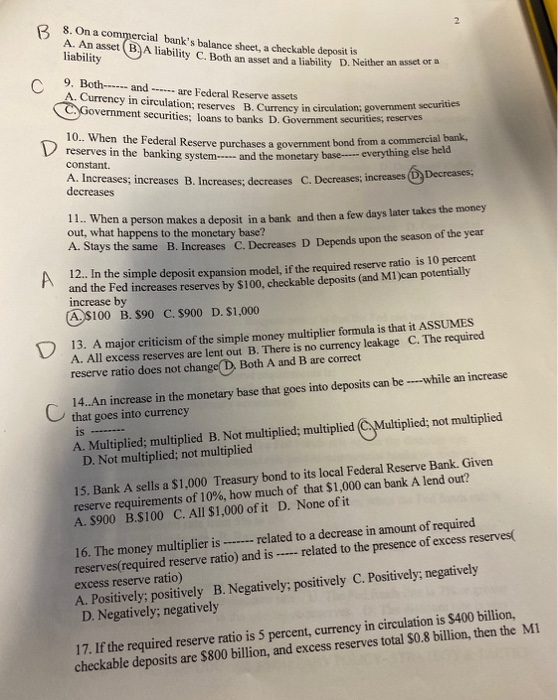

B 8. On a commercial bank's balance sheet, a checkable deposit is A. An asset liability BA liability C. Both an asset and a liability D. Neither an asset of a 9. Both-- and ------ are Federal Reserve assets A. Currency in eirculation; reserves B. Currency in circulation; government securities CGovernment securities; Joans to banks D. Government securities; reserves 10.. When the Federal Reserve purchases a government bond from a commercial bank, V reserves in the banking system----- and the monetary base---- everything else heid constant. A. Increases; increases B. Increases: decreases C. Decreases; increases (D Decreases; decreases 11. When a person makes a deposit in a bank and then a few days later takes the money out, what happens to the monetary base? A. Stays the same B. Increases C. Decreases D Depends upon the season of the year 12. In the simple deposit expansion model, if the required reserve ratio is 10 percent and the Fed increases reserves by $100, checkable deposits (and M1)can potentially increase by (A. $100 B. $90 C. $900 D. $1,000 13. A major criticism of the simple money multiplier formula is that it ASSUMES A. All excess reserves are lent out B. There is no currency leakage C. The required reserve ratio does not change D, Both A and B are correct 14.An increase in the monetary base that goes into deposits can be ---while an increase that goes is s into currency A. Multiplied; multiplied B. Not multiplied; multiplied (CMultiplied; not multiplied D. Not multiplied; not multiplied 15. Bank A sells a $1,000 Treasury bond to its local Federal Reserve Bank. Given reserve requirements of 10%, how much of that $1,000 can bank A lend out? A. $900 B.$100 C. All $1,000 of it D. None of it - related to a decrease in amount of required 16. The money multiplier is reserves(required reserve ratio) and is ----- related to the presence of excess reserves( excess reserve ratio) A. Positively; positively B. Negatively; positively C. Positively; negatively D. Negatively; negatively 17. If the required reserve ratio is 5 percent, currency in circulation is $400 billion, checkable deposits are $800 billion, and excess reserves total $0.8 billion, then the M1