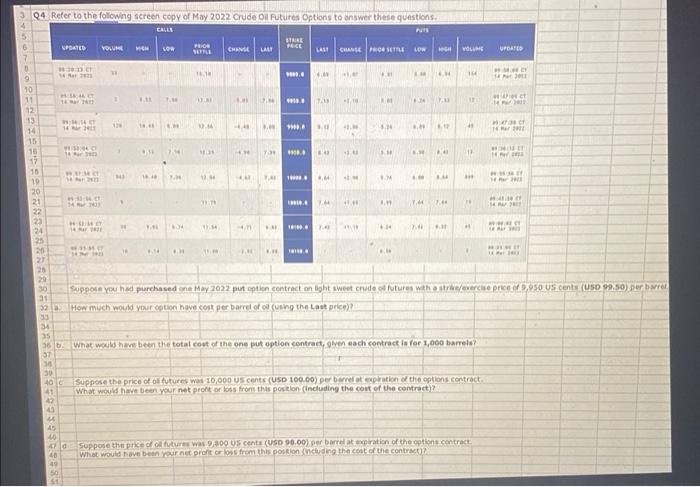

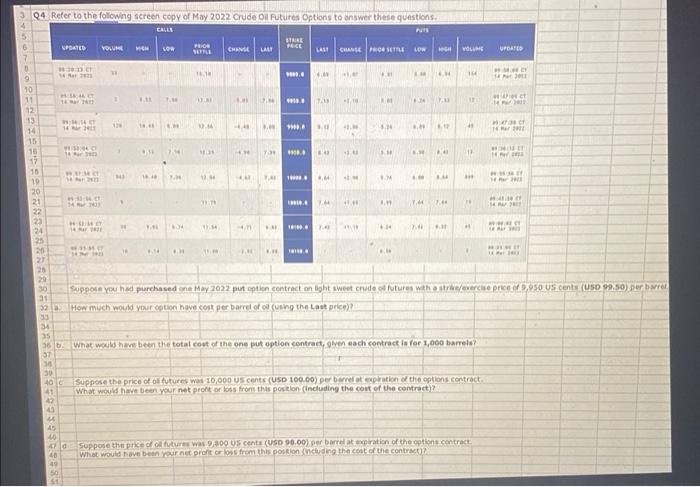

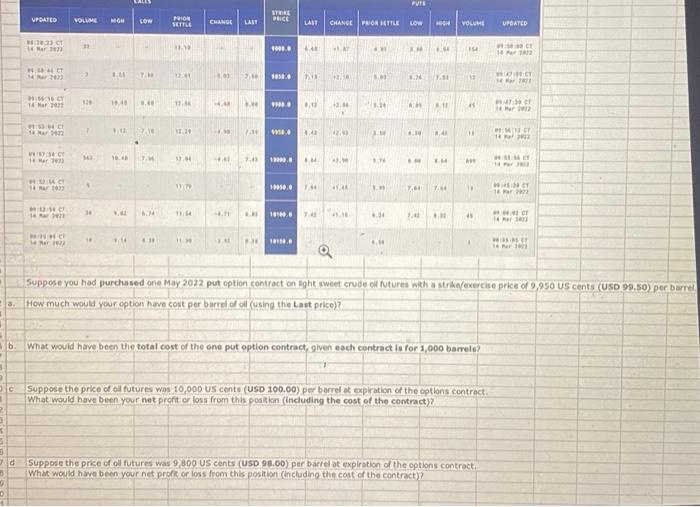

24. Refer to the following screen copy of May 2022 Crude Ol Futures Options to answer these questions CALUN 1 6 7 UPDATED VOLUME Low SERLE CHANGELA LAN CHASE SELE MDN VOLIM UPDATE 161 . 14 HT 1 11 ET 11.13 16 1 9 10 11 12 13 14 15 16 12 18 19 20 21 22 23 11 8. . 4 14 1 REY - . 25 26 IN 1 Soppose your purchased on May 2022 put option contract on light sweet crude oitures with a str/evere price of 9.950 US cents (USD 99.50) per barrel How much would your option have cost per barrel of ol (Using the Law price) 20 29 30 31 32 33 SA 35 36 37 30 30 40 41 2 What would have been the total cost of the one put option contract, given coch contract is for 1,000 barrels Suppose the price for futures was 10,000 US cents (USD 100.00) per bare et exprition of the options contract What would have been your net profit or loss from this position (including the cost of the contract)? 45 -10 47 d 40 49 0 st Suppose the price forures was 0.000 US cents (USD 90.00) per barreteration of the options.contract What would have been your net profit or loss from this portion (including the cost of the contract PUTS UPDATED VOLUME ITEE PHIC LOW Pos SETTLE CHANGE LAIT CHANCE FOR SITLE LOW AH VOLUME UPDATED ES 12) 144 . 12 HET 10 TA CE HE 130 14 More . 3. 1. . AN 111 12 11 44 3.4 1 MCT 13 11 TH . HO 18 19 1se.. 7 10 16 8.31 NH 10 . 2 45 CE Hari 81 11 #1 .. Suppose you had purchased on May 2022 put option contract on ight sweet crude of futures with a strike/exercise price of 0.950 US cents (USD 99.50) per Barrel la How much would your option have cost per barrel of all (using the last price)? b What would have been the total cost of the one put option contract given each contract is for 1,000 barvels? SIC Suppose the price of oil futures was 10,000 US cents (USD 100.00) per barrel at expiration of the options contract What would have been your net profit or loss from this position (including the cost of the contract 2 3d Suppose the prke of ol futures was 9,800 US cents (USD 98.00) per bare at expiration of the options contract What would have been your net profit or loss from this position (including the cost of the contract) 24. Refer to the following screen copy of May 2022 Crude Ol Futures Options to answer these questions CALUN 1 6 7 UPDATED VOLUME Low SERLE CHANGELA LAN CHASE SELE MDN VOLIM UPDATE 161 . 