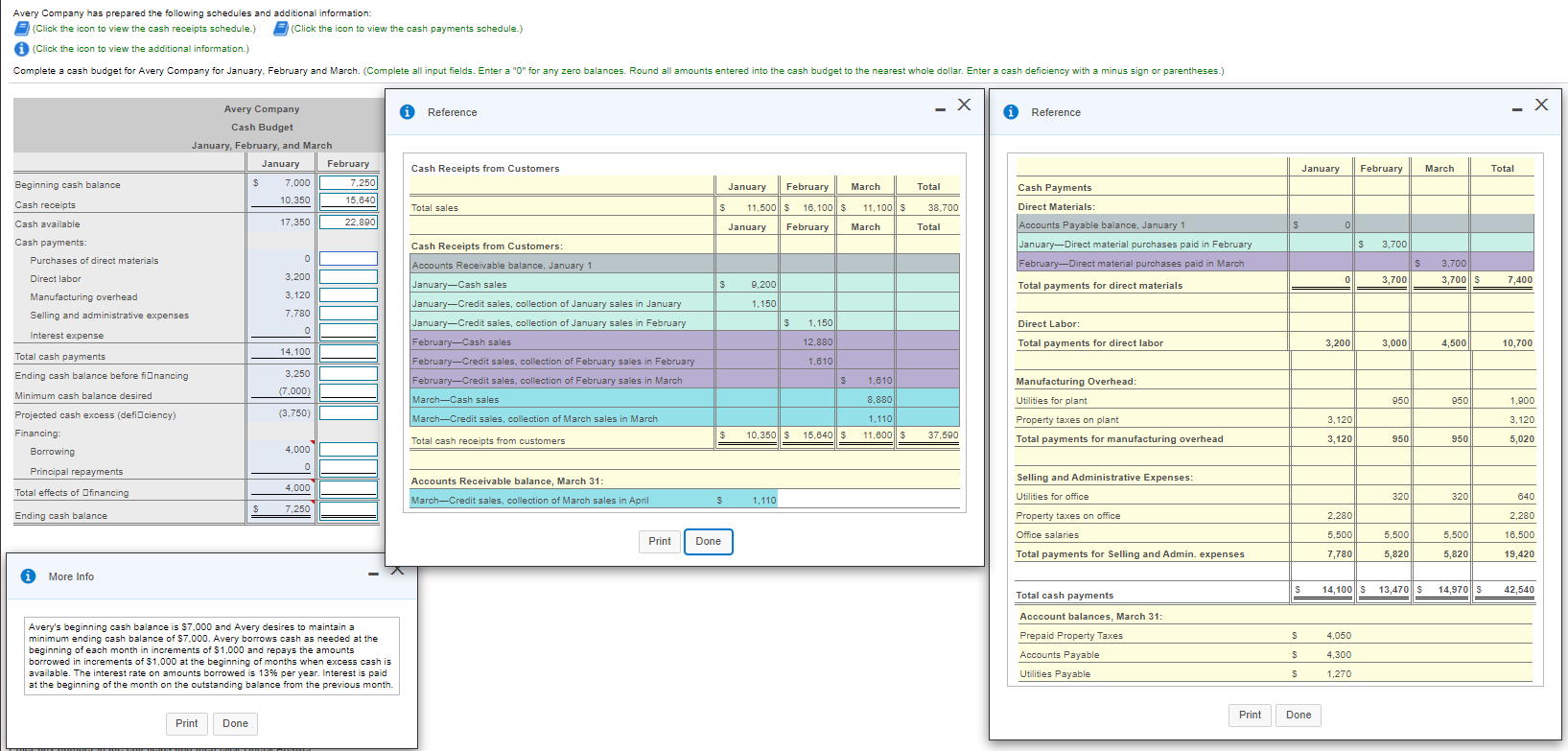

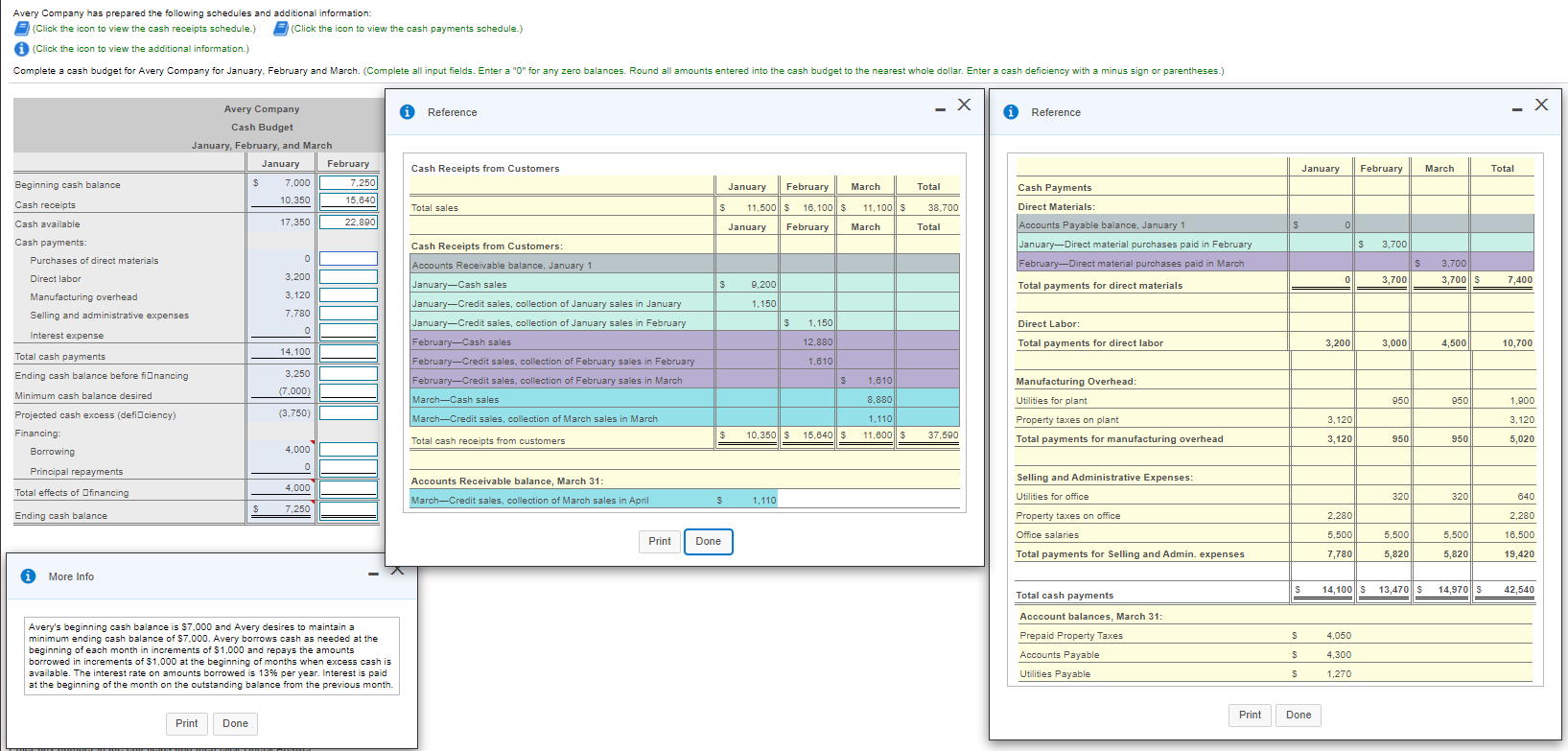

Avery Company has prepared the following schedules and additional information: (Click the icon to view the cash receipts schedule.) (Click the icon to view the cash payments schedule.) (Click the icon to view the additional information.) Complete a cash budget for Avery Company for January. February and March. (Complete all input fields. Enter a "0" for any zero balances. Round all amounts entered into the cash budget to the nearest whole dollar. Enter a cash deficiency with a minus sign or parentheses.) - X - X Reference Reference Avery Company Cash Budget January, February, and March January February $ 7.000 7.250 10.350 15,640 Cash Receipts from Customers January February March Total Beginning cash balance January February March Total Cash receipts Total sales 11,100 $ 38,700 $ 11,500 $ 16,100 $ January February Cash available 17,350 22.890 March Total S 0 Cash payments: Cash Payments Direct Materials Accounts Payable balance, January 1 JanuaryDirect material purchases paid in February February-Direct material purchases paid in March Total payments for direct materials Cash Receipts from Customers: S 3,700 0 Accounts Receivable balance, January 1 S 3,200 3.700 3,700 S 0 3,700 7.400 January-Cash sales $ Purchases of direct materials Direct labor Manufacturing overhead Selling and administrative expenses 9,200 3,120 1,150 7,780 $ 1,150 0 Interest expense Direct Labor: Total payments for direct labor 12,880 3,200 3,000 4,500 10,700 14,100 Total cash payments January-Credit sales, collection of January sales in January January-Credit sales, collection of January sales in February February-Cash