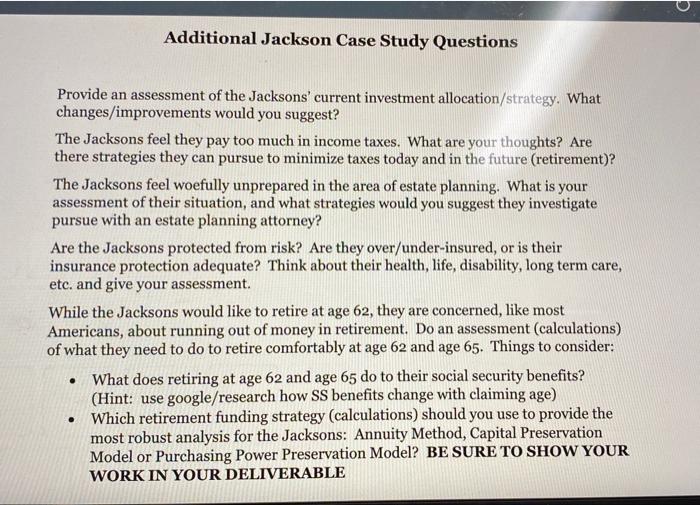

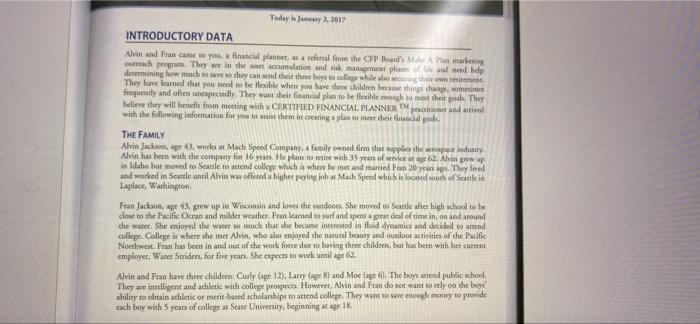

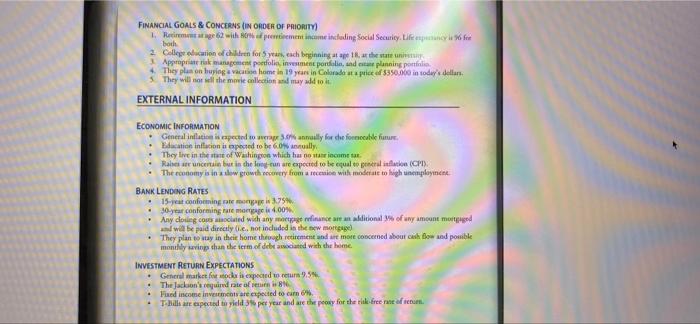

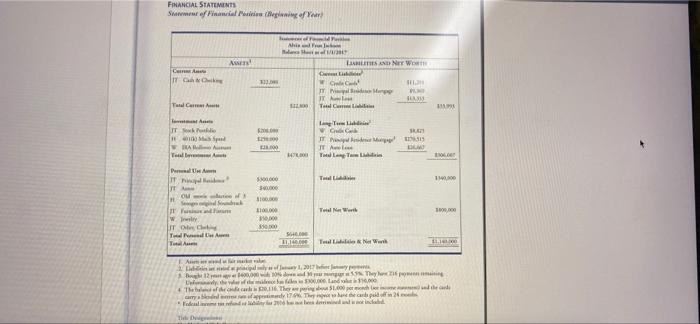

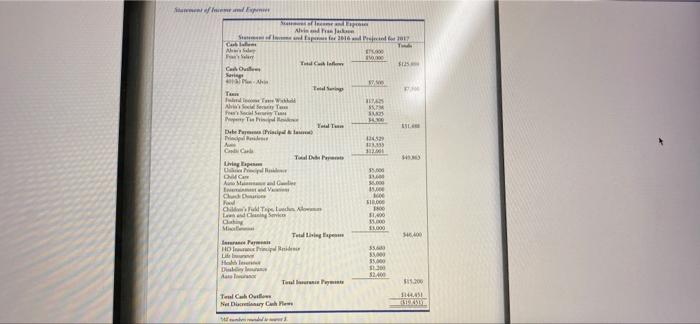

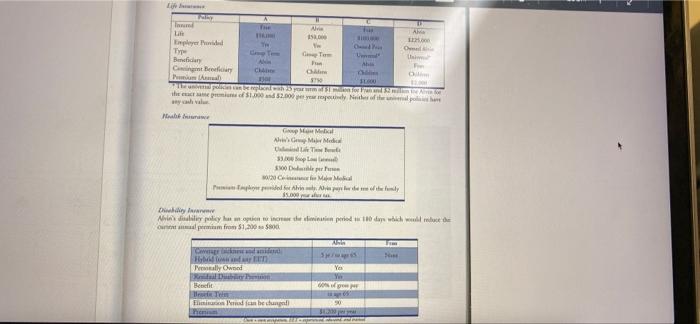

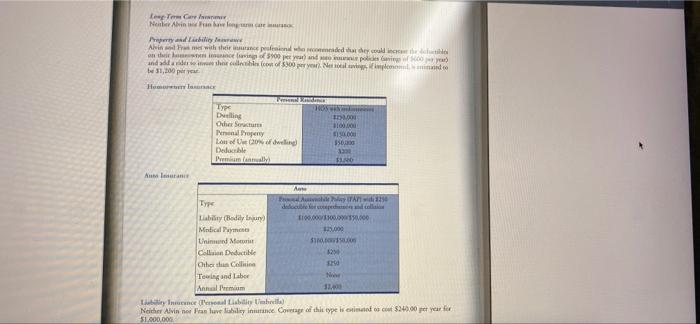

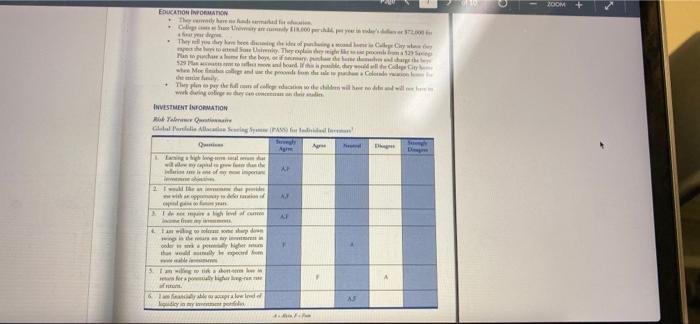

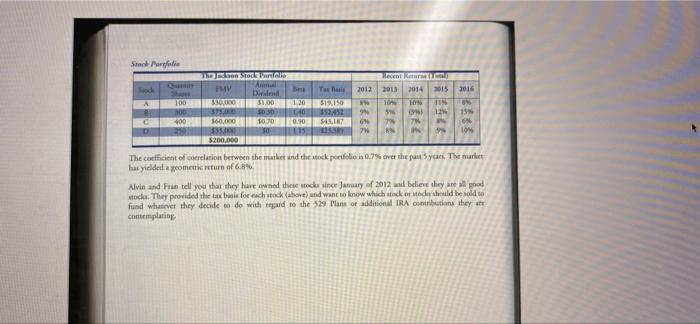

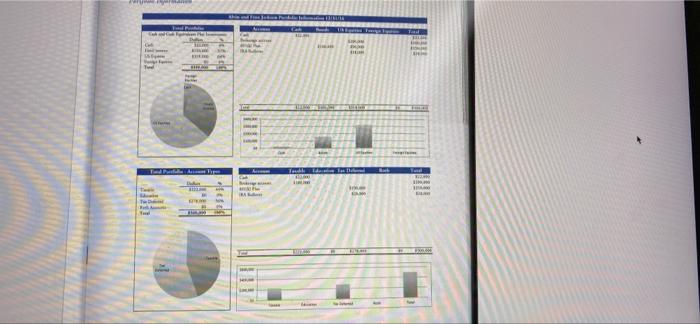

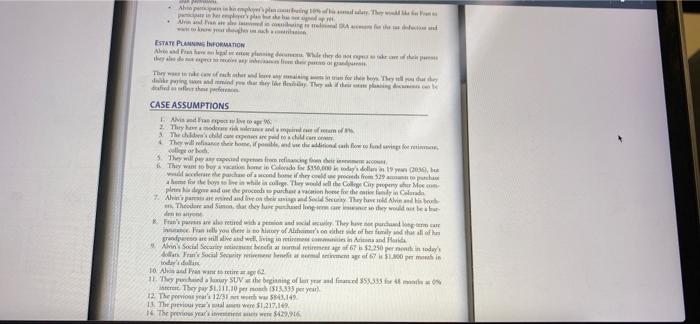

b Additional Jackson Case Study Questions Provide an assessment of the Jacksons' current investment allocation/strategy. What changes/improvements would you suggest? The Jacksons feel they pay too much in income taxes. What are your thoughts? Are there strategies they can pursue to minimize taxes today and in the future (retirement)? The Jacksons feel woefully unprepared in the area of estate planning. What is your assessment of their situation, and what strategies would you suggest they investigate pursue with an estate planning attorney? Are the Jacksons protected from risk? Are they over/under-insured, or is their insurance protection adequate? Think about their health, life, disability, long term care, etc. and give your assessment. While the Jacksons would like to retire at age 62, they are concerned, like most Americans, about running out of money in retirement. Do an assessment (calculations) of what they need to do to retire comfortably at age 62 and age 65. Things to consider: What does retiring at age 62 and age 65 do to their social security benefits? (Hint: use google/research how SS benefits change with claiming age) Which retirement funding strategy (calculations) should you use to provide the most robust analysis for the Jacksons: Annuity Method, Capital Preservation Model or Purchasing Power Preservation Model? BE SURE TO SHOW YOUR WORK IN YOUR DELIVERABLE . Today is Jy 3, 2017 INTRODUCTORY DATA Alvin and Fran came to you financial planeta referal from the CFP Board' MA marketing och program. They are in the accumulative and risk management phases of life and need help determining how much to save they can send their three boys to college while when the wintiment They have learned that you need to be flexible when you have three children became things chang.com frequently and often unexpectedly. They want their financial plan to be flexible coach to meet their goals. They believe they will benefit from meeting with CERTIFIED FINANCIAL PLANNER practices and antivel with the following information for you to them in creating plan to meet their finansal pool THE FAMILY Alvin Jackson, age, work at Madh Speed Company, a family owned firm that supplies the pace Industry Alvin has been with the company for 16 years. He plans to retire with 3 years of service tag 02. Alvin grew up in Idaho