b. Assume that Pirate uses the fully adjusted equity method. Record all journal entries that relate to its investment in the Norwegian subsidiary during 20X5. Provide the necessary documentation and support for the amounts in the journal entries, including a schedule of the translation adjustment related to the differential. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

1) Record the purchase of Ship Inc.

2) Record the dividend received from the foreign subsidiary.

3) Record the equity in the net income of the foreign subsidiary.

4) Record the parent's share of the translation adjustment from the translation of the subsidiary's accounts.

5) Record the amortization of the differential.

6) Record the translation adjustment applicable to the differential.

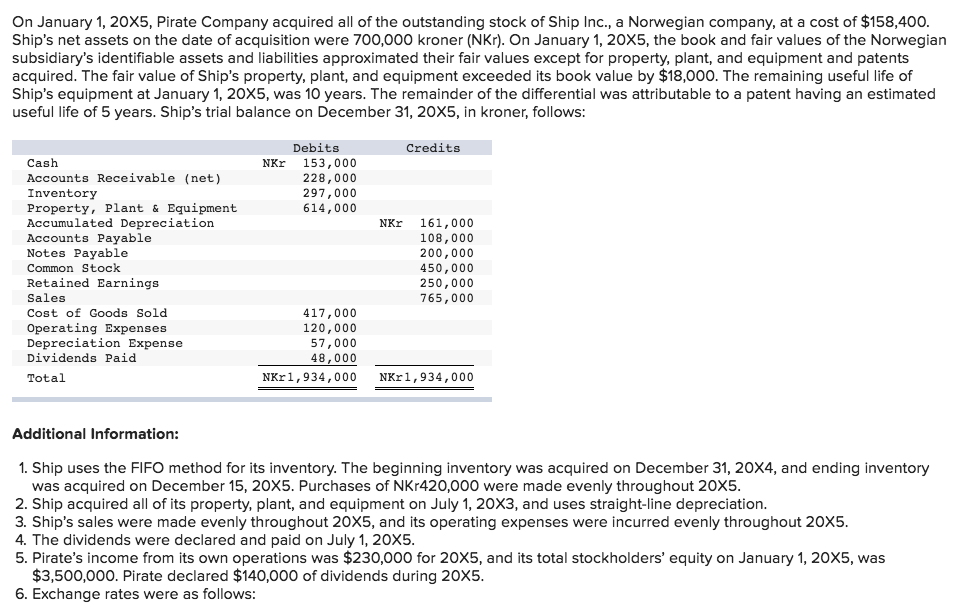

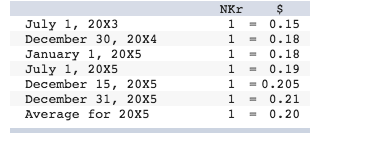

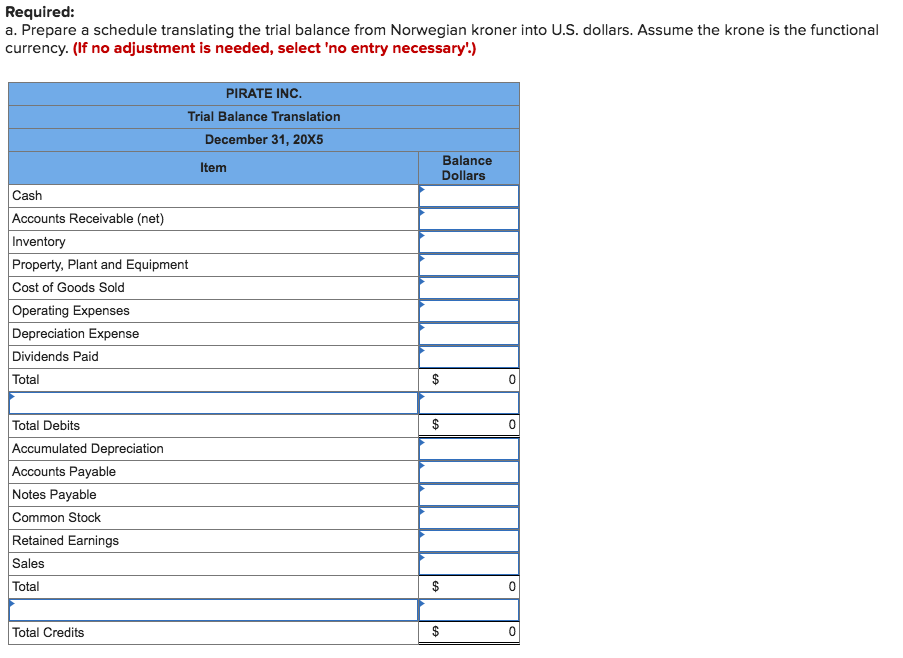

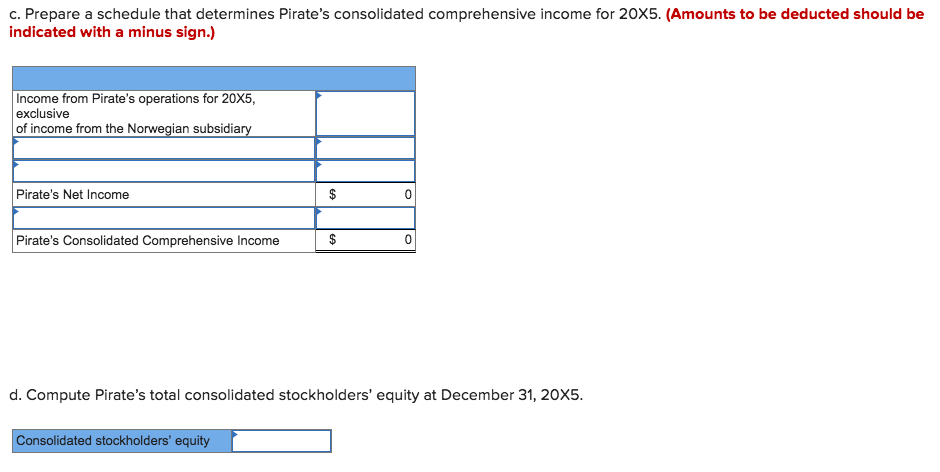

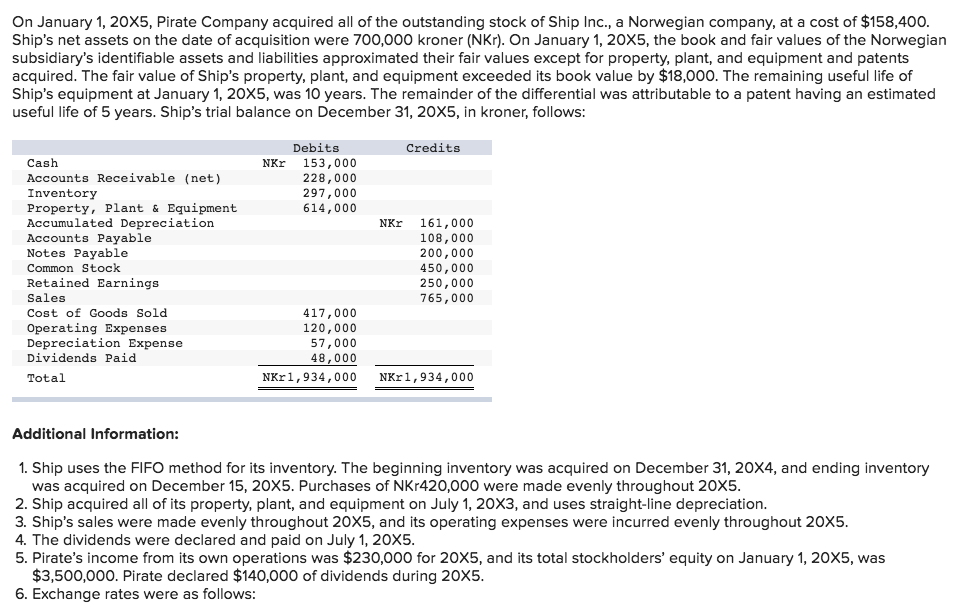

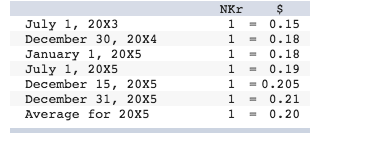

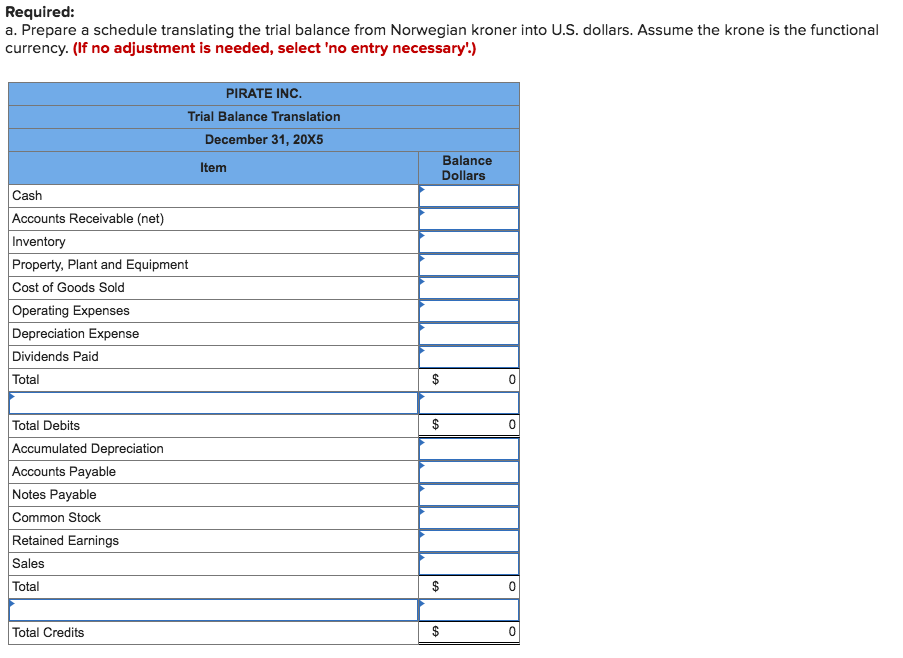

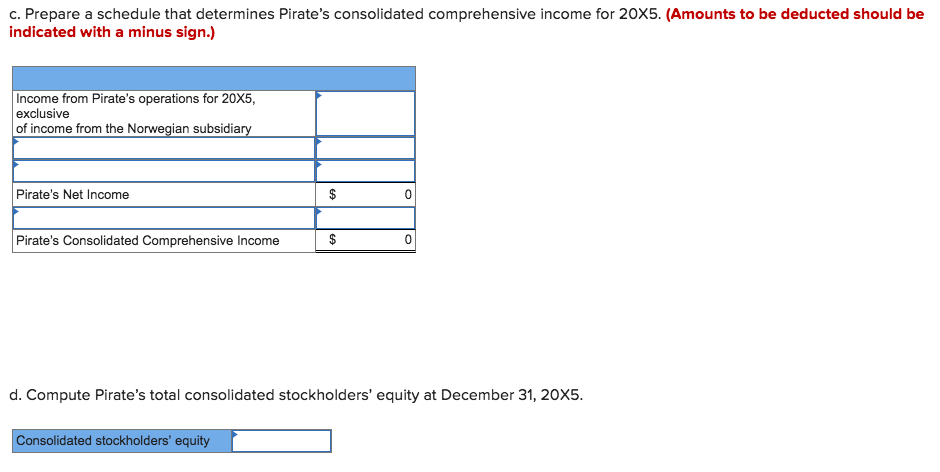

