Answered step by step

Verified Expert Solution

Question

1 Approved Answer

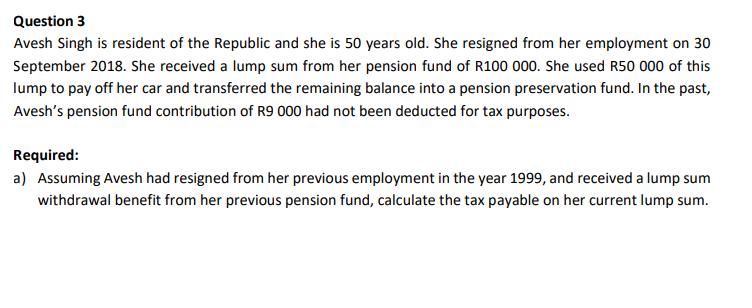

Question 3 Avesh Singh is resident of the Republic and she is 50 years old. She resigned from her employment on 30 September 2018.

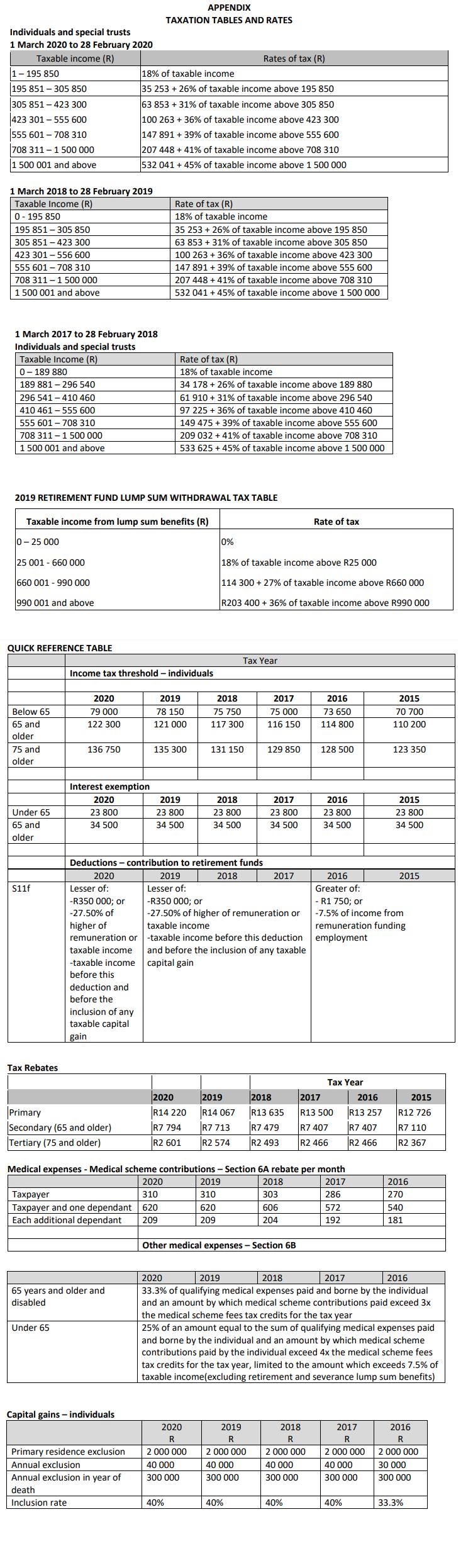

Question 3 Avesh Singh is resident of the Republic and she is 50 years old. She resigned from her employment on 30 September 2018. She received a lump sum from her pension fund of R100 000. She used R50 000 of this lump to pay off her car and transferred the remaining balance into a pension preservation fund. In the past, Avesh's pension fund contribution of R9 000 had not been deducted for tax purposes. Required: a) Assuming Avesh had resigned from her previous employment in the year 1999, and received a lump sum withdrawal benefit from her previous pension fund, calculate the tax payable on her current lump sum. Individuals and special trusts 1 March 2020 to 28 February 2020 Taxable income (R) 1-195 850 195 851-305 850 305 851-423 300 423 301-555 600 555 601-708 310 708 311-1 500 000 1 500 001 and above 1 March 2018 to 28 February 2019 Taxable Income (R) 0-195 850 195 851 305 850 305 851 423 300 423 301-556 600 555 601-708 310 708 311-1 500 000 1 500 001 and above 1 March 2017 to 28 February 2018 Individuals and special trusts Taxable Income (R) 0-189 880 189 881 296 540 296 541 410 460 410 461 555 600 555 601-708 310 708 311-1 500 000 1 500 001 and above 25 001 - 660 000 660 001 - 990 000 990 001 and above QUICK REFERENCE TABLE Below 65 65 and older 75 and older 2019 RETIREMENT FUND LUMP SUM WITHDRAWAL TAX TABLE Taxable income from lump sum benefits (R) 0-25 000 Under 65 65 and older S11f Tax Rebates 2020 79 000 122 300 136 750 Under 65 Interest exemption 2020 23 800 34 500 Income tax threshold - individuals Lesser of: -R350 000; or -27.50% of higher of remuneration or 18% of taxable income 35 253 +26% of taxable income above 195 850 63 853 +31% of taxable income above 305 850 100 263 + 36% of taxable income above 423 300 147 891 +39% of taxable income above 555 600 207 448 + 41% of taxable income above 708 310 532 041 +45% of taxable income above 1 500 000 taxable income -taxable income before this deduction and before the inclusion of any taxable capital gain Primary Secondary (65 and older) Tertiary (75 and older) APPENDIX TAXATION TABLES AND RATES 65 years and older and disabled Capital gains individuals Rate of tax (R) 18% of taxable income Primary residence exclusion Annual exclusion Annual exclusion in year of death Inclusion rate 35 253 +26% of taxable income above 195 850 63 