but moved to Seade to attend college which where he met and married Fran 20 years ago. They lived and worked in Seattle until Alvin was offered higher puying job Mach Speed which is located south of Scuttle in Laplace, Washington Fran Jackson, age 43 grew up in Wisconsin and loves the outdoon. She moved to Sende after high school to be doit to the Pacific Ocean and mildet weather. Fran leamed to surf and spent a great deal of time in, on and around che water. She enjoyed the was so much that she became interested in Hand dynamics and decided to attend college College is where she met Ahrin, who also enjoyed the natural beauty and outdoor activities of the Pacific Northwest. Fran has been in and out of the work force due to having three children, but has been with her curren. employer. Water Seriden, for five years. She expects to work untilage 62 Alvin and Fran have three children: Curly Cage 12). Larry (age 8) and Moe lage. The boys attend public school They are intelligent and athlete with college prospects. However. Alvin and Fran do not want to rely on the boys ability to obtain athletic or merit-based scholarships to attend college. They want to save enough money to provide cach boy with 5 years of college a State University, beginning at age 18 FINANCIAL GOALS & CONCERNS (IN ORDER OF PRIORITY) 1. Retire with pretirement income including Social Security Uncle feet both 2 College education of children for 5 years each beginning the state Appropriatrisk management portfolio investment portfolio and planning ponni 4. They plan on buying a home in 19 years in Colorado pri 350.000 in today's della 5 They will nor well the movie collection and may add to EXTERNAL INFORMATION ECONOMIC INFORMATION General inflation is capected to wrap 3.67% annually for the focuble four dacation inflacionis expected to be 60nully They live in the state of Washington which has no stanicama Rabes uncertain but in the long-run are expected to be equal peneralinion (OP The economy is in a slow growth recovery from a recension with moderate to high unemployment BANK LENDING RATES 15-year conforming at 3.75% 30 year conforming rate mora i 4.00% Any couling comes clied with any page refinance en lion of iny amount mopped and will be paid directly lie hot induded in the new morgige They plan to stay in the home through retirement and are more concerned about how and posible monly wing than the term of debt cited with the home INVESTMENT RETURN EXPECTATIONS General market for work expected to return 9.5 The Jackson'sired rate of Fund income invenements are expected to cur 6%. Tillsar espected to yield per year and are the proxy for the free run FINANCIAL STATEMENTS Smarowal (eling of Year him wa LALTS AND NEW AN CA IT GO 1. IT Ta Gar Tital ITS F pel G IT'S ITA Tali Tea Per Tal 