Question

b. Argo's maintenance service business grosses some $33M per year before discounts and its average days receivable is 20 (unlike the overall business where this

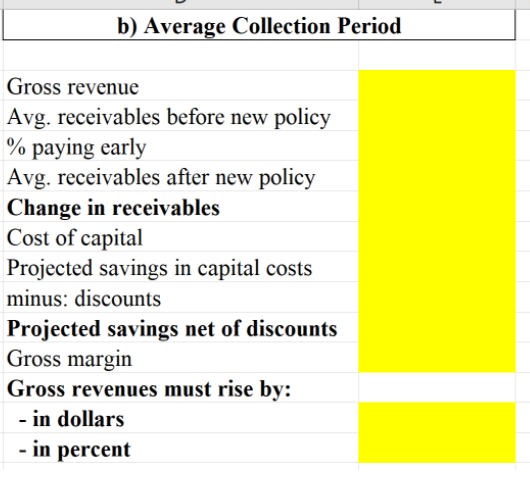

b. Argo's maintenance service business grosses some $33M per year before discounts and its average days receivable is 20 (unlike the overall business where this number is ~15). If 20% of Argo's clients opt to pay earlier and get the 1.1% discount, what will be the change in the service business's receivables? If Argo's cost of capital is 6%, what are the projected savings of this change in policy? If Argo's gross margin is 33%, by how much will gross dollar revenues have to rise to offset the loss from discounts? In percent?

IMPORTANT: PLEASE SHOW FORMULAS USED TO CALCULATE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started