Answered step by step

Verified Expert Solution

Question

1 Approved Answer

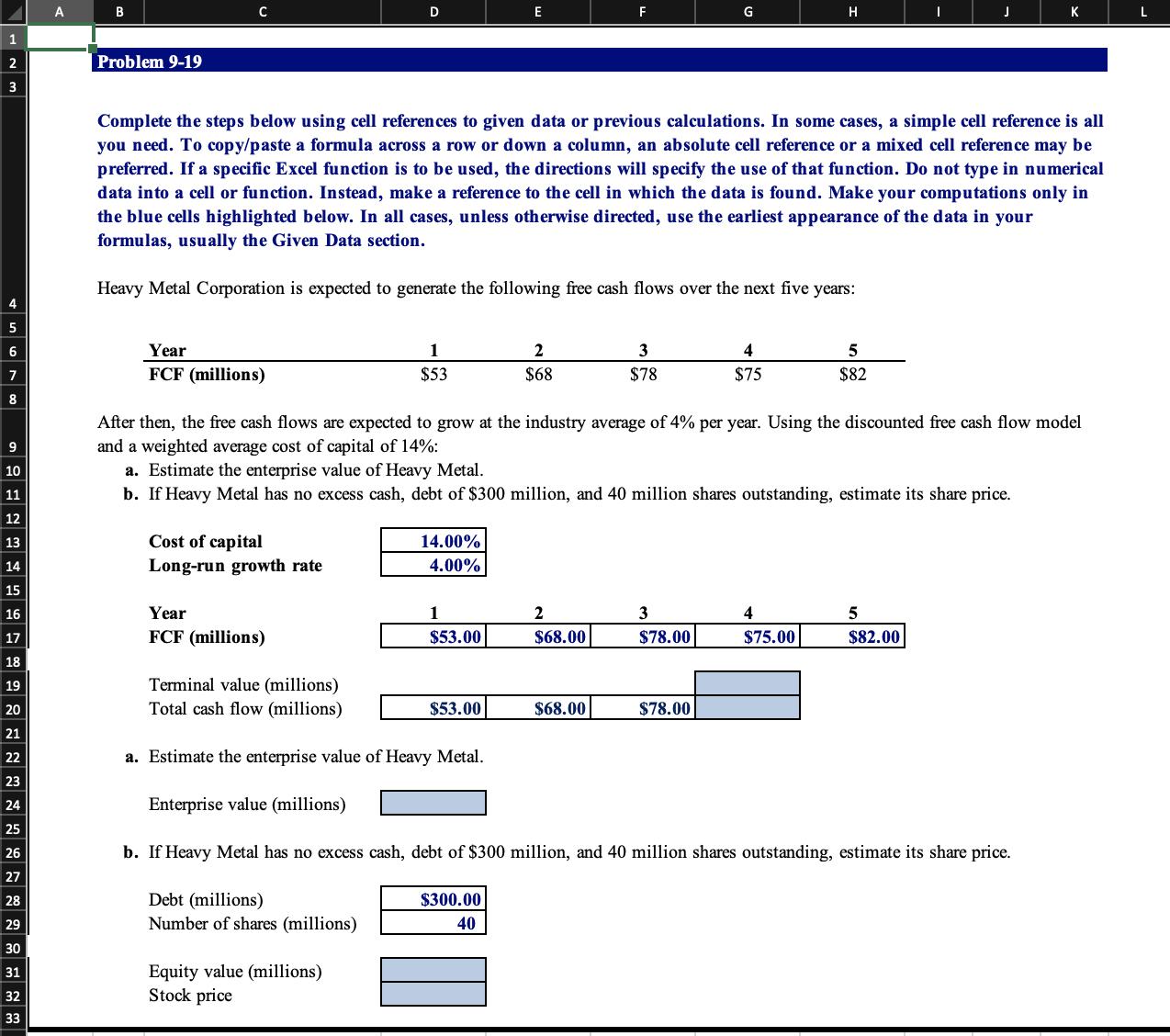

B 1 2 Problem 9-19 3 5 6 8 K L Complete the steps below using cell references to given data or previous calculations.

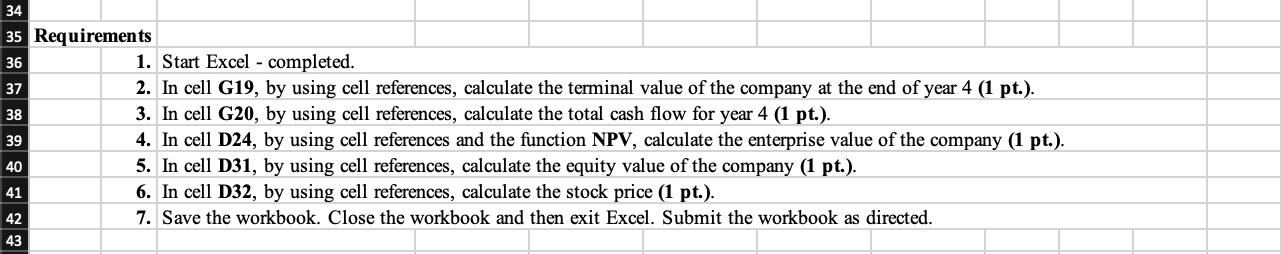

B 1 2 Problem 9-19 3 5 6 8 K L Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Heavy Metal Corporation is expected to generate the following free cash flows over the next five years: Year FCF (millions) 1 $53 2 3 4 5 $68 $78 $75 $82 9 10 11 12 13 14 Long-run growth rate After then, the free cash flows are expected to grow at the industry average of 4% per year. Using the discounted free cash flow model and a weighted average cost of capital of 14%: a. Estimate the enterprise value of Heavy Metal. b. If Heavy Metal has no excess cash, debt of $300 million, and 40 million shares outstanding, estimate its share price. Cost of capital 14.00% 4.00% 15 16 Year 1 2 3 4 5 17 FCF (millions) $53.00 $68.00 $78.00 $75.00 $82.00 18 19 Terminal value (millions) 20 Total cash flow (millions) $53.00 $68.00 $78.00 21 22 23 24 a. Estimate the enterprise value of Heavy Metal. Enterprise value (millions) b. If Heavy Metal has no excess cash, debt of $300 million, and 40 million shares outstanding, estimate its share price. Debt (millions) Number of shares (millions) 25 26 27 28 29 30 31 Equity value (millions) 32 Stock price 33 $300.00 40 34 35 Requirements 36 1. Start Excel - completed. 37 38 39 40 41 42 2. In cell G19, by using cell references, calculate the terminal value of the company at the end of year 4 (1 pt.). 3. In cell G20, by using cell references, calculate the total cash flow for year 4 (1 pt.). 4. In cell D24, by using cell references and the function NPV, calculate the enterprise value of the company (1 pt.). 5. In cell D31, by using cell references, calculate the equity value of the company (1 pt.). 6. In cell D32, by using cell references, calculate the stock price (1 pt.). 7. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed. 43

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started