Answered step by step

Verified Expert Solution

Question

1 Approved Answer

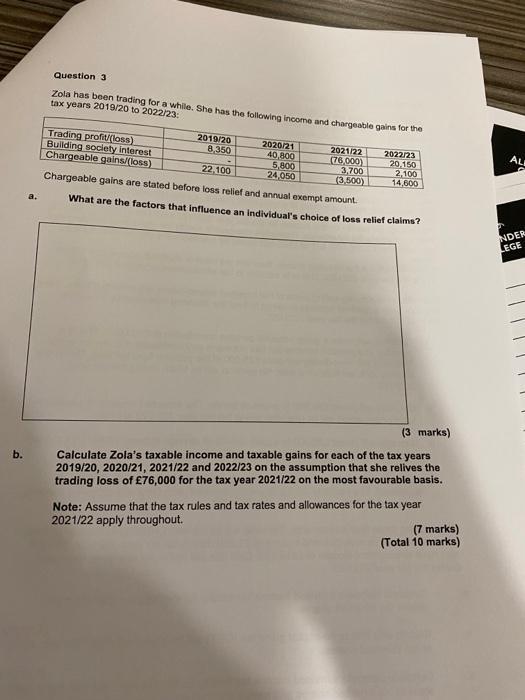

b. a. Question 3 Zola has been trading for a while. She has the following income and chargeable gains for the tax years 2019/20

b. a. Question 3 Zola has been trading for a while. She has the following income and chargeable gains for the tax years 2019/20 to 2022/23: Trading profit/(loss) Building society interest Chargeable gains/(loss) 2019/20 8,350 2020/21 40,800 5,800 24,050 2021/22 (76,000) 2022/23 20.150 2,100 14,600 22,100 Chargeable gains are stated before loss relief and annual exempt amount. What are the factors that influence an individual's choice of loss relief claims? 3,700 (3,500) (3 marks) Calculate Zola's taxable income and taxable gains for each of the tax years 2019/20, 2020/21, 2021/22 and 2022/23 on the assumption that she relives the trading loss of 76,000 for the tax year 2021/22 on the most favourable basis. Note: Assume that the tax rules and tax rates and allowances for the tax year 2021/22 apply throughout. (7 marks) (Total 10 marks) ALI NDER LEGE

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Factors that Influence an Individuals Choice of Loss Relief Claims 1 Availability of Loss R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started