11 OM Total War 1000 2010 W ITO TECH Tutul Tulede Wik LA www.2017 12 They man 4 Thread The 1.000 de carry To They have the capi www The Du Area 106 107 Ah For Salary Total SUS CO Serie hi w Twe TAR ww Am Free To Yal Debes Tip 1.13 C Tural D Living lar 5. ON AG 6.000 EN 15200 Gud I. Opusco LC 11.00 Oui 3.000 Tul unles 6.00 I. HOR 35 Life Hoe D 3 A $2.400 Tuale S. Teulu Owill 444 New Cale 200 www. AME Tum he Avi 150 player Type Ger Bmalar AN Ah C C Punim me For ST 7. who. heim of $1.00 152.000 op. Nitro 1 O O GM Male Medien le 3. SOOD 120 MM ed for videre 32.000 Own While playa en period which we Outprium from 1,200 $80 C sally Oweed Yes Yur Bet Te Flintind can become Hem BE Care Novinha Prapy and ability for Aline with their profesional weddy would be on the go 900 dpi) and the cool 300 per your empleo 31,200 Hea 15.00 10.00 Typ Delling Other Secure honey London Deluche Premium 350 33 Antaran Art wide Liability (Bodily 10.000.000.000 Minbicaly 125.000 Linia Maurit SIS Coll Deductible Othod Celine Towing and labor Annual Rem LO Labirynced by the Neither Alvinnor Freeluve ability instance Coverage of this type loc $240.00 per year for 51.000,00 2DOM EDUCATION INFORMATION The way hew G. your . They were power Topp 125 Plan to the ward. Why whes Meet the people wy They we will be INVESTMENT INFORMATION Yal Galled Allow Light 2 whe wilder yan |TA 1 w poker hoy empecem www Twith bigg Ieprinde Lady is AS 31150 Snack Perefolie The STEP Recent Am FMV Taas 2012 2013 wand 2014 2015 2016 A 100 330000 31.00 120 10 10 300 SD30 CO 3 126 153 400 160.000 10.30 0.90 SALE 7 TH 6N 21 0 ETS 7 10 $200,000 The cofficient of correlation between the market and the stock portfolio in 0.7% over the past year. The market hat yielded a prometne return of 6.8% Alvin and Fran tell you that they have owned the stock since January of 2012 and believe they are good tod. They provided the table for each wok hove) und want to know which tockor oda should be sold to fund wasver they decide to do with regard to the 529 Mansor additional IRA Contribution they contemplating FI Alisher. They pembe view nya ESTATE PLANNING INFORMATION Added They were by They will dolegliw they are They Weeping andialan CASE ASSUMPTIONS Adres www to 2. Thunder The child pod to 4Tall aiara hara paathal aalnil urite allegor had They will paypal.com They want to buy this Condoo, is today, w the path of the 29 to purchase wie by to me while in college. They will the College CyperMe.com plepende de procedures can be the Code Arred and so do Sony Thaye vind Theodore and Simon, dat de lux penthed me they will be Fire she retired with a www They have plecare Tanies you there is my of Alchim's on the video berishwa and relative and will living in rete Armand Hala Alvin Social Security betwema ma 12.250 per min today