Answered step by step

Verified Expert Solution

Question

1 Approved Answer

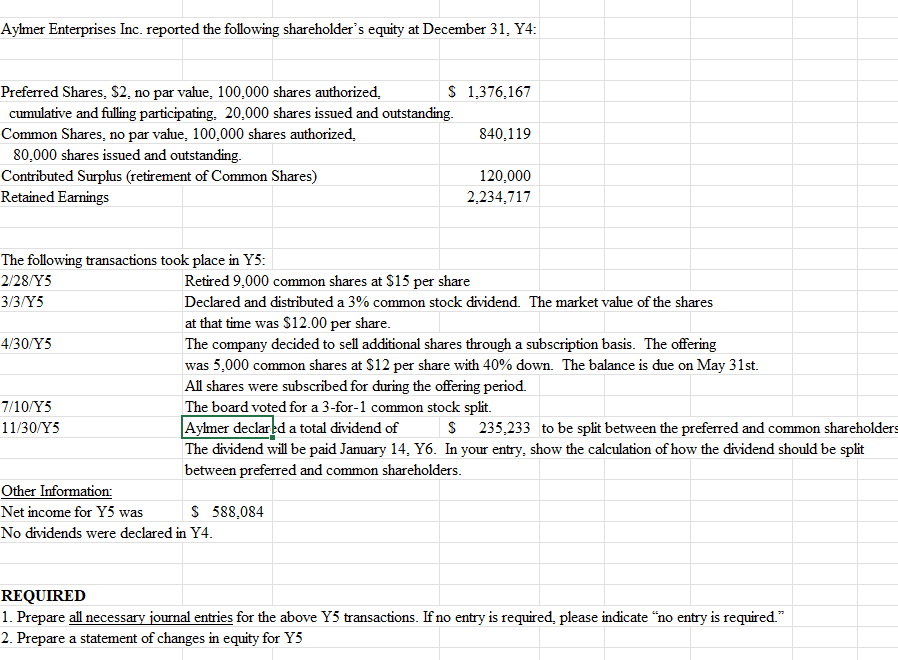

Aylmer Enterprises Inc. reported the following shareholder s equity at December 3 1 , Y 4 : Preferred Shares, $ 2 , no par value,

Aylmer Enterprises Inc. reported the following shareholders equity at December Y:

Preferred Shares, $ no par value, shares authorized, $

cumulative and fulling participating, shares issued and outstanding.

Common Shares, no par value, shares authorized,

shares issued and outstanding.

Contributed Surplus retirement of Common Shares

Retained Earnings

The following transactions took place in Y:

Y Retired common shares at $ per share

Y Declared and distributed a common stock dividend. The market value of the shares

at that time was $ per share.

Y The company decided to sell additional shares through a subscription basis. The offering

was common shares at $ per share with down. The balance is due on May st

All shares were subscribed for during the offering period.

Y The board voted for a for common stock split.

Y Aylmer declared a total dividend of $ to be split between the preferred and common shareholders

The dividend will be paid January Y In your entry, show the calculation of how the dividend should be split

between preferred and common shareholders.

Other Information:

Net income for Y was $

No dividends were declared in Y

REQUIRED

Prepare all necessary journal entries for the above Y transactions. If no entry is required, please indicate no entry is required.

Prepare a statement of changes in equity for Y

I have attached picture with it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started