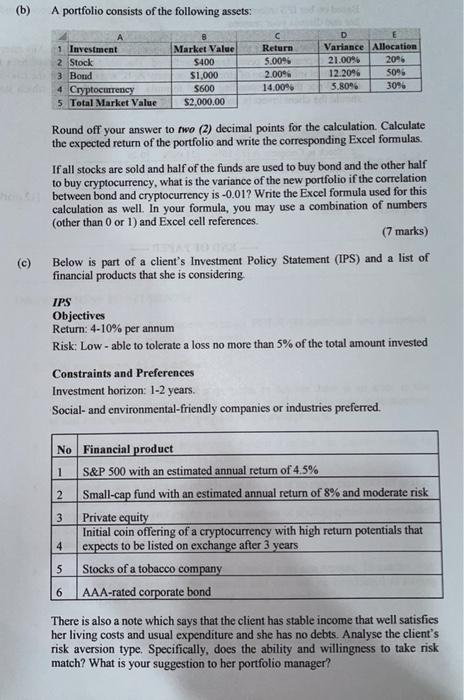

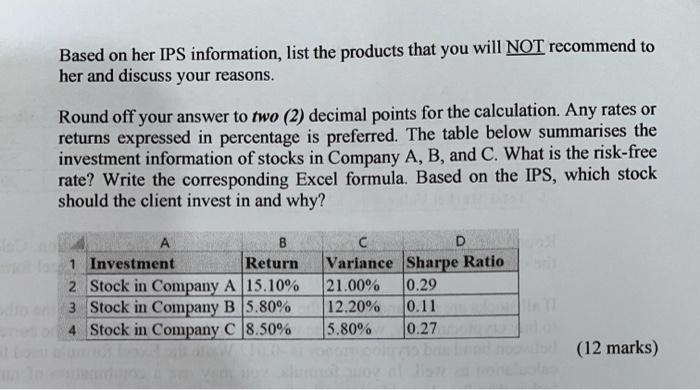

(b) A portfolio consists of the following assets: 1 Investment 2 Stock 3 Bond 4 Cryptocurrency 5 Total Market Value Market Value $400 $1,000 S600 $2,000.00 Return 5.0096 2.00% 14.00% D Variance Allocation 21.00% 2096 12. 2096 50%. 5.8096 30% (c) Round off your answer to two (2) decimal points for the calculation. Calculate the expected return of the portfolio and write the corresponding Excel formulas If all stocks are sold and half of the funds are used to buy bond and the other half to buy cryptocurrency, what is the variance of the new portfolio if the correlation between bond and cryptocurrency is -0.017 Write the Excel formula used for this calculation as well. In your formula, you may use a combination of numbers (other than 0 or 1) and Excel cell references (7 marks) Below is part of a client's Investment Policy Statement (IPS) and a list of financial products that she is considering. IPS Objectives Return: 4-10% per annum Risk: Low - able to tolerate a loss no more than 5% of the total amount invested Constraints and Preferences Investment horizon: 1-2 years. Social- and environmental-friendly companies or industries preferred. No Financial product 1 S&P 500 with an estimated annual return of 4.5% 2 Small-cap fund with an estimated annual return of 8% and moderate risk 3 Private equity Initial coin offering of a cryptocurrency with high return potentials that 4 expects to be listed on exchange after 3 years 5 Stocks of a tobacco company 6 AAA-rated corporate bond There is also a note which says that the client has stable income that well satisfies her living costs and usual expenditure and she has no debts. Analyse the client's risk aversion type. Specifically, does the ability and willingness to take risk match? What is your suggestion to her portfolio manager? Based on her IPS information, list the products that you will NOT recommend to her and discuss your reasons. Round off your answer to two (2) decimal points for the calculation. Any rates or returns expressed in percentage is preferred. The table below summarises the investment information of stocks in Company A, B, and C. What is the risk-free rate? Write the corresponding Excel formula. Based on the IPS, which stock should the client invest in and why? B 1 Investment Return 2 Stock in Company A 15.10% 3 Stock in Company B 5.80% 4 Stock in Company C 8.50% Variance Sharpe Ratio 21.00% 0.29 12.20% 0.11 5.80% 0.27 (12 marks)