853 +31% of taxable income above 305 850 100 263 +36% of taxable income above 423 300 147 891 +39% of taxable income above 555 600 207 448 + 41% of taxable income above 708 310 532 041 +45% of taxable income above 1 500 000 Rate of tax (R) 18% of taxable income 34 178 +26% of taxable income above 189 880 61 910 +31% of taxable income above 296 540 97 225+ 36% of taxable income above 410 460 149 475 + 39% of taxable income above 555 600 209 032 +41% of taxable income above 708 310 533 625 +45% of taxable income above 1 500 000 2019 78 150 121 000 2020 310 Taxpayer Taxpayer and one dependant 620 Each additional dependant 209 135 300 2019 23 800 34 500 Deductions - contribution to retirement funds 2020 2018 Rates of tax (R) 2018 75 750 117 300 40% 0% 18% of taxable income above R25 000 114 300 + 27% of taxable income above R660 000 R203 400 + 36% of taxable income above R990 000 131 150 2018 23 800 34 500 2020 2019 R14 220 R14 067 R7 794 R7 713 R2 601 R2 574 2020 R 2 000 000 40 000 300 000 Tax Year 2019 Lesser of: -R350 000; or -27.50% of higher of remuneration or taxable income -taxable income before this deduction 2019 310 620 209 and before the inclusion of any taxable capital gain 2017 75 000 116 150 129 850 2017 23 800 34 500 2019 R 2 000 000 40 000 300 000 40% Medical expenses - Medical scheme contributions - Section 6A rebate per month 2018 2017 303 286 606 572 204 192 2017 Other medical expenses-Section Rate of tax 2016 73 650 114 800 2018 R 2 000 000 40 000 300 000 128 500 40% 2016 23 800 34 500 2018 2017 2016 R13 500 R13 257 R13 635 R7 479 R7 407 R7 407 R2 493 R2 466 R2 466 Tax Year 2016 Greater of: - R1 750; or -7.5% of income from remuneration funding employment 2017 2016 2020 2019 2018 33.3% of qualifying medical expenses paid and borne by the individual and an amount by which medical scheme contributions paid exceed 3x the medical scheme fees tax credits for the tax year 25% of an amount equal to sum of qualifying expenses paid and borne by the individual and an amount by which medical scheme contributions paid by the individual exceed 4x the medical scheme fees tax credits for the tax year, limited to the amount which exceeds 7.5% of taxable income(excluding retirement and severance lump sum benefits) 2015 70 700 110 200 2017 R 123 350 2015 23 800 34 500 40% 2015 2015 R12 726 R7 110 R2 367 2016 270 540 181 2016 R 2 000 000 2 000 000 40 000 300 000 30 000 300 000 33.3%

Step by Step Solution

★★★★★

3.57 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a Assuming Avesh had resigned from her previous em...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started