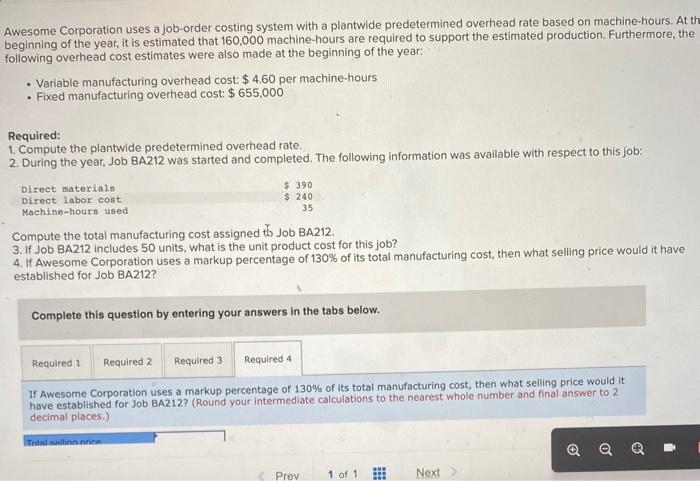

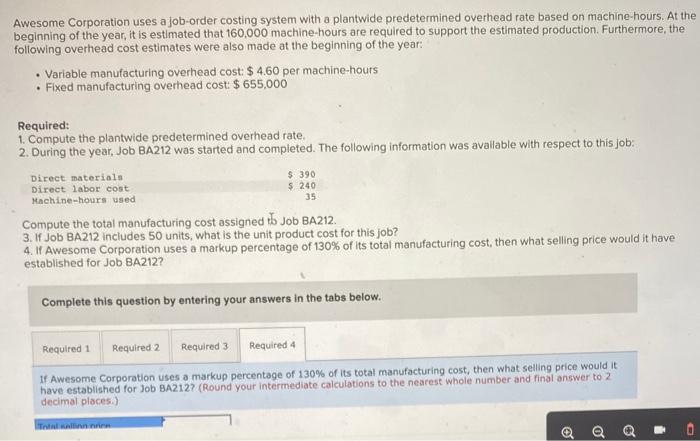

Awesome Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At th beginning of the year, it is estimated that 160,000 machine-hours are required to support the estimated production. Furthermore, the following overhead cost estimates were also made at the beginning of the year: - Variable manufacturing overhead cost: $4.60 per machine-hours - Fixed manufacturing overhead cost: $655,000 Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job BA212 was started and completed. The following information was available with respect to this job: Compute the total manufacturing cost assigned th Job BA212. 3. If Job BA212 includes 50 units, what is the unit product cost for this job? 4. If Awesome Corporation uses a markup percentage of 130% of its total manufacturing cost, then what selling price would it have established for Job BA212? Complete this question by entering your answers in the tabs below. If Awesome Corporation uses a markup percentage of 130% of its total manufacturing cost, then what selling price would it have established for Job BA212? (Round your intermediate calculations to the nearest whole number and final answer to 2 decimal places.) Awesome Corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, it is estimated that 160,000 machine-hours are required to support the estimated production. Furthermore, the following overhead cost estimates were also made at the beginning of the year: - Variable manufacturing overhead cost: $4.60 per machine-hours - Fixed manufacturing overhead cost: $655,000 Required: 1. Compute the plantwide predetermined overhead rate. 2. During the year, Job BA212 was started and completed. The following information was avallable with respect to this job: Compute the total manufacturing cost assigned to Job BA212. 3. If Job BA212 includes 50 units, what is the unit product cost for this job? 4. If Awesome Corporation uses a markup percentage of 130% of its total manufacturing cost, then what selling price would it have established for Job BA212? Complete this question by entering your answers in the tabs below. If Awesome Corporation uses a markup percentage of 130% of its total manufacturing cost, then what selling price would it have established for Job BA212? (Round your intermediate calculations to the nearest whole number and final answer to 2 decimal places.)