Answered step by step

Verified Expert Solution

Question

1 Approved Answer

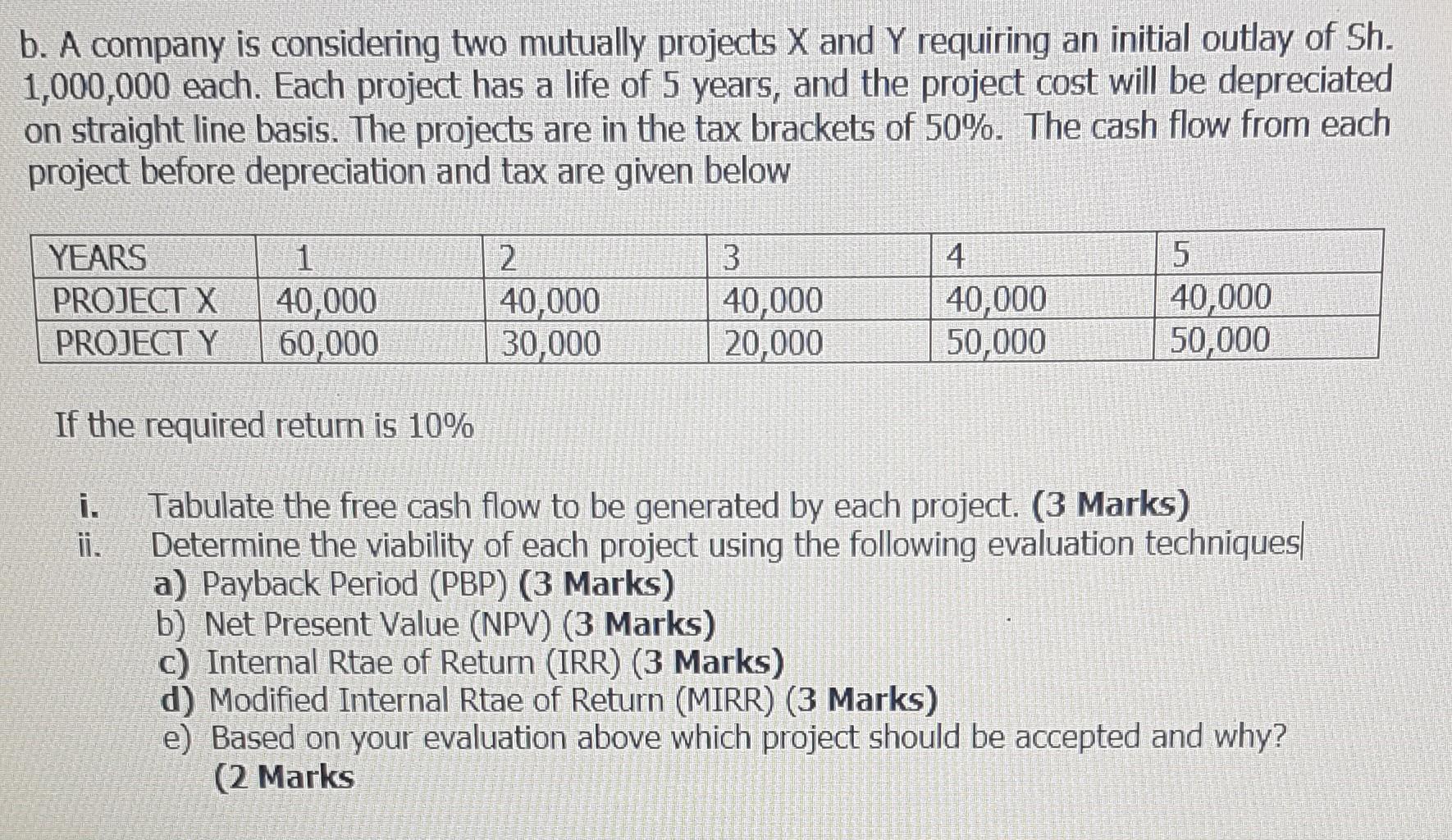

b. A company is considering two mutually projects X and Y requiring an initial outlay of Sh. 1,000,000 each. Each project has a life of

b. A company is considering two mutually projects X and Y requiring an initial outlay of Sh. 1,000,000 each. Each project has a life of 5 years, and the project cost will be depreciated on straight line basis. The projects are in the tax brackets of 50%. The cash flow from each project before depreciation and tax are given below YEARS PROJECT X PROJECT Y 1 40,000 60,000 2 40,000 30,000 3 40,000 20,000 4 40,000 50,000 5 40,000 50,000 If the required return is 10% i. Tabulate the free cash flow to be generated by each project. (3 Marks) Determine the viability of each project using the following evaluation techniques a) Payback Period (PBP) (3 Marks) b) Net Present Value (NPV) (3 Marks) c) Internal Rtae of Return (IRR) (3 Marks) d) Modified Internal Rtae of Return (MIRR) (3 Marks) e) Based on your evaluation above which project should be accepted and why? (2 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started