buyers of new apartments and possibility to use bank credit in order to purchase real estate. Price range of transactions in micro-districts of Riga remained the same 9001400 euro per square metre. Price of square metre in standard-type apartments increased by 0,5% or by 3 euro in December compared to previous month and reached 583 euro. April 2013. Activity in the segment of new projects in April remained at the level of previous months. In the first months this year the price of new apartments was increasing. The average price of new apartments in micro-districts of Riga from January to March 2013 was 1294 euro per square metre and by 11,6% exceeded the average price of the first quarter of last year. In comparison with last quarter 2012 the average prices of new apartments in both the centre of Riga and micro-districts increased approximately by 5% in the first three months of this year. Price range of main transactions in micro-districts of Riga remained the same 9001400 euro per square metre of new housing. The average price of square metre in standard-type apartments in Riga increased by 1 euro in April compared to last month and reached 596 euro. As compared to April 2012 the price of square metre increased by 1,7%. Unlike last 2 years when the average price varied between increase or decrease, at the end of 2012 and at the beginning of 2013 the average price of standard-type apartments in Riga increased within 6 months. Number of apartment purchase-sale transactions increased gradually. June 2013. In new projects of micro-districts the local buyers were interested in completed apartments at 1200 euro per square metre. New apartment purchase-sale t