Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(b) An investor has taken a short position in a forward contract. If Sy is the price of the underlying stock at maturity and K

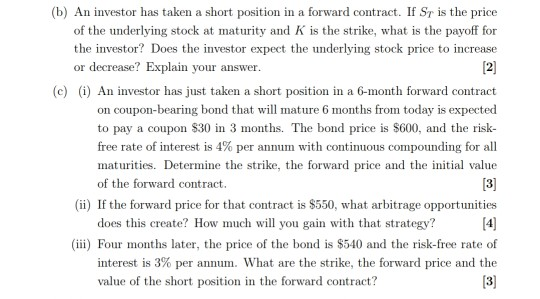

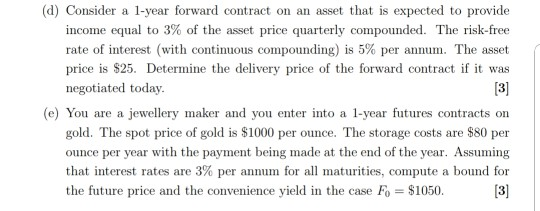

(b) An investor has taken a short position in a forward contract. If Sy is the price of the underlying stock at maturity and K is the strike, what is the payoff for the investor? Does the investor expect the underlying stock price to increase or decrease? Explain your answer. [2] (c) (i) An investor has just taken a short position in a 6-month forward contract on coupon-bearing bond that will mature 6 months from today is expected to pay a coupon $30 in 3 months. The bond price is $600, and the risk- free rate of interest is 4% per annum with continuous compounding for all maturities. Determine the strike, the forward price and the initial value of the forward contract. [3] (ii) If the forward price for that contract is $550, what arbitrage opportunities does this create? How much will you gain with that strategy? (iii) Four months later, the price of the bond is $540 and the risk-free rate of interest is 3% per annum. What are the strike, the forward price and the value of the short position in the forward contract? (3) (d) Consider a 1-year forward contract on an asset that is expected to provide income equal to 3% of the asset price quarterly compounded. The risk-free rate of interest (with continuous compounding) is 5% per annum. The asset price is $25. Determine the delivery price of the forward contract if it was negotiated today. [3] (e) You are a jewellery maker and you enter into a 1-year futures contracts on gold. The spot price of gold is $1000 per ounce. The storage costs are $80 per ounce per year with the payment being made at the end of the year. Assuming that interest rates are 3% per annum for all maturities, compute a bound for the future price and the convenience yield in the case Fo = $1050. [3]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started