Answered step by step

Verified Expert Solution

Question

1 Approved Answer

b Apple Corporation expects an EBIT of $23,000 every year forever. The company currently has no debt, and its cost of equity is 11 percent.

b

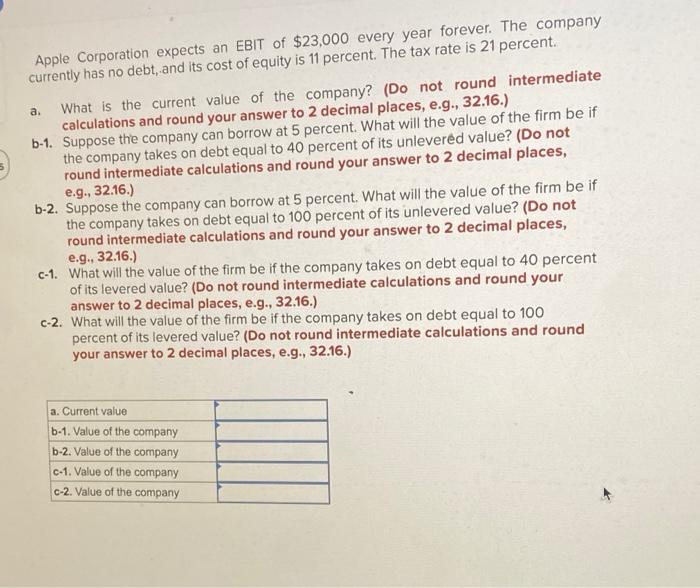

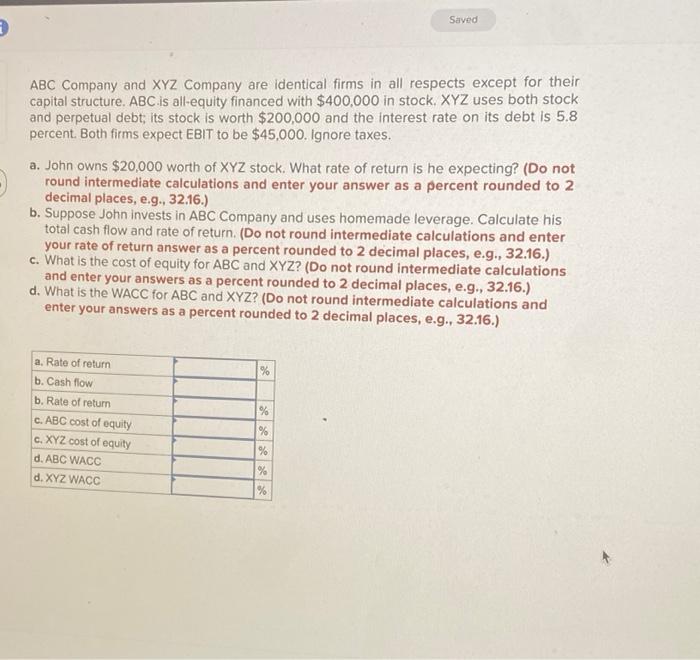

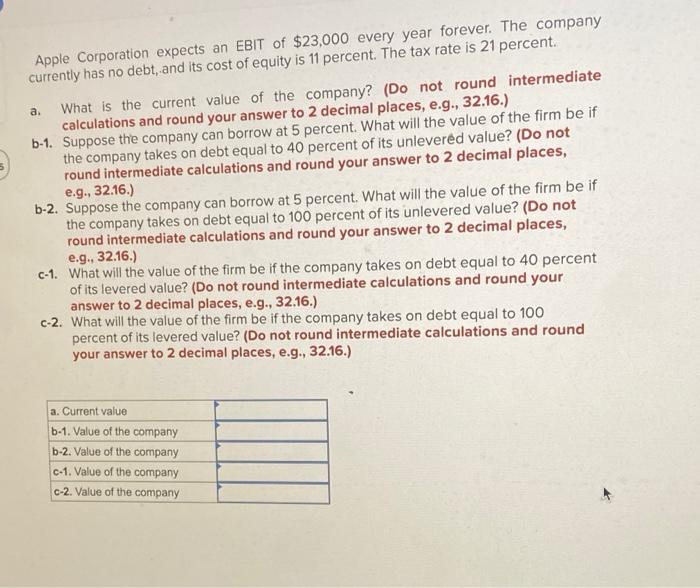

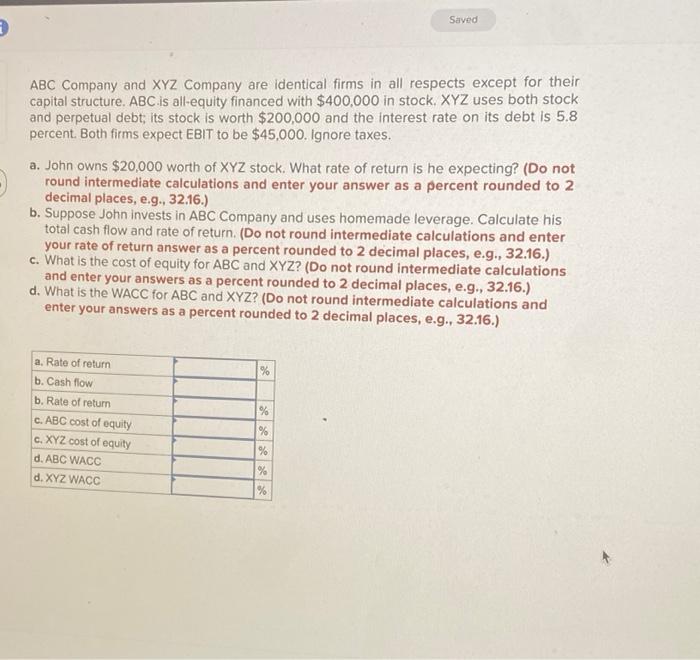

Apple Corporation expects an EBIT of $23,000 every year forever. The company currently has no debt, and its cost of equity is 11 percent. The tax rate is 21 percent. a. What is the current value of the company? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b-1. Suppose the company can borrow at 5 percent. What will the value of the firm be if the company takes on debt equal to 40 percent of its unlevered value? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b-2. Suppose the company can borrow at 5 percent. What will the value of the firm be if the company takes on debt equal to 100 percent of its unlevered value? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c-1. What will the value of the firm be if the company takes on debt equal to 40 percent of its levered value? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c-2. What will the value of the firm be if the company takes on debt equal to 100 percent of its levered value? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Current value b-1. Value of the company b-2. Value of the company C-1. Value of the company c-2. Value of the company Saved ABC Company and XYZ Company are identical firms in all respects except for their capital structure. ABC is all-equity financed with $400,000 in stock. XYZ uses both stock and perpetual debt; its stock is worth $200,000 and the interest rate on its debt is 5.8 percent. Both firms expect EBIT to be $45,000. Ignore taxes. a. John owns $20,000 worth of XYZ stock. What rate of return is he expecting? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. Suppose John invests in ABC Company and uses homemade leverage Calculate his total cash flow and rate of return. (Do not round intermediate calculations and enter your rate of return answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the cost of equity for ABC and XYZ? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) d. What is the WACC for ABC and XYZ? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) % a. Rate of return b. Cash flow b. Rate of return c. ABC cost of equity c. XYZ cost of equity d. ABC WACC d. XYZ WACC % % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started