Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b A store will cost $825,000 to open. Variable costs will be 53% of sales and fixed costs are $190,000 per year. The investment costs

b

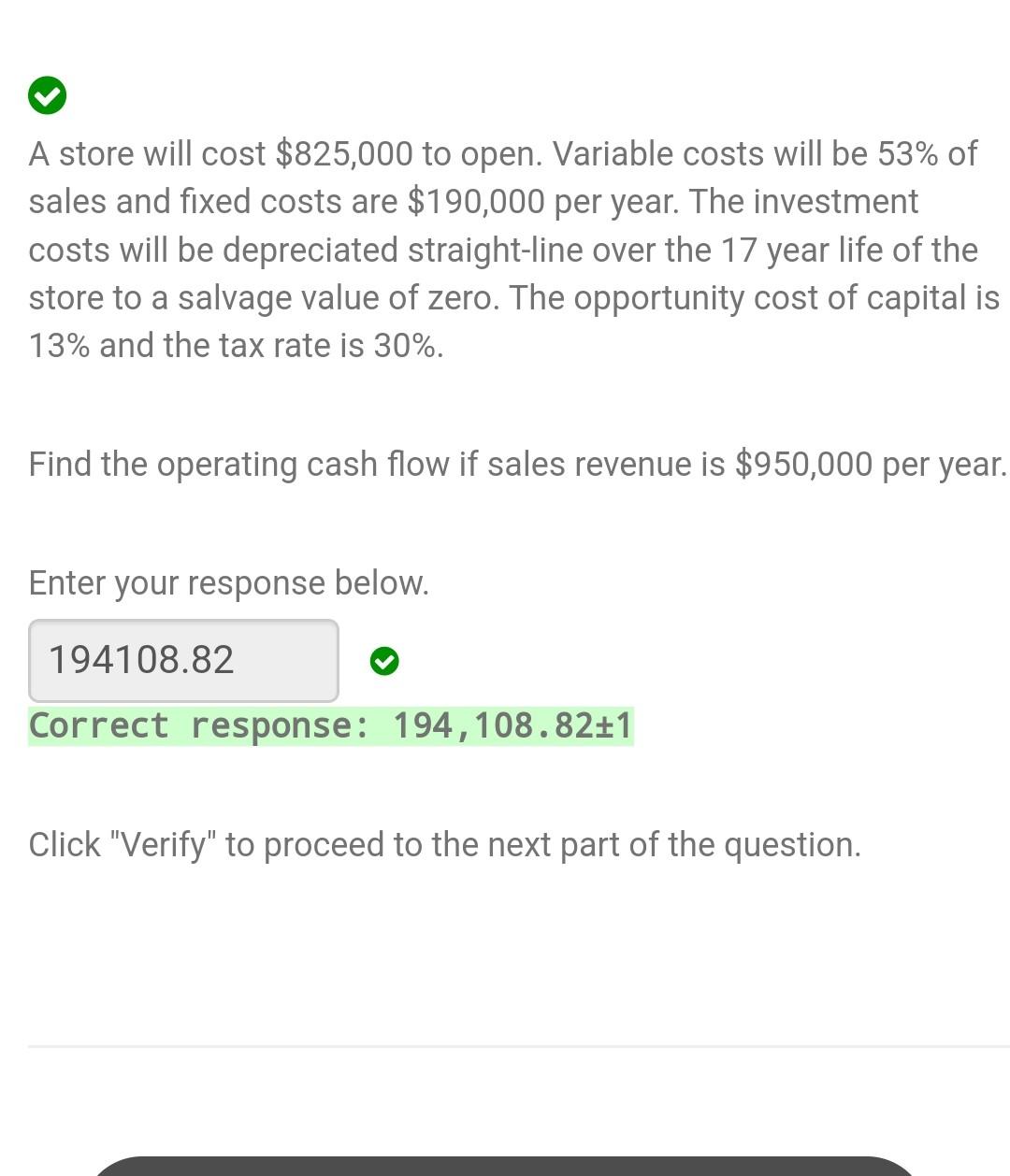

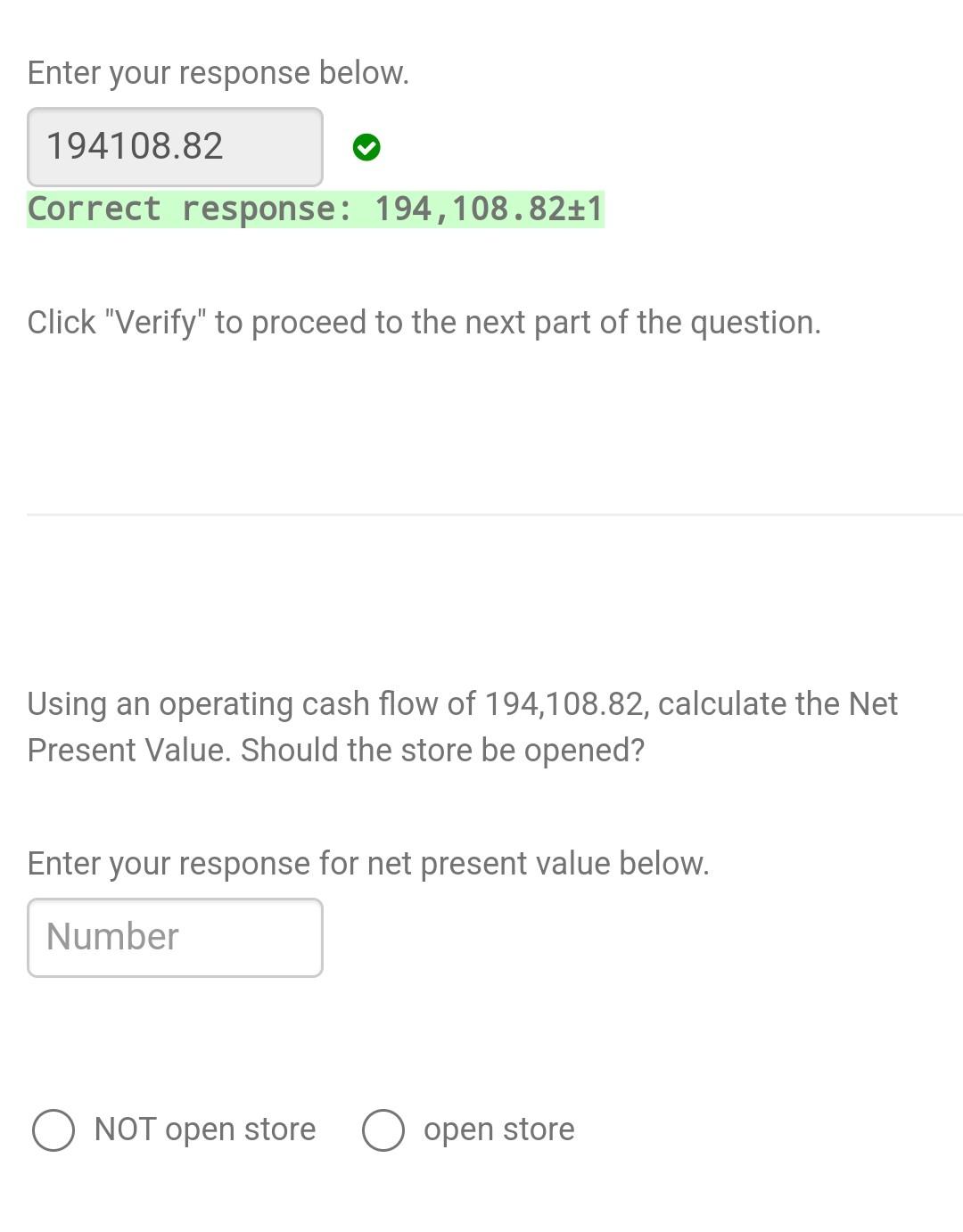

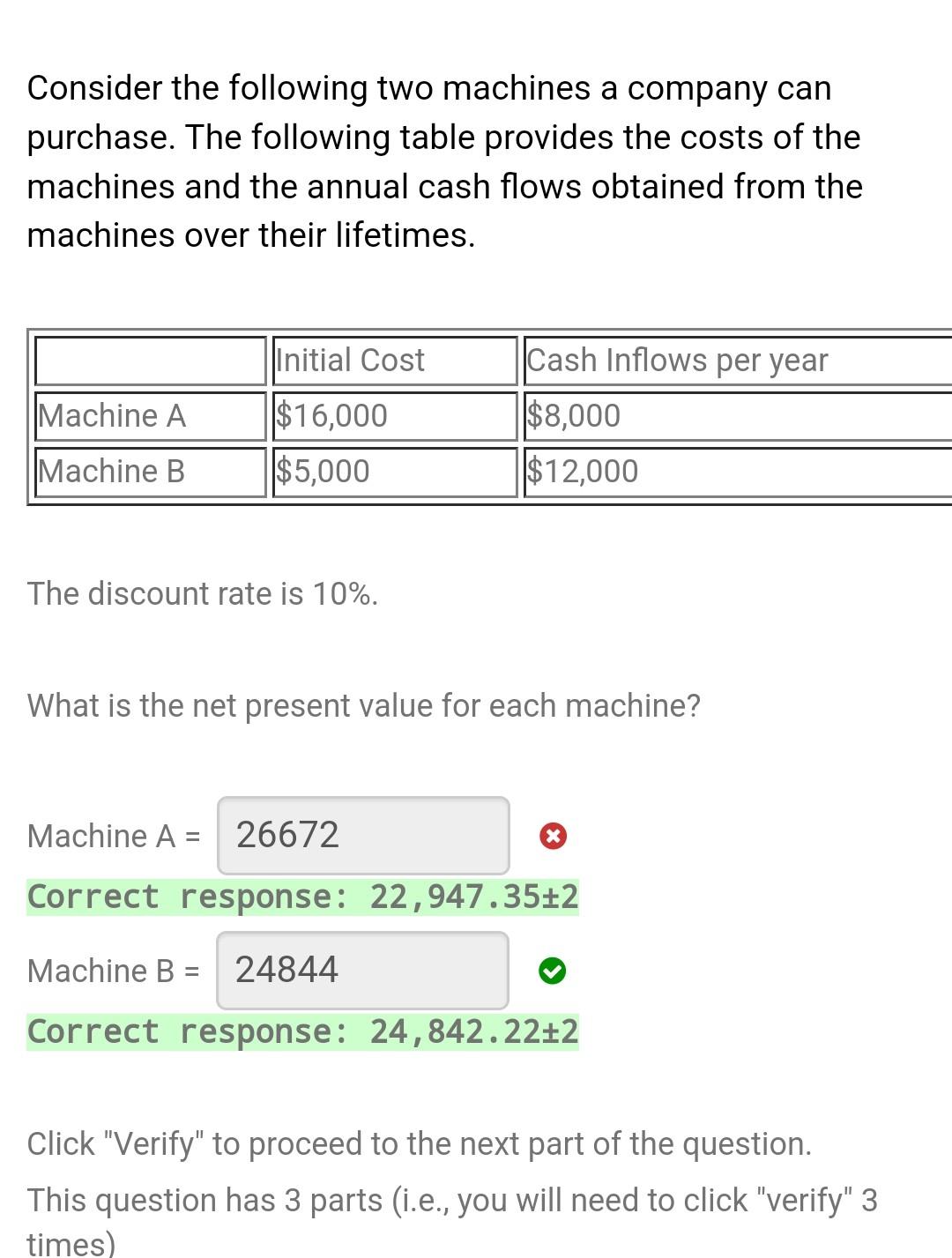

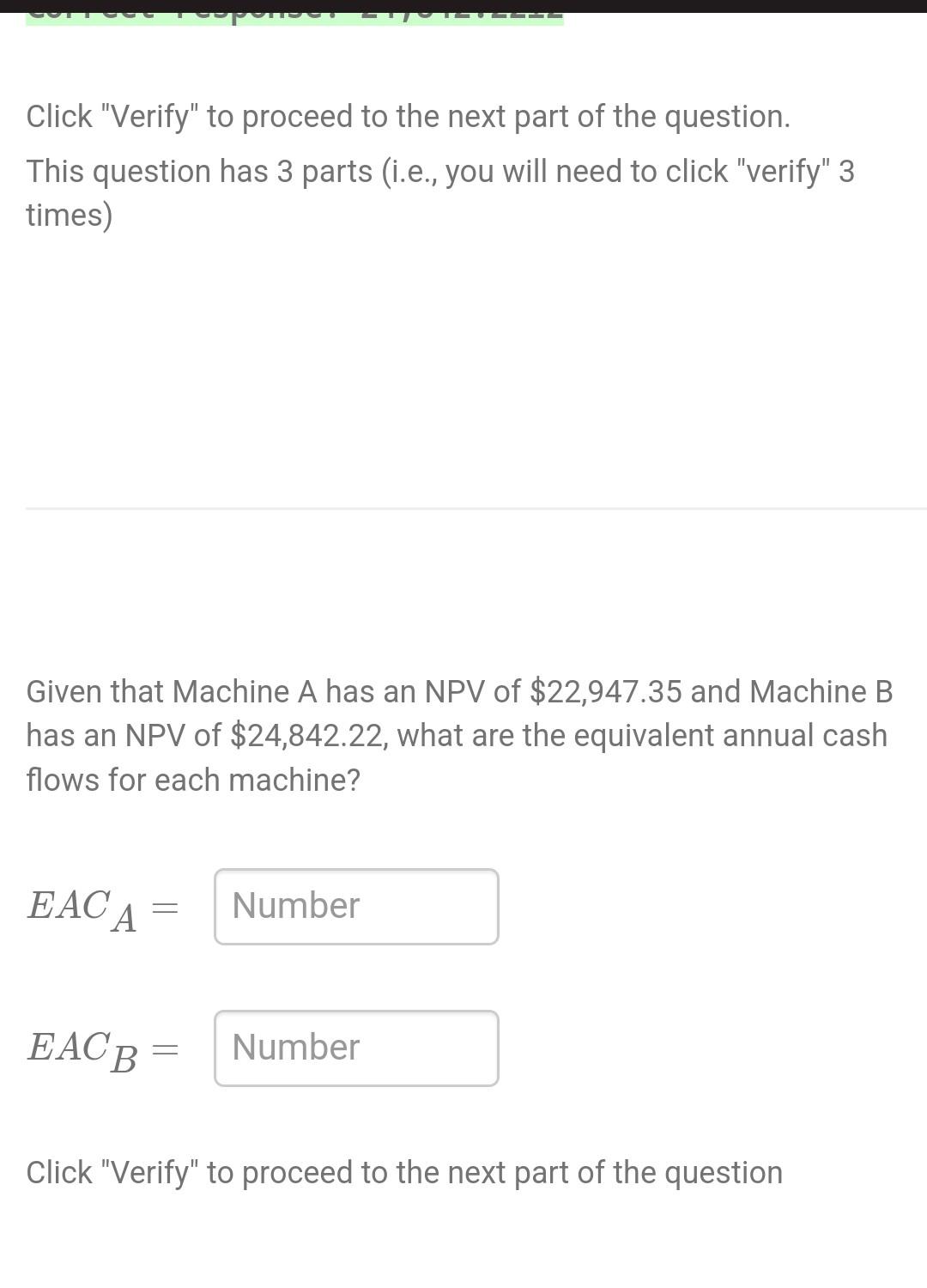

A store will cost $825,000 to open. Variable costs will be 53% of sales and fixed costs are $190,000 per year. The investment costs will be depreciated straight-line over the 17 year life of the store to a salvage value of zero. The opportunity cost of capital is 13% and the tax rate is 30%. Find the operating cash flow if sales revenue is $950,000 per year. Enter your response below. Correct response: 194,108.821 Click "Verify" to proceed to the next part of the question. Enter your response below. Correct response: 194,108.821 Click "Verify" to proceed to the next part of the question. Using an operating cash flow of 194,108.82, calculate the Net Present Value. Should the store be opened? Enter your response for net present value below. NOT open store open store Consider the following two machines a company can purchase. The following table provides the costs of the machines and the annual cash flows obtained from the machines over their lifetimes. The discount rate is 10%. What is the net present value for each machine? Machine A= Correct response: 22,947.352 Machine B= Correct response: 24,842.222 Click "Verify" to proceed to the next part of the question. This question has 3 parts (i.e., you will need to click "verify" 3 times) Click "Verify" to proceed to the next part of the question. This question has 3 parts (i.e., you will need to click "verify" 3 times) Given that Machine A has an NPV of $22,947.35 and Machine B has an NPV of $24,842.22, what are the equivalent annual cash flows for each machine? EACA= EACB= Click "Verify" to proceed to the next part of the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started