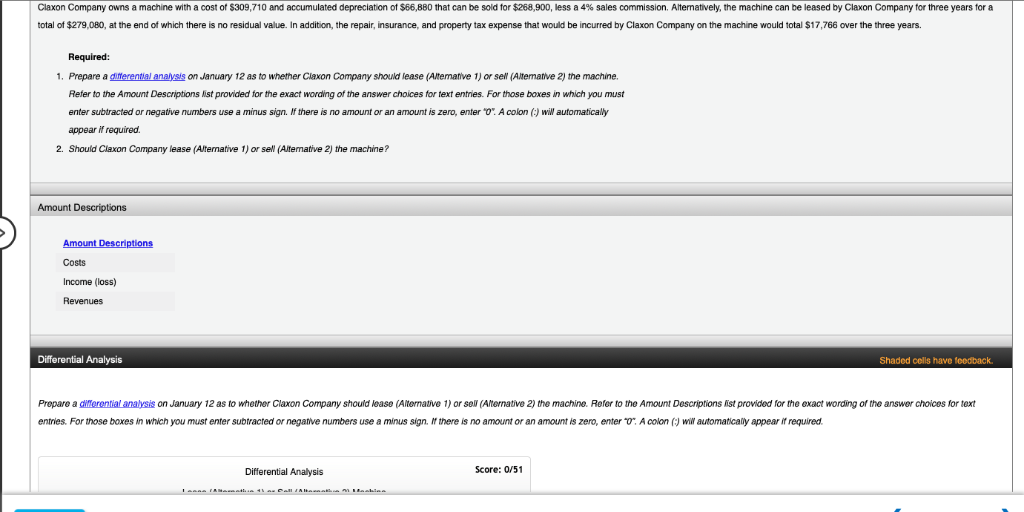

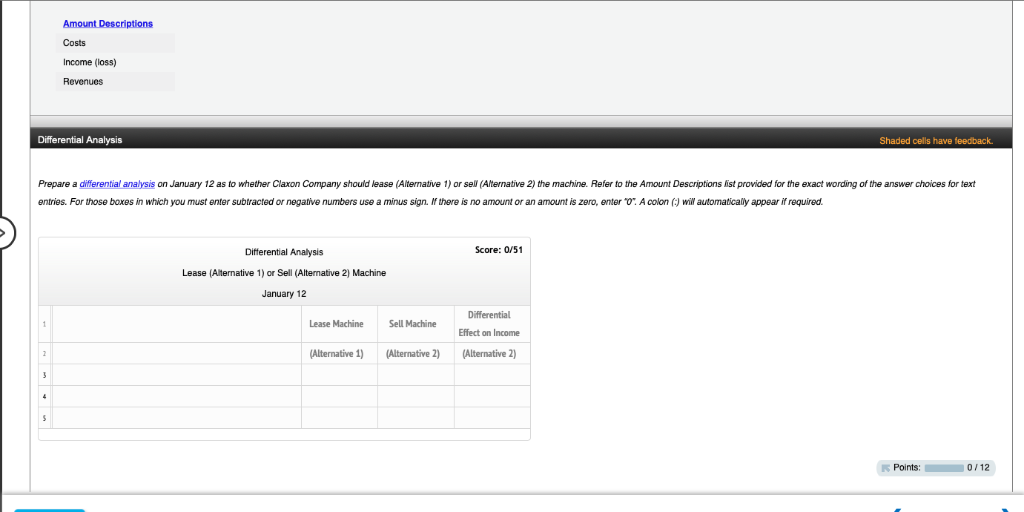

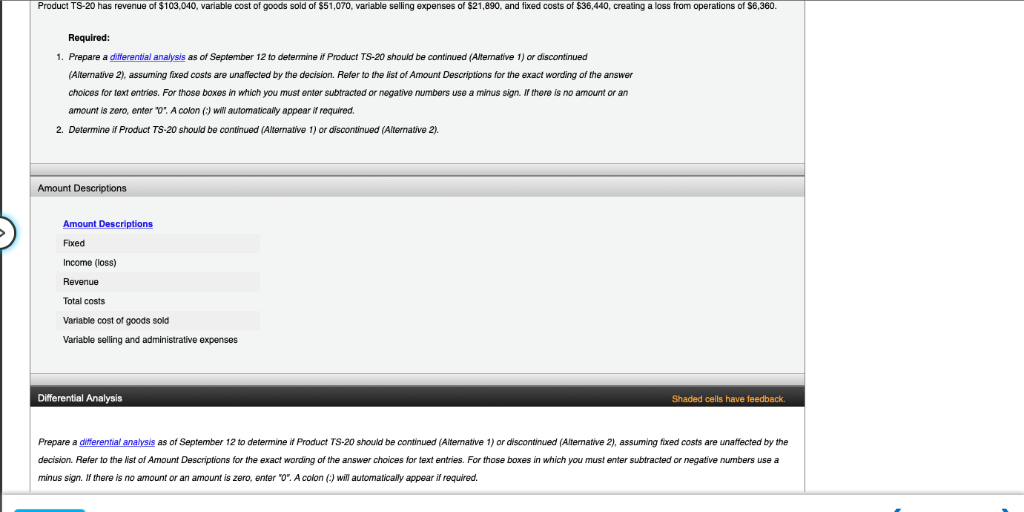

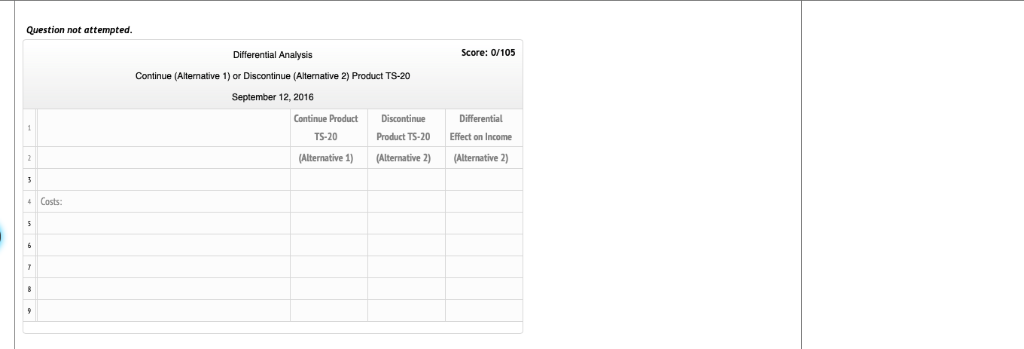

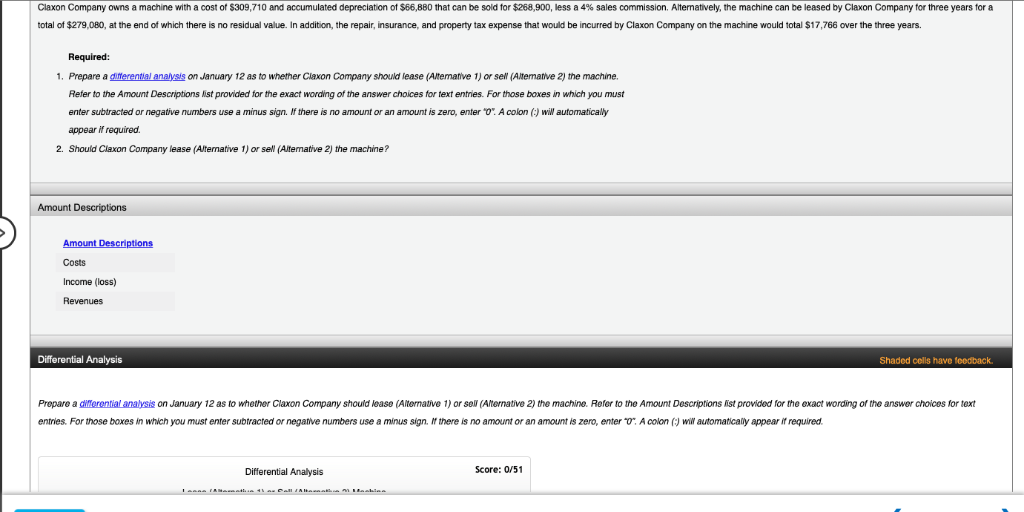

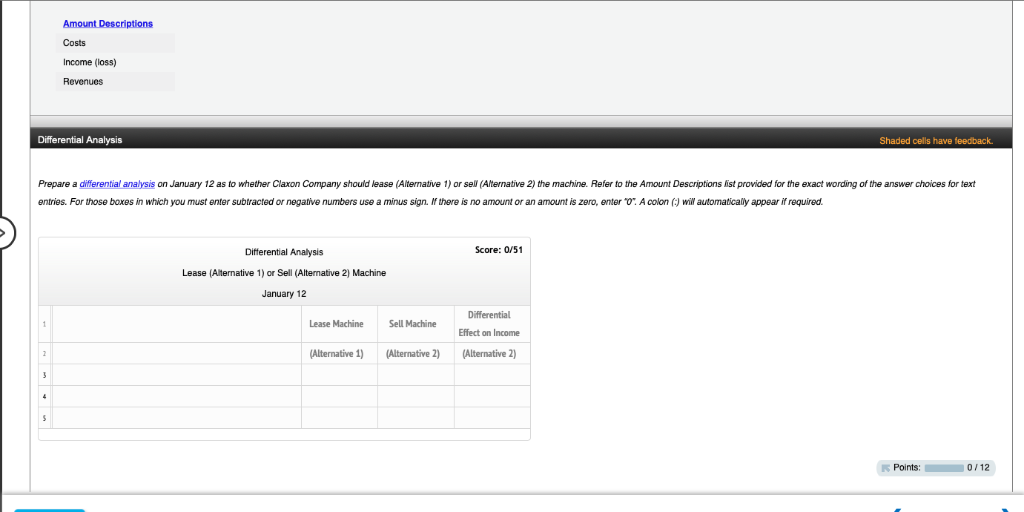

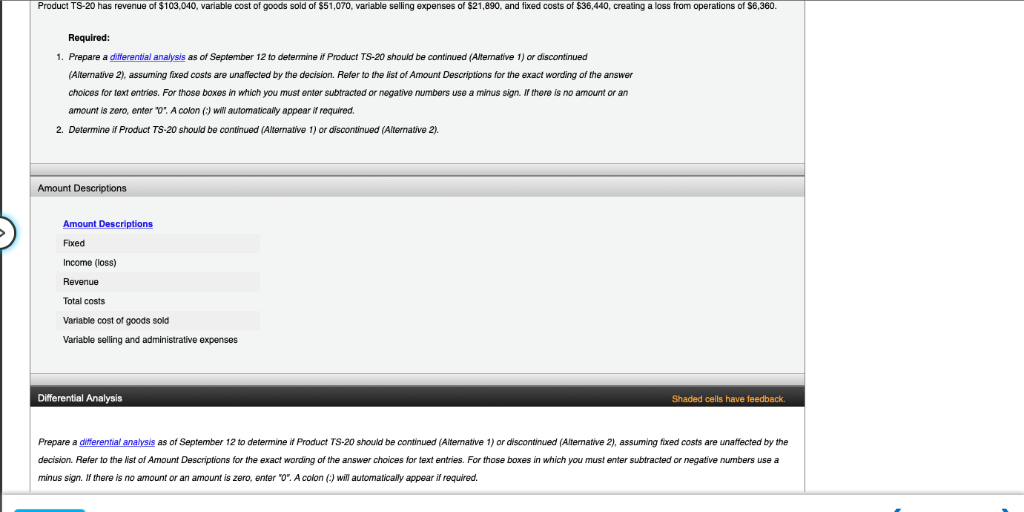

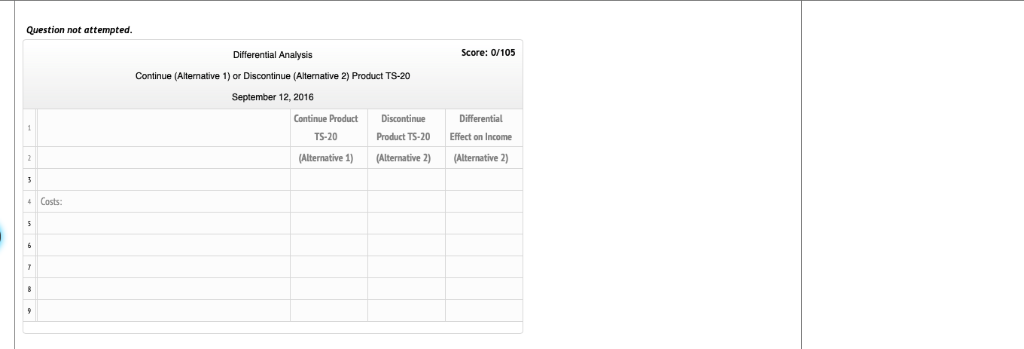

axon Company o ns a machine with a cost of S309 710 and accumulated depreciation of 66 880 that can be sold for 268,900 less a 4% sales commission. Alternatively, the machine can be leased by Claxon Company for three years for a total of $279,080, at the end of which there is no residual value. In addition, the repair, insurance, and property tax expense that would be incurred by Claxon Company on the machine would total $17,766 over the three years. Required: . Prepare a gilferential analysis on January 12 as to whether Ciaxon Company should lease (Altemative 1) or set (Altemative 2) the machine Refer to the Amount Descriptions lst provided for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter O A colon (:)wiW automaticaly appear if required 2. Should Claxon Company lease (Alternative 1) or sel (Aitemative 2) the machine? Amount Descriptions Amount Descriptions Costs Income (loss) Revenues Differential Analysis Shaded cells have feedback. Prepare a derential anahsis on January 12 as to whether Claxon Company should lease (Alternative 1) or sel (Aternative 2) the machine. Refer to the Amount Descriptions ist provided for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign there is no amount or an amount is zero, enter "O Acolon C wautomatically appear it required. Score: 0/51 Differential Analysis Costs Income (loss) Revenues Differential Analysis Shaded cells have feedback Prepare a differential analysis on January 12 as to whether Claxon Company should lease (Alternative 1) or sel (Alternative 2) the machine. Refer to the Amount Descriptions fist provided for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter 0. A colon (:) will automaticaly appear if required Score: 0/51 Difterential Analysis Lease (Alternative 1) or Sell (Alternative 2 Machine January 12 Differential Effect on Income (Alternative 2) Lease Machine Sell Machine Effect on (Alternative 1) (Alternative 2) R Points:0/12 Product TS-20 has revenue of $103,040, variable cost of goods sold of $51,070, variable selling expenses of $21,890, and fixed costs of $36,440, creating a loss from operations of S6,360 Required: 1. Prepare a differential analysis as of September 12 to determine if Product TS-20 should be continued (Altemative 1) or discontinued (Alternative 2), assuming fixed costs are unaffected by the decision. Refer to the list of Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter "O". A colon(:) will automatically appear required. 2. Determine if Product TS-20 should be continued (Alternative 1) or discontinued (Alternative 2). Amount Descriptions Amount Descriptions Fixed Income (loss) Revenue Total costs Variable cost of goods sold Variable selling and administrative expenses Shaded cells have Prepare a derentia analysis as of September 12 to determine it Product TS-20 should be continued (Alternative 1) or discontinued (Alernative 2), assuming fixed costs are unaffected by the decision. Refer to the list of Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter "O. A colon () wl automatically appear if required. Question not attempted. Score: O/105 Differential Analysis Continue (Alternative 1) orDiscontinue(teative 2) Product TS-20 September 12, 2016 Differential Continue Product Discontinue Product TS-20 Effect on Income (Alternative Alternative 2)(Alternative 2) Costs