Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AW Design a = ($62,681) AW design b = $126,838 Please help show how to get the right answers A firm must decide between two

AW Design a =

AW Design a =

| ($62,681) |

AW design b =

| $126,838 |

Please help show how to get the right answers

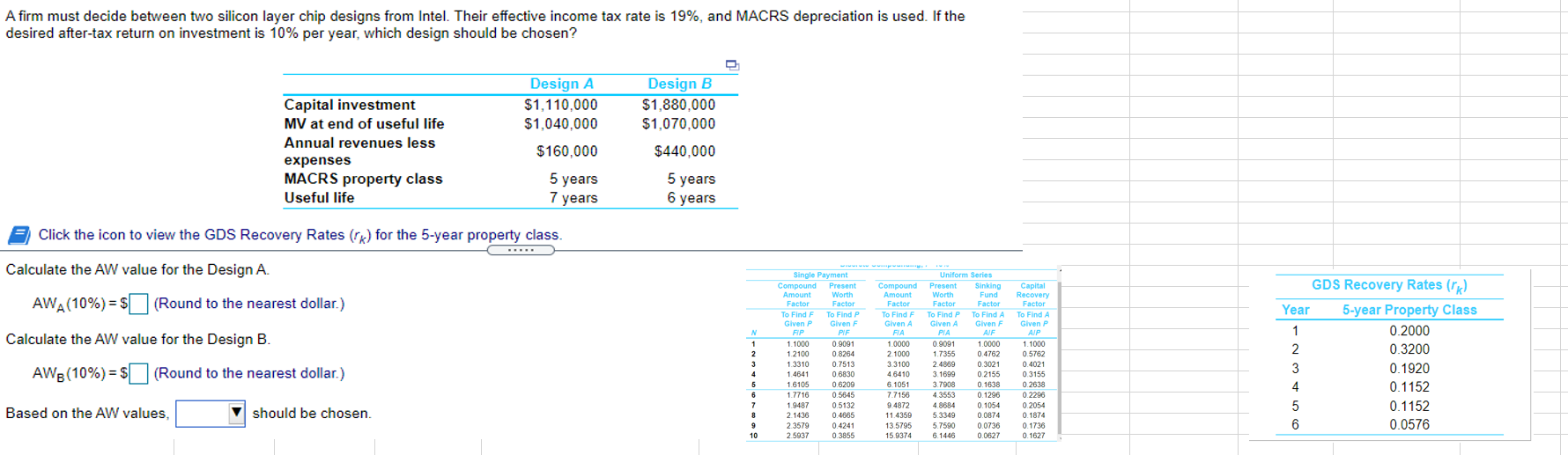

A firm must decide between two silicon layer chip designs from Intel. Their effective income tax rate is 19%, and MACRS depreciation is used. If the desired after-tax return on investment is 10% per year, which design should be chosen? Design A $1,110,000 $1,040,000 $160.000 Design B $1,880,000 $1,070,000 Capital investment MV at end of useful life Annual revenues less expenses MACRS property class Useful life $440,000 5 years 7 years 5 years 6 years Click the icon to view the GDS Recovery Rates (r) for the 5-year property class. Calculate the AW value for the Design A. AWA(10%) = $(Round to the nearest dollar.) Capital Recovery Factor To Find A Given P AIP Calculate the AW value for the Design B. N 1 2 3 4 Present Worth Factor To Find P Given PIF 0.9091 0.8264 0.7513 0 6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 Compound Amount Factor To Find F Given A FIA 1.0000 2.1000 3 3100 46410 6.1051 7.7156 9.4872 11.4359 13.5795 15.9374 Uniform Series Present Sinking Worth Fund Factor Factor To Find P To Find A Given A Given F PIA AIF 0.9091 1.0000 1.7355 0.4762 2 2.4869 0.3021 3 1699 0.2155 3.7908 0.1638 43553 0.1296 4.8684 0.1054 5.3349 0.0874 5.7590 0.0736 6.1446 0.0627 GDS Recovery Rates (r) Year 5-year Property Class 1 0.2000 2 0.3200 3 0.1920 4 0.1152 5 0.1152 6 0.0576 1.1000 0.5762 0.4021 0.3155 0.2638 02296 0.2054 0.1874 0.1736 0.1627 AWE(10%) = $(Round to the nearest dollar.) Based on the AW values, should be chosen 6 7 8 9 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started