Answered step by step

Verified Expert Solution

Question

1 Approved Answer

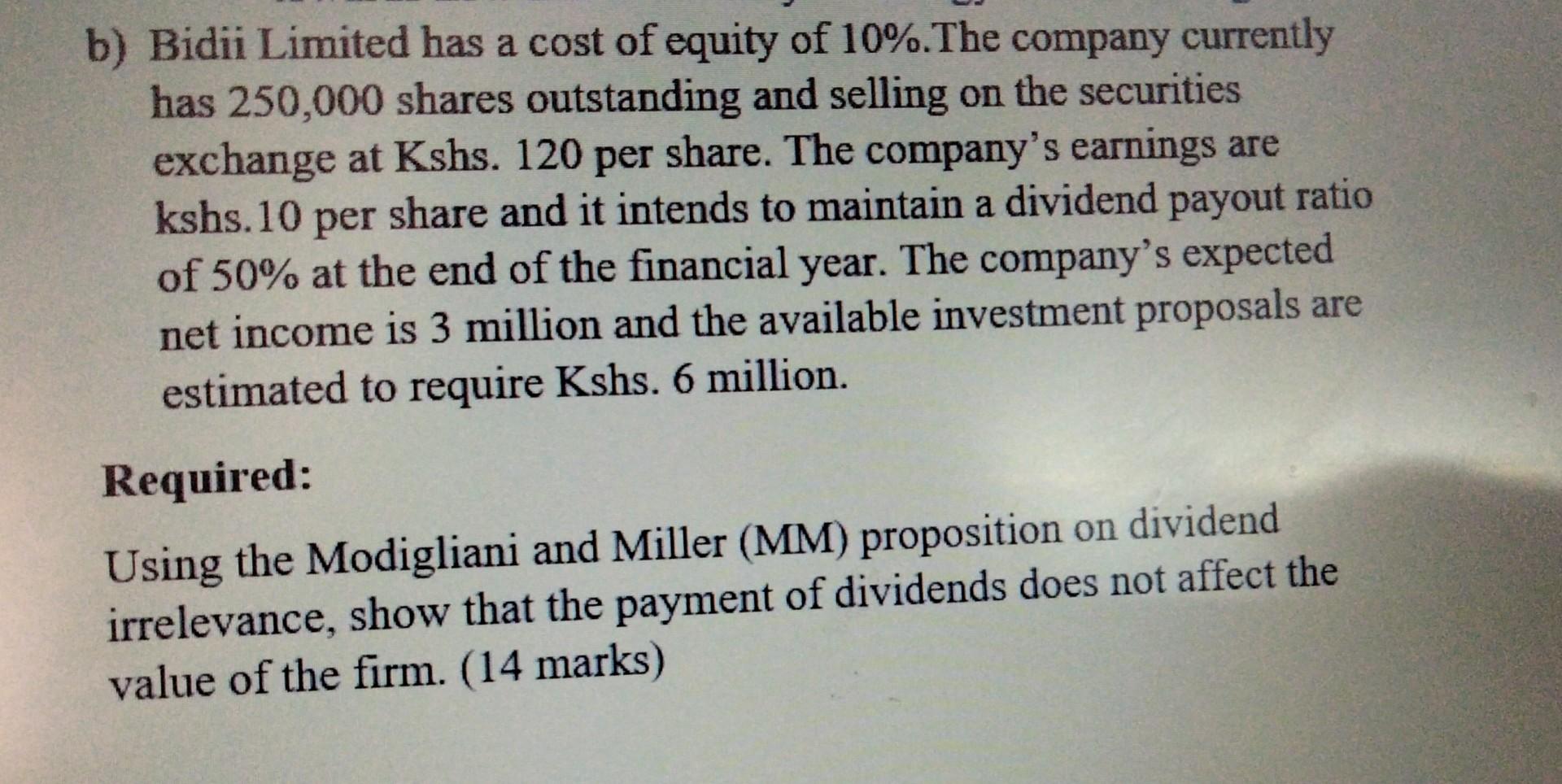

b) Bidii Limited has a cost of equity of 10%.The company currently has 250,000 shares outstanding and selling on the securities exchange at Kshs. 120

b) Bidii Limited has a cost of equity of 10%.The company currently has 250,000 shares outstanding and selling on the securities exchange at Kshs. 120 per share. The company's earnings are kshs.10 per share and it intends to maintain a dividend payout ratio of 50% at the end of the financial year. The company's expected net income is 3 million and the available investment proposals are estimated to require Kshs. 6 million. Required: Using the Modigliani and Miller (MM) proposition on dividend irrelevance, show that the payment of dividends does not affect the value of the firm. (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started