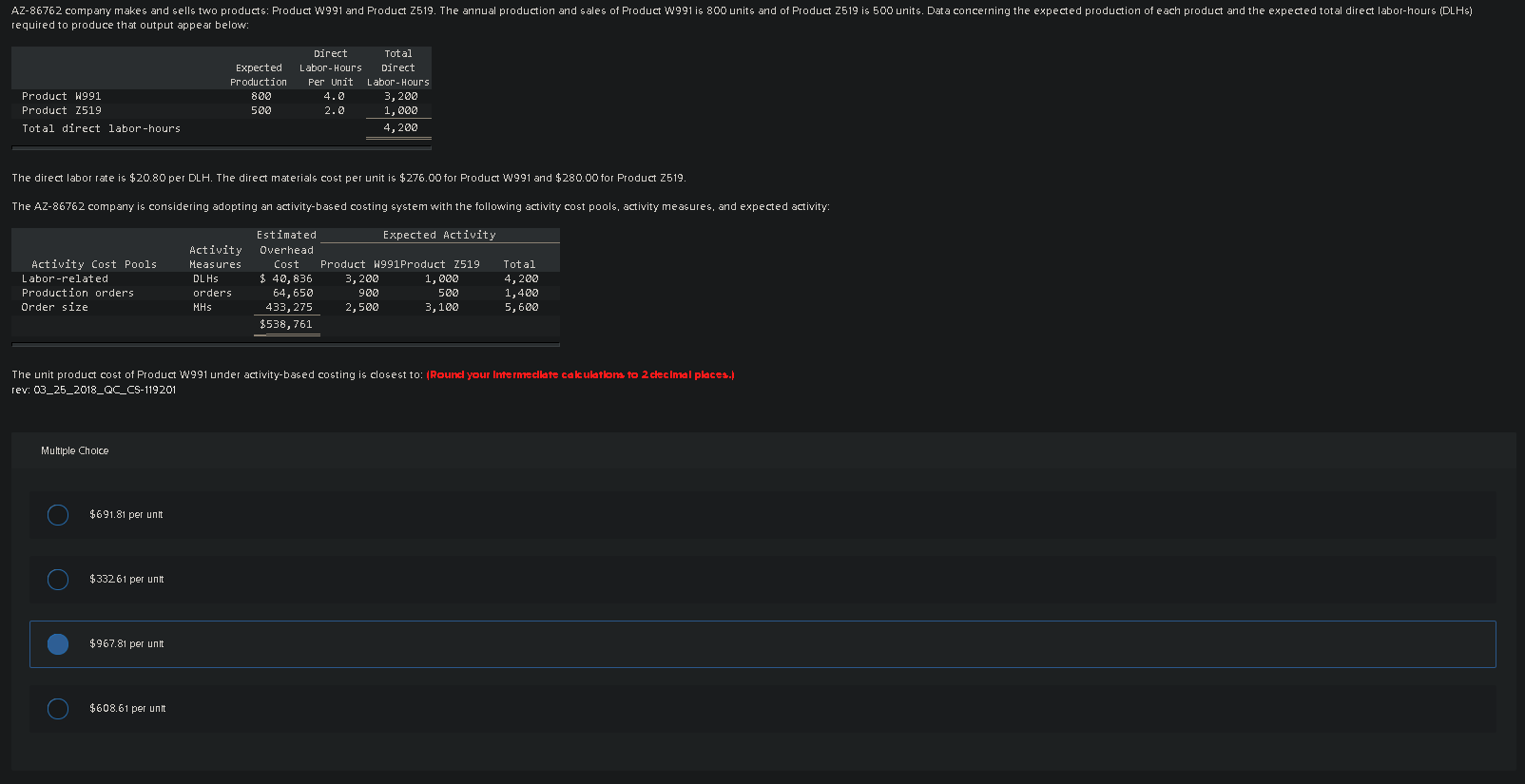

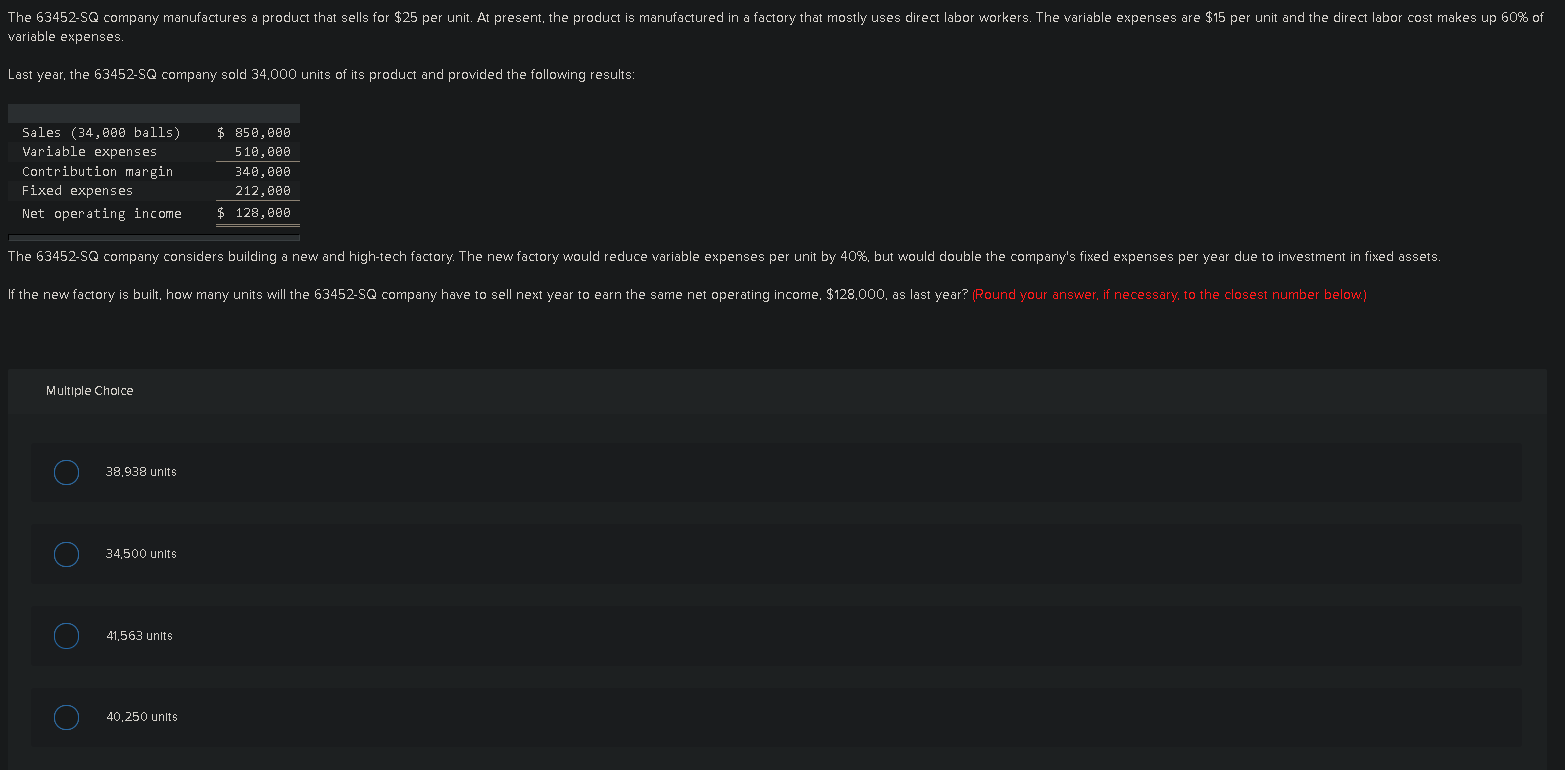

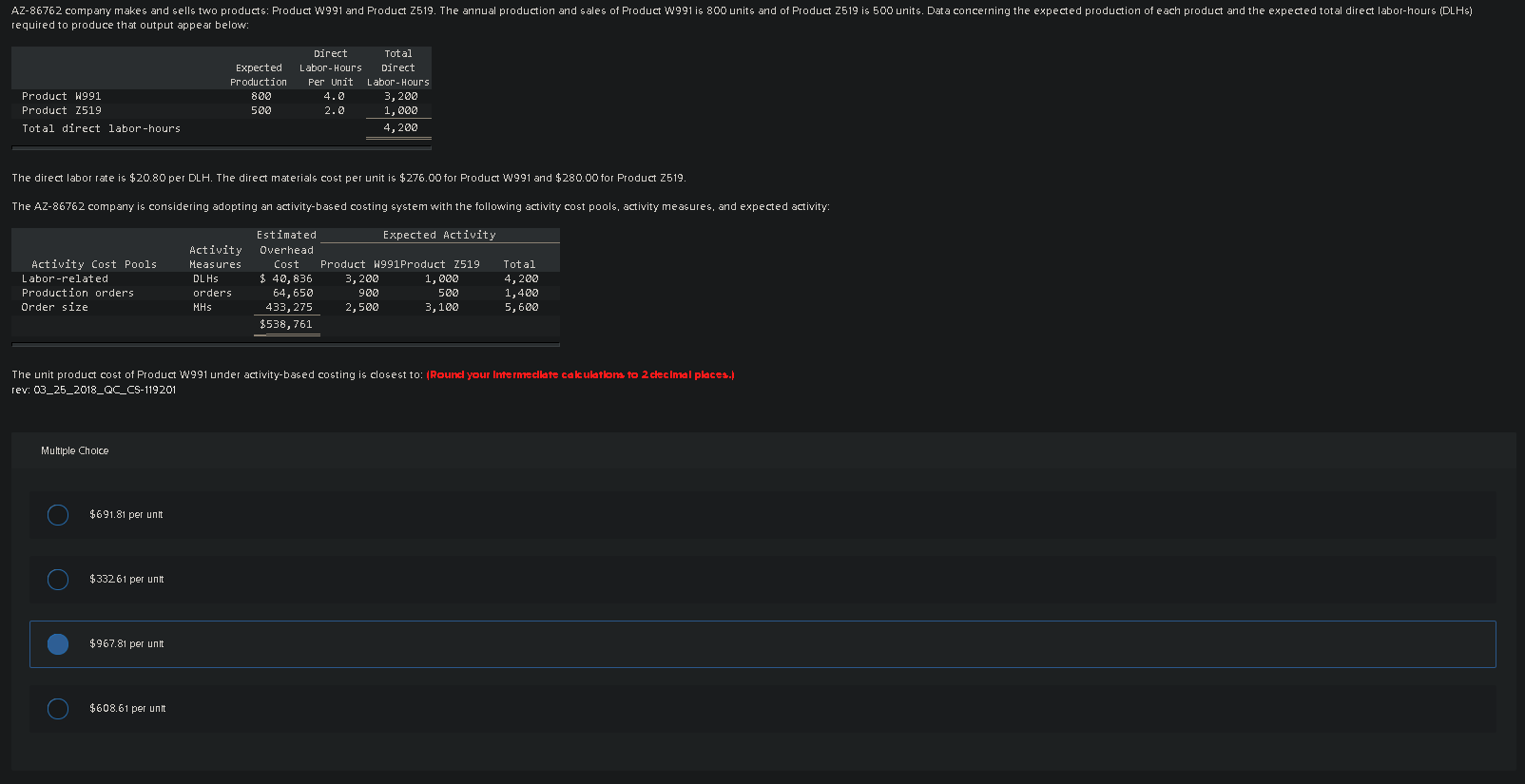

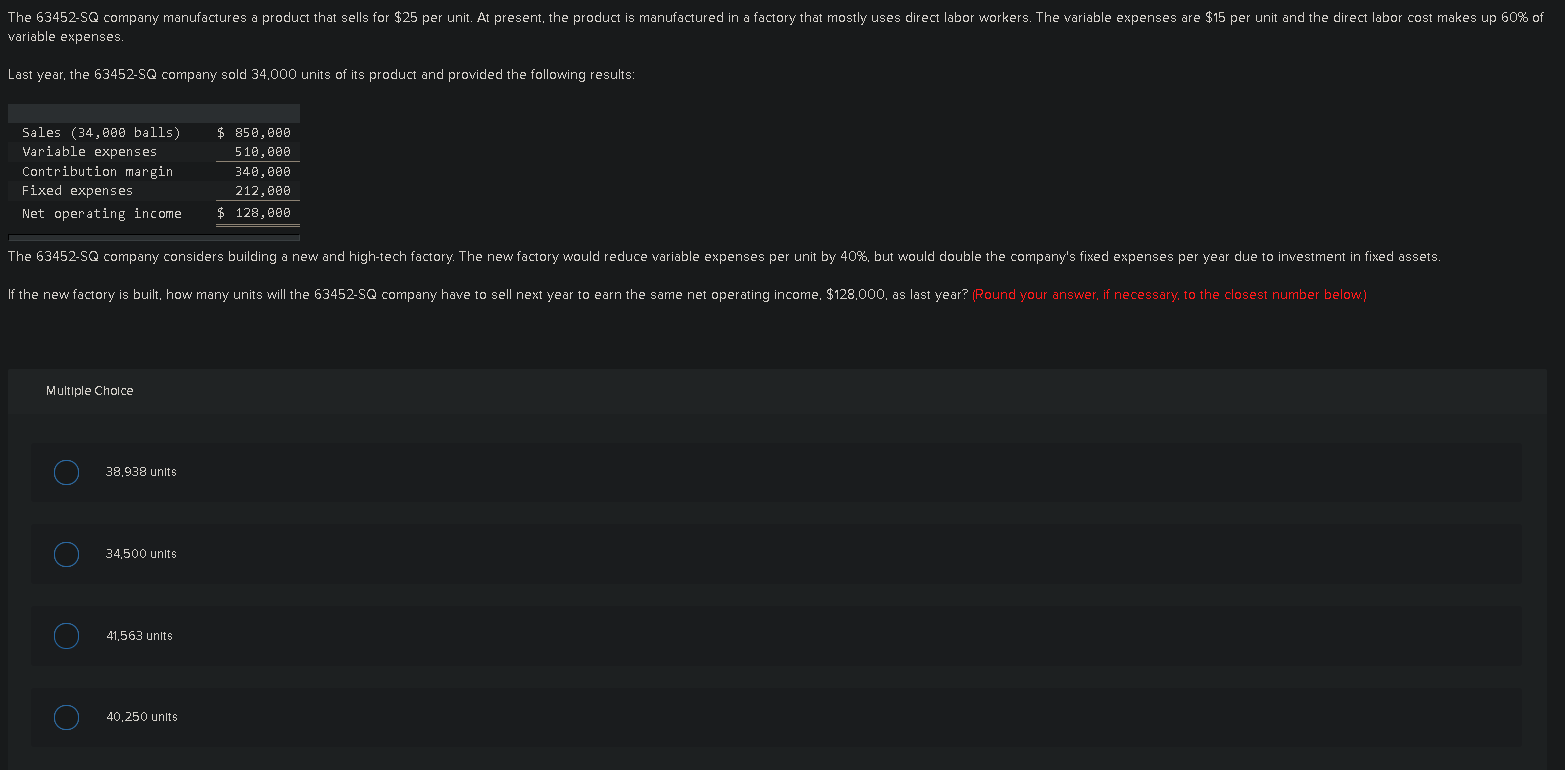

AZ-86762 company makes and sells two products: Product W991 and Product Z519. The annual production and sales of Product W991 is 800 units and of Product Z519 is 500 units. Data concerning the expected production of each product and the expected total direct labor-hours (DLHS) required to produce that output appear below: Expected Production 800 500 direct Labor - Hours Per Unit 4.0 2.0 Product W991 Product Z519 Total direct