On January 1, 20X5, Pirate Company acquired all of the outstanding stock of Ship Inc., a Norwegian company, at a cost of $158,400 Ship's net assets on the date of acquisition were 700,000 kroner (NKr). On January 1, 20X5, the book and fair values of the Norwegian subsidiary's identifiable assets and liabilities approximated their fair values except for property, plant, and equipment and patents acquired. The fair value of Ship's property, plant, and equipment exceeded its book value by $18,000. The remaining useful life of Ship's equipment at January 1, 20X5, was 10 years. The remainder of the differential was attributable to a patent having an estimated useful life of 5 years. Ship's trial balance on December 31, 20x5, in kroner, follows: Debits Credits NKr 153,000 228,000 297,000 614,000 Cash Accounts Receivable (net) Inventory Property, Plant & Equipment Accumulated Depreciation Accounts Payable Notes Pavable Common Stock Retained Earnings Sales Cost of Goods Sold Operating Expenses Depreciation Expense Dividends Paid Total NKr 161,000 108,000 200,000 450,000 250,000 765,000 417,000 120,000 57,000 48,000 NKr1,934,000 NKr1,934,000 Additional Information: 1. Ship uses the FIFO method for its inventory. The beginning inventory was acquired on December 31, 20X4, and ending inventory was acquired on December 15, 20X5. Purchases