dollar Social Security intent of 200 min 10 Alas want to retire 62 11. hdwy SUV bang of life 53333 ON The 110 per month 12 The previous year's 12/31 S149 13. The previous you were 51.217.14 16. The previous year's iets were 429916 b Additional Jackson Case Study Questions Provide an assessment of the Jacksons' current investment allocation/strategy. What changes/improvements would you suggest? The Jacksons feel they pay too much in income taxes. What are your thoughts? Are there strategies they can pursue to minimize taxes today and in the future (retirement)? The Jacksons feel woefully unprepared in the area of estate planning. What is your assessment of their situation, and what strategies would you suggest they investigate pursue with an estate planning attorney? Are the Jacksons protected from risk? Are they over/under-insured, or is their insurance protection adequate? Think about their health, life, disability, long term care, etc. and give your assessment. While the Jacksons would like to retire at age 62, they are concerned, like most Americans, about running out of money in retirement. Do an assessment (calculations) of what they need to do to retire comfortably at age 62 and age 65. Things to consider: What does retiring at age 62 and age 65 do to their social security benefits? (Hint: use google/research how SS benefits change with claiming age) Which retirement funding strategy (calculations) should you use to provide the most robust analysis for the Jacksons: Annuity Method, Capital Preservation Model or Purchasing Power Preservation Model? BE SURE TO SHOW YOUR WORK IN YOUR DELIVERABLE . Today is Jy 3, 2017 INTRODUCTORY DATA Alvin and Fran came to you financial planeta referal from the CFP Board' MA marketing och program. They are in the accumulative and risk management phases of life and need help determining how much to save they can send their three boys to college while when the wintiment They have learned that you need to be flexible when you have three children became things chang.com frequently and often unexpectedly. They want their financial plan to be flexible coach to meet their goals. They believe they will benefit from meeting with CERTIFIED FINANCIAL PLANNER practices and antivel with the following information for you to them in creating plan to meet their finansal pool THE FAMILY Alvin Jackson, age, work at Madh Speed Company, a family owned firm that supplies the pace Industry Alvin has been with the company for 16 years. He plans to retire with 3 years of service tag 02. Alvin grew up in Idaho but moved to Seade to attend college which where he met and married Fran 20 years ago. They lived and worked in Seattle until Alvin was offered higher puying job Mach Speed which is located south of Scuttle in Laplace, Washington