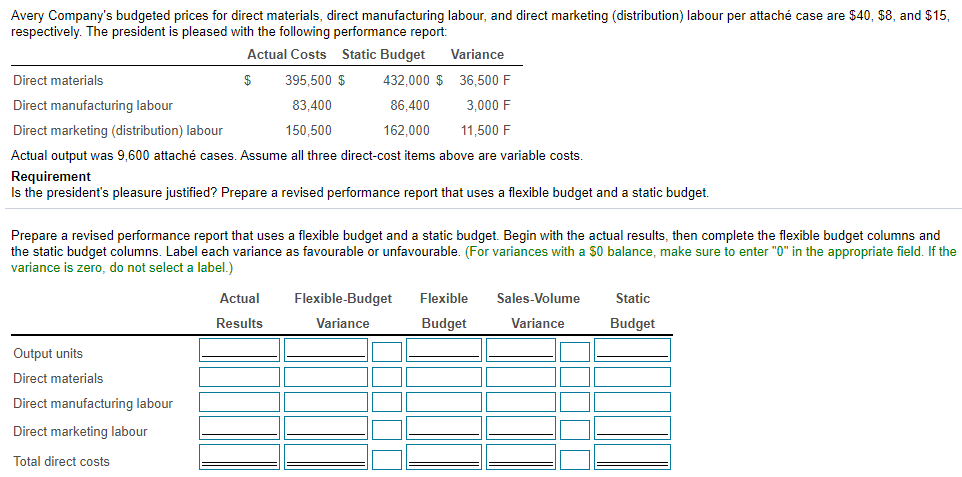

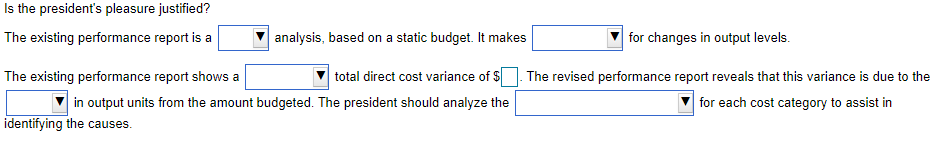

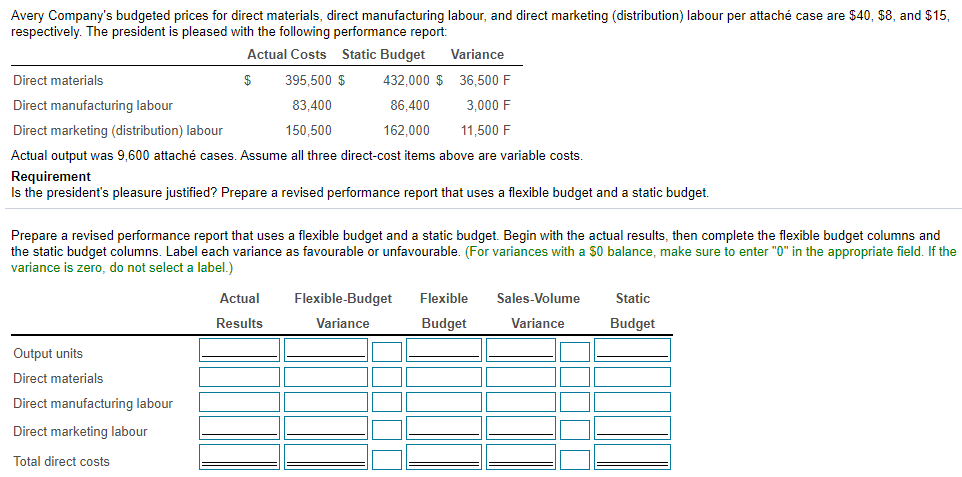

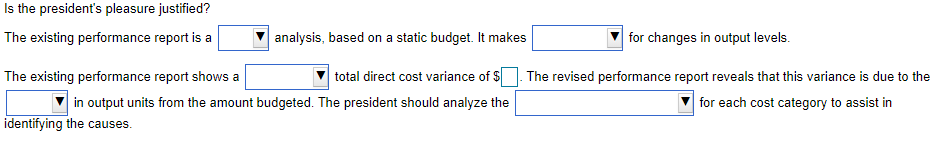

Avery Company's budgeted prices for direct materials, direct manufacturing labour, and direct marketing (distribution) labour per attach case are $40, $8, and $15, respectively. The president is pleased with the following performance report: Actual Costs Static Budget Variance Direct materials 395,500 $ 432,000 $ 36,500 F Direct manufacturing labour 83.400 86,400 3,000 F Direct marketing (distribution) labour 150,500 162,000 11.500 F Actual output was 9,600 attach cases. Assume all three direct-cost items above are variable costs. Requirement Is the president's pleasure justified? Prepare a revised performance report that uses a flexible budget and a static budget. Prepare a revised performance report that uses a flexible budget and a static budget. Begin with the actual results, then complete the flexible budget columns and the static budget columns. Label each variance as favourable or unfavourable. (For variances with a $0 balance, make sure to enter "0" in the appropriate field. If the variance is zero, do not select a label.) Actual Flexible Sales-Volume Static Flexible-Budget Variance Results Budget Variance Budget Output units Direct materials Direct manufacturing labour Direct marketing labour Total direct costs Is the president's pleasure justified? The existing performance report is a analysis, based on a static budget. It makes for changes in output levels. The existing performance report shows a total direct cost variance of $ in output units from the amount budgeted. The president should analyze the identifying the causes. The revised performance report reveals that this variance is due to the for each cost category to assist in Avery Company's budgeted prices for direct materials, direct manufacturing labour, and direct marketing (distribution) labour per attach case are $40, $8, and $15, respectively. The president is pleased with the following performance report: Actual Costs Static Budget Variance Direct materials 395,500 $ 432,000 $ 36,500 F Direct manufacturing labour 83.400 86,400 3,000 F Direct marketing (distribution) labour 150,500 162,000 11.500 F Actual output was 9,600 attach cases. Assume all three direct-cost items above are variable costs. Requirement Is the president's pleasure justified? Prepare a revised performance report that uses a flexible budget and a static budget. Prepare a revised performance report that uses a flexible budget and a static budget. Begin with the actual results, then complete the flexible budget columns and the static budget columns. Label each variance as favourable or unfavourable. (For variances with a $0 balance, make sure to enter "0" in the appropriate field. If the variance is zero, do not select a label.) Actual Flexible Sales-Volume Static Flexible-Budget Variance Results Budget Variance Budget Output units Direct materials Direct manufacturing labour Direct marketing labour Total direct costs Is the president's pleasure justified? The existing performance report is a analysis, based on a static budget. It makes for changes in output levels. The existing performance report shows a total direct cost variance of $ in output units from the amount budgeted. The president should analyze the identifying the causes. The revised performance report reveals that this variance is due to the for each cost category to assist in