Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ayuda!!! Assuming now that the expected performance in the market is -7%, what impact could be expected on the return required for the ABC firm

Ayuda!!!

Assuming now that the expected performance in the market is -7%, what impact could be expected on the return required for the ABC firm and the CDF firm. Explain your answer. (6 pts)

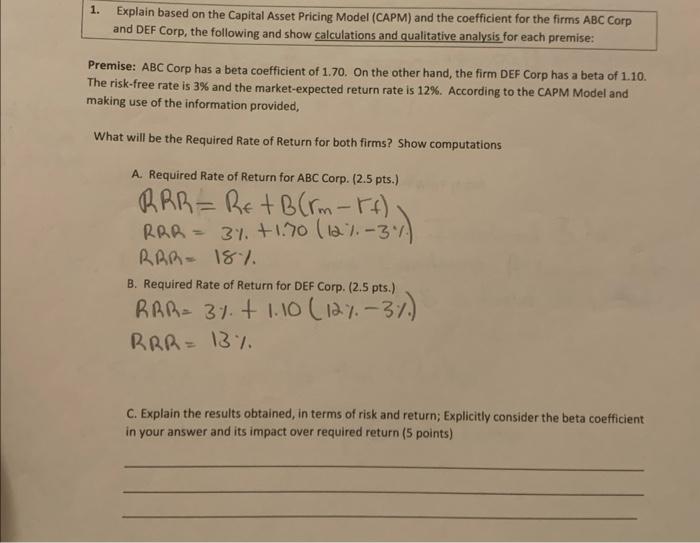

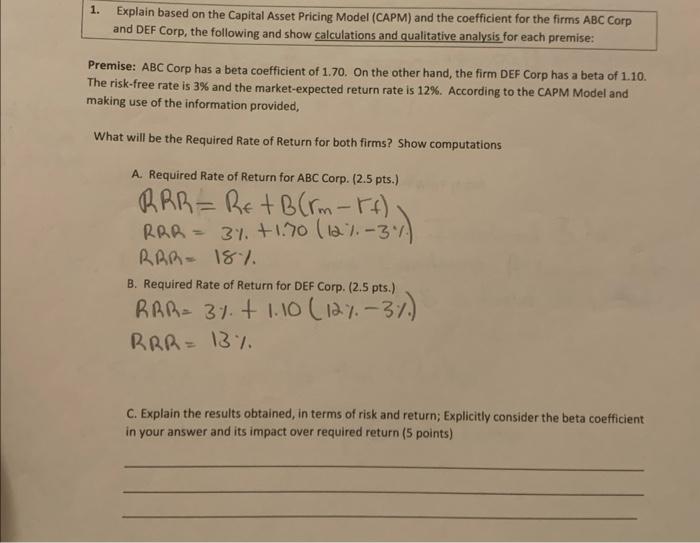

1. Explain based on the Capital Asset Pricing Model (CAPM) and the coefficient for the firms ABC Corp and DEF Corp, the following and show calculations and qualitative analysis for each premise: Premise: ABC Corp has a beta coefficient of 1.70. On the other hand, the firm DEF Corp has a beta of 1.10. The risk-free rate is 3% and the market-expected return rate is 12%. According to the CAPM Model and making use of the information provided, What will be the Required Rate of Return for both firms? Show computations A. Required Rate of Return for ABC Corp. (2.5 pts.) RRR=R+B(rmrf)RRR=3%+1.70(12%3%)RRR=18% B. Required Rate of Return for DEF Corp. (2.5 pts.) RRR=3%+1.10(12%3%)RRR=13% C. Explain the results obtained, in terms of risk and return; Explicitly consider the beta coefficient in your answer and its impact over required return ( 5 points) D. Asumiendo ahora que el rendimiento esperado en el mercado sea -7\%, que impacto podria esperarse sobre el retorno requerido para la firma ABC y para la firma CDF. Explica tu contestacin. ( 6 pts) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started