sales February-Credit sales, collection of February sales in February February-Credit sales, collection of February sales in March March-Cash sales - 1,610 Ending cash balance before financing 3.250 (7.000) S 1,610 Manufacturing Overhead: Minimum cash balance desired 8,880 Utilities for plant 950 950 1.900 (3.750) March-Credit sales, collection of March sales in March Property taxes on plant 3,120 3,120 Projected cash excess (deficiency) Financing Borrowing 1,110 11,800 $ $ 10.350|| $ 15,840||$ 37,500 Total cash receipts from customers Total payments for manufacturing overhead 3,120 950 950 5,020 4.000 0 Principal repayments 4,000 Total effects of financing Accounts Receivable balance, March 31: March-Credit sales, collection of March sales in April Selling and Administrative Expenses: Utilities for office $ 1,110 320 320 640 S 7,250 Ending cash balance Property taxes on office 2.280 2.280 Office salaries 5,500 5,500 5,500 Print Done 16,500 Done Total payments for Selling and Admin. expenses 7,780 5,820 5,820 19,420 i More Info $ 14,100 $ 13,470lls Total cash payments 14,970 S 42,540 Acccount balances, March 31: Prepaid Property Taxes s 4,050 Avery's beginning cash balance is $7.000 and Avery desires to maintain a minimum ending cash balance of $7,000. Avery borrows cash as needed at the beginning of each month in increments of $1,000 and repays the amounts borrowed in increments of $1,000 at the beginning of months when excess cash is available. The interest rate on amounts borrowed is 13% per year. Interest is paid at the beginning of the month on the outstanding balance from the previous month. $ 4,300 Accounts Payable Utilities Payable $ 1.270 Print Done Print Done