labor-hours Total Direct Labor - Hours 3,200 1,000 4,200 The direct labor rate is $20.80 per DLH. The direct materials cost per unit is $276.00 for Product W991 and $280.00 for Product Z519. The AZ-86762 company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Activity Cost Pools Labor-related Production orders Order size Activity Measures DLHS orders MHS Estimated Expected Activity Overhead Cost Product W991 Product 7519 $ 40,836 3,200 1,000 64,650 900 500 433,275 2,500 3,100 $538,761 Total 4,200 1,400 5,600 The unit product cost of Product W991 under activity-based costing is closest to: [Round your Intermedlate calculations to 2 decimal places... rev: 03_25_2018_QC_CS-119201 Multiple Choice $691.81 per unit $33261 per unit $967.81 per unit $608.61 per unit The 63452-SQ company manufactures a product that sells for $25 per unit. At present, the product is manufactured in a factory that mostly uses direct labor workers. The variable expenses are $15 per unit and the direct labor cost makes up 60% of variable expenses. Last year, the 63452-SQ company sold 34,000 units of its product and provided the following results: Sales (34,000 balls) Variable expenses Contribution margin Fixed expenses Net operating income $ 850,000 510,000 340,000 212,000 $ 128,000 The 63452-SQ company considers building a new and high-tech factory. The new factory would reduce variable expenses per unit by 40%, but would double the company's fixed expenses per year due to investment in fixed assets. If the new factory is built, how many units will the 63452-SQ company have to sell next year to earn the same net operating income. $128,000, as last year? (Round your answer, if necessary, to the closest number below.) Multiple Choice 38,938 units o 34,500 units 41,563 units O 40,250 units