Answered step by step

Verified Expert Solution

Question

1 Approved Answer

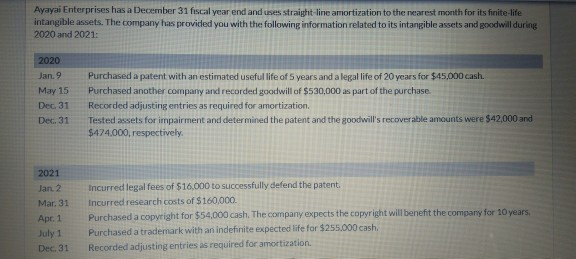

Ayayai Enterprises has a December 31 fiscal year end and uses straight line amortization to the nearest month for its finite-life intangible assets. The company

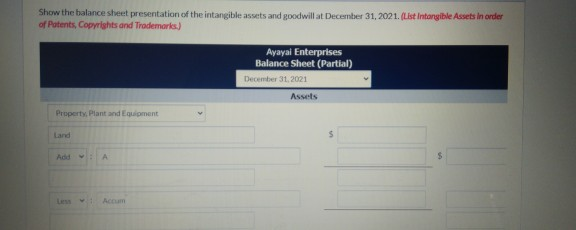

Ayayai Enterprises has a December 31 fiscal year end and uses straight line amortization to the nearest month for its finite-life intangible assets. The company has provided you with the following information related to its intangible assets and goodwill during 2020 and 2021 2020 Jan 9 May 15 Dec 31 Dec. 31 Purchased a patent with an estimated useful life of 5 years and a legal life of 20 years for $45,000 cash. Purchased another company and recorded goodwill of $530,000 as part of the purchase. Recorded adjusting entries as required for amortization. Tested assets for impairment and determined the patent and the goodwill's recoverable amounts were $42.000 and $474.000, respectively 2021 Jan. 2 Mar 31 Apr. 1 July 1 Dec. 31 Incurred legal fees of $16,000 to successfully defend the patent Incurred research costs of $160,000 Purchased a copyright for $54,000 cash. The company expects the copyright will benefit the company for 10 years, Purchased a trademark with an indefinite expected life for $255.000 cash. Recorded adjusting entries as required for amortization Show the balance sheet presentation of the intangible assets and goodwill at December 31, 2021. (List Intangible Assets in order of Patents, Copyrights and Trademarks.) Ayayai Enterprises Balance Sheet (Partial) December 31, 2021 Assets Property, Plant and Equipment land Add

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started