Answered step by step

Verified Expert Solution

Question

1 Approved Answer

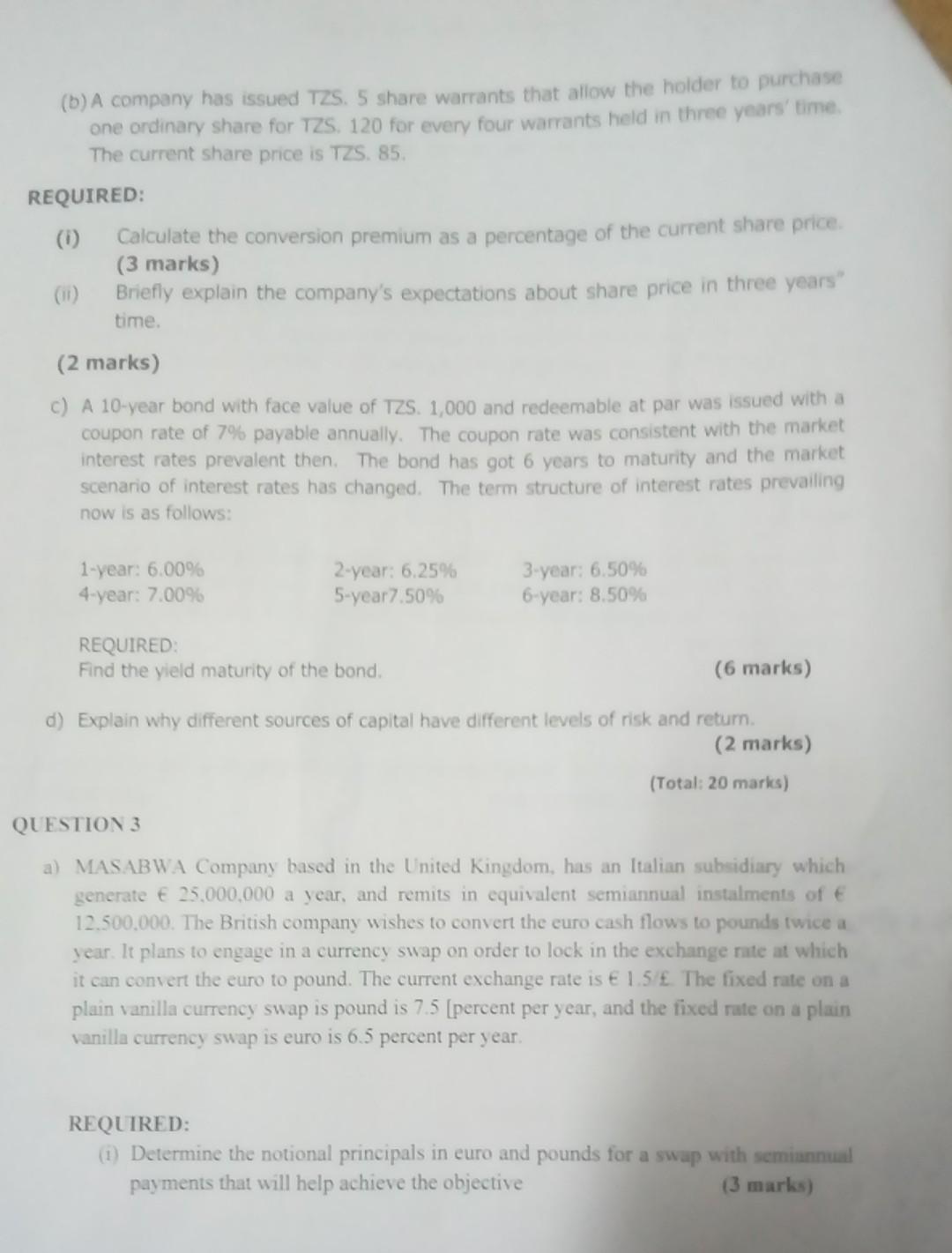

(b) A company has issued TZS. 5 share warrants that allow the holder to purchase one ordinary share for TZS. 120 for every four warrants

(b) A company has issued TZS. 5 share warrants that allow the holder to purchase one ordinary share for TZS. 120 for every four warrants held in three years' time, The current share price is TZS. 85. REQUIRED: Calculate the conversion premium as a percentage of the current share price. (3 marks) Briefly explain the company's expectations about share price in three years" time. (2 marks) c) A 10-year bond with face value of TZS. 1,000 and redeemable at par was issued with a coupon rate of 7% payable annually. The coupon rate was consistent with the market interest rates prevalent then. The bond has got 6 years to maturity and the market scenario of interest rates has changed. The term structure of interest rates prevailing now is as follows: 1-year: 6.00% 4-year: 7.009 2-year: 6.25% 5-year7.50% 3 year: 6.50% 6-year: 8.50% REQUIRED Find the yield maturity of the bond, (6 marks) d) Explain why different sources of capital have different levels of risk and return (2 marks) (Total: 20 marks) QUESTION 3 a) MASABWA Company based in the United Kingdom, has an Italian subsidiary which generate 25.000.000 a year, and remits in equivalent semiannual instalments of 12.500,000. The British company wishes to convert the euro cash flows to pounds twice a year. It plans to engage in a currency swap on order to lock in the exchange rate at which it can convert the euro to pound. The current exchange rate is 1.5/. The fixed rate on a plain vanilla currency swap is pound is 7.5 [percent per year, and the fixed rate on a plain vanilla currency swap is euro is 6.5 percent per year. REQUIRED: (1) Determine the notional principals in euro and pounds for a swap with semiannual payments that will help achieve the objective (3 marks) (b) A company has issued TZS. 5 share warrants that allow the holder to purchase one ordinary share for TZS. 120 for every four warrants held in three years' time, The current share price is TZS. 85. REQUIRED: Calculate the conversion premium as a percentage of the current share price. (3 marks) Briefly explain the company's expectations about share price in three years" time. (2 marks) c) A 10-year bond with face value of TZS. 1,000 and redeemable at par was issued with a coupon rate of 7% payable annually. The coupon rate was consistent with the market interest rates prevalent then. The bond has got 6 years to maturity and the market scenario of interest rates has changed. The term structure of interest rates prevailing now is as follows: 1-year: 6.00% 4-year: 7.009 2-year: 6.25% 5-year7.50% 3 year: 6.50% 6-year: 8.50% REQUIRED Find the yield maturity of the bond, (6 marks) d) Explain why different sources of capital have different levels of risk and return (2 marks) (Total: 20 marks) QUESTION 3 a) MASABWA Company based in the United Kingdom, has an Italian subsidiary which generate 25.000.000 a year, and remits in equivalent semiannual instalments of 12.500,000. The British company wishes to convert the euro cash flows to pounds twice a year. It plans to engage in a currency swap on order to lock in the exchange rate at which it can convert the euro to pound. The current exchange rate is 1.5/. The fixed rate on a plain vanilla currency swap is pound is 7.5 [percent per year, and the fixed rate on a plain vanilla currency swap is euro is 6.5 percent per year. REQUIRED: (1) Determine the notional principals in euro and pounds for a swap with semiannual payments that will help achieve the objective

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started