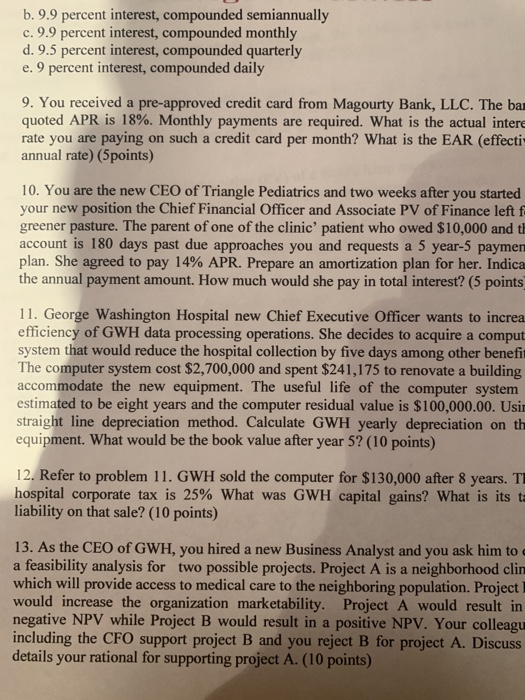

b. 9.9 percent interest, compounded semiannually c. 9.9 percent interest, compounded monthly d. 9.5 percent interest, compounded quarterly e. 9 percent interest, compounded daily 9. You received a pre-approved credit card from Magourty Bank, LLC. The ba quoted APR is 18%. Monthly payments are required. What is the actual intere rate you are paying on such a credit card per month? What is the EAR (effecti annual rate) (Spoints) 10. You are the new CEO of Triangle Pediatrics and two weeks after you started your new position the Chief Financial Officer and Associate PV of Finance left f greener pasture. The parent of one of the clinic patient who owed $10,000 and t account is 180 days past due approaches you and requests a 5 year-5 paymen plan. She agreed to pay 14% APR. Prepare an amortization plan for her. Indica the annual payment amount. How much would she pay in total interest? (5 points 11. George Washington Hospital new Chief Executive Officer wants to increa efficiency of GWH data processing operations. She decides to acquire a comput system that would reduce the hospital collection by five days among other benefi The computer system cost $2,700,000 and spent $241,175 to renovate a building accommodate the new equipment. The useful life of the computer system estimated to be eight years and the computer residual value is $100,000.00. Usir straight line depreciation method. Calculate GWH yearly depreciation on th equipment. What would be the book value after year 5? (10 points) 12. Refer to problem 11. GWH sold the computer for $130,000 after 8 years. T hospital corporate tax is 25% What was GWH capital gains? What is its t liability on that sale? (10 points) 13. As the CEO of GWH, you hired a new Business Analyst and you ask him to a feasibility analysis for two possible projects. Project A is a neighborhood clir which will provide access to medical care to the neighboring population. Project would increase the organization marketability. Project A would result in negative NPV while Project B would result in a positive NPV. Your colleagy including the CFO support project B and you reject B for project A. Discuss details your rational for supporting project A. (10 points)