Fran Jackson, age 43 grew up in Wisconsin and loves the outdoon. She moved to Sende after high school to be doit to the Pacific Ocean and mildet weather. Fran leamed to surf and spent a great deal of time in, on and around che water. She enjoyed the was so much that she became interested in Hand dynamics and decided to attend college College is where she met Ahrin, who also enjoyed the natural beauty and outdoor activities of the Pacific Northwest. Fran has been in and out of the work force due to having three children, but has been with her curren. employer. Water Seriden, for five years. She expects to work untilage 62 Alvin and Fran have three children: Curly Cage 12). Larry (age 8) and Moe lage. The boys attend public school They are intelligent and athlete with college prospects. However. Alvin and Fran do not want to rely on the boys ability to obtain athletic or merit-based scholarships to attend college. They want to save enough money to provide cach boy with 5 years of college a State University, beginning at age 18 FINANCIAL GOALS & CONCERNS (IN ORDER OF PRIORITY) 1. Retire with pretirement income including Social Security Uncle feet both 2 College education of children for 5 years each beginning the state Appropriatrisk management portfolio investment portfolio and planning ponni 4. They plan on buying a home in 19 years in Colorado pri 350.000 in today's della 5 They will nor well the movie collection and may add to EXTERNAL INFORMATION ECONOMIC INFORMATION General inflation is capected to wrap 3.67% annually for the focuble four dacation inflacionis expected to be 60nully They live in the state of Washington which has no stanicama Rabes uncertain but in the long-run are expected to be equal peneralinion (OP The economy is in a slow growth recovery from a recension with moderate to high unemployment BANK LENDING RATES 15-year conforming at 3.75% 30 year conforming rate mora i 4.00% Any couling comes clied with any page refinance en lion of iny amount mopped and will be paid directly lie hot induded in the new morgige They plan to stay in the home through retirement and are more concerned about how and posible monly wing than the term of debt cited with the home INVESTMENT RETURN EXPECTATIONS General market for work expected to return 9.5 The Jackson'sired rate of Fund income invenements are expected to cur 6%. Tillsar espected to yield per year and are the proxy for the free run FINANCIAL STATEMENTS Smarowal (eling of Year him wa LALTS AND NEW AN CA IT GO 1. IT Ta Gar Tital ITS F pel G IT'S ITA Tali Tea Per Tal 11 OM Total War 1000 2010 W ITO TECH Tutul Tulede Wik LA www.2017 12 They man 4 Thread The 1.000 de carry To They have the capi www The Du Area 106 107 Ah For Salary Total SUS CO Serie hi w Twe TAR ww Am Free To Yal Debes Tip 1.13 