of NKr420,000 were made evenly throughout 20X5 2. Ship acquired all of its property, plant, and equipment on July 1, 20X3, and uses straight-line depreciation 3. Ship's sales were made evenly throughout 20X5, and its operating expenses were incurred evenly throughout 20X5 4. The dividends were declared and paid on July 1, 20X5 5. Pirate's income from its own operations was $230,000 for 20X5, and its total stockholders' equity on January 1, 20X5, was $3,500,000. Pirate declared $140,000 of dividends during 20X5 6. Exchange rates were as follows On January 1, 20X5, Pirate Company acquired all of the outstanding stock of Ship Inc., a Norwegian company, at a cost of $158,400 Ship's net assets on the date of acquisition were 700,000 kroner (NKr). On January 1, 20X5, the book and fair values of the Norwegian subsidiary's identifiable assets and liabilities approximated their fair values except for property, plant, and equipment and patents acquired. The fair value of Ship's property, plant, and equipment exceeded its book value by $18,000. The remaining useful life of Ship's equipment at January 1, 20X5, was 10 years. The remainder of the differential was attributable to a patent having an estimated useful life of 5 years. Ship's trial balance on December 31, 20x5, in kroner, follows: Debits Credits NKr 153,000 228,000 297,000 614,000 Cash Accounts Receivable (net) Inventory Property, Plant & Equipment Accumulated Depreciation Accounts Payable Notes Pavable Common Stock Retained Earnings Sales Cost of Goods Sold Operating Expenses Depreciation Expense Dividends Paid Total NKr 161,000 108,000 200,000 450,000 250,000 765,000 417,000 120,000 57,000 48,000 NKr1,934,000 NKr1,934,000 Additional Information: 1. Ship uses the FIFO method for its inventory. The beginning inventory was acquired on December 31, 20X4, and ending inventory was acquired on December 15, 20X5. Purchases of NKr420,000 were made evenly throughout 20X5 2. Ship acquired all of its property, plant, and equipment on July 1, 20X3, and uses straight-line depreciation 3. Ship's sales were made evenly throughout 20X5, and its operating expenses were incurred evenly throughout 20X5 4. The dividends were declared and paid on July 1, 20X5 5. Pirate's income from its own operations was $230,000 for 20X5, and its total stockholders' equity on January 1, 20X5, was $3,500,000. Pirate declared $140,000 of dividends during 20X5 6. Exchange rates were as follows