14 HT 1 11 ET 11.13 16 1 9 10 11 12 13 14 15 16 12 18 19 20 21 22 23 11 8. . 4 14 1 REY - . 25 26 IN 1 Soppose your purchased on May 2022 put option contract on light sweet crude oitures with a str/evere price of 9.950 US cents (USD 99.50) per barrel How much would your option have cost per barrel of ol (Using the Law price) 20 29 30 31 32 33 SA 35 36 37 30 30 40 41 2 What would have been the total cost of the one put option contract, given coch contract is for 1,000 barrels Suppose the price for futures was 10,000 US cents (USD 100.00) per bare et exprition of the options contract What would have been your net profit or loss from this position (including the cost of the contract)? 45 -10 47 d 40 49 0 st Suppose the price forures was 0.000 US cents (USD 90.00) per barreteration of the options.contract What would have been your net profit or loss from this portion (including the cost of the contract PUTS UPDATED VOLUME ITEE PHIC LOW Pos SETTLE CHANGE LAIT CHANCE FOR SITLE LOW AH VOLUME UPDATED ES 12) 144 . 12 HET 10 TA CE HE 130 14 More . 3. 1. . AN 111 12 11 44 3.4 1 MCT 13 11 TH . HO 18 19 1se.. 7 10 16 8.31 NH 10 . 2 45 CE Hari 81 11 #1 .. Suppose you had purchased on May 2022 put option contract on ight sweet crude of futures with a strike/exercise price of 0.950 US cents (USD 99.50) per Barrel la How much would your option have cost per barrel of all (using the last price)? b What would have been the total cost of the one put option contract given each contract is for 1,000 barvels? SIC Suppose the price of oil futures was 10,000 US cents (USD 100.00) per barrel at expiration of the options contract What would have been your net profit or loss from this position (including the cost of the contract 2 3d Suppose the prke of ol futures was 9,800 US cents (USD 98.00) per bare at expiration of the options contract What would have been your net profit or loss from this position (including the cost of the contract)