Answered step by step

Verified Expert Solution

Question

1 Approved Answer

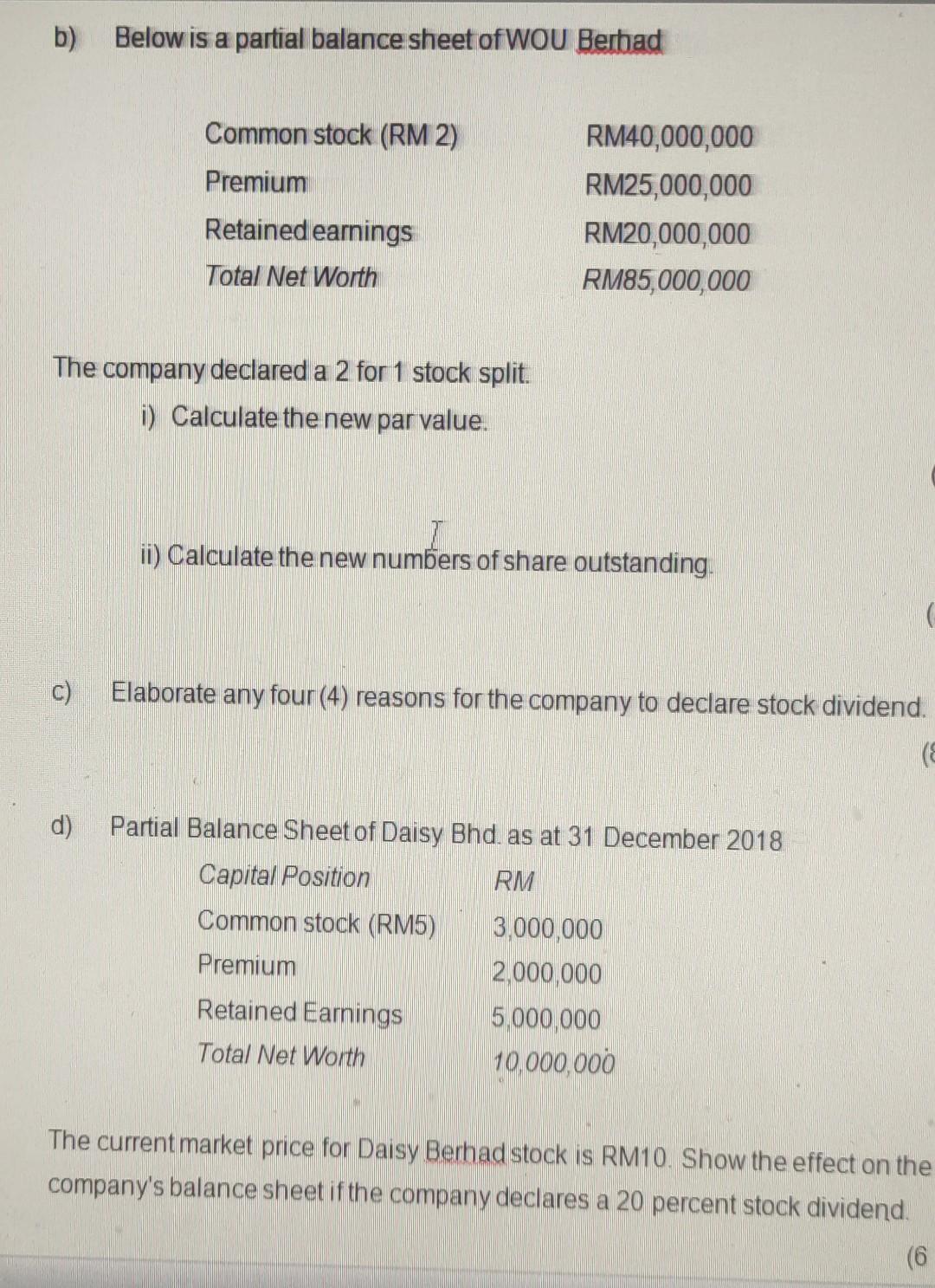

b) Below is a partial balance sheet of WOU Berhad Common stock (RM 2) Premium Retained earnings Total Net Worth The company declared a 2

