Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Aviwe Matanga runs a small beauty products sole proprietorship in Khayelitsha, Western Cape. Aviwe designed an African hair food product. The product is manufactured

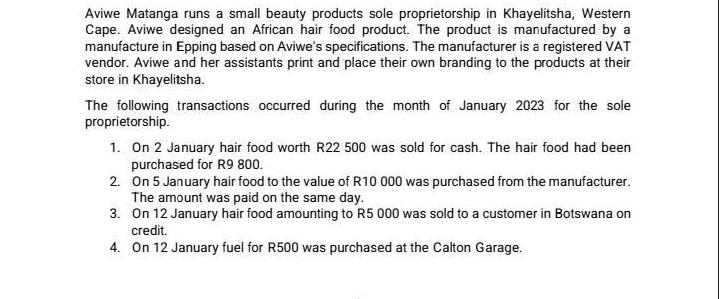

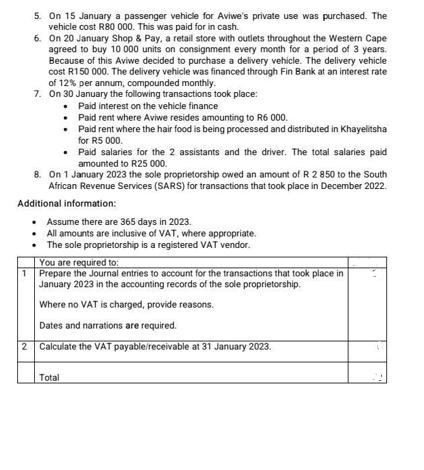

Aviwe Matanga runs a small beauty products sole proprietorship in Khayelitsha, Western Cape. Aviwe designed an African hair food product. The product is manufactured by a manufacture in Epping based on Aviwe's specifications. The manufacturer is a registered VAT vendor. Aviwe and her assistants print and place their own branding to the products at their store in Khayelitsha. The following transactions occurred during the month of January 2023 for the sole proprietorship. 1. On 2 January hair food worth R22 500 was sold for cash. The hair food had been purchased for R9 800. 2. On 5 January hair food to the value of R10 000 was purchased from the manufacturer. The amount was paid on the same day. 3. On 12 January hair food amounting to R5 000 was sold to a customer in Botswana on credit. 4. On 12 January fuel for R500 was purchased at the Calton Garage. 5. On 15 January a passenger vehicle for Aviwe's private use was purchased. The vehicle cost R80 000. This was paid for in cash. 6. On 20 January Shop & Pay, a retail store with outlets throughout the Western Cape agreed to buy 10 000 units on consignment every month for a period of 3 years. Because of this Aviwe decided to purchase a delivery vehicle. The delivery vehicle cost R150 000. The delivery vehicle was financed through Fin Bank at an interest rate of 12% per annum, compounded monthly. 7. On 30 January the following transactions took place: Paid interest on the vehicle finance Paid rent where Aviwe resides amounting to R6 000. Paid rent where the hair food is being processed and distributed in Khayelitsha for R5 000. Paid salaries for the 2 assistants and the driver. The total salaries paid amounted to R25 000. 8. On 1 January 2023 the sole proprietorship owed an amount of R 2 850 to the South African Revenue Services (SARS) for transactions that took place in December 2022. Additional information: Assume there are 365 days in 2023. All amounts are inclusive of VAT, where appropriate. The sole proprietorship is a registered VAT vendor. You are required to: 1 Prepare the Journal entries to account for the transactions that took place in January 2023 in the accounting records of the sole proprietorship. Where no VAT is charged, provide reasons. Dates and narrations are required. 2 Calculate the VAT payable/receivable at 31 January 2023. Total

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 January 2 Sale of Hair Food for Cash Date Account Debit R Credit R Explanation Jan 2 Cash Revenue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started