Answered step by step

Verified Expert Solution

Question

1 Approved Answer

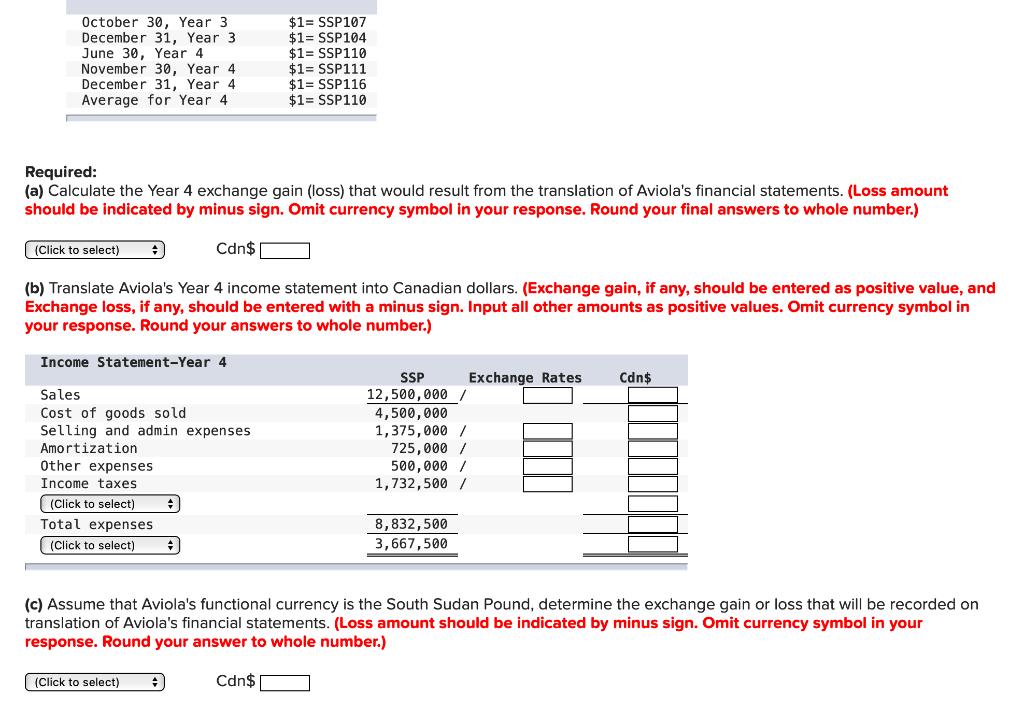

October 30, Year 3 December 31, Year 3 June 30, Year 4 November 30, Year 4. December 31, Year 4. Average for Year 4

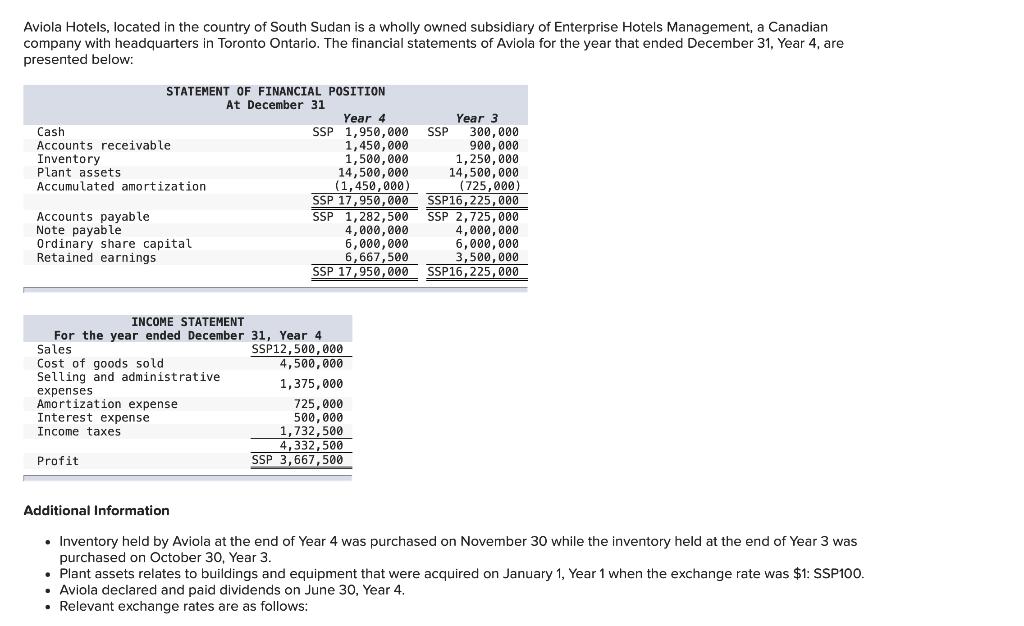

October 30, Year 3 December 31, Year 3 June 30, Year 4 November 30, Year 4. December 31, Year 4. Average for Year 4 Required: (a) Calculate the Year 4 exchange gain (loss) that would result from the translation of Aviola's financial statements. (Loss amount should be indicated by minus sign. Omit currency symbol in your response. Round your final answers to whole number.) Cdn$ (Click to select) (b) Translate Aviola's Year 4 income statement into Canadian dollars. (Exchange gain, if any, should be entered as positive value, and Exchange loss, if any, should be entered with a minus sign. Input all other amounts as positive values. Omit currency symbol in your response. Round your answers to whole number.) Income Statement-Year 4 Sales Cost of goods sold Selling and admin expenses Amortization Other expenses Income taxes (Click to select) Total expenses (Click to select) $1= SSP107 $1 SSP104 $1 SSP110 $1=SSP111 $1 SSP116 $1= SSP110 # (Click to select) # Cdn$ SSP 12,500,000/ Exchange Rates 4,500,000 1,375,000 / 725,000 / 500,000/ 1,732,500 / 8,832,500 3,667,500 (c) Assume that Aviola's functional currency is the South Sudan Pound, determine the exchange gain or loss that will be recorded on translation of Aviola's financial statements. (Loss amount should be indicated by minus sign. Omit currency symbol in your response. Round your answer to whole number.) Cdn$

Step by Step Solution

★★★★★

3.33 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started