C Tural D Living lar 5. ON AG 6.000 EN 15200 Gud I. Opusco LC 11.00 Oui 3.000 Tul unles 6.00 I. HOR 35 Life Hoe D 3 A $2.400 Tuale S. Teulu Owill 444 New Cale 200 www. AME Tum he Avi 150 player Type Ger Bmalar AN Ah C C Punim me For ST 7. who. heim of $1.00 152.000 op. Nitro 1 O O GM Male Medien le 3. SOOD 120 MM ed for videre 32.000 Own While playa en period which we Outprium from 1,200 $80 C sally Oweed Yes Yur Bet Te Flintind can become Hem BE Care Novinha Prapy and ability for Aline with their profesional weddy would be on the go 900 dpi) and the cool 300 per your empleo 31,200 Hea 15.00 10.00 Typ Delling Other Secure honey London Deluche Premium 350 33 Antaran Art wide Liability (Bodily 10.000.000.000 Minbicaly 125.000 Linia Maurit SIS Coll Deductible Othod Celine Towing and labor Annual Rem LO Labirynced by the Neither Alvinnor Freeluve ability instance Coverage of this type loc $240.00 per year for 51.000,00 2DOM EDUCATION INFORMATION The way hew G. your . They were power Topp 125 Plan to the ward. Why whes Meet the people wy They we will be INVESTMENT INFORMATION Yal Galled Allow Light 2 whe wilder yan |TA 1 w poker hoy empecem www Twith bigg Ieprinde Lady is AS 31150 Snack Perefolie The STEP Recent Am FMV Taas 2012 2013 wand 2014 2015 2016 A 100 330000 31.00 120 10 10 300 SD30 CO 3 126 153 400 160.000 10.30 0.90 SALE 7 TH 6N 21 0 ETS 7 10 $200,000 The cofficient of correlation between the market and the stock portfolio in 0.7% over the past year. The market hat yielded a prometne return of 6.8% Alvin and Fran tell you that they have owned the stock since January of 2012 and believe they are good tod. They provided the table for each wok hove) und want to know which tockor oda should be sold to fund wasver they decide to do with regard to the 529 Mansor additional IRA Contribution they contemplating FI Alisher. They pembe view nya ESTATE PLANNING INFORMATION Added They were by They will dolegliw they are They Weeping andialan CASE ASSUMPTIONS Adres www to 2. Thunder The child pod to 4Tall aiara hara paathal aalnil urite allegor had They will paypal.com They want to buy this Condoo, is today, w the path of the 29 to purchase wie by to me while in college. They will the College CyperMe.com plepende de procedures can be the Code Arred and so do Sony Thaye vind Theodore and Simon, dat de lux penthed me they will be Fire she retired with a www They have plecare Tanies you there is my of Alchim's on the video berishwa and relative and will living in rete Armand Hala Alvin Social Security betwema ma 12.250 per min today dollar Social Security intent of 200 min 10 Alas want to retire 62 11. hdwy SUV bang of life 53333 ON The 110 per month 12 The previous year's 12/31 S149 13. The previous you were 51.217.14 16. The previous year's iets were 429916