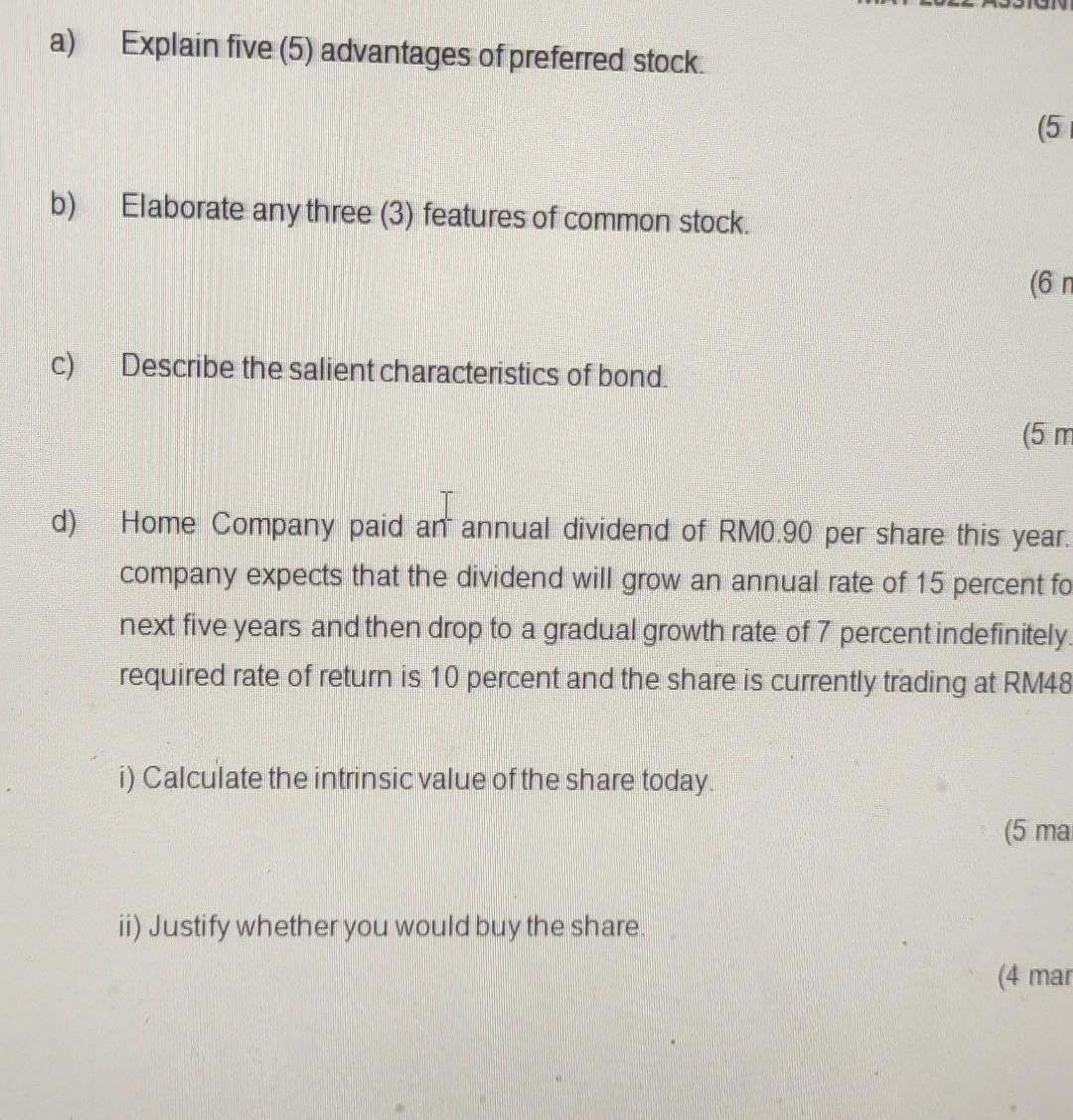

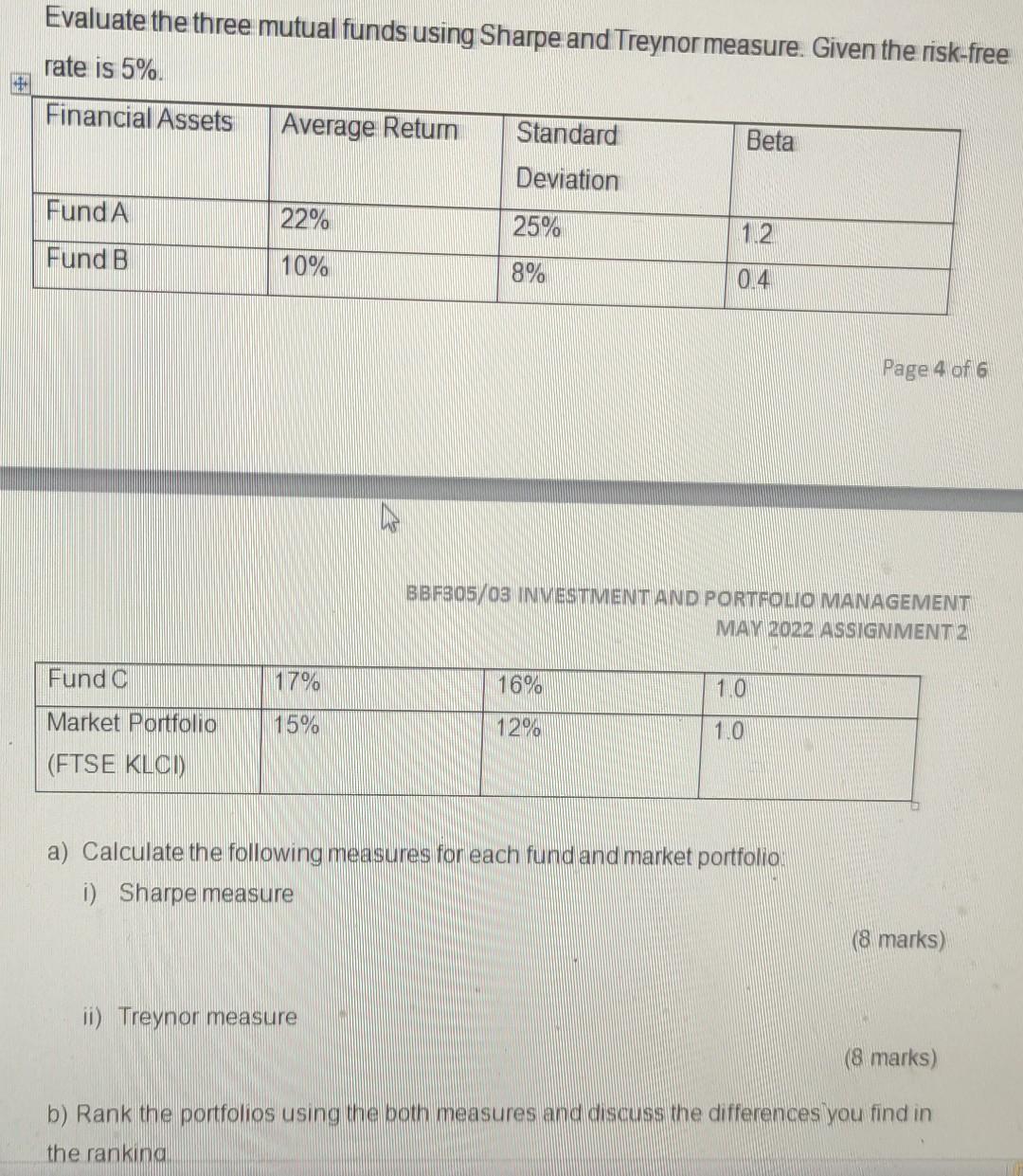

b) Below is a partial balance sheet of WOU Berhad Common stock (RM 2) Premium Retained earnings Total Net Worth The company declared a 2 for 1 stock split. i) Calculate the new par value. c) RM40,000,000 RM25,000,000 RM20,000,000 RM85,000,000 ii) Calculate the new numbers of share outstanding. Elaborate any four (4) reasons for the company to declare stock dividend. d) Partial Balance Sheet of Daisy Bhd. as at 31 December 2018 Capital Position RM Common stock (RM5) Premium Retained Earnings Total Net Worth 3,000,000 2,000,000 5,000,000 10,000,000 (8 The current market price for Daisy Berhad stock is RM10. Show the effect on the company's balance sheet if the company declares a 20 percent stock dividend. (6 a) b) c) d) Explain five (5) advantages of preferred stock. Elaborate any three (3) features of common stock. Describe the salient characteristics of bond i) Calculate the intrinsic value of the share today. (6 m Home Company paid an annual dividend of RM0.90 per share this year. company expects that the dividend will grow an annual rate of 15 percent fo next five years and then drop to a gradual growth rate of 7 percent indefinitely required rate of return is 10 percent and the share is currently trading at RM48 ii) Justify whether you would buy the share. (5 m (5 ma (4 mar Evaluate the three mutual funds using Sharpe and Treynor measure. Given the risk-free rate is 5%. Financial Assets Fund A Fund B Fund C Market Portfolio (FTSE KLCI) Average Return 22% 10% 17% 15% Standard Deviation ii) Treynor measure 25% 8% 16% 12% Beta 1.2 04 BBF305/03 INVESTMENT AND PORTFOLIO MANAGEMENT MAY 2022 ASSIGNMENT2 1.0 1.0 a) Calculate the following measures for each fund and market portfolio i) Sharpe measure Page 4 of 6 (8 marks) (8 marks) b) Rank the portfolios using the both measures and discuss the differences you find in the ranking QUESTION 4 (25 MARKS) a) You are a senior management position in a leading international funds management firm. Your Board of Directors required you to analyse FOUR (4) benefits of allocating funds across various countries and geographical regions based on two market dimensions: i) Developed countries. ii) Emerging markets. (12 Marks) (13 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started